Rental Application Form California Withholding

Description

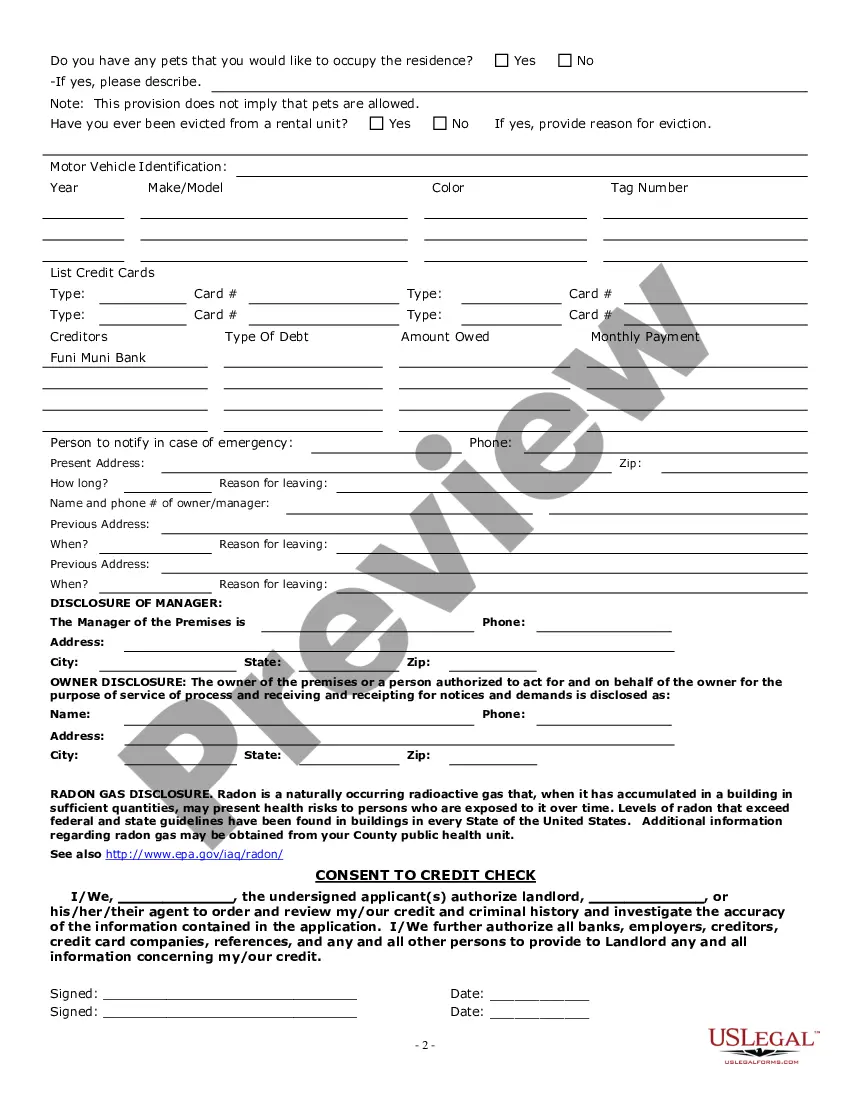

How to fill out California Residential Rental Lease Application?

The management of legal documents can be daunting, even for seasoned professionals.

If you are looking for a Rental Application Form California Withholding and lack the time to search for the right and current version, the process can be stressful.

Access a wealth of articles, guides, and manuals pertinent to your situation and needs.

Save time and effort searching for the paperwork you require, and use US Legal Forms’ advanced search and Preview feature to locate and obtain the Rental Application Form California Withholding.

Take advantage of the US Legal Forms online library, backed by 25 years of expertise and trustworthiness. Transform your daily document management into a seamless and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and obtain it.

- Check the My documents tab to see the documents you've previously saved and manage your folders as needed.

- If it's your first experience with US Legal Forms, create a free account and enjoy unlimited access to all platform benefits.

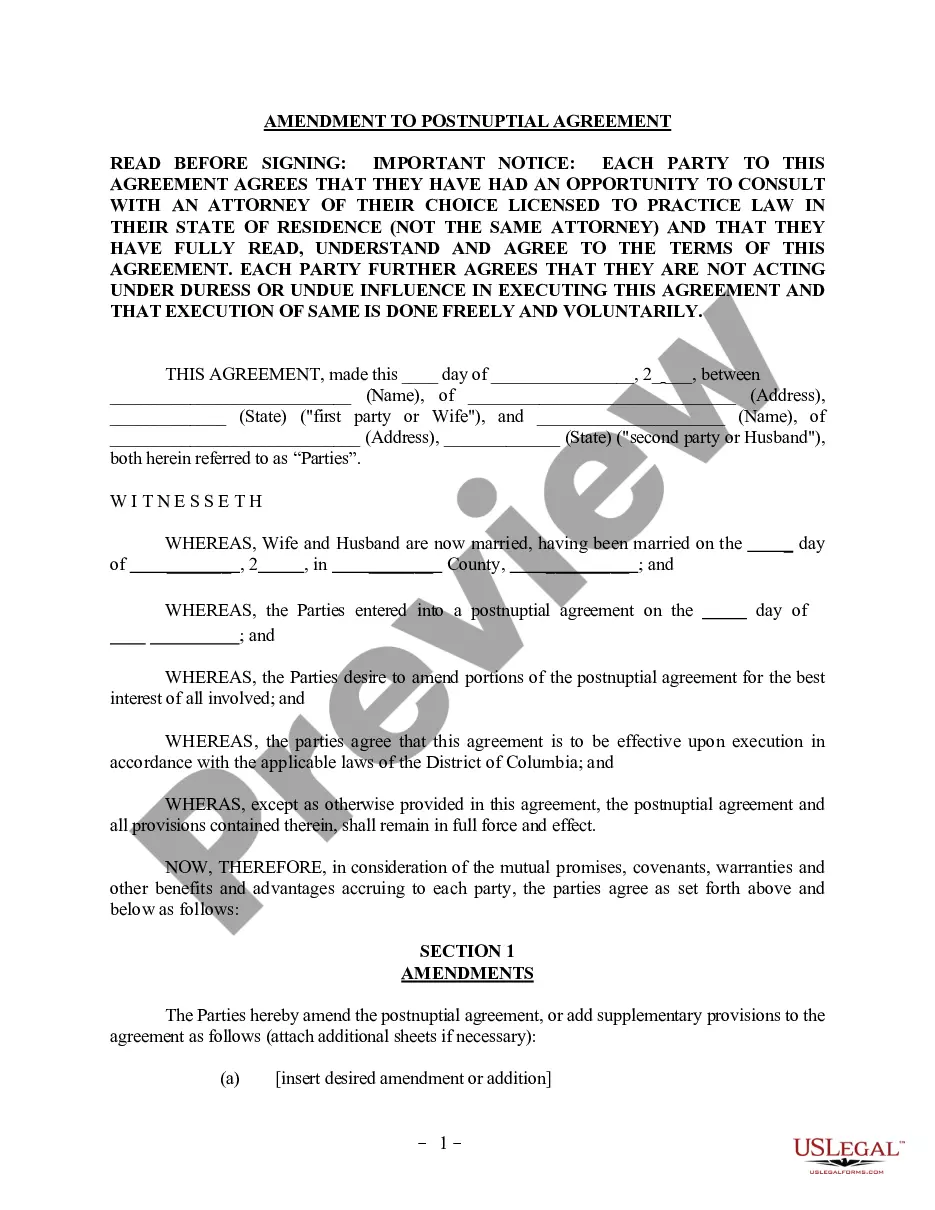

- After downloading the necessary form, ensure it's the correct version by previewing it and reviewing its description.

- Confirm that the template is accepted in your state or county.

- Select Buy Now when you're prepared.

- Choose a subscription option.

- Select the file format you prefer and Download, complete, eSign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all your needs, from personal to business paperwork, in one convenient location.

- Utilize sophisticated tools to complete and manage your Rental Application Form California Withholding.

Form popularity

FAQ

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

State withholding is money that is withheld and sent to the State of California to pay California income taxes. It pays for state programs such as education, health and welfare, public safety, and the court justice system. California's elected representatives also meet every year to decide how this money will be spent.

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.

Property managers are required to withhold 7% of the gross rent or lease payments in excess of $1,500 per calendar year, and remit those payments to us if they both: Manage real property. Collect rent or lease payments for California property owners that reside outside of California (nonresident owner)

Your payer must take 7% from your California income. Backup withholding: Replaces all other types of withholding.