Lease With Guarantor

Description

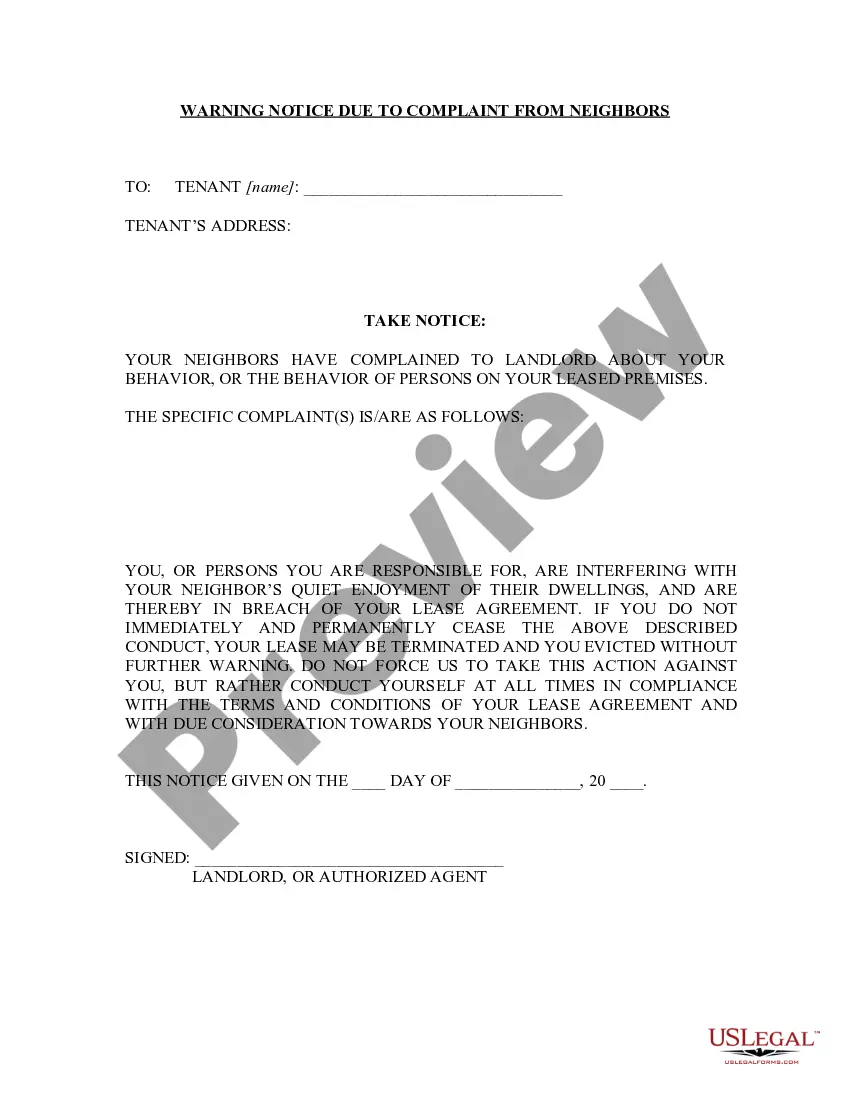

How to fill out California Guaranty Attachment To Lease For Guarantor Or Cosigner?

Legal administration can be bewildering, even for the most adept experts.

When seeking a Lease With Guarantor and lacking the time to dedicate to finding the accurate and current version, the processes can become stressful.

US Legal Forms accommodates all needs you may have, ranging from personal to business documentation, all in one location.

Utilize sophisticated tools to complete and oversee your Lease With Guarantor.

Here are the steps to follow after downloading the desired form: Confirm that it is the correct form by previewing it and reviewing its description. Ensure the template is recognized in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the format you desire, then Download, complete, eSign, print, and send your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Improve your daily document management in a streamlined and user-friendly manner today.

- Access a valuable collection of articles, guides, and resources related to your situation and requirements.

- Save time and energy searching for the documents you need, and use US Legal Forms’ advanced search and Review tool to find Lease With Guarantor and obtain it.

- If you possess a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to view the documents you have previously downloaded and to manage your folders as needed.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- A comprehensive online form repository could be transformative for anyone aiming to handle these matters effectively.

- US Legal Forms is a leading provider in online legal documents, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access region-specific legal and organizational documents.

Form popularity

FAQ

Being a guarantor on a lease means that you are agreeing to take responsibility for the lease obligations if the primary tenant cannot fulfill them. This role provides the landlord with added security, as they can rely on you to cover rent or damages if needed. Essentially, when you sign a lease with a guarantor, you are financially backing the tenant's commitment, which can make it easier for them to secure housing.

Typically, a guarantor should have a steady income that is at least three times the rent amount. This requirement can vary depending on the landlord's policies and the rental market. Having a reliable income reassures landlords that the guarantor can cover rent if necessary. For comprehensive guidelines on income requirements, US Legal Forms can provide relevant resources.

Filling out a guarantor form requires providing specific information such as the guarantor’s personal details, financial status, and relationship to the tenant. Ensure that all sections are completed and that the information is accurate. After filling out the form, both the tenant and the guarantor should review it together. You can find user-friendly templates on US Legal Forms to guide you through this process.

To add a guarantor to a lease agreement, you should first communicate with your landlord or property management company about your intention. They may have specific procedures in place. Once you have their approval, you can complete a guarantor form and attach it to your lease. US Legal Forms offers customizable templates that ensure all necessary details are captured accurately.

To put a guarantor on a lease, you need to first discuss this option with your landlord or property manager. They usually require a separate guarantor agreement or addendum to the lease. Make sure to gather the necessary information about the guarantor, such as their financial details. Using a platform like US Legal Forms can simplify this process, providing you with the required documents.

The person acting as guarantor needs to: be 18 or older. have known you for at least 2 years. be available and capable of answering questions about you, for example, your name, approximate age, place of birth, physical description and place of residence, if contacted by us.

The Guarantor/Co-Signor should state that they are guaranteeing all of the obligations of the tenant in the attached lease shown as Schedule A. Then just attach the lease to the guarantee and call it Schedule A.

Date ? the date at which the Guarantor contract was signed. Guarantor details ? the name and contact information of the Guarantor. Landlord details ? the name and contact information of the landlord. Tenant details ? the name of the tenant or tenants for whom the guarantor is providing the guarantee.

Lenders have their own rules and guidelines, but usually guarantors will: be over 21 years old. have a good credit history. have a separate bank account to the borrower ? you may be able to guarantee a loan for a spouse or partner, but only if you have separate bank accounts.

A guarantor or co-signer is someone who agrees to pay your rent for you in case you are not able to pay. Usually, only close friends or relatives will agree to act as a guarantor for you.