Lease Guarantor Form Nyc

Description

How to fill out California Guaranty Attachment To Lease For Guarantor Or Cosigner?

Obtaining a reliable location to access the most up-to-date and suitable legal templates is half the battle of dealing with bureaucracy. Finding the appropriate legal documents requires precision and meticulousness, which is why it is essential to source Lease Guarantor Form Nyc exclusively from reputable providers, such as US Legal Forms. An incorrect template will squander your time and delay the situation you are facing. With US Legal Forms, you have minimal concerns. You can access and review all the details regarding the document’s applicability and significance for your case and in your locality.

Consider the following steps to complete your Lease Guarantor Form Nyc.

Eliminate the hassle associated with your legal documentation. Explore the extensive US Legal Forms collection to discover legal samples, verify their applicability to your scenario, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form’s description to determine if it meets the criteria of your state and locality.

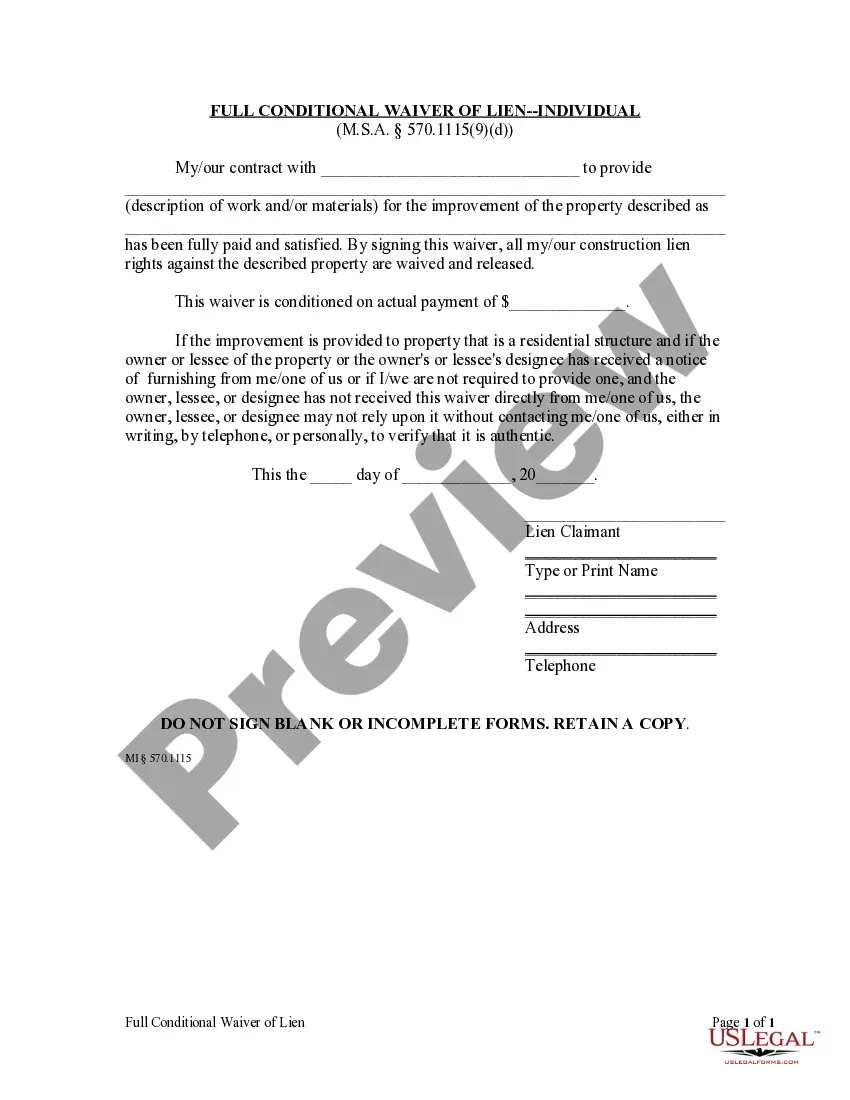

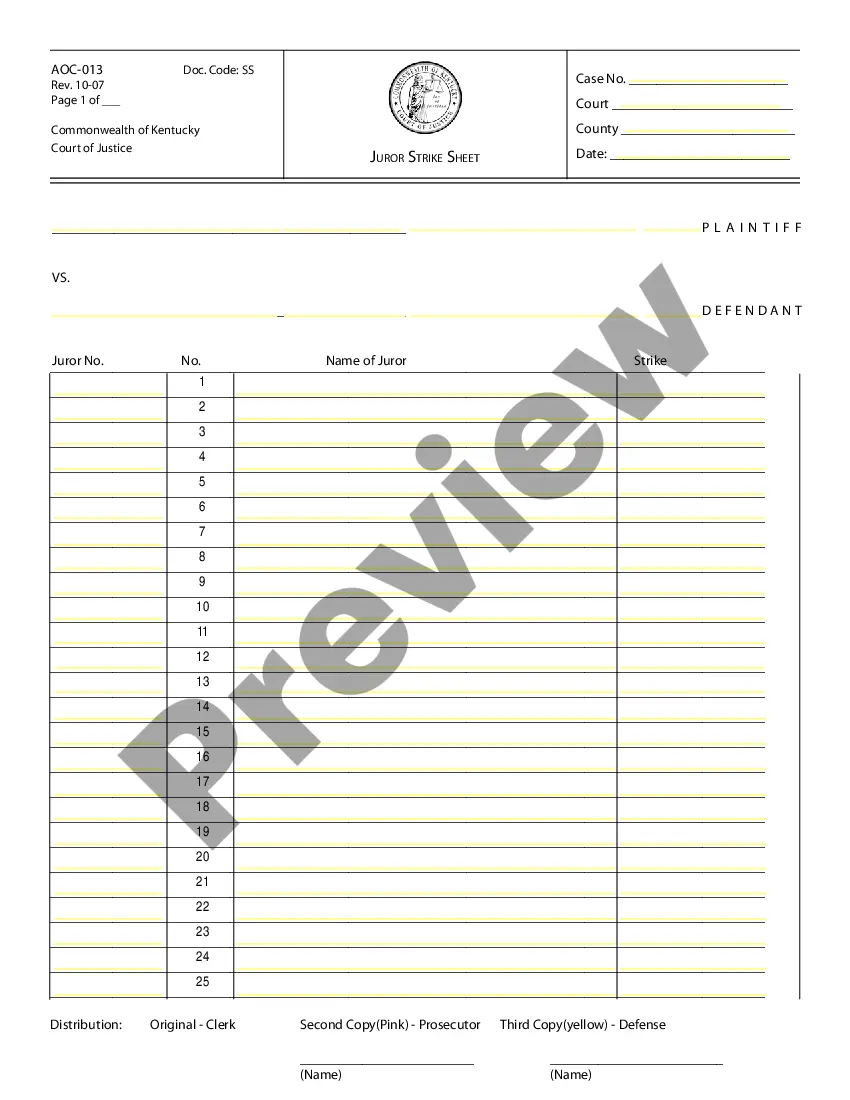

- Review the form preview, if available, to ensure the template is indeed the one you want.

- Continue searching and locate the correct template if the Lease Guarantor Form Nyc does not meet your requirements.

- If you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Lease Guarantor Form Nyc.

- Once you have the form on your device, you can modify it using the editor or print it and fill it out manually.

Form popularity

FAQ

Filling out a guarantor form requires accurate information about the guarantor’s identity and financial status. Start by providing their full name, address, and contact information. Next, include details about their income and employment to show their capability to support the lease. For convenience, consider using the lease guarantor form NYC available on US Legal Forms, which guides you through each required section.

Adding a guarantor to your lease application involves filling out the lease guarantor form NYC. You should include the guarantor's personal information and financial details to demonstrate their ability to cover the lease. Platforms like US Legal Forms provide user-friendly templates to simplify this process. After completing the form, submit it alongside your lease application to your landlord.

To add a guarantor to your tenancy agreement, first, discuss the arrangement with your landlord or property manager. They may require a specific lease guarantor form NYC, which you can obtain from platforms like US Legal Forms. Ensure that both you and the guarantor understand the terms before signing. Once completed, submit the form to your landlord for their approval.

You might need a 'guarantor' so you can rent a place to live. A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

As Guarantor, I hereby agree to guarantee payment of all amounts due under the lease, or that may come due, and all other obligations of the Tenant for the entire duration of the lease attached hereto unless the tenant gives notice of termination within the guidelines of the lease; however, if the lease is renewed ...

First, they should have an excellent credit score. This means that their credit score should be 750 or higher. Second, they must make 80 times the monthly rent annually. This means that if you are applying for an apartment that costs $2000 in rent per month, your guarantor must earn at least $160,000 per year.

Guarantors will need to provide information to a landlord or letting agency to ensure they can take on the responsibility of being a guarantor: Proof of identity, like a passport or UK driving licence. There will be credit checks that they need to pass.