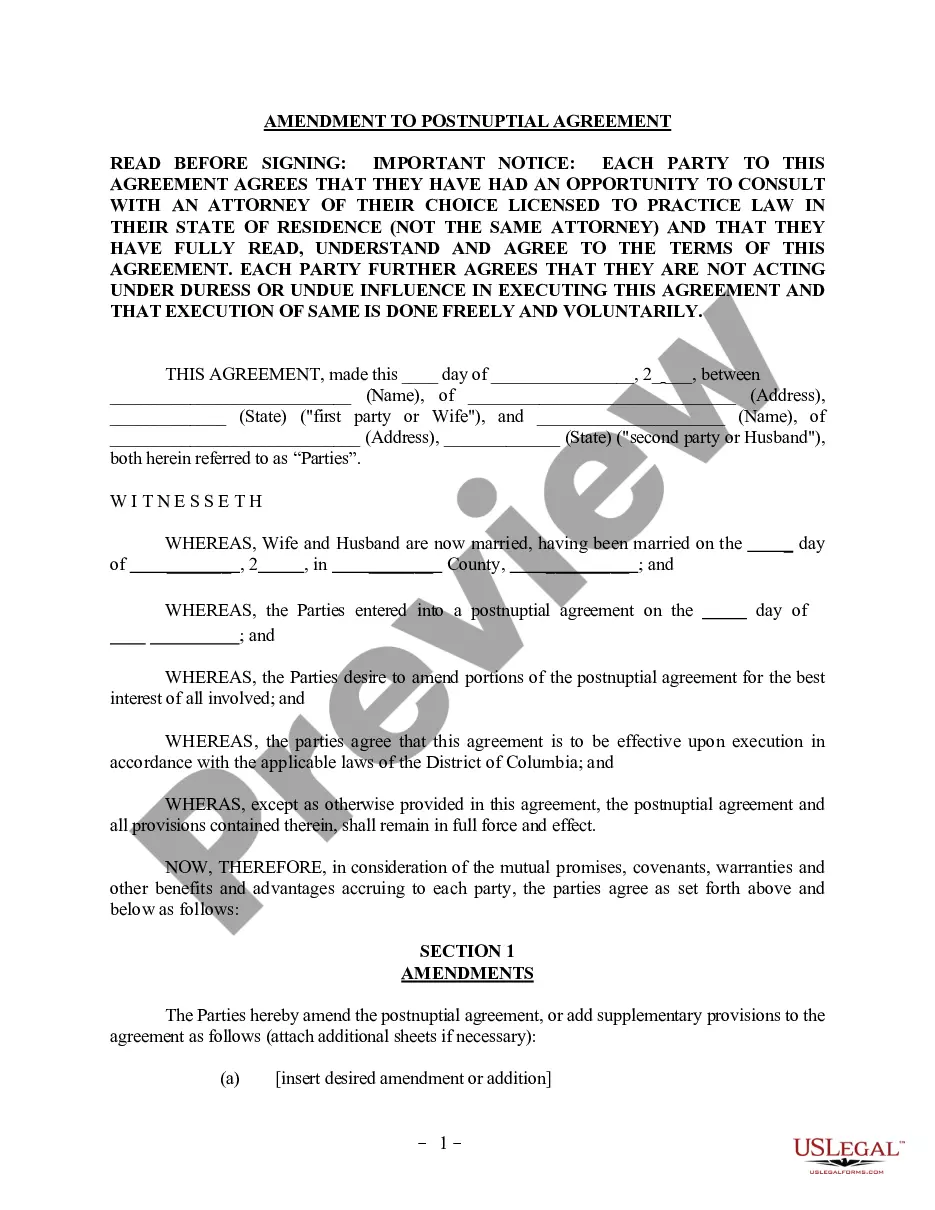

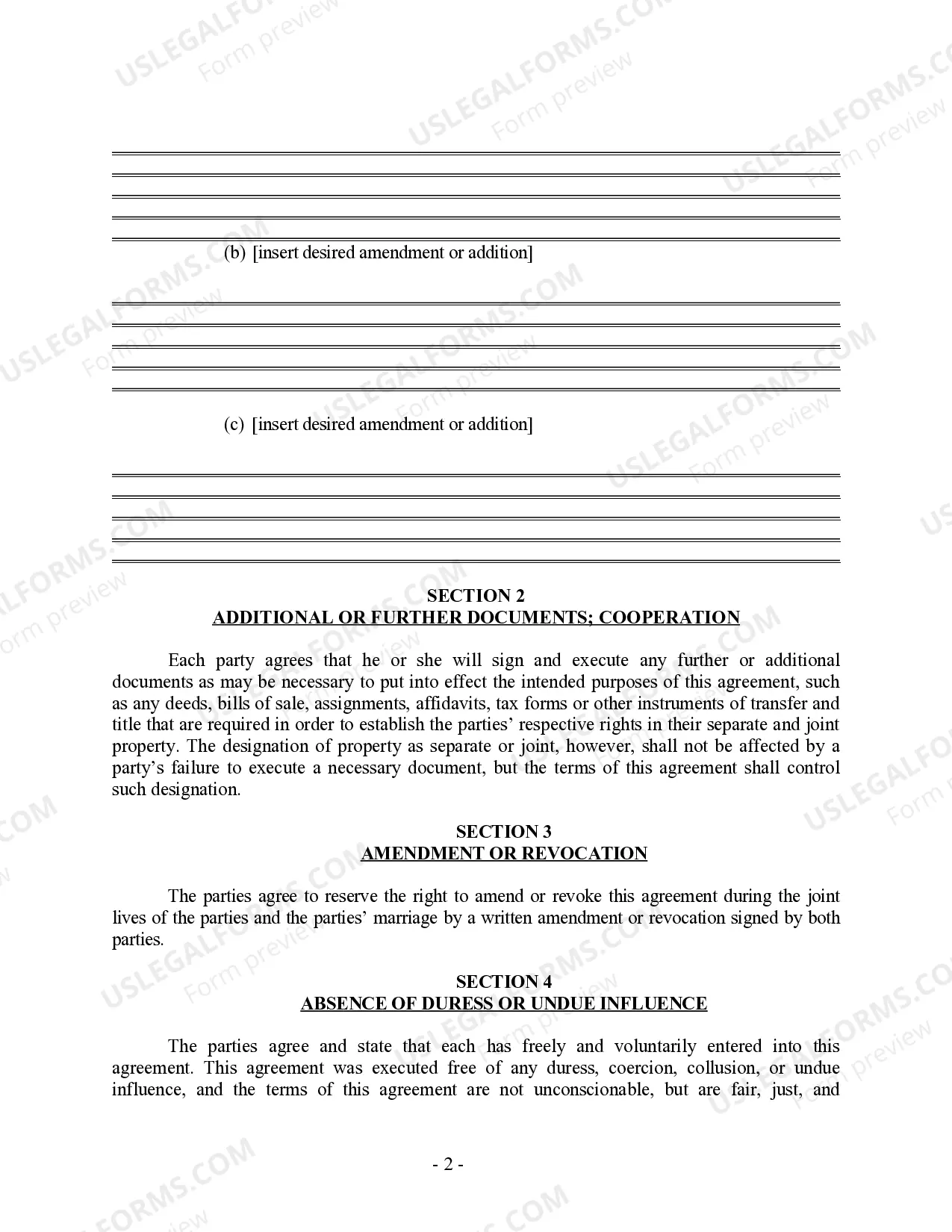

District of Columbia Amendment to Postnuptial Property Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Amendment To Postnuptial Property Agreement?

The greater the number of documents you need to produce - the more stressed you become.

You can find countless Amendment to Postnuptial Property Agreement - District of Columbia templates online, but you may not know which ones to trust.

Eliminate the stress of searching for samples by using US Legal Forms.

Select Buy Now to initiate the registration process and choose a payment plan that suits your needs. Provide the necessary information to set up your account and complete your purchase using your PayPal or credit card. Choose a suitable file format and download your copy. Access all the documents you acquire in the My documents section. Simply navigate there to prepare a new copy of the Amendment to Postnuptial Property Agreement - District of Columbia. Even with expertly drafted templates, it remains essential to consider having your local attorney review the completed document to ensure it is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain properly crafted documents that comply with state requirements.

- If you already possess a subscription to US Legal Forms, Log In to your account, and you will locate the Download button on the webpage for the Amendment to Postnuptial Property Agreement - District of Columbia.

- If you have never utilized our service before, follow these steps to register.

- Ensure that the Amendment to Postnuptial Property Agreement - District of Columbia is acceptable in your jurisdiction.

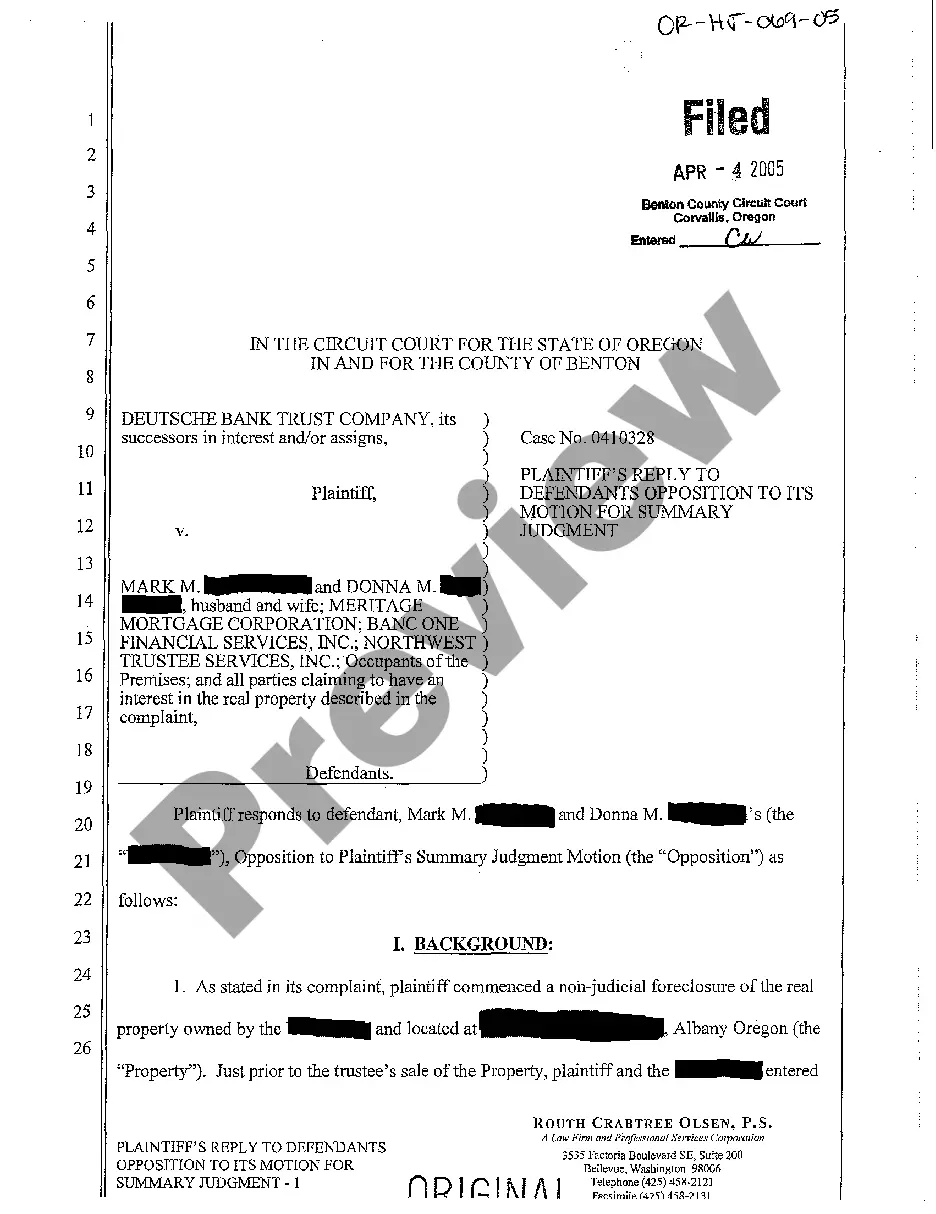

- Verify your selection by reviewing the description or by utilizing the Preview feature if it’s available for the chosen file.

Form popularity

FAQ

The District of Columbia does not adhere to a strict 50/50 split of marital property in divorce. Instead, it employs equitable distribution, meaning that assets are divided fairly based on several factors, including income and contributions. This approach allows for a more tailored solution in each case. Therefore, if you're looking to navigate the complexities of property division, understanding the District of Columbia Amendment to Postnuptial Property Agreement can provide clarity.

Yes, a separation agreement can sometimes be referred to as a postnuptial agreement, though they are not exactly the same. A postnuptial agreement outlines asset division during marriage, while a separation agreement typically involves terms for living apart. Understanding the nuances between these agreements is vital, particularly if you are looking at a District of Columbia Amendment to Postnuptial Property Agreement. Clear definitions help you choose the right legal tools for your situation.

No, the District of Columbia is not a community property state. Instead, it follows the principle of equitable distribution for dividing property during divorce. This means that while assets may not be split equally, they will be divided fairly based on various factors. When considering a District of Columbia Amendment to Postnuptial Property Agreement, it's essential to grasp how the state's laws might affect your assets.

In the District of Columbia, inheritance is typically not considered marital property if it is kept separate from marital assets. However, if inherited property is commingled with marital assets, it might be treated differently during divorce proceedings. Familiarity with this aspect is crucial when drafting a District of Columbia Amendment to Postnuptial Property Agreement. This understanding helps you protect your inheritance in case of future disputes.

The nine community property states in the United States are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In these states, property acquired during marriage is generally considered jointly owned. While the District of Columbia is not a community property state, it has its own guidelines that you should be aware of, especially if you’re considering a District of Columbia Amendment to Postnuptial Property Agreement. Each jurisdiction has unique rules regarding asset division.

Yes, the District of Columbia is considered a federal district and not one of the 50 states. However, it functions similarly to a state in many aspects, including tax and legal practices. For those residing in the District of Columbia, understanding the implications of local laws like the District of Columbia Amendment to Postnuptial Property Agreement is important for managing marital assets. Knowing where you stand legally ensures better preparation.

To enforce a postnuptial agreement in the District of Columbia, both spouses must demonstrate that the agreement meets specific legal requirements. This includes clarity, mutual agreement, and full disclosure of assets. Making sure your postnuptial agreement adheres to the District of Columbia Amendment to Postnuptial Property Agreement can significantly strengthen its enforceability. Legal assistance may be beneficial to navigate this process effectively.

The equitable distribution statute in the District of Columbia outlines how property is divided during divorce. Under this statute, the court considers various factors, including the length of the marriage and the financial contributions of both spouses. The goal is to achieve a fair distribution rather than a strict 50/50 split. Understanding how this applies to the District of Columbia Amendment to Postnuptial Property Agreement is essential for anyone in a marital relationship.

Despite popular belief, DC is not strictly a 50/50 divorce state; it follows the principle of equitable distribution. This means assets are divided fairly, although not necessarily equally. The District of Columbia Amendment to Postnuptial Property Agreement can help establish clearer terms for how assets should be distributed, allowing both parties to maintain stability.

Marital property refers to assets owned jointly by a couple during their marriage. This includes tangible items, finances, and property acquired after the wedding. The District of Columbia Amendment to Postnuptial Property Agreement becomes pivotal in defining these assets, allowing couples to negotiate fair outcomes in case of a divorce.