Irs Irc Codes

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

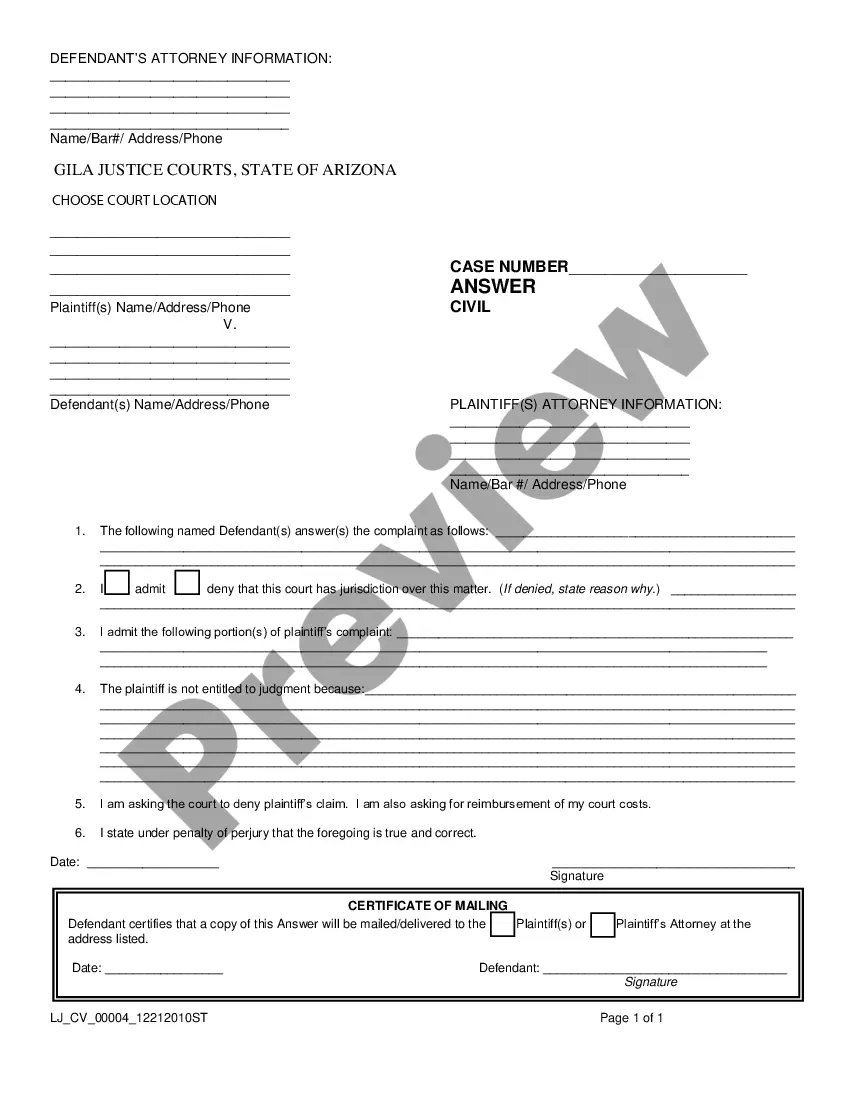

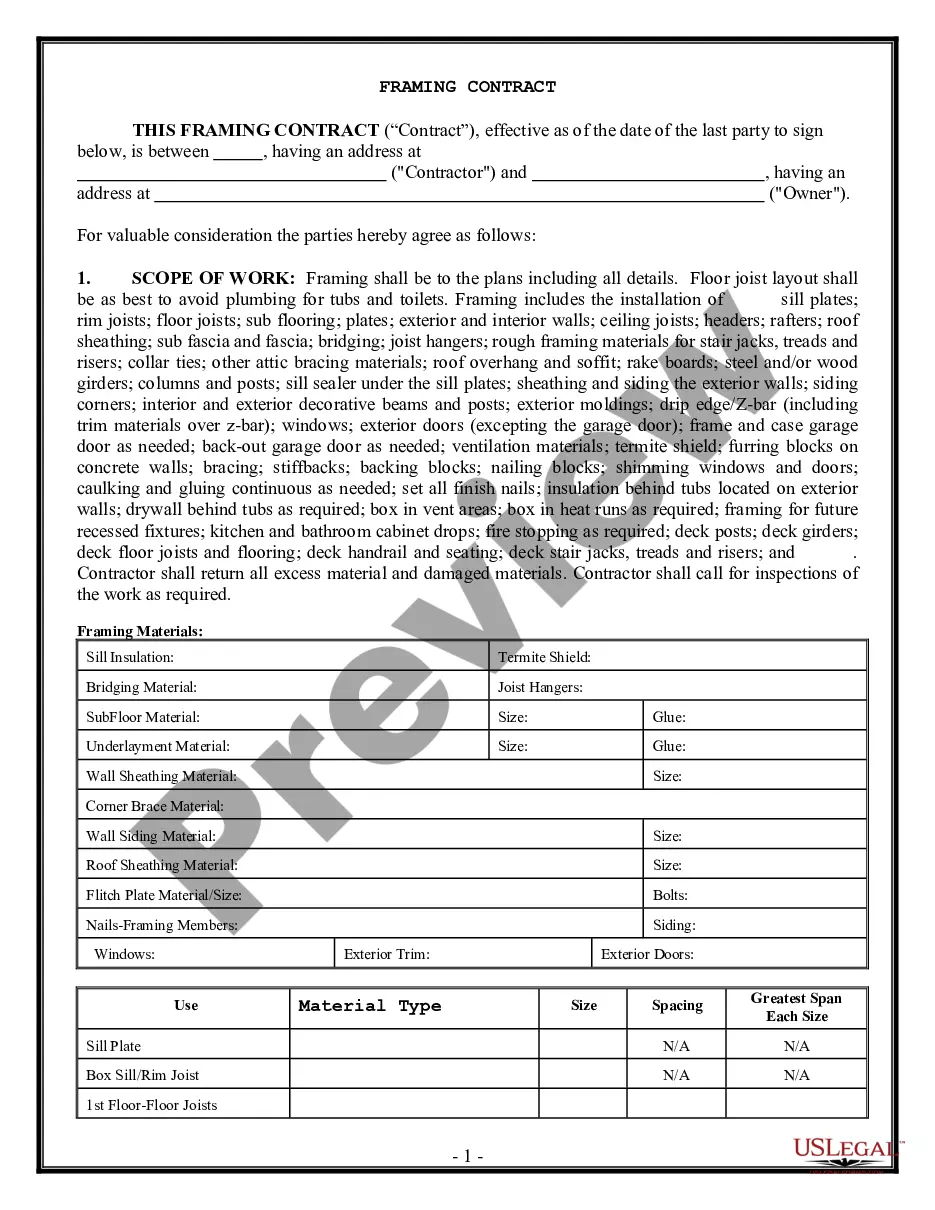

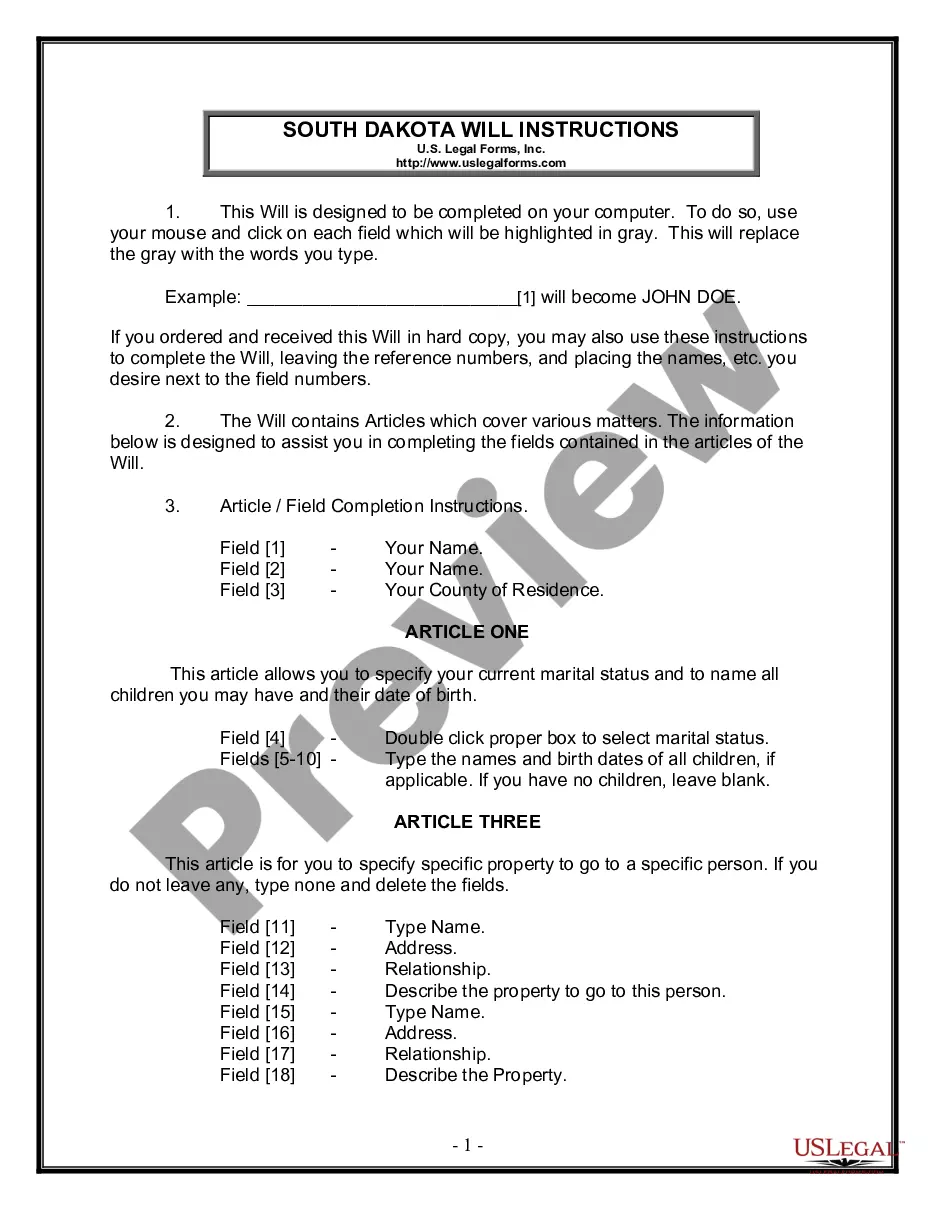

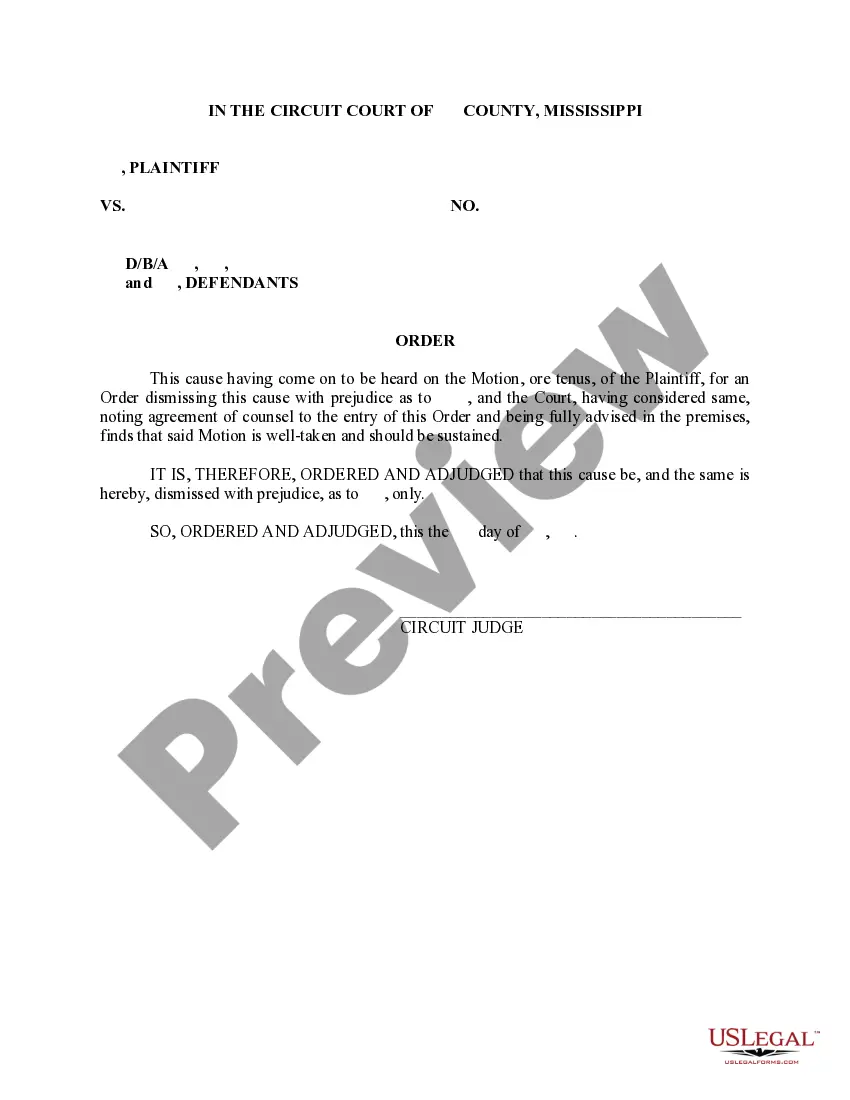

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Completing legal paperwork requires careful attention, starting with selecting the right form sample. For instance, if you pick a wrong edition of a Irs Irc Codes, it will be turned down once you send it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to get a Irs Irc Codes sample, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it fits your case, state, and county.

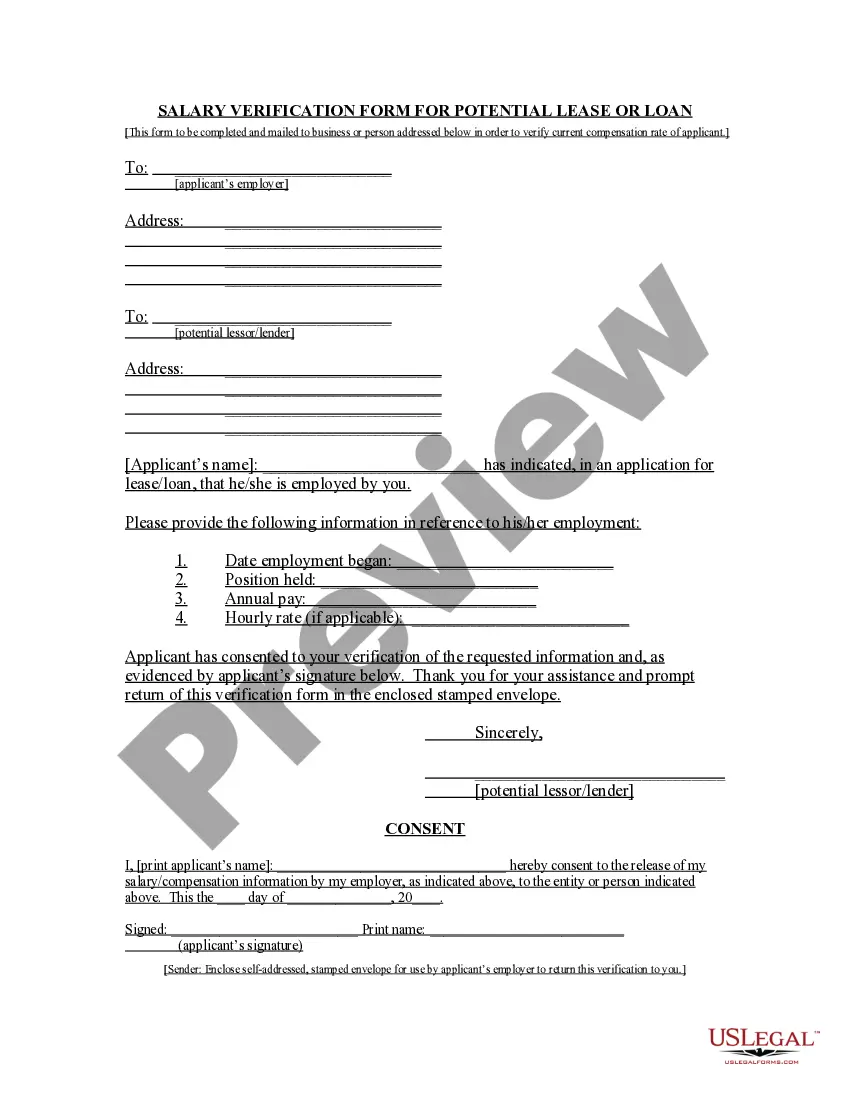

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Irs Irc Codes sample you need.

- Get the template if it meets your needs.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Irs Irc Codes.

- Once it is downloaded, you can fill out the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the web. Make use of the library’s easy navigation to get the proper form for any situation.

Form popularity

FAQ

What is IRS code 971? Code 971 means the IRS has asked you for additional information on an issue, and it's typically related to Code 570.

When the 846-transaction code appears on your transcript, it means that you have been approved for a refund and a direct deposit date has been set. The date that appears beside the 846 code indicates when the IRS is expected to deposit your tax refund into your bank account.

Internal Revenue Code Citations: If you are citing ot the current edition of the Code, use the abbreviations "I.R.C." and provide only the section number, using regular Bluebook rules for numbering. Example: I.R.C. § 61.

Tax codes contain information about tax rates and the transaction types they should be applied to. Tax codes help you apply special tax conditions, for example tax exemption.

A tax code is usually made up of three or four numbers and one letter, for example 1234L, and can be found on your payslip. The numbers reflect the tax free personal allowance amount that you are entitled to in that tax year. You do not start paying income tax until you are earning over your personal allowance figure.