California Termination Tenancy Ca Withholding

Description

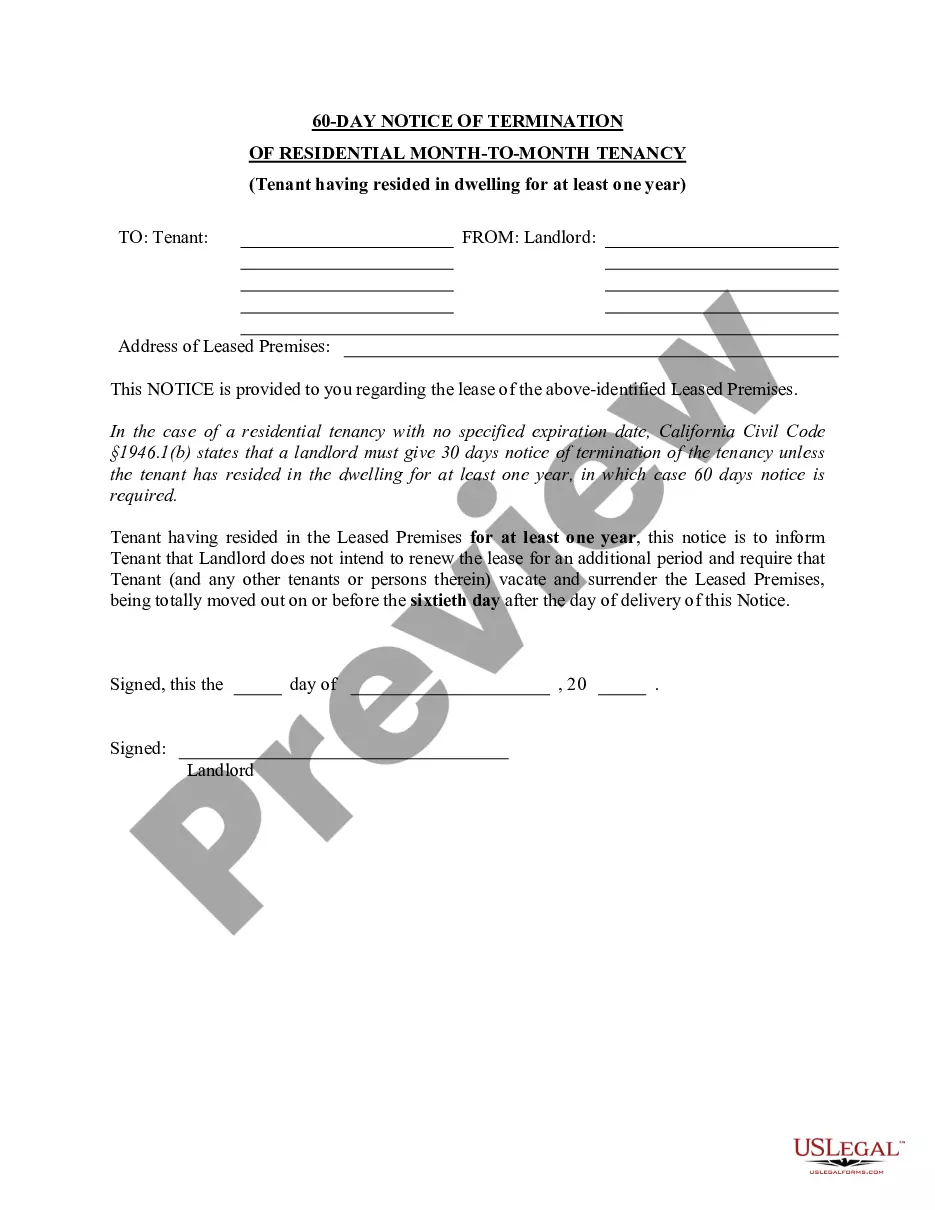

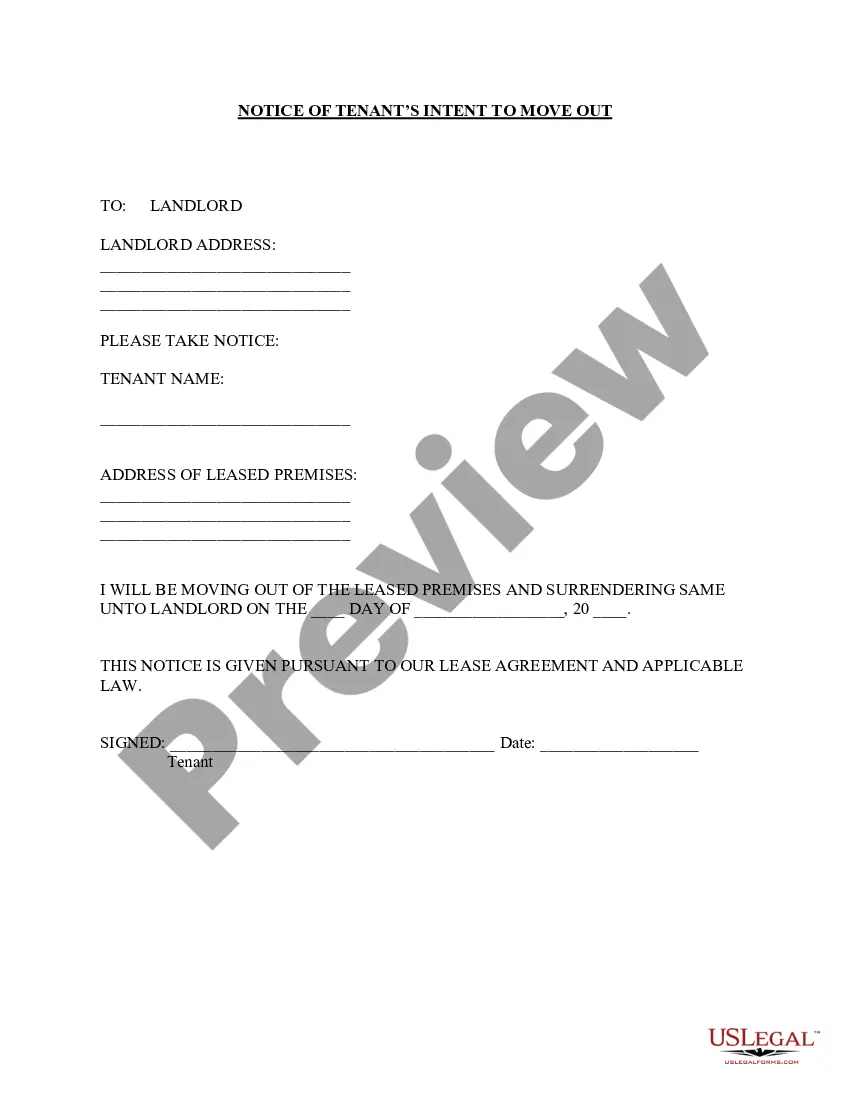

How to fill out California 60 Day Notice Of Termination - Residential Month-to-Month Tenancy?

It's clear that one cannot become a legal expert in a single night, nor can one easily learn to swiftly draft California Termination Tenancy Ca Withholding without having an expert background.

Drafting legal documents is a lengthy process that demands specialized training and expertise. So why not entrust the creation of the California Termination Tenancy Ca Withholding to professionals.

With US Legal Forms, featuring one of the largest collections of legal templates, you have access to a wide range of documents from court filings to templates for internal corporate communication. We recognize the significance of compliance with federal and state statutes and guidelines. That's why all templates on our site are tailored to specific locations and are current.

Click Buy now. After the payment is completed, you can obtain the California Termination Tenancy Ca Withholding, fill it out, print it, and deliver it to the required individuals or organizations.

You can revisit your forms at any time from the My documents section. If you're a returning customer, simply Log In to locate and download the template from the same section.

Regardless of the intention behind your forms—be it financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Begin your journey with our platform to acquire the document you require in just minutes.

- Find the document you need using the search bar positioned at the top of the webpage.

- Preview the document (if this option is available) and review the accompanying description to ascertain whether California Termination Tenancy Ca Withholding is what you're after.

- If you need a different form, restart your search.

- Create a free account and select a subscription plan to purchase the template.

Form popularity

FAQ

To properly fill out a tax withholding form, start by reviewing all the required information you need, such as personal identification and income levels. Accurately assess your withholding allowances based on your financial situation. Resources like uslegalforms can simplify the process of understanding and filling the California termination tenancy ca withholding form correctly.

Choosing between claiming 1 or 0 in California will largely depend on your financial goals and circumstances. Claiming 0 can be advantageous if you want to avoid any tax liability at year-end, providing peace of mind. However, claiming 1 may increase your monthly income but requires careful budgeting to cover any taxes owed later on.

To complete a California state tax form, gather all necessary documentation, including your income statements and any deductions you're eligible for. Input your personal details correctly and follow the instructions for each section. For more detailed help, consider using platforms like uslegalforms, which offer resources specifically aimed at California termination tenancy ca withholding.

Filling out a California state withholding form involves entering essential information like your name, address, and total income. Be sure to carefully follow the instructions provided with the form to determine your correct withholding allowances. Using the California termination tenancy ca withholding guide can provide clarity, ensuring your submissions are correct.

In California, whether to claim 1 or 0 on your withholding form hinges on your unique financial circumstances. Claiming 0 ensures higher withholding rates, which can be beneficial if you anticipate owing taxes. Conversely, if you expect a refund, claiming 1 may suit you better. Evaluate your past tax returns or consult a tax professional for tailored advice.

To fill out your withholding form, start by obtaining the correct California termination tenancy ca withholding form. Enter your personal information, such as your name, address, and Social Security number. Follow the instructions for the specific form you have, ensuring that all entries are clear and accurate to avoid delays or issues.

If you choose not to withhold taxes when required, you could face penalties from the California tax authorities. Non-compliance may lead to back taxes owed, interest accumulation, and potential legal actions. It's beneficial to understand the requirements of California termination tenancy CA withholding and seek guidance to fulfill your tax obligations correctly. Platforms like uslegalforms can simplify this process and ensure you're properly informed.

Termination of an order to withhold tax in California signifies that the state no longer requires the payer to withhold funds from a non-resident's income. This can occur when certain conditions are met, like full payment of owed taxes. Being informed about California termination tenancy CA withholding can help you avoid unnecessary penalties and maintain compliance with state laws.

When an order to withhold is terminated, it means that the directive to withhold funds from a person's income has been lifted. This can happen for several reasons, such as the resolution of a tax obligation or completion of a specific condition. Understanding California termination tenancy CA withholding can help you navigate these situations responsibly and ensure compliance.

CA form 593 is generally filed by individuals or entities that make payments to non-residents within the state. This includes businesses, rental property owners, and other payers subject to California termination tenancy CA withholding. By filing this form, you ensure compliance with the state's tax regulations concerning non-resident income tax withholding.