This form is a Complaint for Retroactive Rent Abatement. The form provides that plaintiffs refused to pay defendant any further rent until certain conditions were remedied and repaired. Plaintiffs were forced to vacate the premises due to the uninhabitable condition of the residence. Therefore, plaintiffs seek damages for the period in which they were not able to occupy the residence due to the unsafe conditions.

Retroactive Rent Abatement Withholding Tax

Description

How to fill out California Complaint For Retroactive Rent Abatement?

It’s obvious that you can’t become a law expert immediately, nor can you figure out how to quickly prepare Retroactive Rent Abatement Withholding Tax without the need of a specialized background. Creating legal documents is a time-consuming venture requiring a particular education and skills. So why not leave the creation of the Retroactive Rent Abatement Withholding Tax to the pros?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court documents to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

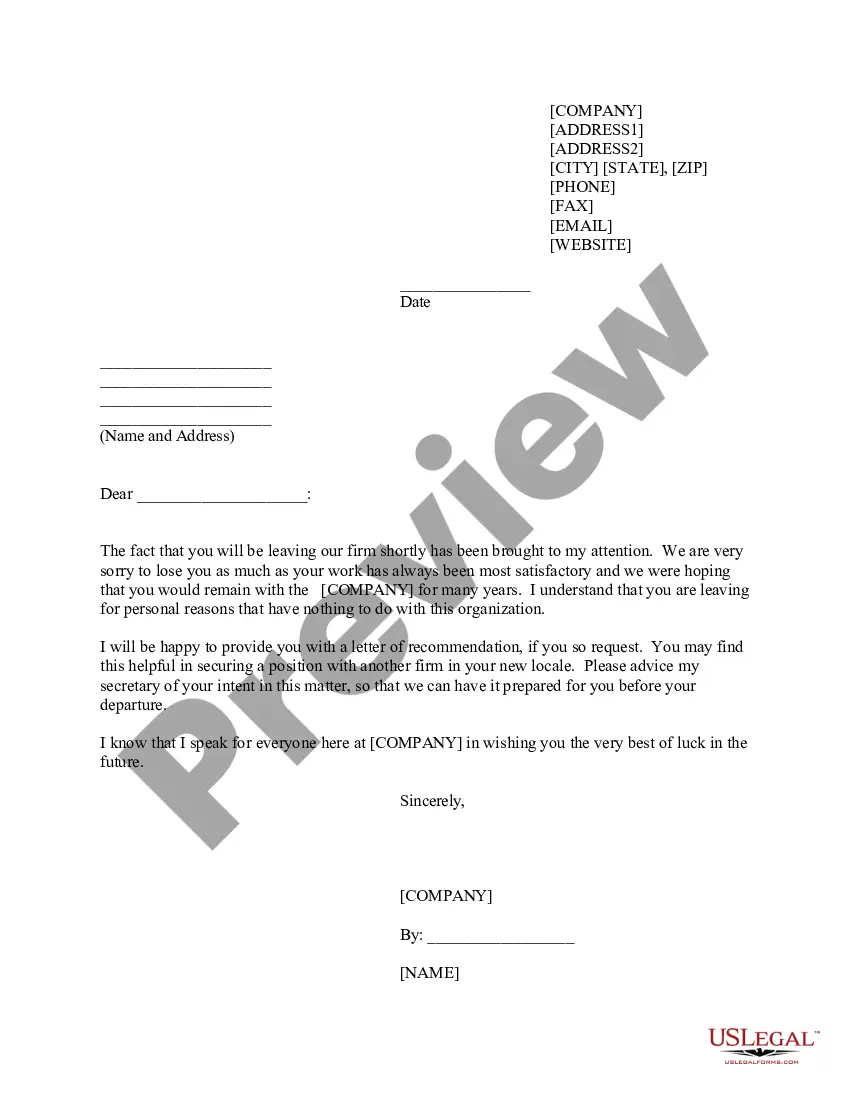

Here’s start off with our platform and get the form you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Retroactive Rent Abatement Withholding Tax is what you’re searching for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the template.

- Pick Buy now. Once the transaction is complete, you can get the Retroactive Rent Abatement Withholding Tax, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

You may be able to sue your landlord for a rent reduction or withhold rent, if you landlord fails to make a repair or violates the warrant of habitability. Withholding rent can be risky because your landlord may sue you for non-payment of rent.

If you live in Chicago, yes. If you live anywhere else in Illinois, it's illegal for tenants to withhold rent for repairs?no matter how serious the issue. State law in Illinois allows you to make repairs and deduct the cost from your rent, as long as it's less than $500 or half a month's rent (whichever is lower).

Tenants are not allowed to withhold rent or break their lease until they have (1) given the landlord a written notice and (2) given the landlord at least 14 days to fix the problem after the landlord gets the written notice.

Under Pennsylvania Law, you may withhold rent if you can prove the dwelling unit is not habitable and have taken the proper steps of informing the landlord of the problem and giving the landlord a reasonable amount of time to fix the defect that caused your rental unit to be uninhabitable.

The law allows the tenant to legally withhold rent under certain conditions involving the Court. By depositing rent with the Court, the tenant forces the landlord to take some action to recover rent money. The landlord must repair the conditions and apply to the Court for an order releasing the rent.