Internal Revenue Code (irc) (except For Section 121)

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Using legal templates that comply with federal and local laws is crucial, and the internet offers many options to pick from. But what’s the point in wasting time looking for the right Internal Revenue Code (irc) (except For Section 121) sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are easy to browse with all papers collected by state and purpose of use. Our professionals keep up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Internal Revenue Code (irc) (except For Section 121) from our website.

Obtaining a Internal Revenue Code (irc) (except For Section 121) is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

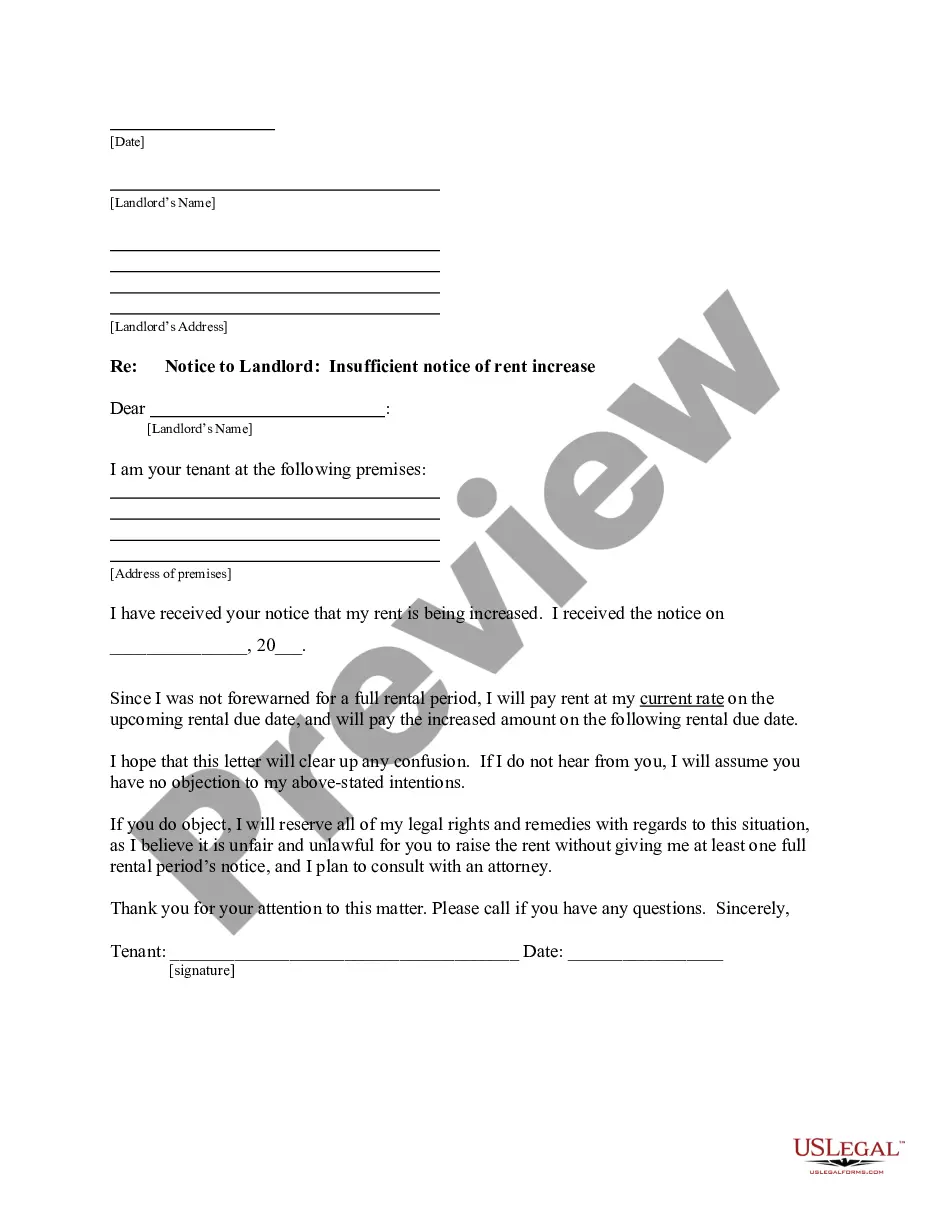

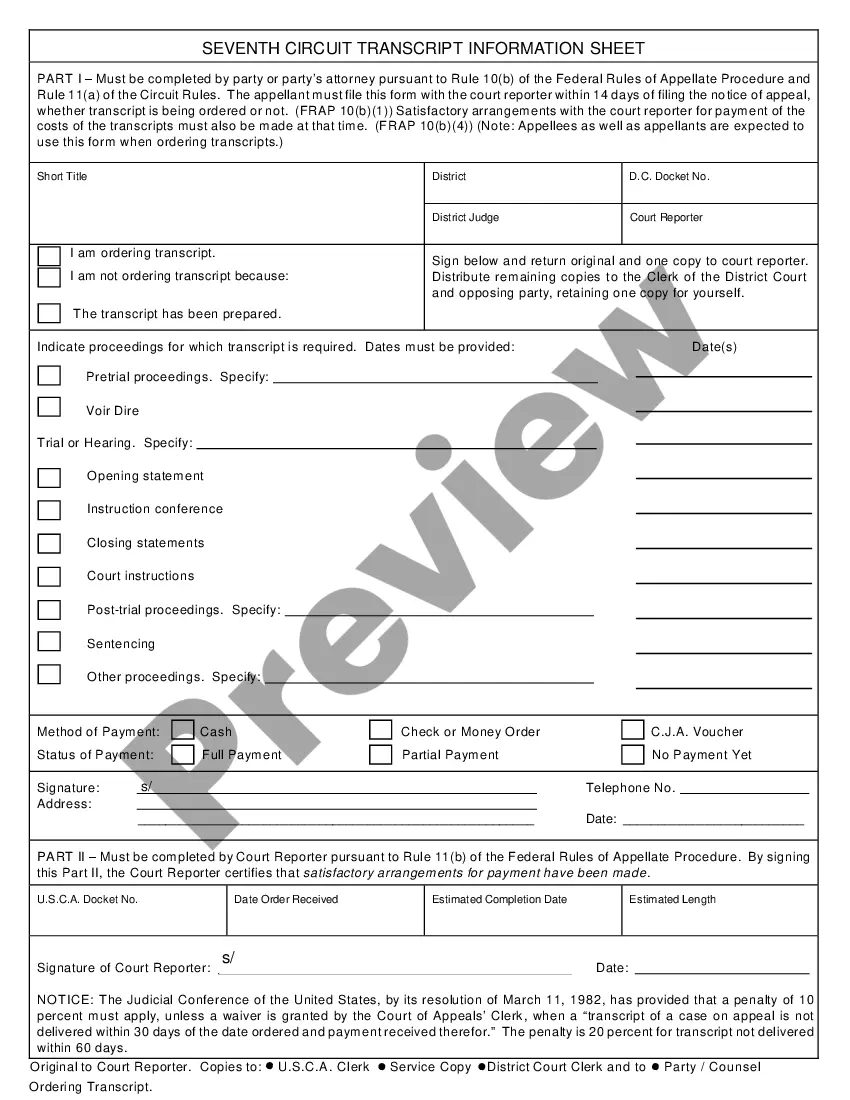

- Examine the template using the Preview feature or through the text description to ensure it meets your requirements.

- Look for a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Internal Revenue Code (irc) (except For Section 121) and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Hear this out loud PauseHomeowners can move out of their primary residence and convert it to any other non-qualified use such as rental, investment, vacation, or business use property and still qualify for the tax free exclusion under Section 121.

Hear this out loud PauseI.R.C. § 121(a) Exclusion ? Gross income shall not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange, such property has been owned and used by the taxpayer as the taxpayer's principal residence for periods aggregating 2 years or more.

The Section 121 Exclusion is an IRS rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.

Hear this out loud PauseExceptions to the 2-out-of-5-Year Rule You might be able to exclude at least a portion of your gain if you lived in your home less than 24 months but you qualify for one of a handful of special circumstances such as a change in workplace, a health-related move, or an unforeseeable event.

Hear this out loud PauseThe Section 121 Exclusion is an IRS rule that allows you to exclude from taxable income a gain of up to $250,000 from the sale of your principal residence. A couple filing a joint return gets to exclude up to $500,000.