California Dissolution Ca Withholding

Description

How to fill out California Complaint For Dissolution Of Limited Partnership?

Creating legal documents from the ground up can occasionally feel a bit daunting. Some instances may require extensive research and substantial financial investment. If you’re looking for a more straightforward and economical method to generate California Dissolution Ca Withholding or any other paperwork without dealing with unnecessary obstacles, US Legal Forms is always readily available.

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can effortlessly access state- and county-specific templates meticulously prepared for you by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services to swiftly find and download the California Dissolution Ca Withholding. If you’re familiar with our website and have already created an account with us, simply Log In to your account, choose the template, and download it or re-download it anytime later in the My documents section.

Don’t have an account? No worries. It takes minimal time to set it up and browse the catalog. However, before proceeding to download California Dissolution Ca Withholding, follow these suggestions.

US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and simplify form completion into a seamless process!

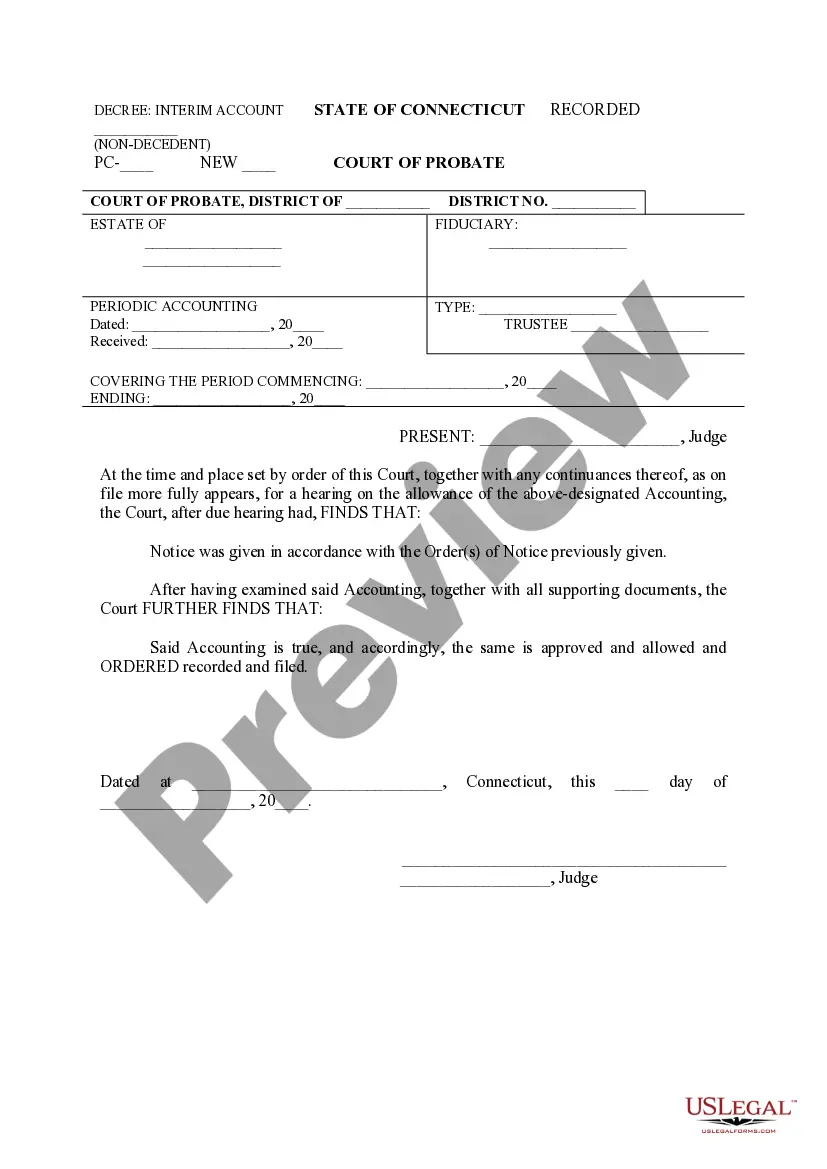

- Examine the document preview and descriptions to confirm you are on the correct form.

- Verify that the template you select meets the criteria of your specific state and county.

- Choose the most appropriate subscription plan to acquire the California Dissolution Ca Withholding.

- Download the file. Then complete, sign, and print it out.

Form popularity

FAQ

Being subject to withholding means that a portion of your earnings will be withheld for tax purposes before you receive your payment. This practice ensures that state taxes are collected upfront and reduces the risk of tax liabilities later. Knowing if you are subject to withholding is essential for proper financial planning regarding California dissolution ca withholding.

Individuals who receive certain types of payments, including wages, commissions, and some contract payments, are typically subject to California withholding. Additionally, residents and non-residents earning income in California may also fall under this requirement. Understanding your status can help you navigate the complexities of California dissolution ca withholding.

Dissolving a business in California can have significant tax implications, including potential liabilities for unpaid taxes and obligations related to California dissolution ca withholding. It is essential to settle any outstanding tax matters before dissolution to avoid penalties. Consulting with a tax professional can help clarify these implications.

A CA withholding form is an official document used to report and manage the withholding of state taxes from payments made to individuals. This form includes information about your income, residency status, and any exemptions you may claim. Using the correct CA withholding form is crucial to ensuring compliance with California dissolution ca withholding requirements.

To certify that you are not subject to California withholding, you will need to complete the appropriate form, usually the California Withholding Exemption Certificate. This document allows you to declare your exemption status. Make sure to follow the guidelines carefully to avoid complications with California dissolution ca withholding.

Being subject to California withholding means that a portion of your income is withheld by your employer or payer to cover state tax obligations. This can apply to wages, certain payments, and other types of income. Understanding this can help you manage your finances better when dealing with California dissolution ca withholding.

When filling out your tax forms, you should indicate the appropriate amount for California tax withholding based on your income and residency status. If you are unsure, consider consulting a tax professional for guidance tailored to your situation. Remember, accurate reporting is essential to avoid issues related to California dissolution ca withholding.

Certain individuals may be exempt from California withholding, typically including non-residents or those who meet specific criteria. For example, if you are a foreign entity or an individual who meets specific income conditions, you may not be subject to California dissolution ca withholding. Always verify your status to ensure compliance with California tax regulations.

To fill out a California state tax form, begin by obtaining the correct form for your situation, such as the California Resident Income Tax Return. Gather all necessary financial documents, including income statements and deductions. Carefully follow the instructions provided for each section, ensuring that all information is accurate. For a smoother experience, you can use uslegalforms to access guidance and templates tailored for California tax filings.

California Form 593 is typically filled out by the buyer of real estate who is required to report withholding on the sale of California real property. This form is essential for ensuring compliance with California dissolution ca withholding regulations. Buyers must complete this form at the time of the sale, and it is crucial for accurate reporting. If you need assistance with this form, uslegalforms provides resources that can guide you through the process.