Quitclaim Deed Trustees For Trust

Description

How to fill out California Quitclaim Deed - Trust (Two Trustees) To An Individual?

- Check if you have an account with US Legal Forms. If you do, log in to access your purchased forms.

- If you're a new user, search for 'quitclaim deed' in the preview mode to find a suitable template that matches your needs.

- Examine other options if the initial choice does not fit. Use the search bar to locate any alternate forms.

- Once you've selected the correct document, click on the 'Buy Now' button and choose a subscription plan. You will need to create an account to proceed.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the quitclaim deed. Save it to your device and access it anytime from the My Forms section.

In conclusion, US Legal Forms makes it simple to acquire vital legal documentation like a quitclaim deed for trustees. Their extensive form collection, coupled with expert assistance, ensures you create documents that are both accurate and legally valid.

Start your journey with US Legal Forms today to handle your legal needs effortlessly!

Form popularity

FAQ

Finding a trustee for a deed of trust involves researching qualified individuals or institutions in your area. Start by asking for recommendations from real estate professionals or legal advisors. Ensure that the trustee you choose has a good reputation and experience in handling such transactions. USLegalForms can assist you by providing resources and guidance to help you identify the right quitclaim deed trustees for trust.

Determining whether a trust is better than a quitclaim deed often depends on your personal goals. If you seek to protect your assets and plan for long-term management, a trust can be more beneficial. Alternatively, if you want an efficient transfer of property ownership without long-term management, a quitclaim deed may be ideal. Consult quitclaim deed trustees for trust to help you navigate this decision effectively.

When deciding between a quitclaim deed and a trust, it is important to consider your specific needs. A quitclaim deed transfers ownership without warranty, making it simple for transferring property. On the other hand, a trust provides legal protections and can manage assets effectively over time. Depending on your situation, quitclaim deed trustees for trust may offer the best balance of simplicity and security.

Choosing a trustee involves careful consideration of various factors, including trustworthiness, expertise, and willingness to serve. Many people opt for family members or friends who understand the family dynamics, while others prefer a professional with experience in managing trusts. When establishing quitclaim deed trustees for trust, it's essential to discuss expectations and responsibilities to ensure the selected individual or entity is prepared for the role. Platforms like US Legal Forms can assist you in this process by providing resources and templates for creating trusts effectively.

Typically, the trustee in a deed of trust is a neutral third party, often a bank or a professional trust company. This trustee holds the legal title to the property on behalf of the beneficiaries and manages the trust according to the terms laid out in the trust document. Choosing a reliable trustee is crucial for handling the quitclaim deed trustees for trust and ensuring compliance with legal obligations. A trusted professional can provide peace of mind during the trust's administration.

In most cases, the person who creates the trust, known as the grantor, appoints the trustees. This choice is essential because quitclaim deed trustees for trust hold significant responsibilities in managing and distributing the trust's assets. The grantor can choose themselves, a family member, a friend, or a professional trustee. It's vital to select someone trustworthy and competent to ensure the trust operates effectively.

In a deed of trust, the trustee and the beneficiary have different functions. The trustee oversees the trust arrangement, managing the property and ensuring compliance with the trust terms. On the other hand, the beneficiary is the person or organization that ultimately benefits from the trust’s assets, receiving the advantages or proceeds from the property. Clarifying these roles is vital, as it helps align responsibilities and expectations among all parties involved.

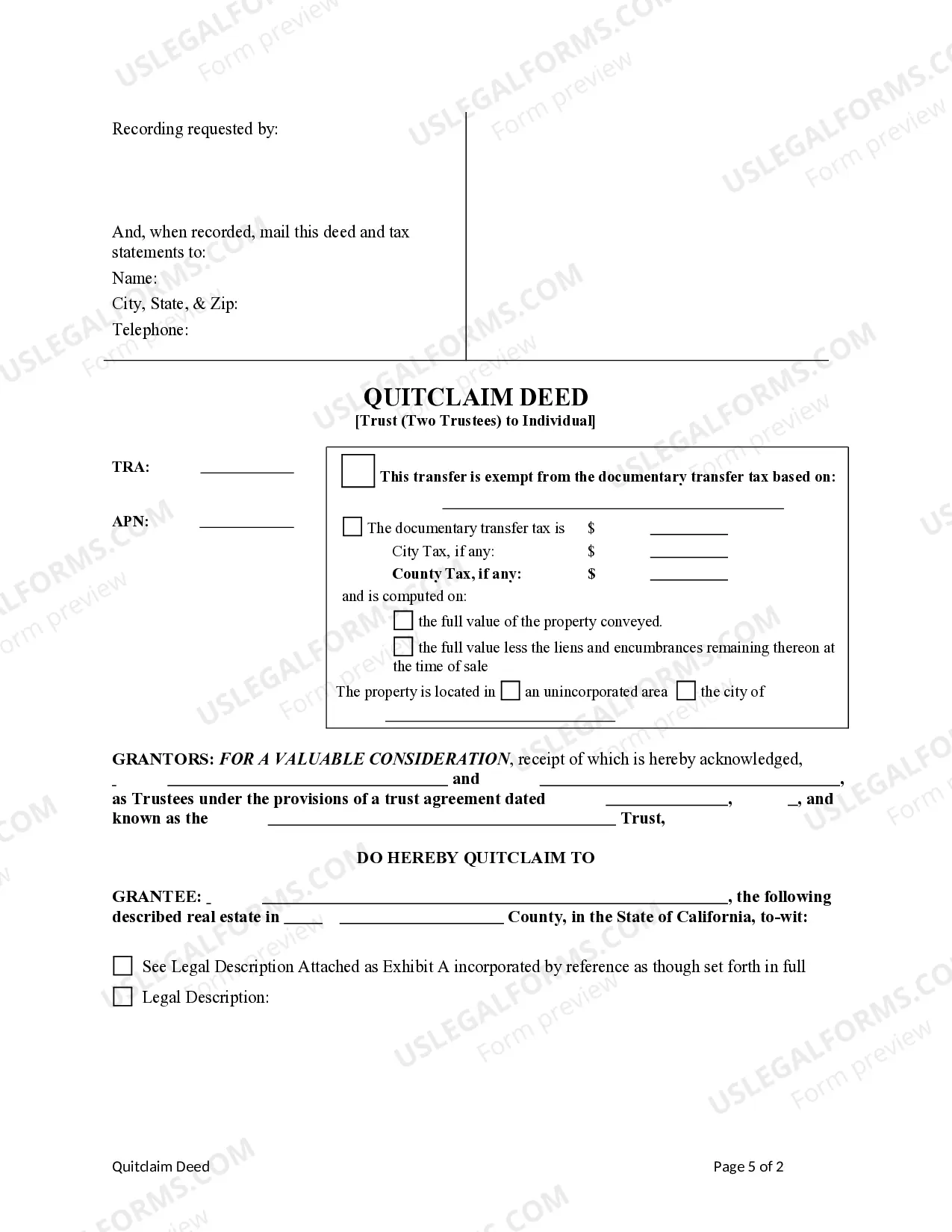

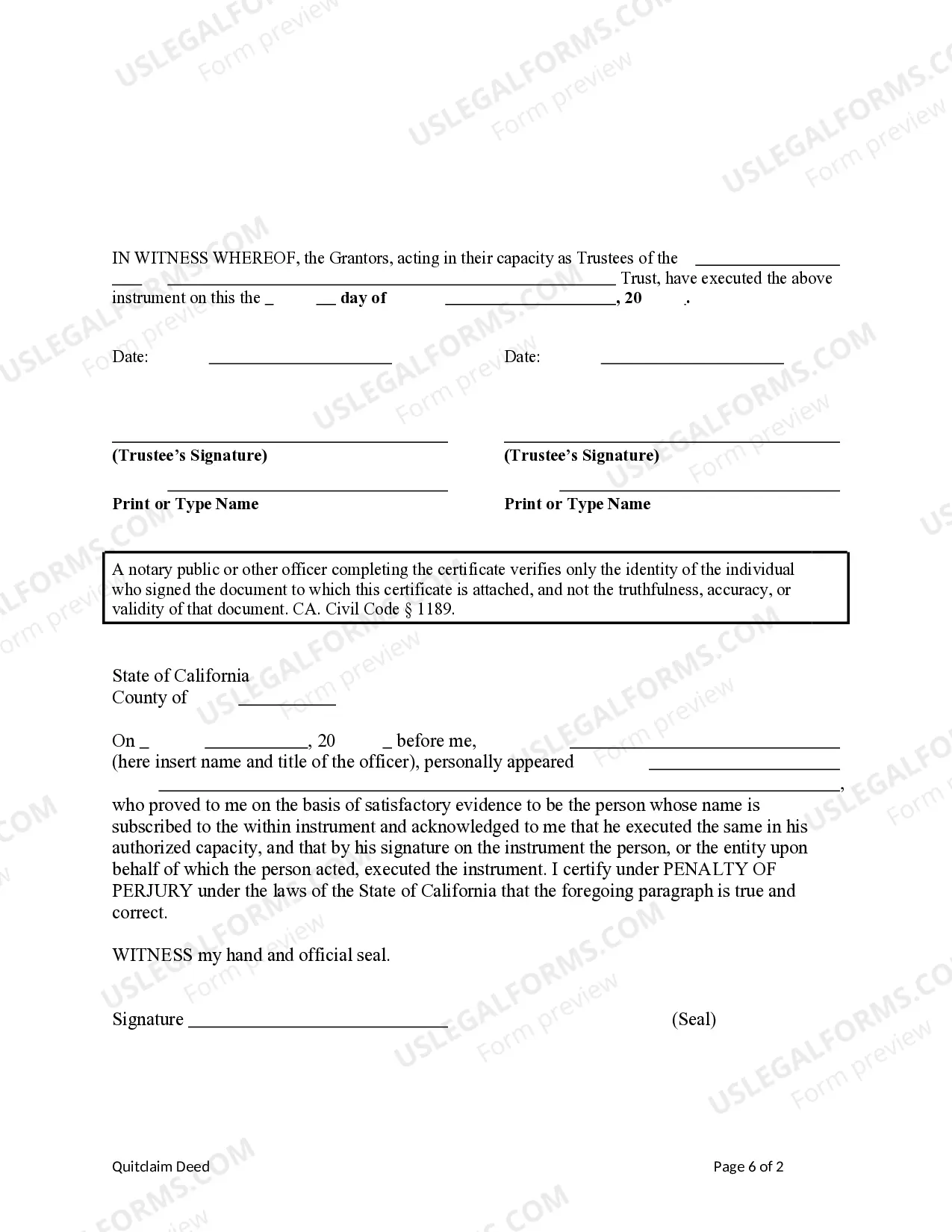

Filling out a quitclaim deed form involves several straightforward steps. First, clearly identify the property being transferred and its current owner. Next, include the names of the grantor and grantee, and make sure to provide accurate legal descriptions of the property. For a seamless experience, consider utilizing platforms like US Legal Forms, which can provide guidance and templates to ensure your quitclaim deed trustees for trust is executed correctly.

No, trustees and beneficiaries play different roles in a deed of trust. The trustee manages the property and upholds the terms of the trust, while beneficiaries are the individuals or entities that benefit from the trust’s assets. Understanding these distinct roles is crucial for anyone navigating the complexities of property management. Trusts can be intricate, so knowing the difference can help you make informed decisions.

The trustee in a deed of trust serves as a neutral third party who manages the property for the benefit of the beneficiaries. Their primary duty is to ensure that the terms of the trust are followed and that all parties involved adhere to legal requirements. By acting on behalf of the beneficiaries, the quitclaim deed trustees for trust provide an essential layer of protection and oversight. This guarantees that the handling of property matters is transparent and equitable.