Quitclaim Deed Trustees For Executors

Description

How to fill out California Quitclaim Deed - Trust (Two Trustees) To An Individual?

- If you're an existing user, log in to your account and download the form template by clicking 'Download'. Ensure that your subscription is current, or renew it as needed.

- For new users, begin by exploring the Preview mode. Check the form description to select the quitclaim deed that aligns with your jurisdiction requirements.

- If you find any discrepancies, use the Search function to locate alternate templates that better fit your needs.

- Once you find the correct document, click 'Buy Now' and select a suitable subscription plan. Registration is required to access our extensive library.

- Proceed with your purchase by entering your payment details; you may choose a credit card or PayPal.

- After payment, download your form and save it on your device. Access your documents anytime through the My Forms menu.

Utilizing US Legal Forms ensures you have access to thousands of legal documents all in one place, including over 85,000 editable templates. This service empowers you to confidently execute legal tasks effectively and accurately.

Don't navigate your legal needs alone; explore US Legal Forms today and simplify your document execution. Start your journey to legal clarity and control!

Form popularity

FAQ

The individuals who benefit the most from a quitclaim deed are typically the grantors, as they can quickly transfer property without the need for a lengthy sales process. This can be especially useful for quitclaim deed trustees for executors managing estate properties, as it streamlines the distribution of assets. However, beneficiaries should be aware of the possible implications of this agreement. Understanding these factors can help them make better choices.

For buyers, the main disadvantage of receiving a quitclaim deed is the lack of title protection. This arrangement means that the buyer could face significant challenges if there are undisclosed liens or legal claims on the property. Quitclaim deed trustees for executors should educate their clients about these risks to ensure informed decisions are made. It is crucial to conduct thorough research before accepting such a deed.

Typically, a quitclaim deed is used when transferring property between family members or in situations where the parties trust one another. It simplifies the transfer process without the need for a formal sale. In the context of quitclaim deed trustees for executors, it can facilitate quicker transfers during estate settlements, making it easier to settle affairs. However, the involved parties should still understand the risks.

Quitclaim deeds are often viewed with skepticism because they offer no warranties regarding the property's condition or the strength of the title. This lack of protection leaves buyers vulnerable to potential legal complications. Quitclaim deed trustees for executors must be mindful of these issues when managing estate assets. Ultimately, they should weigh the risks against the benefits before proceeding.

A quitclaim deed can be perceived as risky because it transfers ownership without guaranteeing that the title is clear of liens or other claims. This means that if issues arise, the new owner may inherit debts or disputes related to the property. For quitclaim deed trustees for executors, this lack of assurance might complicate the estate settlement process. Thus, caution is advisable when considering this option.

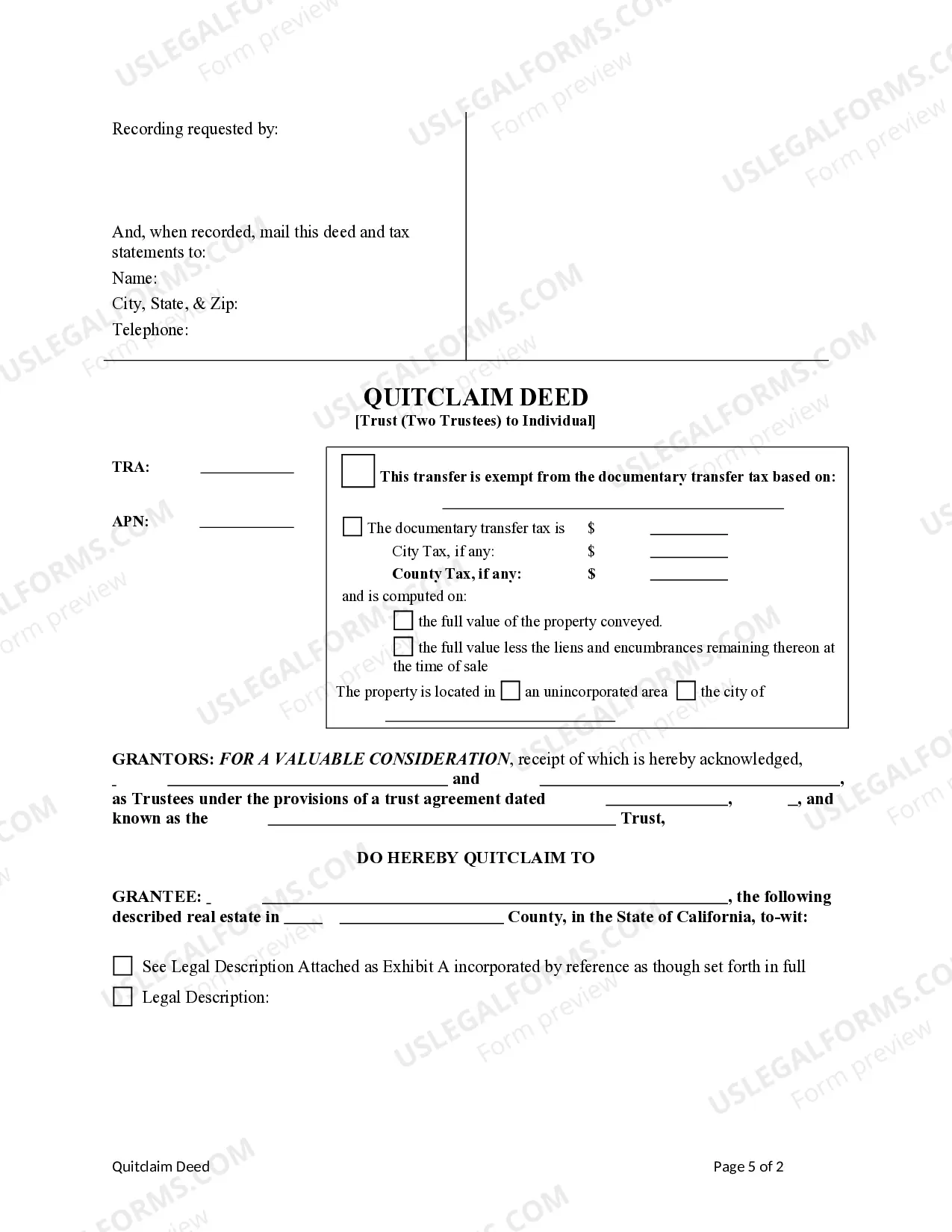

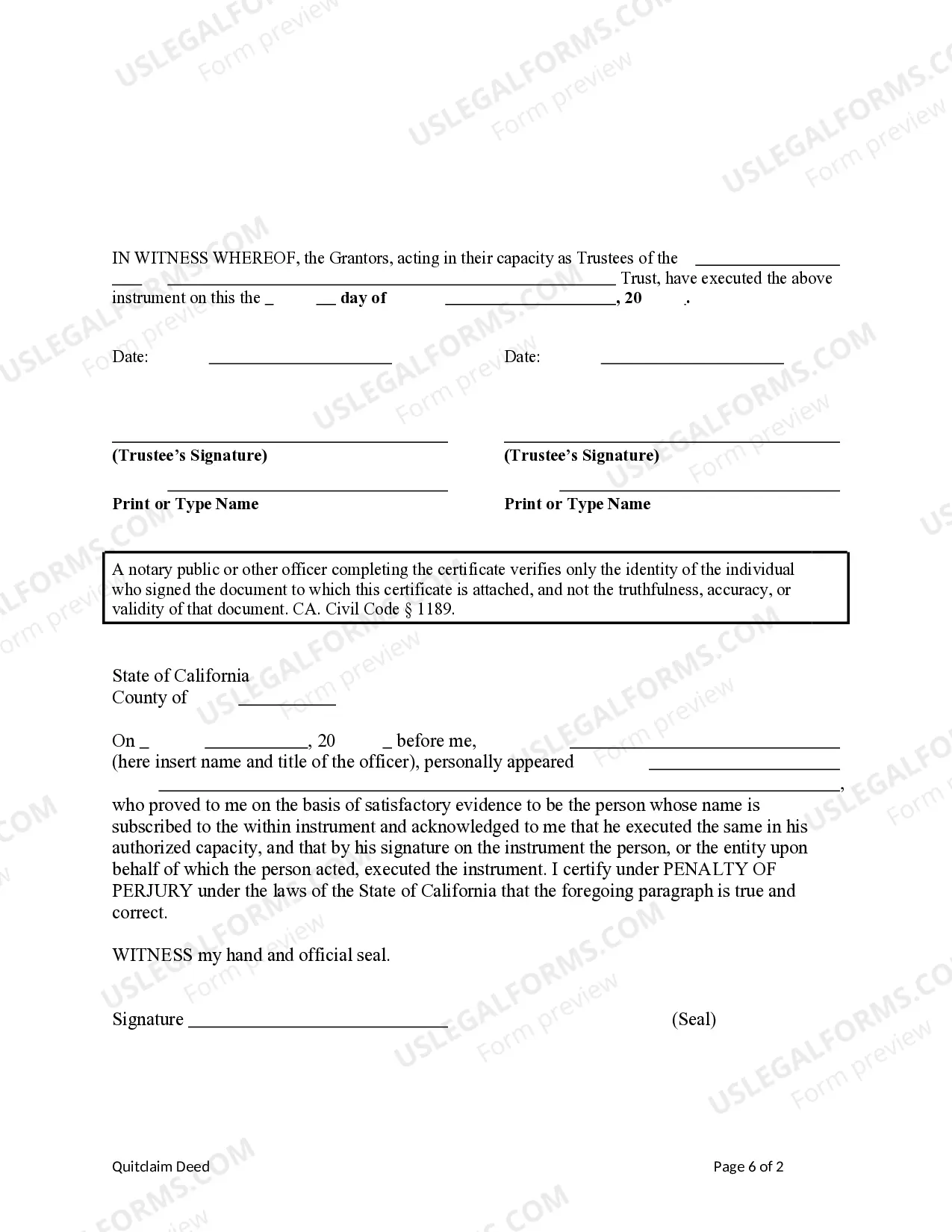

To properly fill out a quitclaim deed, you need to include essential details, such as the names of the grantor and grantee, a clear description of the property, and the date of transfer. Ensure that the document is signed by the grantor and witness signatures if required by state law. Remember to file the deed with the appropriate local government office to make the transfer official. Platforms like UsLegalForms can guide you in preparing and filing these documents effectively.

Yes, a trustee can execute a quitclaim deed to transfer property interests held in trust. This action is often necessary when settling an estate or distributing assets to beneficiaries. Executors should ensure that the quitclaim deed is in compliance with state laws and properly recorded. Leveraging the expertise of quitclaim deed trustees for executors can streamline this process and provide clarity during the transfer.

A trustee deed is used to transfer property held in a trust, while a quitclaim deed transfers whatever interest the grantor has in a property, without guaranteeing that the title is clear. Unlike a trustee deed, a quitclaim deed does not offer any warranties regarding the property’s status. For executors, understanding these differences is essential in deciding which type of deed to use when transferring property. Utilizing quitclaim deed trustees for executors can simplify this decision.

A quitclaim deed is typically executed by the grantor, who is the person transferring their interest in a property. In many cases, trustees have the authority to execute quitclaim deeds on behalf of the estate they manage. For executors, understanding the role of quitclaim deed trustees is crucial, as they facilitate the transfer of property without warranty, making the process simpler. It's advisable to seek assistance to ensure the deed is correctly executed and filed.