Internal Revenue Code Of 1986 (irc)

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

It’s obvious that you can’t become a law professional immediately, nor can you learn how to quickly draft Internal Revenue Code Of 1986 (irc) without the need of a specialized background. Creating legal forms is a long process requiring a specific training and skills. So why not leave the creation of the Internal Revenue Code Of 1986 (irc) to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

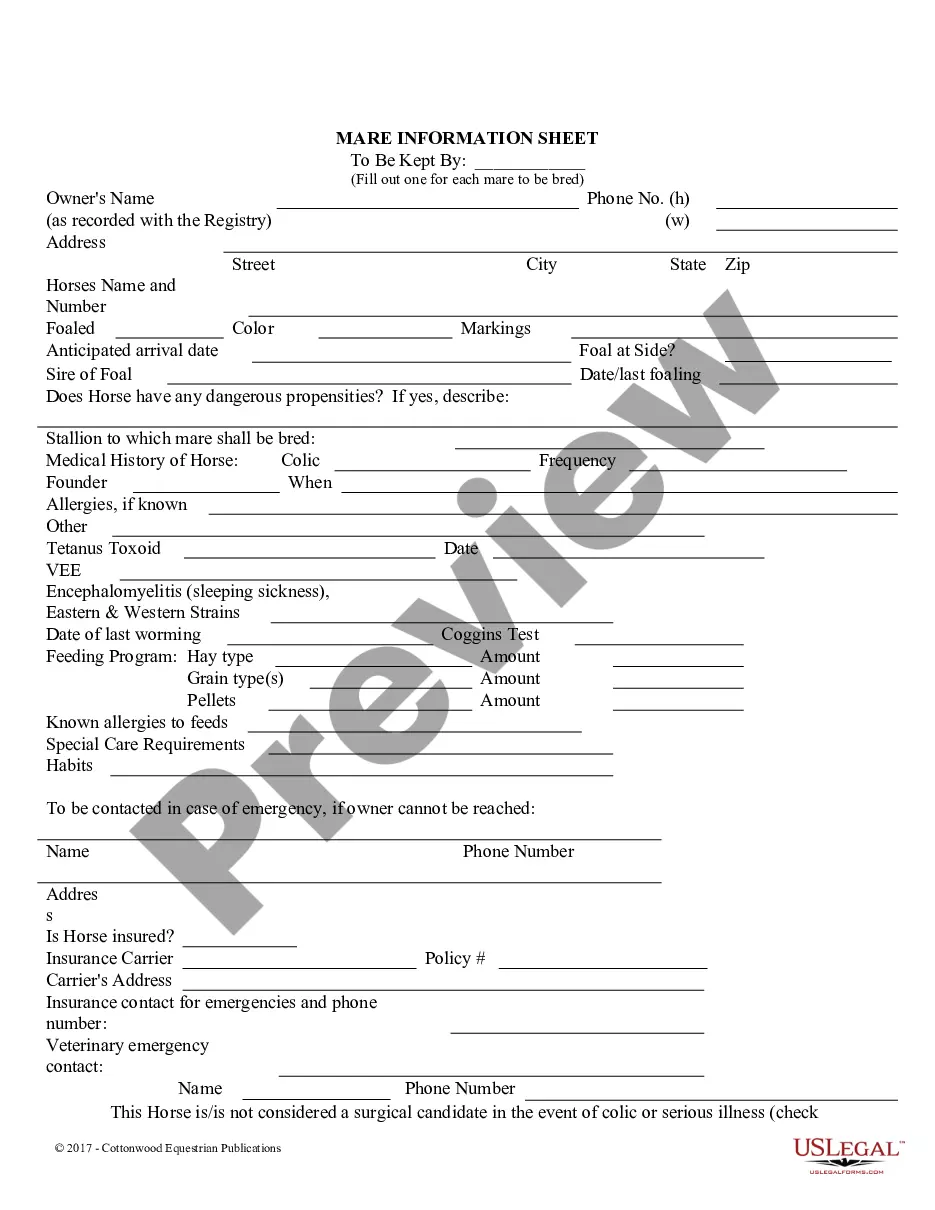

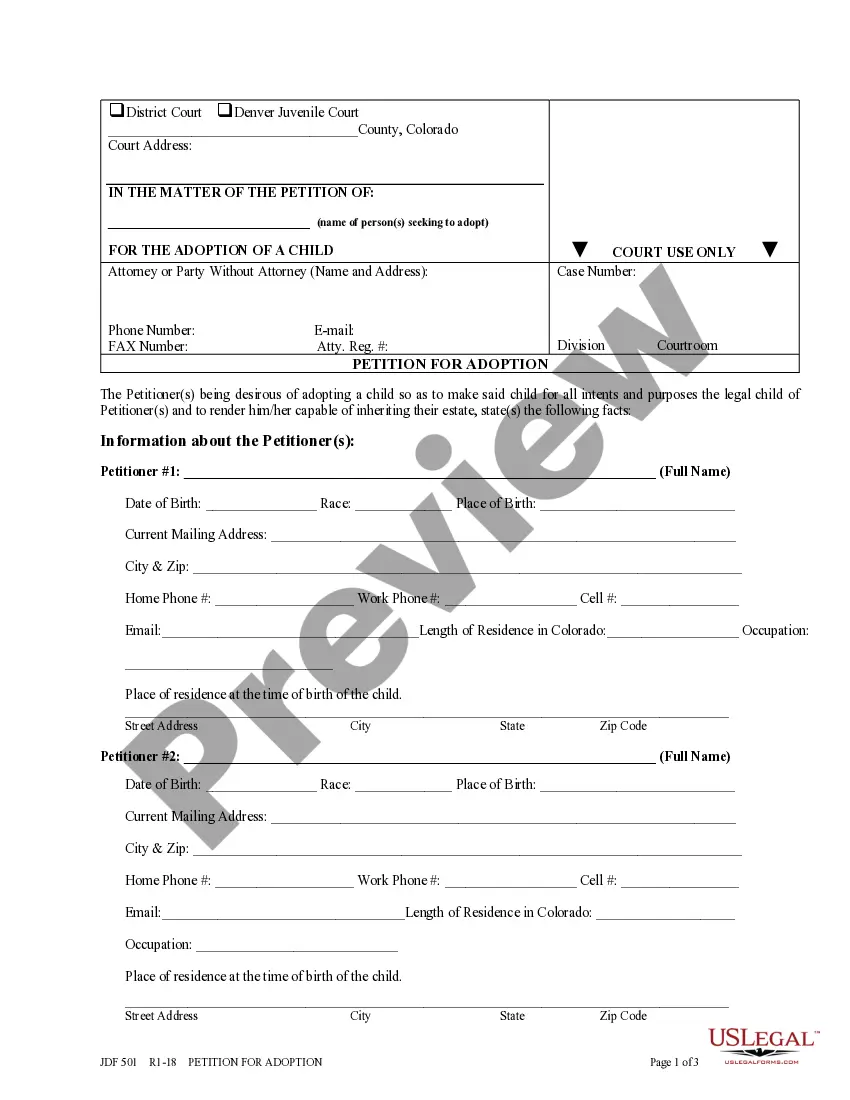

- Preview it (if this option available) and check the supporting description to determine whether Internal Revenue Code Of 1986 (irc) is what you’re searching for.

- Begin your search over if you need any other form.

- Set up a free account and choose a subscription option to buy the form.

- Choose Buy now. Once the payment is complete, you can download the Internal Revenue Code Of 1986 (irc), complete it, print it, and send or mail it to the necessary people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The term ?tax codes? can refer to a collection of tax laws, such as the Internal Revenue Code (IRC), and can also refer to specific tax laws within the IRC. For example, IRC section 162 is a tax code that defines when you can claim a business deduction.

Understanding the Tax Reform Act of 1986 The Tax Reform Act of 1986 lowered the top tax rate for ordinary income from 50% to 28% and raised the bottom tax rate from 11% to 15%. This was the first time in U.S. income tax history that the top tax rate was lowered and the bottom rate was increased at the same time.

Tax codes contain information about tax rates and the transaction types they should be applied to. Tax codes help you apply special tax conditions, for example tax exemption.

Congress made major statutory changes to Title 26 in 1939, 1954, and 1986. Because of the extensive revisions made in the Tax Reform Act of 1986, Title 26 is now known as the Internal Revenue Code of 1986 (Pub. L.

Internal Revenue Code The sections of the IRC can be found in Title 26 of the United States Code (26 USC).