California Tenant Increase Formula

Description

How to fill out California Letter From Landlord To Tenant About Intent To Increase Rent And Effective Date Of Rental Increase?

Legal management can be exasperating, even for experienced professionals.

When searching for a California Tenant Increase Formula and lacking the time to find the accurate and current version, the tasks can be challenging.

Access a valuable resource hub of articles, guides, and materials pertinent to your situation and needs.

Save time and energy searching for the documents you require, and make use of US Legal Forms’ sophisticated search and Review feature to locate California Tenant Increase Formula and obtain it.

Leverage the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly process today.

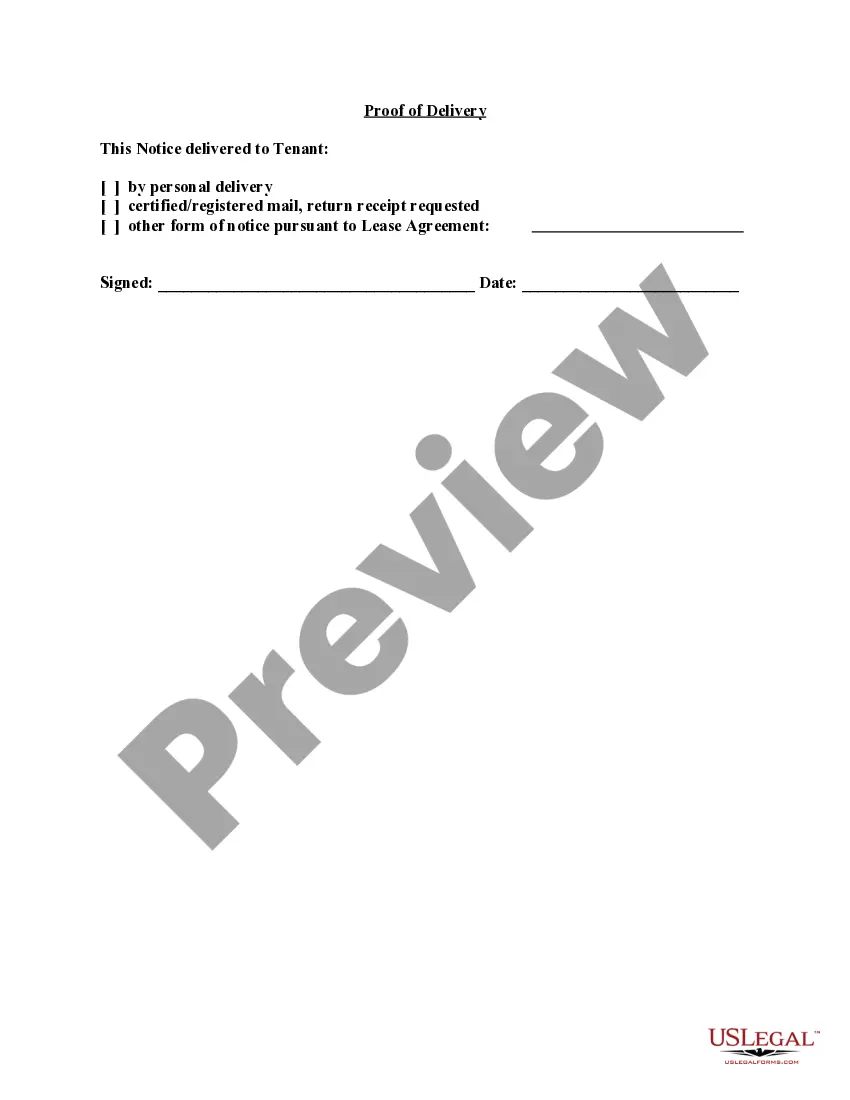

- Confirm that this is the correct form by previewing it and reviewing its details.

- Ensure that the template is valid in your state or county.

- Click Buy Now once you are prepared.

- Select a subscription plan.

- Choose the file format you prefer, and Download, complete, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses all your needs, from personal to organizational papers, in one location.

- Use innovative tools to complete and manage your California Tenant Increase Formula.

Form popularity

FAQ

California's Tenant Protection Act There is a maximum increase of 10% allowed in any given year, thus the Act's provision is often referred to as a ?rent cap.? To calculate the cost of living increase that is applicable to your market, use the Consumer Price Index (CPI) published by the Bureau of Labor Statistics.

Raising rent in California Landlords are allowed to raise rent by a maximum of 10% every 12 months. That means if the CPI change is above 5%, the maximum increase caps at 10%. It's vital to understand, however, that the actual amount you can raise rent depends largely on your local city laws.

Limits on Rent Increases The Tenant Protection Act caps rent increases for most tenants in California. Landlords cannot raise rent more than 10% total or 5% plus the percentage change in the cost of living ? whichever is lower ? over a 12-month period.

Effective July 1, 2023, the annual rent adjustment maximum rate will be 9.2%. The Tenant Protection Program annual rent adjustment is based on 5% plus the percentage of the annual increase in the California Consumer Price Index (CPI) for All Urban Consumers for all items, if any. 5.156.

AB 1482 restricts rent increases in any 12-month period to no more than 5% plus the percentage change in the cost of living (CPI), or 10%, whichever is lower. For increases that take effect on or after Aug. 1, 2023, all the applicable CPIs are less than 5%, reflecting a drop in the inflation rate from the prior year.