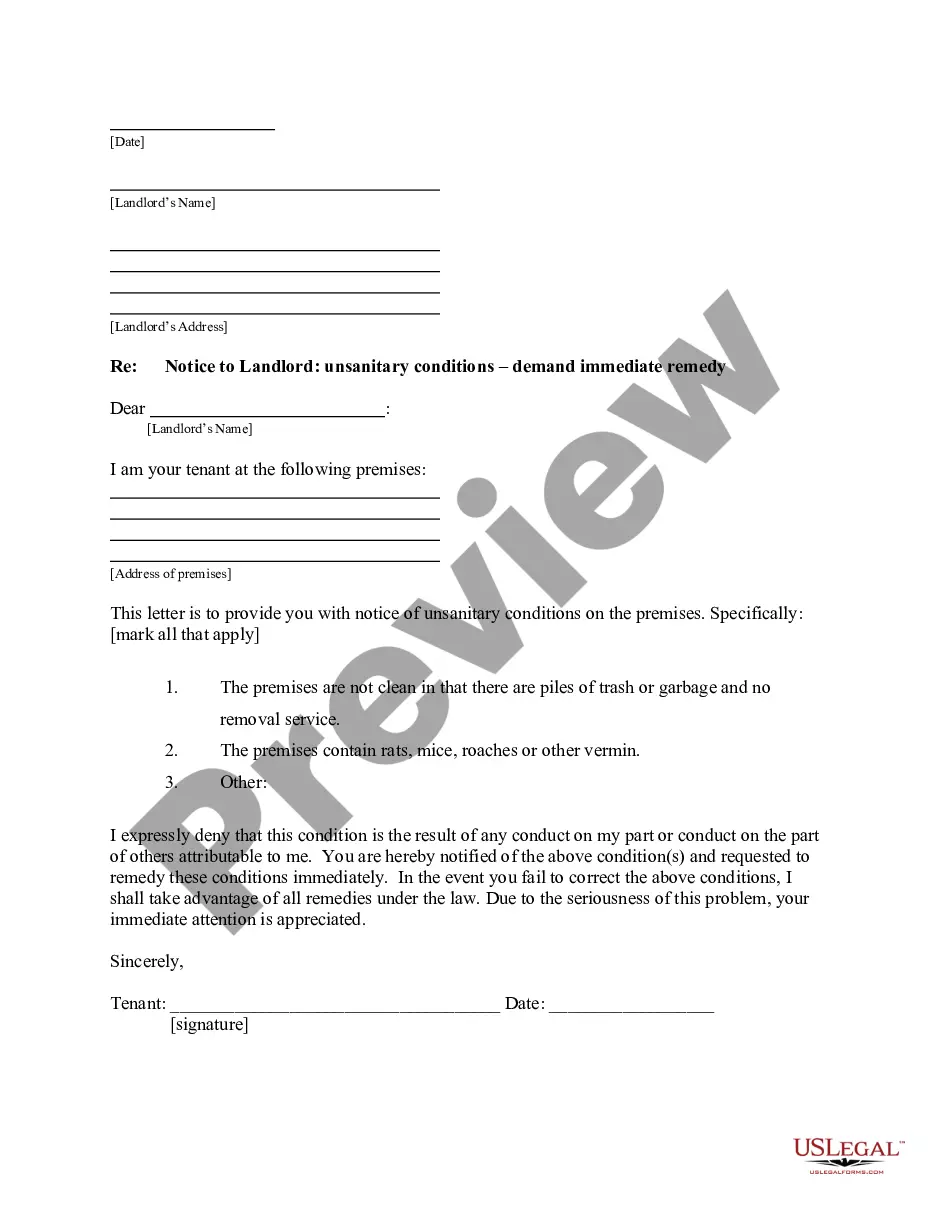

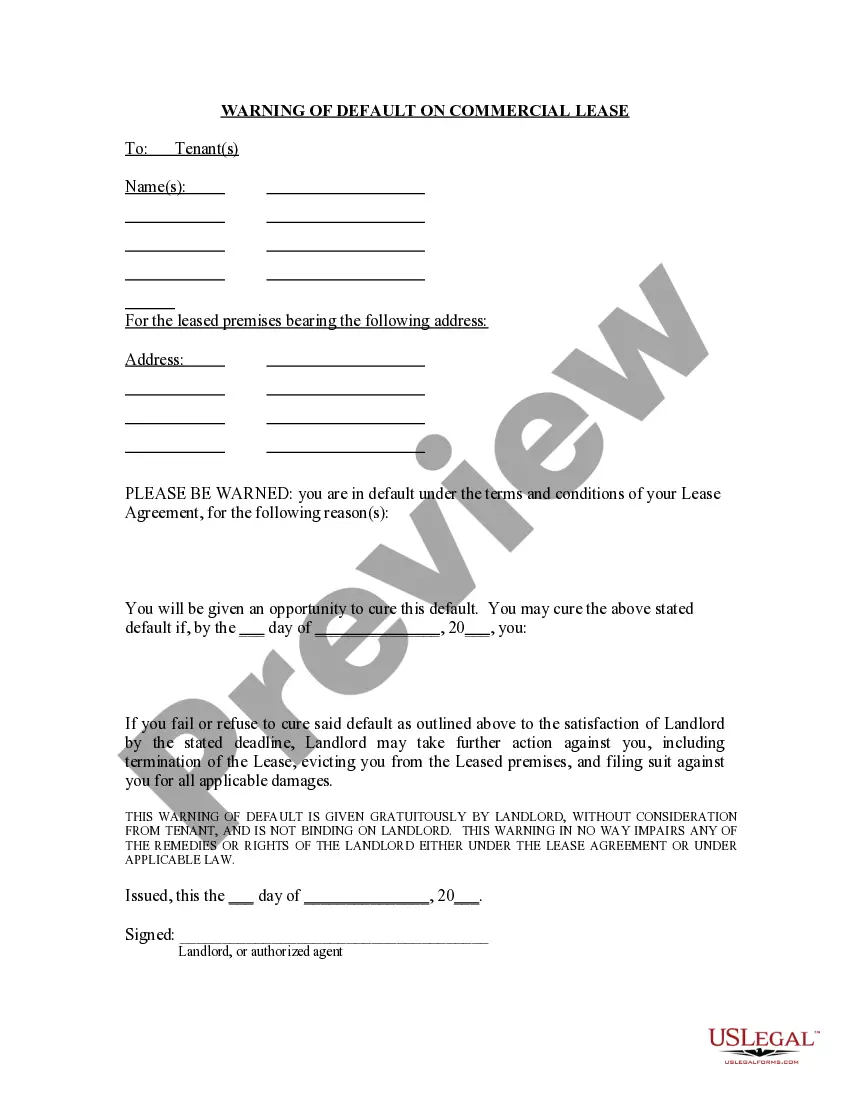

A 30 Day Notice of Termination is used when the Landlord and Tenant are on a month-to-month basis. During that time, when either the Tenant or the Landlord wishes to terminate the lease agreement, he/she must give only a 30 days notice of said termination.

30 Day Notice Letter For Job

Description

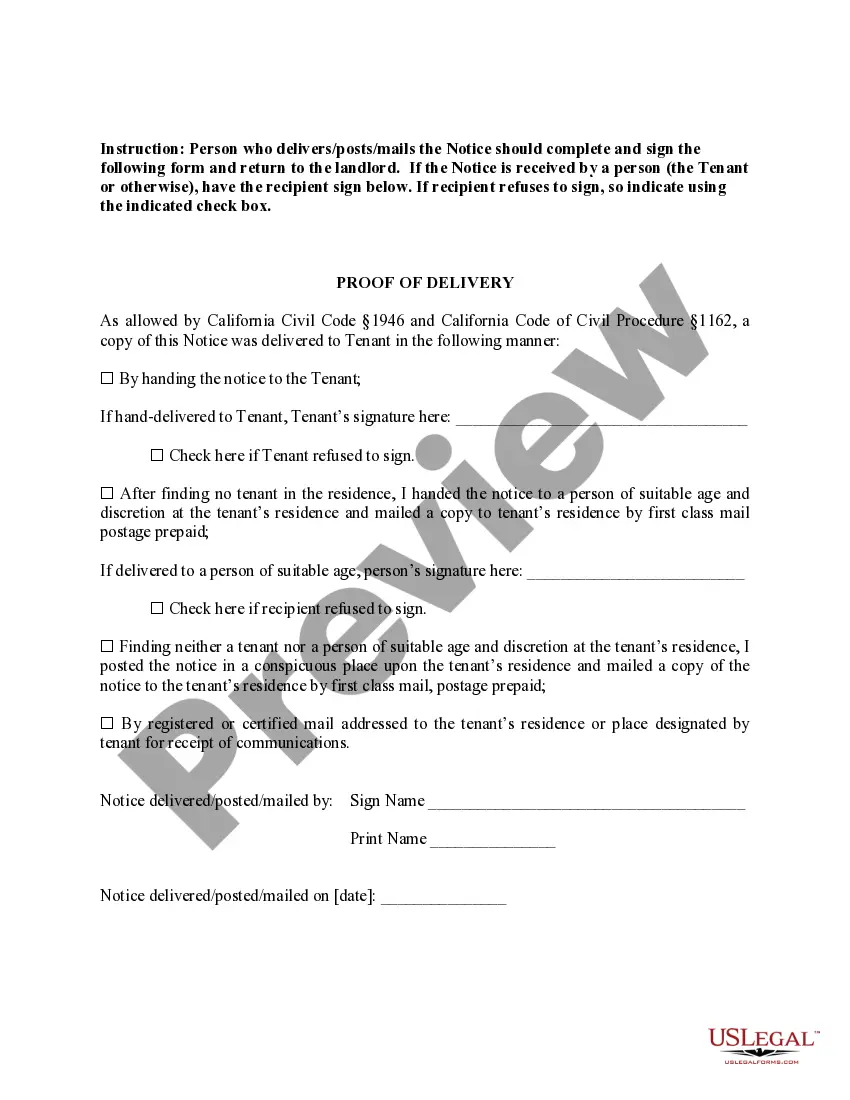

How to fill out California 30 Day Notice Of Termination - Residential Month-to-Month Tenancy - Nonrenewal Of Lease?

It’s clear that you cannot become a legal authority instantly, nor can you understand how to swiftly draft a 30 Day Notice Letter For Job without a specialized background.

Producing legal documents is a lengthy process that necessitates specific education and abilities.

So why not entrust the drafting of the 30 Day Notice Letter For Job to the professionals.

Preview it (if this option is available) and review the accompanying description to confirm whether the 30 Day Notice Letter For Job is what you’re looking for.

Create a free account and select a subscription plan to purchase the template.

- With US Legal Forms, one of the most extensive legal document repositories, you can discover everything from court papers to templates for internal corporate communications.

- We understand how vital compliance and adherence to federal and local regulations are.

- For this reason, on our platform, all templates are tailored to specific locations and current.

- Here’s how to start with our platform and acquire the document you require in just minutes.

- Find the form you need using the search bar at the top of the page.

Form popularity

FAQ

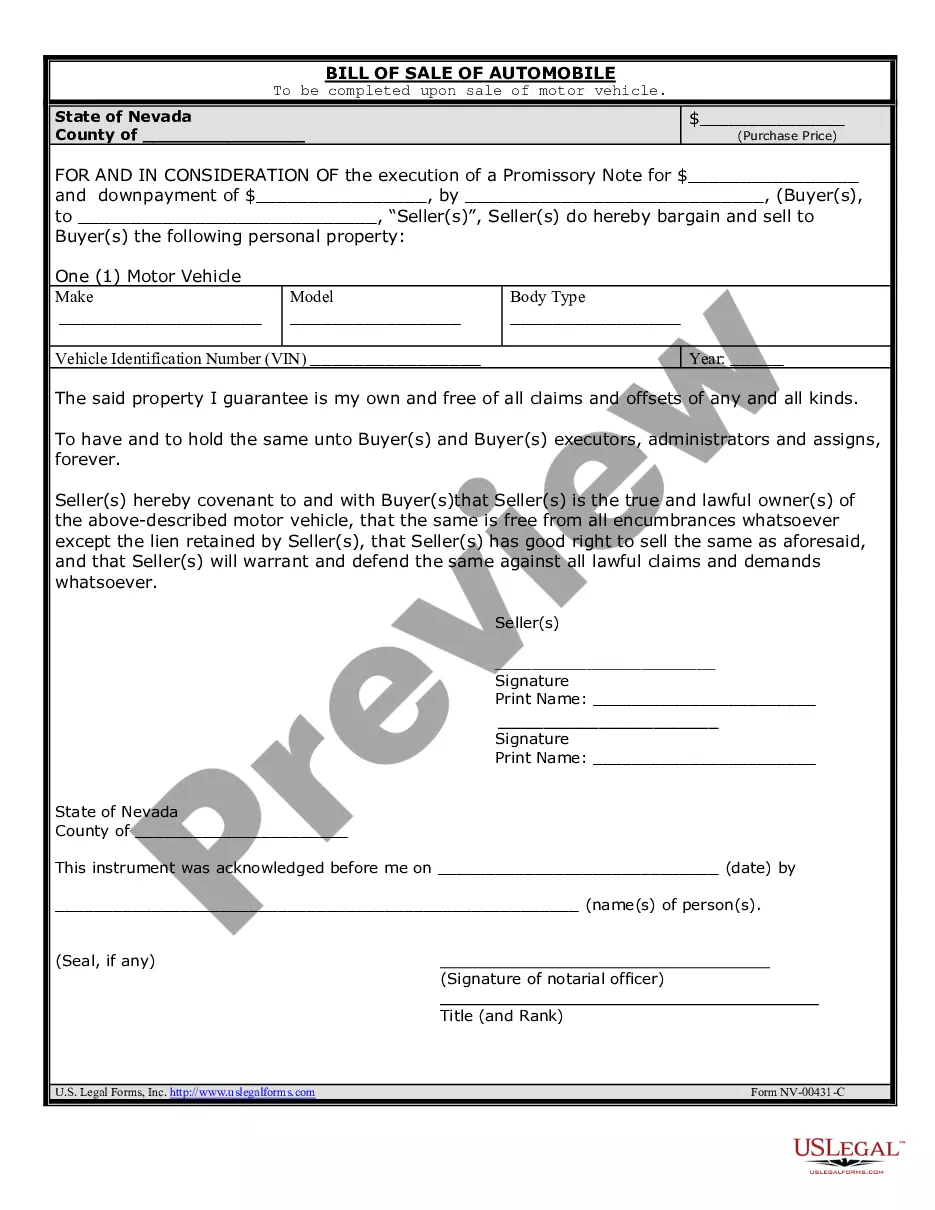

A 30-day letter generally refers to a notice that gives your employer or service provider a month's time before your departure or cancellation takes effect. This type of letter helps facilitate a structured exit process, allowing all parties to prepare accordingly. It often serves to uphold professionalism and enhance future relationships. For crafting such letters, US Legal Forms provides templates tailored for various situations.

To write a one month notice letter, start with a clear statement of your intent to resign, followed by your last working day. Include a brief expression of gratitude for the opportunities you've had during your employment. It’s important to keep the letter professional and concise. Our platform offers easy-to-use templates specifically designed for a 30-day notice letter for job, making the process straightforward.

A 30-day notice letter for job is a formal document that informs your employer of your intention to resign. It generally provides your employer with a month's notice before your planned departure, allowing them time to find a replacement. This letter helps maintain professionalism and ensures a smooth transition. Using our US Legal Forms platform, you can find templates to create an effective 30-day notice letter.

To file your federal taxes, use Form 1040, U.S. Individual Income Tax Return, and supporting schedules if needed. To file your Vermont taxes, use Form IN-111, Vermont Income Tax Return, and supporting schedules if needed.

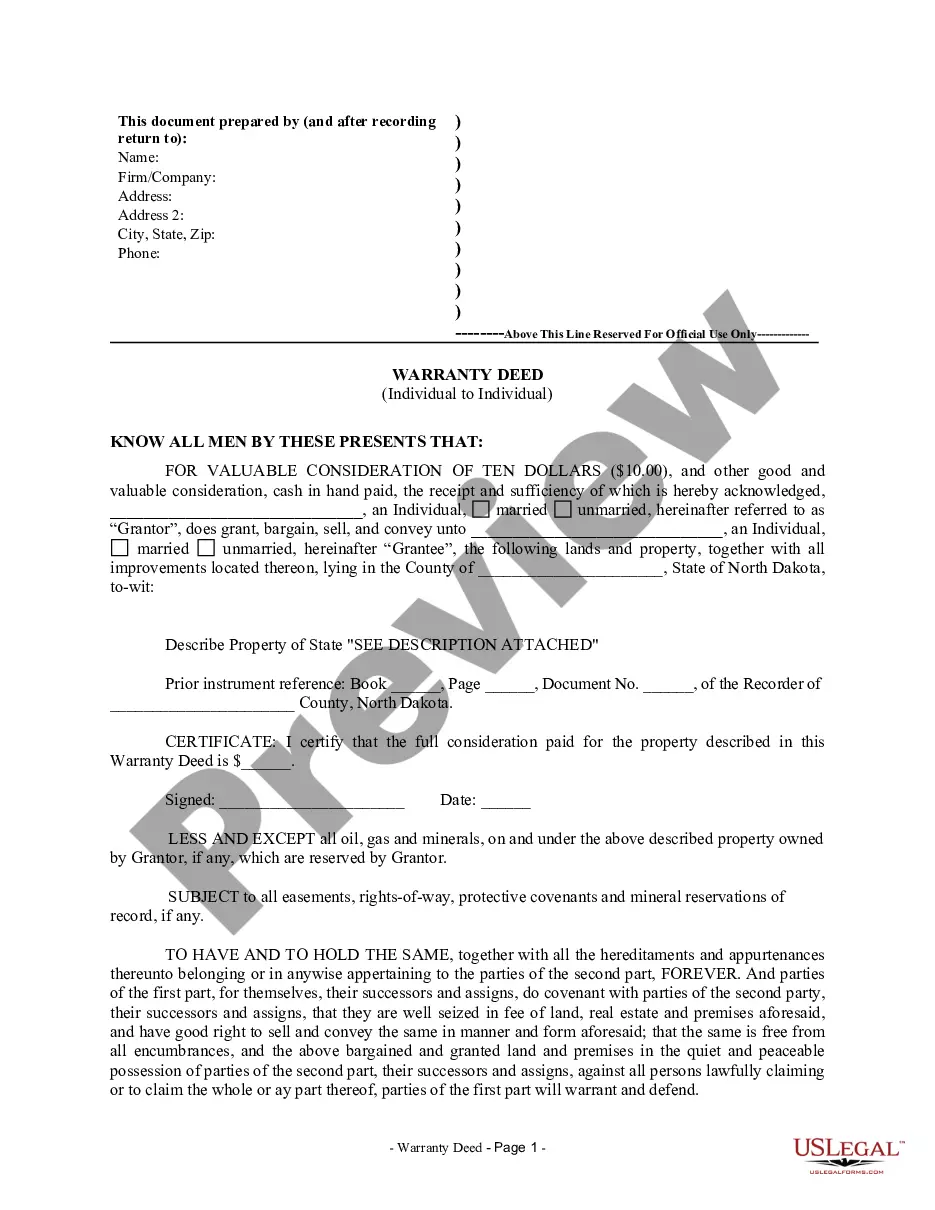

If you don't pay your real property taxes in Vermont, the tax collector can sell the property to a new owner at a tax sale. Fortunately, you'll have some time to get current on the delinquent amounts before and after a sale.

Local IRS Taxpayer Assistance Center (TAC) ? The most common tax forms and instructions are available at local TACs in IRS offices throughout the country. To find the nearest IRS TAC, use the TAC Office Locator on IRS.gov.

These are tax lien states: Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Maryland, Mississippi, Missouri, Montana, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Vermont, West Virginia, and Wyoming. The District of Columbia is also a tax lien jurisdiction.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

To order forms by phone: Call 800-338-0505. Select 1 for Personal Income Tax, 2 for Business Entity Information. Select "Forms and Publications"

Ways to Get Your. Vermont Income Tax Forms. Download fillable PDF forms from the web. Order forms online. Order forms by email. Order forms by phone. For a faster refund, e-file your taxes! For information on free e-filing and tax assistance for qualified taxpayers, visit .tax.vermont.gov.