Limited Partnerships

Description

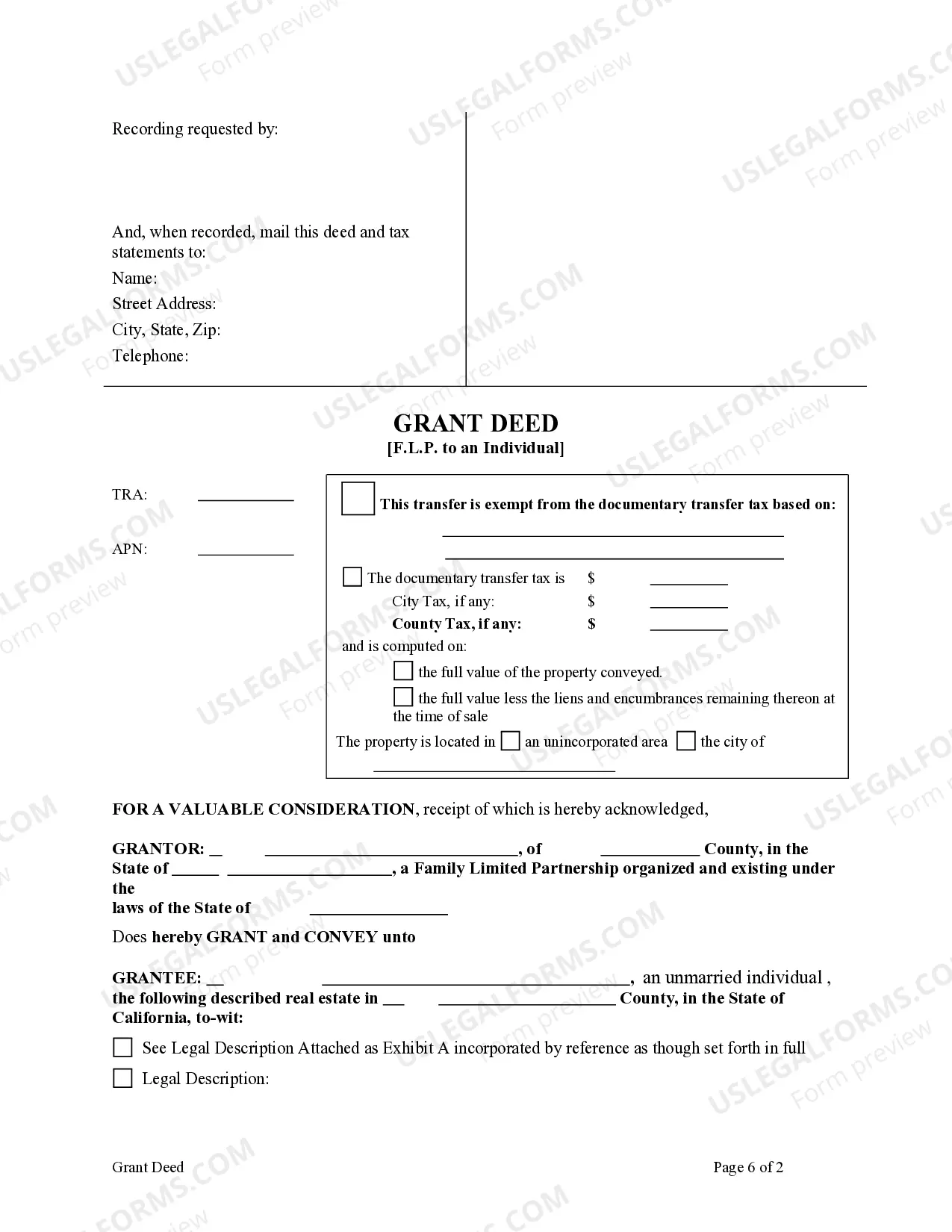

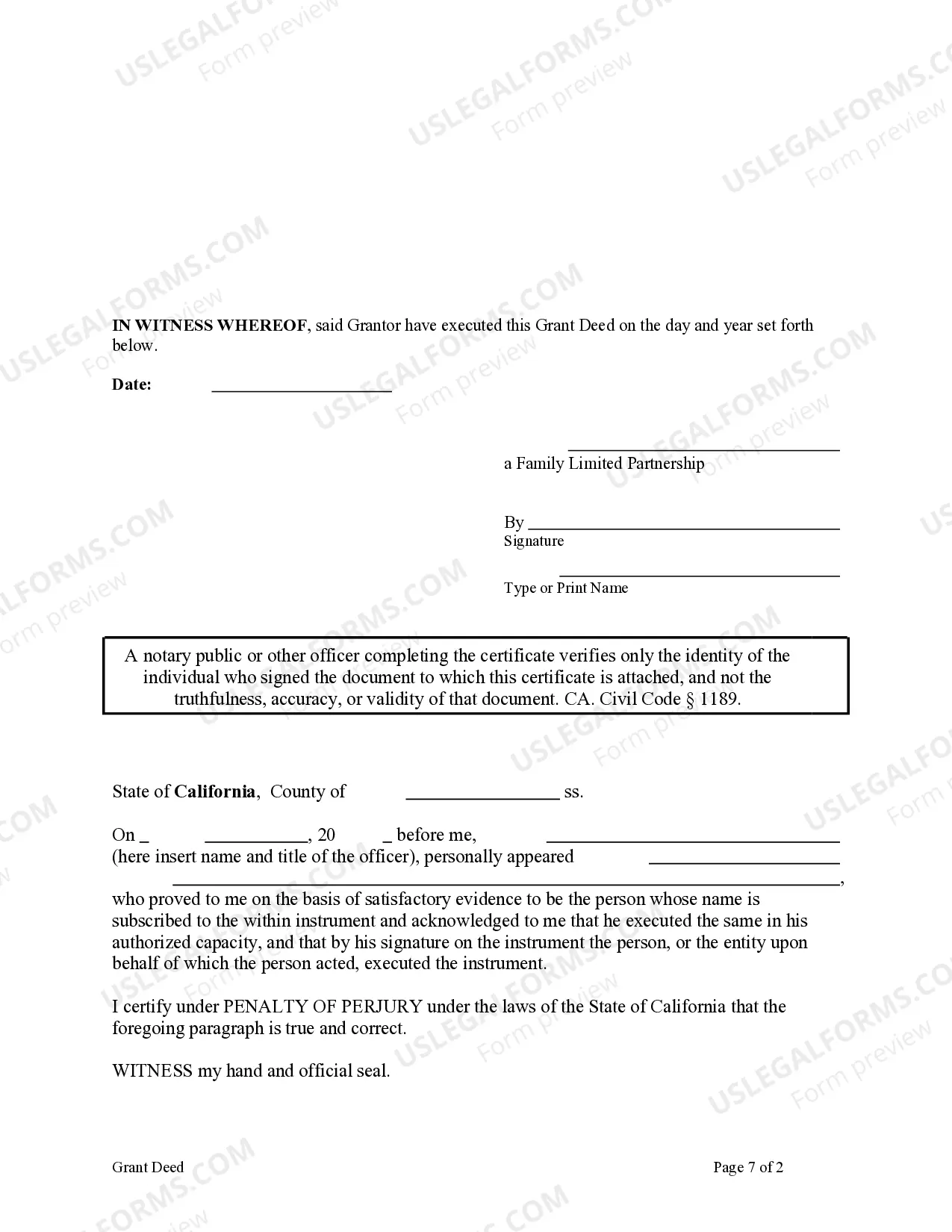

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- Log in to your US Legal Forms account if you're a returning user. Check that your subscription is active; if it's expired, renew it according to your plan.

- Review the Preview mode and description of the limited partnership form. Ensure it aligns with your local jurisdiction requirements.

- If necessary, utilize the Search tab to find another template that fits your needs better.

- Click on the Buy Now button for the selected document and choose a suitable subscription plan. Make sure to create an account for full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download the completed form to your device. You can access it anytime from the My Forms menu in your profile.

By following these steps, you can easily acquire the legal documents you need for your limited partnership. US Legal Forms stands out with its robust library of over 85,000 forms, ensuring that you find exactly what you need.

Take advantage of the resources available at US Legal Forms today and ensure your limited partnership runs smoothly. Visit the website now to get started!

Form popularity

FAQ

To fill out a W9 for a limited partnership, enter the partnership's name and its business classification. Include the partnership's EIN if applicable, and ensure accurate addresses are provided. It's vital to double-check all information for accuracy before submitting the form to avoid any issues with tax reporting. USLegalForms can assist you in understanding the specifics associated with completing a W9.

Filing requirements for limited partnerships often include submitting a Certificate of Limited Partnership to the relevant state agency. Additionally, some states may require publication of the partnership formation in a local newspaper. It’s crucial to stay informed about specific local laws, which can vary. Platforms like USLegalForms provide tailored checklists to keep you on track.

Filling out a partnership form involves providing accurate information about each partner, including names, addresses, and roles within the business. Specify the partnership’s name and its legal structure, such as whether it is a limited partnership. USLegalForms offers comprehensive support to help you ensure the form is filled out correctly, making the process less daunting.

To form a limited partnership, you need to file a Certificate of Limited Partnership with your state’s Secretary of State office. This typically involves providing partner details and the partnership’s business purpose. Additionally, create a partnership agreement to codify the roles and responsibilities of all partners. For a streamlined experience, consider using platforms like USLegalForms that guide you through each step.

A common example of limited partnerships is venture capital firms. In these partnerships, general partners manage the fund and make investment decisions, while limited partners contribute capital without participating in management. This structure allows limited partners to invest in businesses while limiting their exposure to risk. Understanding examples like this helps clarify the unique benefits of limited partnerships.

To fill out a partnership agreement for limited partnerships, start by clearly defining the roles of both general and limited partners. Include information about capital contributions, profit distribution, and management responsibilities. Be sure to outline the procedures for resolving disputes or dissolving the partnership. Utilizing USLegalForms can ensure you cover all necessary aspects in a straightforward manner.

Limited partnerships require the completion of a specific formation document, typically referred to as a Certificate of Limited Partnership. This form can vary by state, but it generally includes key details such as the partnership name, the names of general and limited partners, and the duration of the partnership. Using an online platform like USLegalForms can greatly simplify this process by providing state-specific templates and guidance.

The difference between a limited partnership and an LLC fundamentally concerns ownership and liability. Limited partnerships consist of general and limited partners, defining roles and liabilities distinctly, while LLCs afford limited liability to all members, regardless of their involvement in management. This difference impacts how owners protect their personal assets, making it crucial to carefully select the right partnership structure to meet individual business goals.

The primary difference between a limited partnership (LP) and a limited liability company (LLC) lies in liabilities and management structure. In an LP, general partners face unlimited liability while limited partners have restricted exposure. Conversely, an LLC protects all members from personal liability, allowing them to participate without facing the risks associated with management decisions. Understanding these distinctions can help investors choose the right structure for their business needs.

Individuals may choose limited partnerships for several reasons, including financial protection and passive investment opportunities. Limited partners can invest in a business without the worry of personal liability beyond their initial contribution. Additionally, the flexibility of this structure can attract investors looking for a balanced approach to risk and reward.