Notice 30 Day Forecast Melbourne

Description

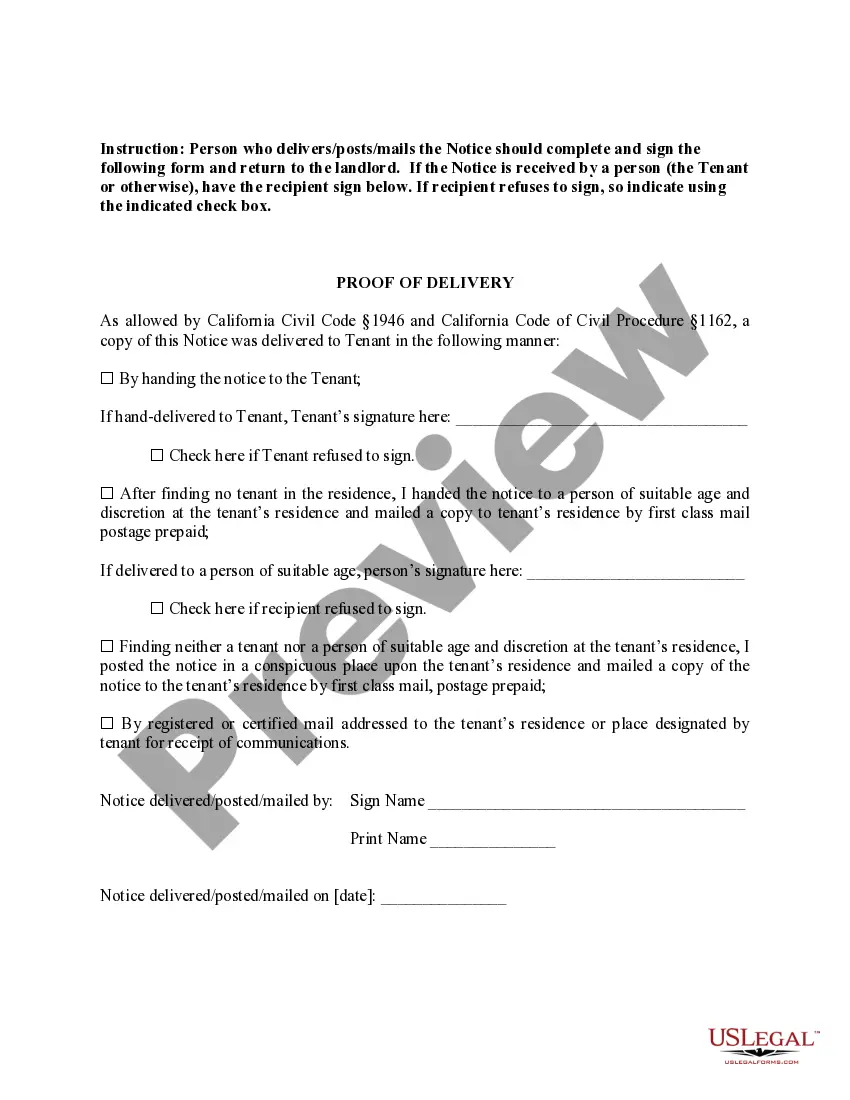

How to fill out California 30 Day Notice Of Termination - Residential Month-to-Month Tenancy - Nonrenewal Of Lease?

Handling legal documents and processes can be a lengthy addition to your daily routine.

Notice 30 Day Forecast Melbourne and similar forms generally necessitate that you locate them and figure out how to fill them out properly.

For this reason, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online library of forms available will be incredibly beneficial.

US Legal Forms is the leading online service for legal templates, featuring over 85,000 state-specific forms and various resources to assist you in completing your documents with ease.

Is this your first time using US Legal Forms? Sign up and create your account in a few minutes and you'll gain access to the form library and Notice 30 Day Forecast Melbourne. Then, follow these steps to complete your form: Make sure you have found the correct form using the Preview feature and reviewing the form description. Click Buy Now when you're ready, and choose the monthly subscription plan that suits you best. Hit Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience aiding clients with their legal documents. Obtain the form you need now and simplify any process without breaking a sweat.

- Explore the collection of relevant documents with just a single click.

- US Legal Forms offers state- and county-specific forms accessible at any time for download.

- Streamline your document management processes with premium support that enables you to prepare any form in minutes without any additional or hidden fees.

- Simply Log In to your account, find Notice 30 Day Forecast Melbourne and obtain it immediately from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

NOTE: To cancel your Limited Liability Partnership registration, you must write ?Cancellation? on the form in box four. A signature of at least 2 partners or authorized agent is required.

?All partnerships are granted an automatic six-month extension to file Form M3, Partnership Return. If the IRS grants an extension of time to file your federal return that is longer than Minnesota's six-month extension, your state filing due date is extended to the federal due date.

A partnership that has taxable Minnesota gross income must file Form M3, Partnership Return, if it's required to file one of the following federal tax forms: Form 1065, U.S. Return of Partnership Income. Form 1065-B, U.S. Return of Income for Electing Large Partnerships.

Who Must File. A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565. See definition of ?doing business? in General Information A, Important Information.

A Minnesota partnership, limited liability company or S Corporation (other than those that have a partnership, limited liability company or corporation as a member)1 may elect2 to pay a tax at the highest state tax rate, 9.85% for 2021. The tax is imposed on the income of qualifying owners from the entity.

Beneficiaries of a fiduciary, partners of a partnership, and shareholders of an S corporation may qualify to elect Composite Income Tax when filing. When a fiduciary (estate or trust) has Minnesota-source income, beneficiaries generally must file a state tax return to report and pay tax on their share.