California Divorce Information Law Formula

Description

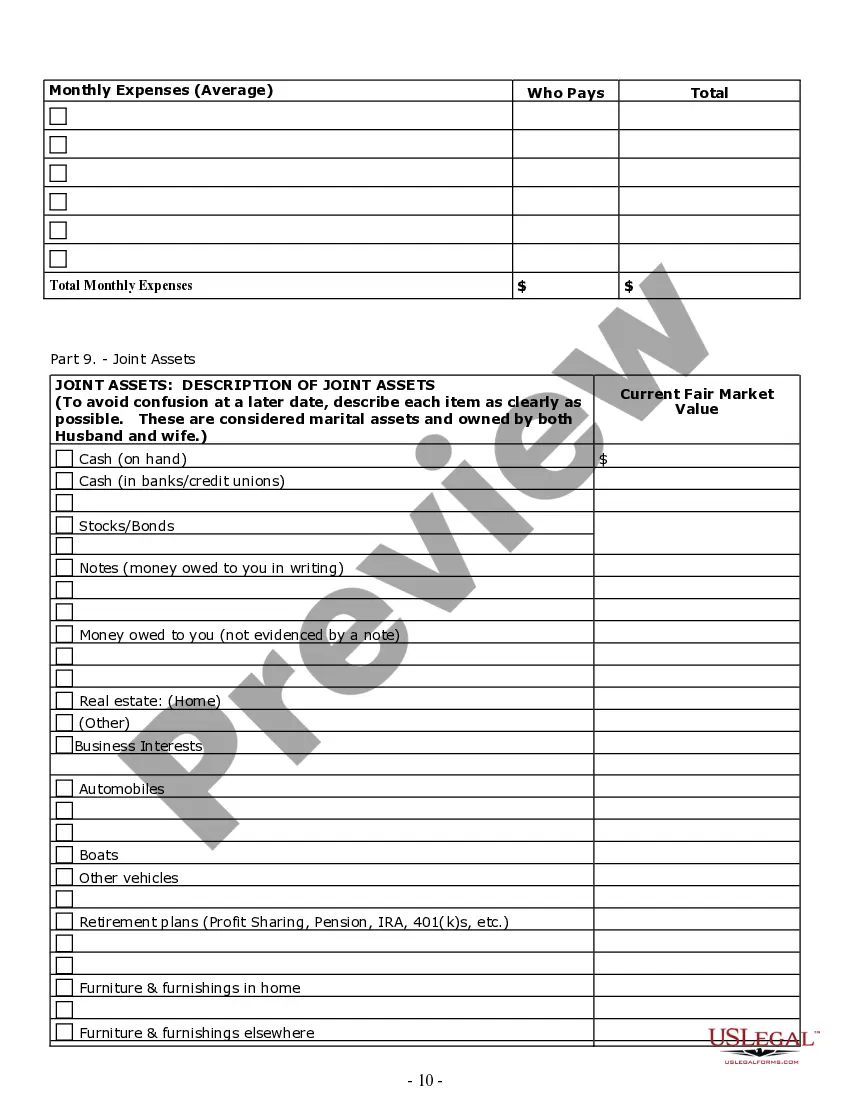

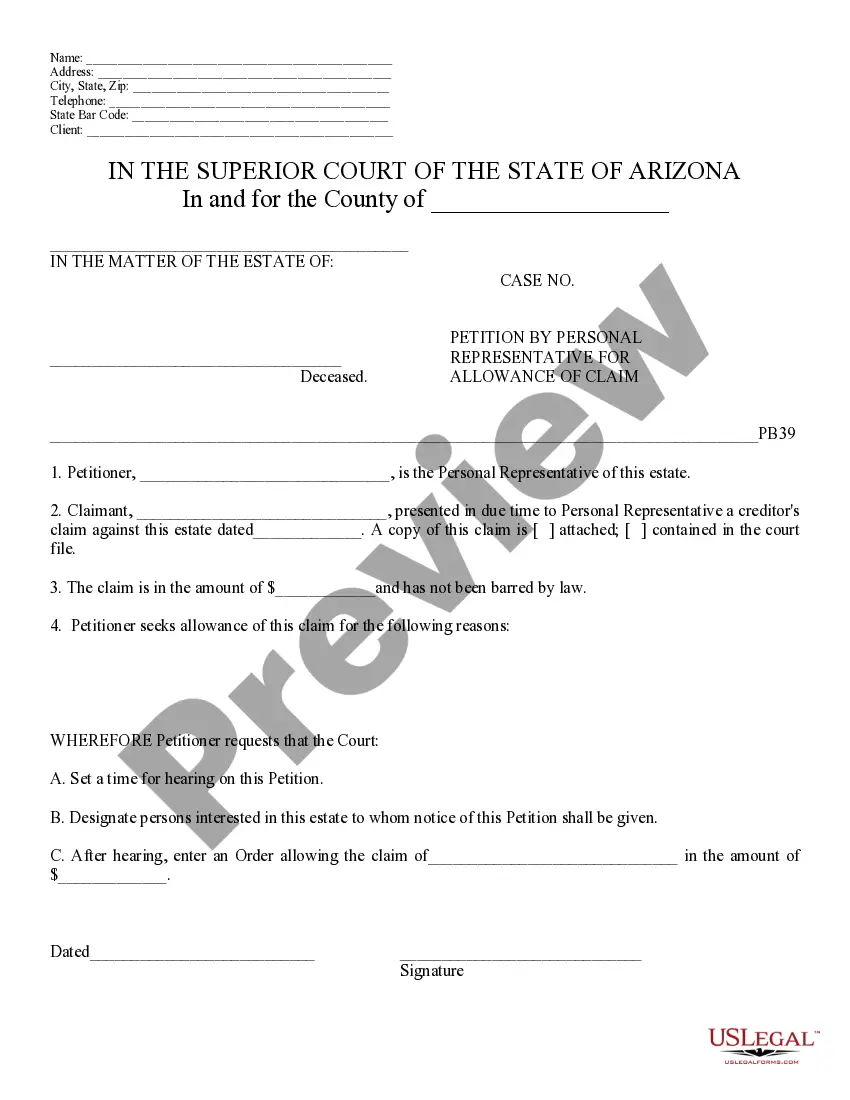

How to fill out California Divorce Worksheet And Law Summary For Contested Or Uncontested Case Of Over 25 Pages - Ideal Client Interview Form?

Identifying a primary location to obtain the most up-to-date and pertinent legal templates is a significant part of dealing with bureaucracy. Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to source California Divorce Information Law Formula samples exclusively from reliable providers, such as US Legal Forms. An incorrect template can squander your time and delay your situation. With US Legal Forms, you have minimal concerns. You can access and review all details concerning the document’s application and significance for your situation and in your state or county.

Consider the outlined steps to complete your California Divorce Information Law Formula.

Eliminate the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms catalog where you can discover legal templates, verify their pertinence to your situation, and download them immediately.

- Utilize the library navigation or search function to find your sample.

- Examine the form’s details to determine if it satisfies the stipulations of your state and locality.

- Review the form preview, if offered, to ensure the form meets your needs.

- Return to the search to find the suitable template if the California Divorce Information Law Formula does not fulfill your requirements.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Select the pricing plan that suits your requirements.

- Proceed with the registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading California Divorce Information Law Formula.

- Once you have the form on your device, you can modify it using the editor or print it out and fill it out manually.

Form popularity

FAQ

Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage. There's no guarantee your request will be accepted, but there's no harm in asking. A record of on-time payments since the debt was paid will help your case.

The statute of limitations on debt in NJ is six years ing to Section 2A:14-1 of the state's laws. The statute of limitations applies to all kinds of debt. These include written, oral, promissory, or open. Once this period lapses, you cannot sue an individual or use force to try and recover the debt.

For most types of debts in New Jersey, the statute of limitations is six years. However, the statute of limitations is 20 years on judgments, and there are other specific types of debts that may have a different statute of limitations.

InCharge provides free, nonprofit credit counseling and debt management programs to New Jersey residents. If you live in New Jersey and need help paying off your credit card debt, InCharge can help you.

If you dispute the debt, make a copy of your written dispute and send the original to the debt collector. It's also generally a good idea to send the dispute by certified mail. If you pay for a "return receipt," you'll have proof the debt collector received your mail.

NJ laws limit the amount of time a creditor can collect on debt to six years. If a default judgment is entered against you, the time allowed to collect increases to 20 years, or longer if renewed. The writ of execution allows the judgment to be enforced, and creditors gain access to more ways to collect from you.

Statute of Limitations on Debt in New Jersey Debt TypeDeadlineOpen account6 yearsWritten contracts6 yearsOral contracts6 yearsJudgment20 years5 more rows ?

Confirm that the debt is yours. ... Check your state's statute of limitations. ... Know your debt collection rights. ... Figure out how much you can afford to pay. ... Ask to have your account deleted. ... Set up a payment plan. ... Make your payment. ... Document everything.