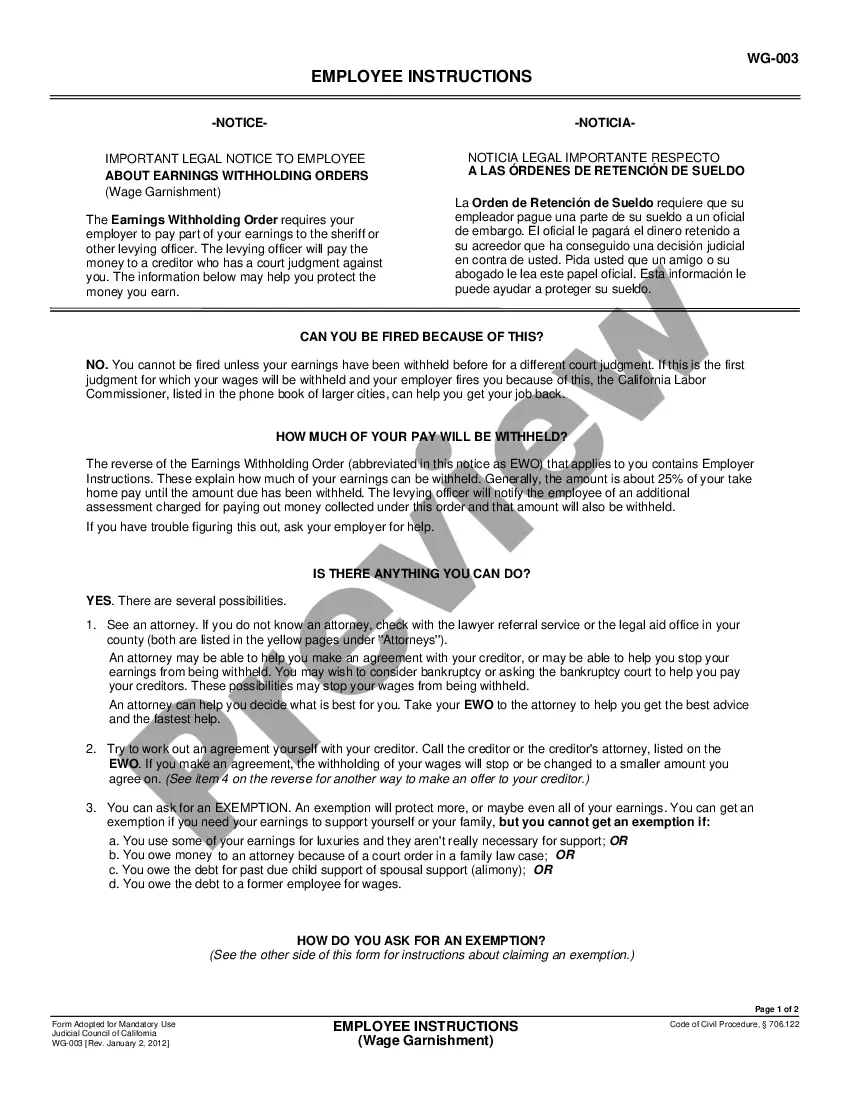

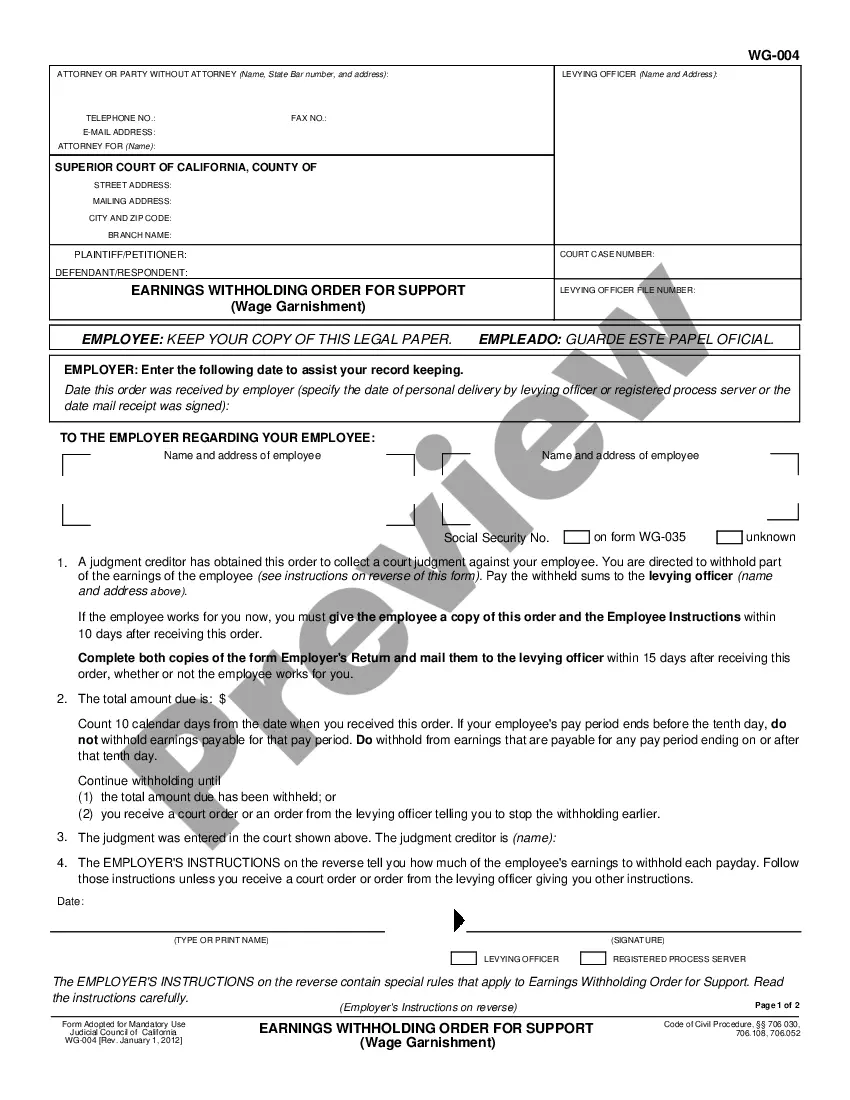

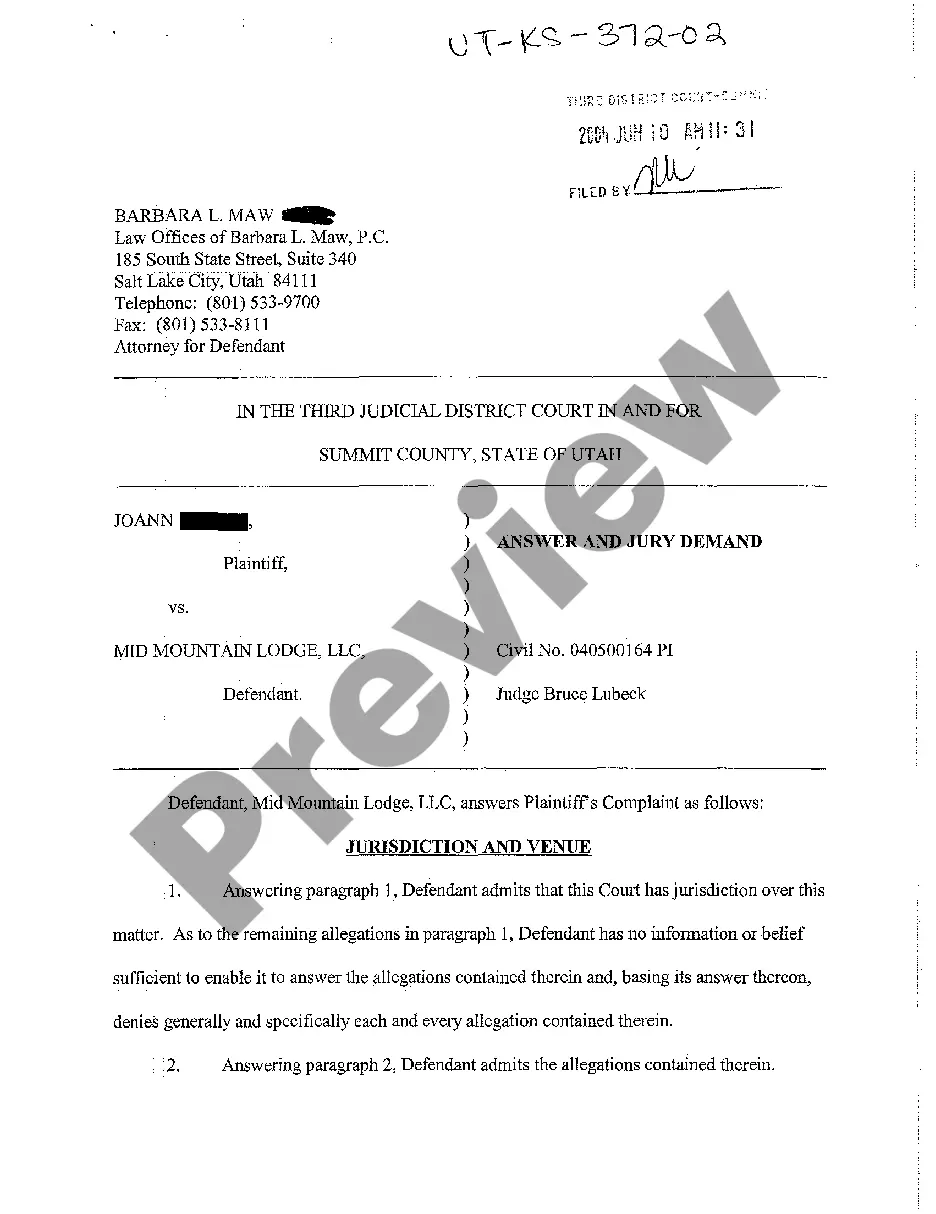

Employer's Return: An Employer's Return involves the wage garnishment of an Employee. This form is to be filled out and signed by the Employer, or risk fines from the court for non-compliance. It lists the Employee's name, address and wages, among other things.

California Employer's Return - Wage Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Employer's Return - Wage Garnishment?

If you're looking for accurate California Employer's Return - Wage Garnishment samples, US Legal Forms is what you need; access documents created and validated by state-certified legal experts.

Utilizing US Legal Forms not only spares you from complications regarding legal paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is considerably cheaper than hiring legal representation to do it for you.

And that’s all. In just a few simple steps, you have an editable California Employer's Return - Wage Garnishment. After setting up your account, all future requests will be processed even more effortlessly. Once you have a US Legal Forms subscription, simply Log In to your profile and click the Download button available on the form’s page. Then, when you need to access this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort searching through countless forms on various platforms. Obtain professional templates from a single reliable service!

- To begin, finalize your registration process by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the California Employer's Return - Wage Garnishment template to resolve your issues.

- Utilize the Preview feature or review the document description (if available) to ensure that the sample is what you require.

- Verify its validity in your state.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

Form popularity

FAQ

If you have your wages garnished to settle a debt, that pay is still legally yours, so you can't simply ask the Internal Revenue Service to deduct it from your income or ask for a refund of garnished wages on your taxes. It's effectively the same as if you received your paycheck and then paid your creditor.

Although your employer is not required to report wage garnishments on your W-2. you can manually insert this information on Box 14 of the form.

Fill out a Claim of Exemption (Form EJ-160 ) and a Financial Statement (Form EJ-165 ). Use the Exemptions From the Enforcement of Judgments (Form EJ-155.

For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employee's disposable earnings, or the amount by which an employee's disposable earnings are greater than 30 times the federal minimum wage (currently

If you have a garnish imposed on your earnings, money will be taken from your gross income rather than your net income in order to satisfy your debt obligations.

Garnishment applies to your net income. This is the amount of an employee's income left after required deductions such as taxes and Social Security contributions.

Unfortunately, by ignoring the proper Writ of Garnishment, your employer can get in trouble and Debbie may get fired.and the creditor finds out, your employer may end up going to court on an Order to Show Cause, where they have to explain to the judge why they ignored the court documents.

Unfortunately, by ignoring the proper Writ of Garnishment, your employer can get in trouble and Debbie may get fired.and the creditor finds out, your employer may end up going to court on an Order to Show Cause, where they have to explain to the judge why they ignored the court documents.

Call the county's levying officer. Ask the court clerk who the levying officer is. Typically, it is the sheriff's office. Call and ask what the fee is to cover the costs of garnishing the debtor's wages. Be prepared to have a check or money order made out in that amount.