Grant Deed For Living Trust

Description

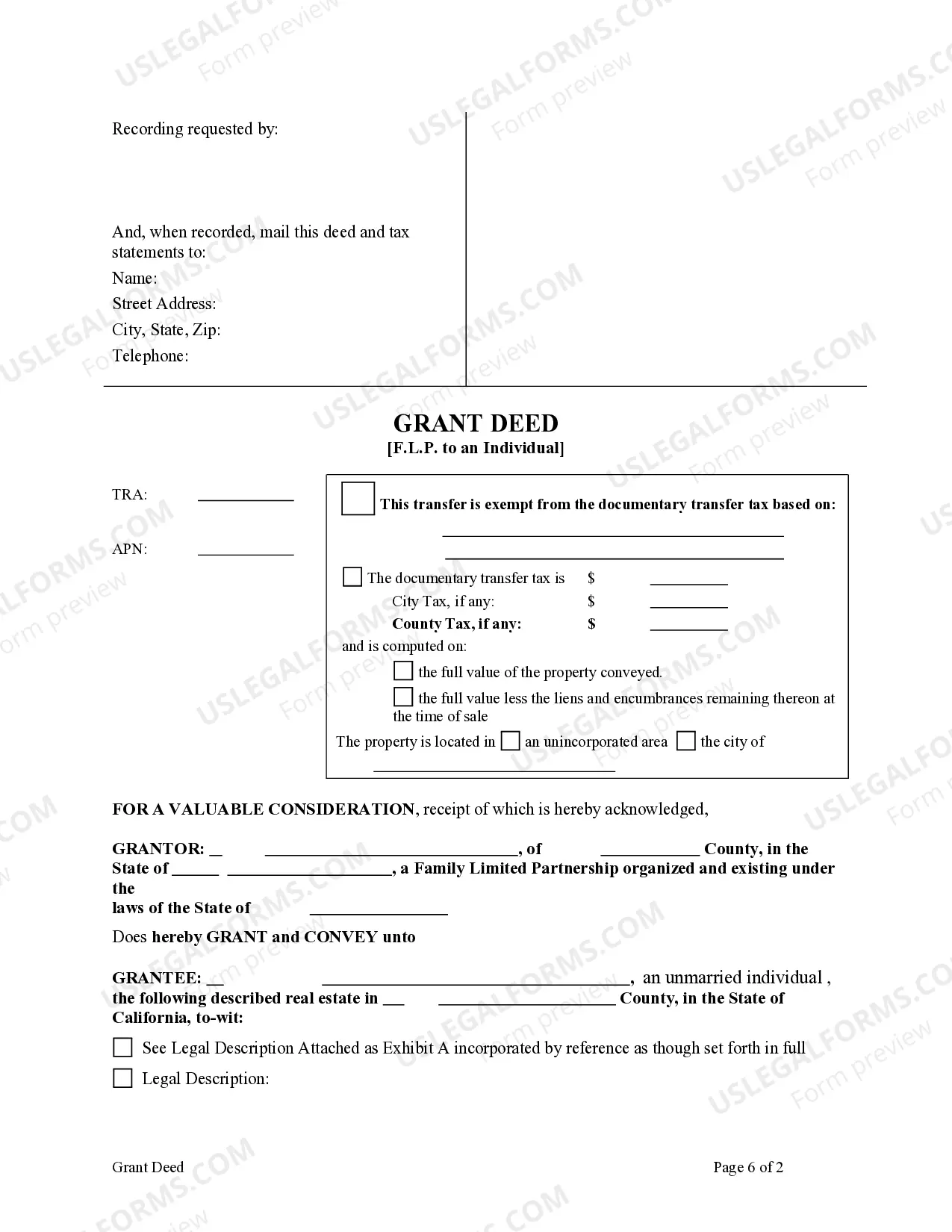

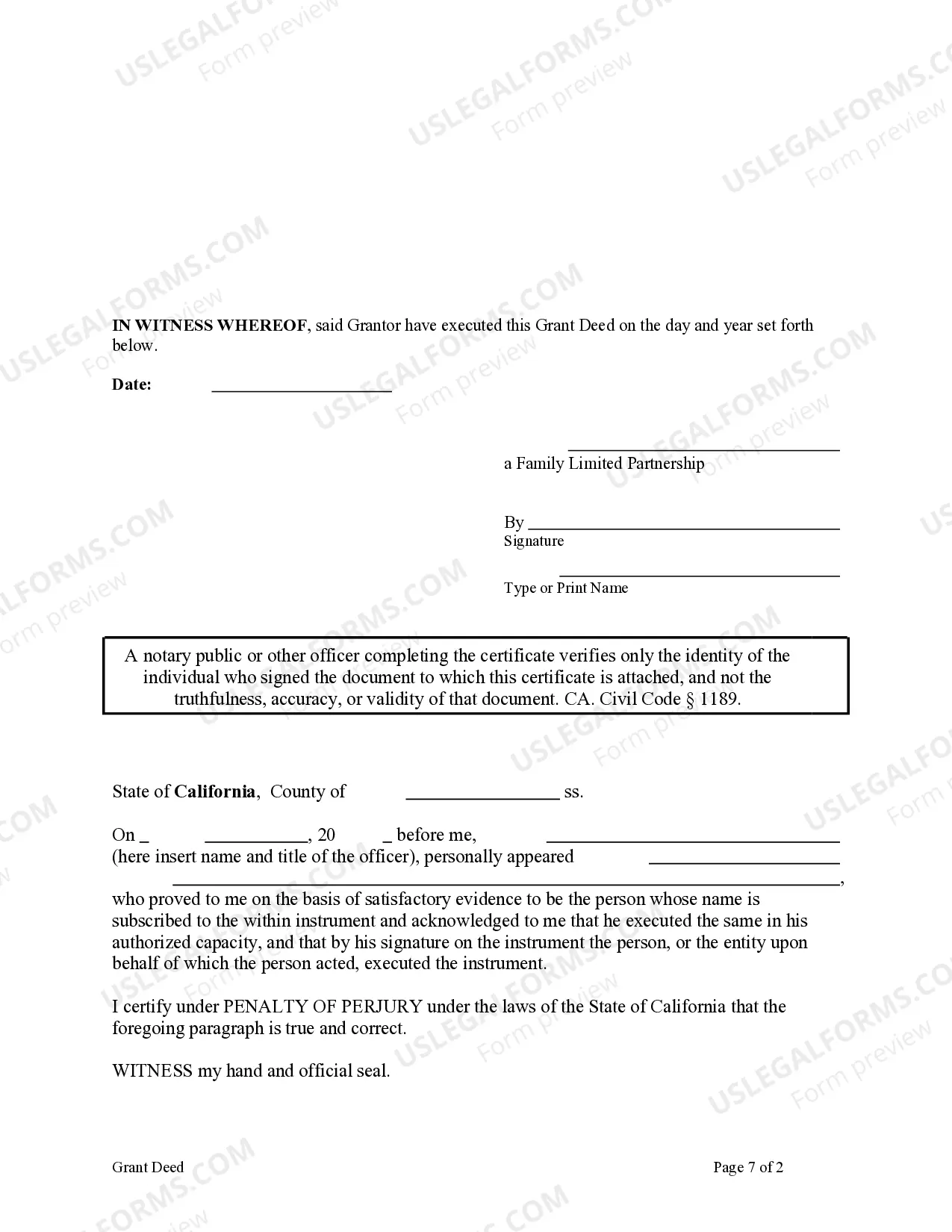

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- Sign in to your existing US Legal Forms account and verify that your subscription is active. If needed, renew your subscription.

- In the form library, search for 'grant deed for living trust' to locate the specific template you need. Review the preview and description to ensure it meets your requirements.

- If necessary, utilize the Search function to find alternative templates that may better suit your needs.

- Once you've selected the appropriate form, click the 'Buy Now' button and choose your preferred subscription plan. Establish your account to gain full access.

- Complete the purchase using your credit card or PayPal account for convenience.

- Finally, download the form directly to your device for completion and future reference in the 'My Forms' section of your profile.

Acquiring a grant deed for living trust through US Legal Forms is straightforward and efficient. With a vast library of over 85,000 legal forms, you can feel confident in the quality and accuracy of your documents.

Start your journey with US Legal Forms today for reliable access to essential legal resources. Empower yourself with the right tools to manage your estate!

Form popularity

FAQ

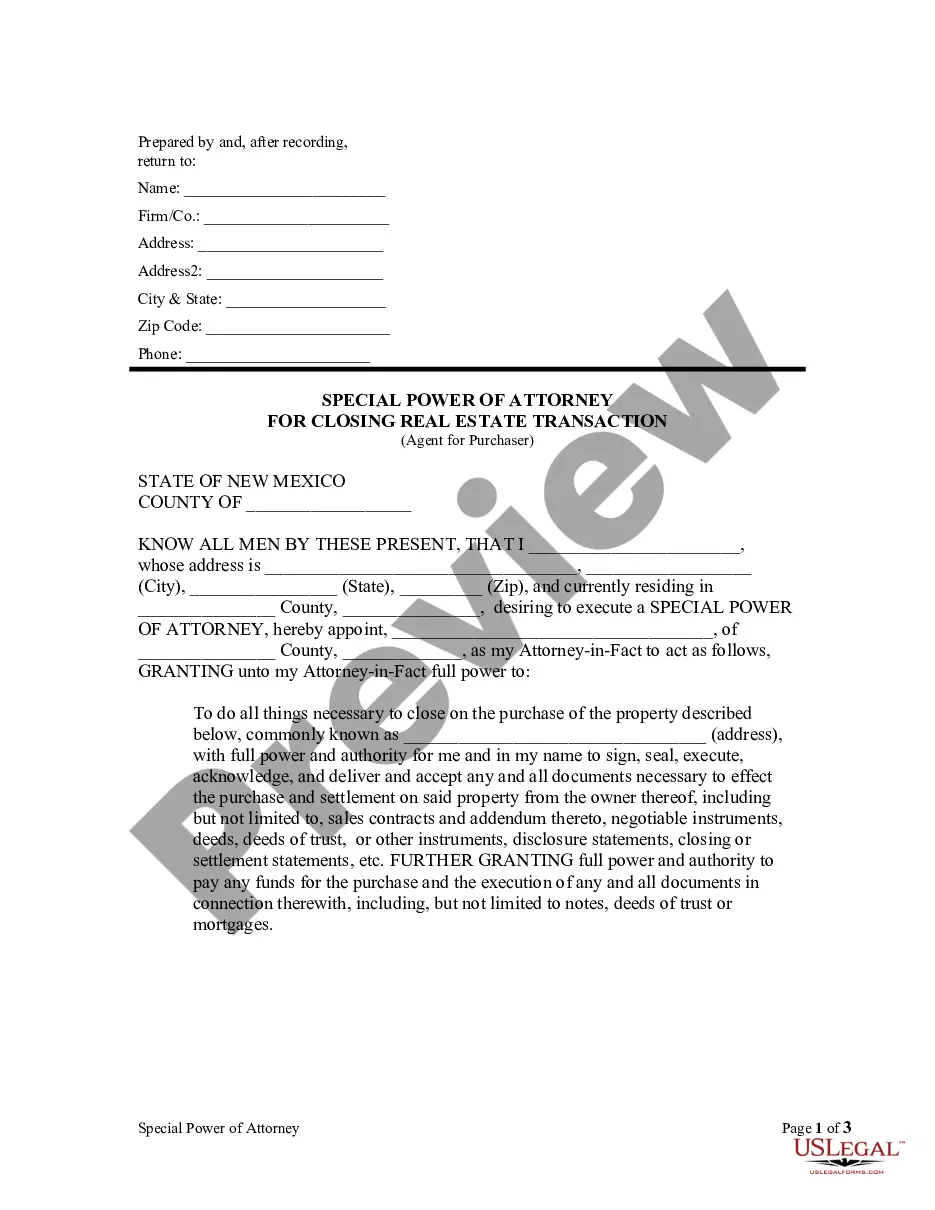

The purpose of a grant deed for living trust is to transfer real estate into the trust's name, thereby helping to streamline estate planning. This process allows you to maintain control over your property while ensuring it avoids probate upon your passing. By utilizing a grant deed, you protect your assets and provide clear instructions for future beneficiaries. If you are considering this transfer, platforms like US Legal Forms can guide you through creating the necessary documents.

A grant deed is not the same as a deed of trust. A grant deed transfers ownership of property and includes guarantees about the title, making it essential for tasks like establishing a grant deed for living trust. In contrast, a deed of trust is a security instrument that involves three parties: the borrower, the lender, and a trustee. Understanding these differences can help you manage your property effectively.

One common mistake parents make is failing to properly fund the trust. If you do not transfer assets into the trust, it cannot serve its intended purpose. Additionally, neglecting to use a grant deed for living trust to transfer property can lead to complications. Taking the time to ensure all assets are included and documented will help your trust function smoothly and protect your family's future.

A grant deed of trust is a legal document that transfers property into a trust, making it an essential part of estate planning. This deed ensures that the trustee has the authority to hold and manage the property according to the trust's terms. It offers both protection and clear direction for asset management. You can efficiently create a grant deed for living trust through platforms like US Legal Forms, which simplify the documentation process.

While there are many benefits, placing your house in a trust can have some disadvantages. For instance, transferring property into a trust may involve upfront costs and potential taxes. Additionally, you will need to adhere to the trust's guidelines, which can limit flexibility in managing the property. It is essential to weigh these factors against the advantages of a grant deed for living trust.

People often choose to place their property in a living trust to simplify estate planning. A living trust allows property owners to control their assets during their lifetime and manage how those assets are distributed after passing away. This arrangement prevents probate delays and can also lower estate taxes. Utilizing a grant deed for living trust is a crucial step in this process.

A trust can help manage and protect property. When you place property in a trust, it often avoids probate, making it easier and faster to transfer to beneficiaries. This arrangement also allows for greater privacy, as trust documents do not go through public court filings. By using a grant deed for living trust, you ensure that your property is effectively tied to the trust.