Ca Termination California Withholding

Description

How to fill out California 60 Day Notice Of Termination - Residential Month-to-Month Tenancy?

Creating legal documents from the beginning can occasionally be somewhat daunting.

Certain situations may require extensive research and significant expenses.

If you're looking for a simpler and more budget-friendly method of generating Ca Termination California Withholding or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every dimension of your financial, legal, and personal issues.

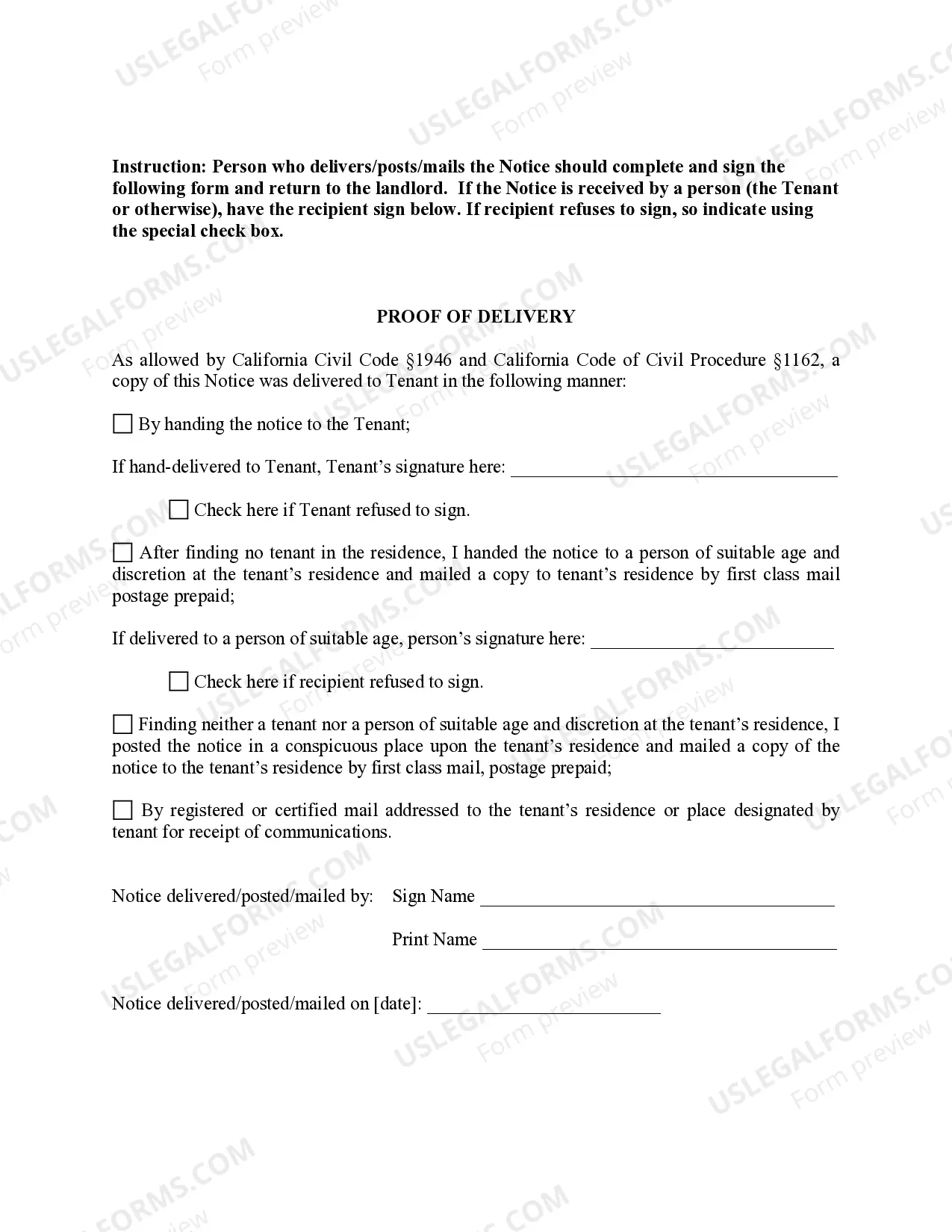

But before proceeding to download Ca Termination California Withholding, adhere to these guidelines: Ensure to review the form preview and descriptions to confirm it’s the document you require. Verify if the template you select complies with your state and county regulations. Opt for the appropriate subscription plan to acquire the Ca Termination California Withholding. Download the document, then fill it out, certify it, and print it. US Legal Forms takes pride in its impeccable reputation and over 25 years of experience. Join us today and transform the process of filling out forms into something straightforward and efficient!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you require dependable and trustworthy services to seamlessly find and download the Ca Termination California Withholding.

- If you are familiar with our website and have set up an account previously, simply Log In, find the template, and download it immediately or retrieve it later in the My documents section.

- Don’t possess an account? No worries. It only takes a few minutes to create one and browse the catalog.

Form popularity

FAQ

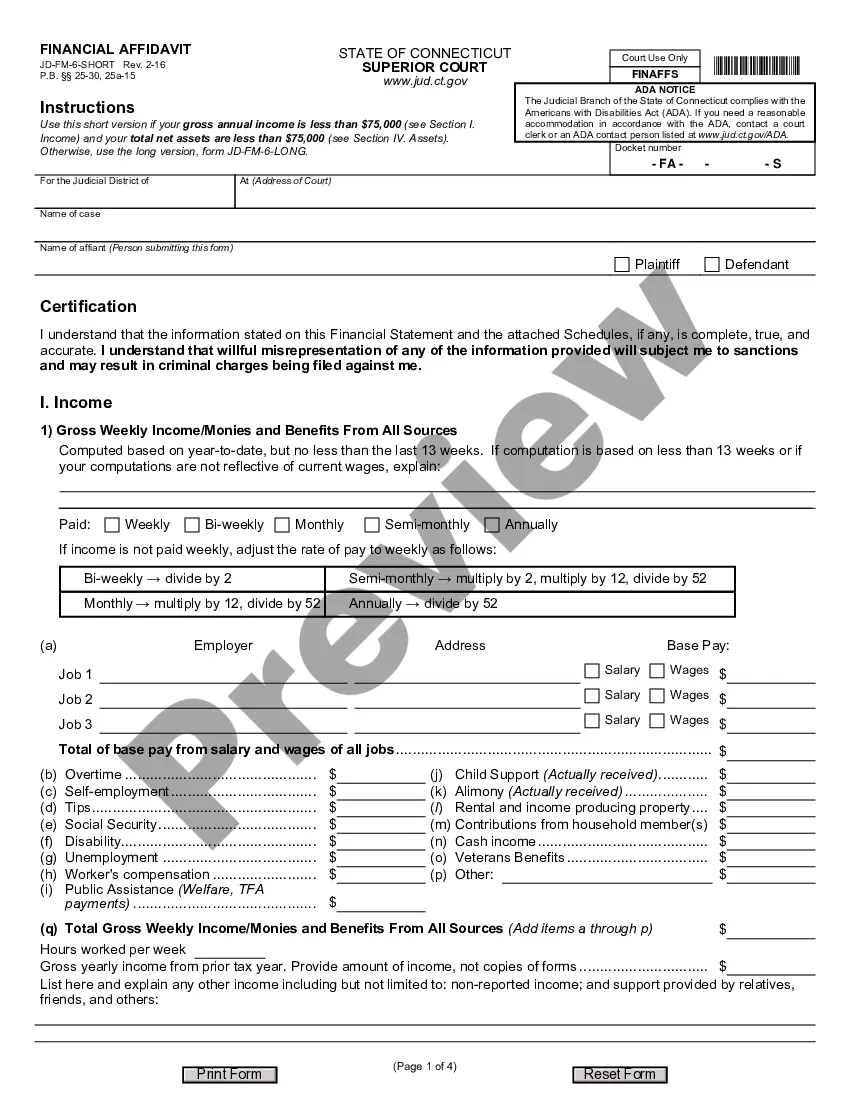

State withholding is money that is withheld and sent to the State of California to pay California income taxes. It pays for state programs such as education, health and welfare, public safety, and the court justice system. California's elected representatives also meet every year to decide how this money will be spent.

How do I close an employer payroll tax account? Log in to e-Services for Business. Submit your final documents: Payroll Tax Deposit. Tax Return. Wage Report. Select Close Account from the Account Management panel. Enter the required information, then select Next. Complete the Declaration, then select Submit.

Completing the Form: Fill in your name, address, Social Security number, and the identification number (if any) of the pension or annuity. ... Enter an estimate of your itemized deductions for California taxes for this tax year as listed in the. ... Enter estimate of total wages for tax year 2023.

An individual's *account* with EDD is a different matter and cannot be ?closed? or ?cancelled?, since it's an official government agency record.

Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages: AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4.