Deed Partnership To Withholding

Description

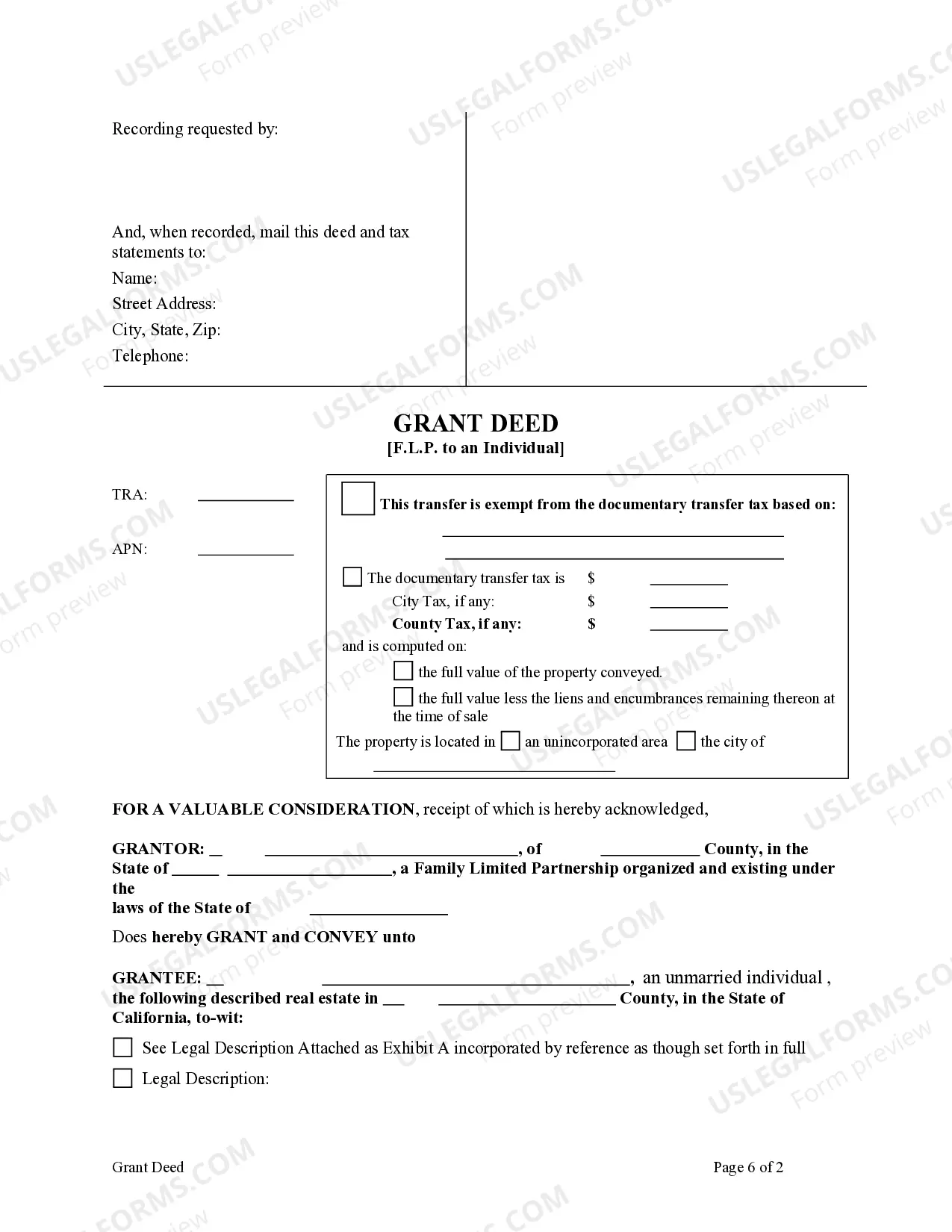

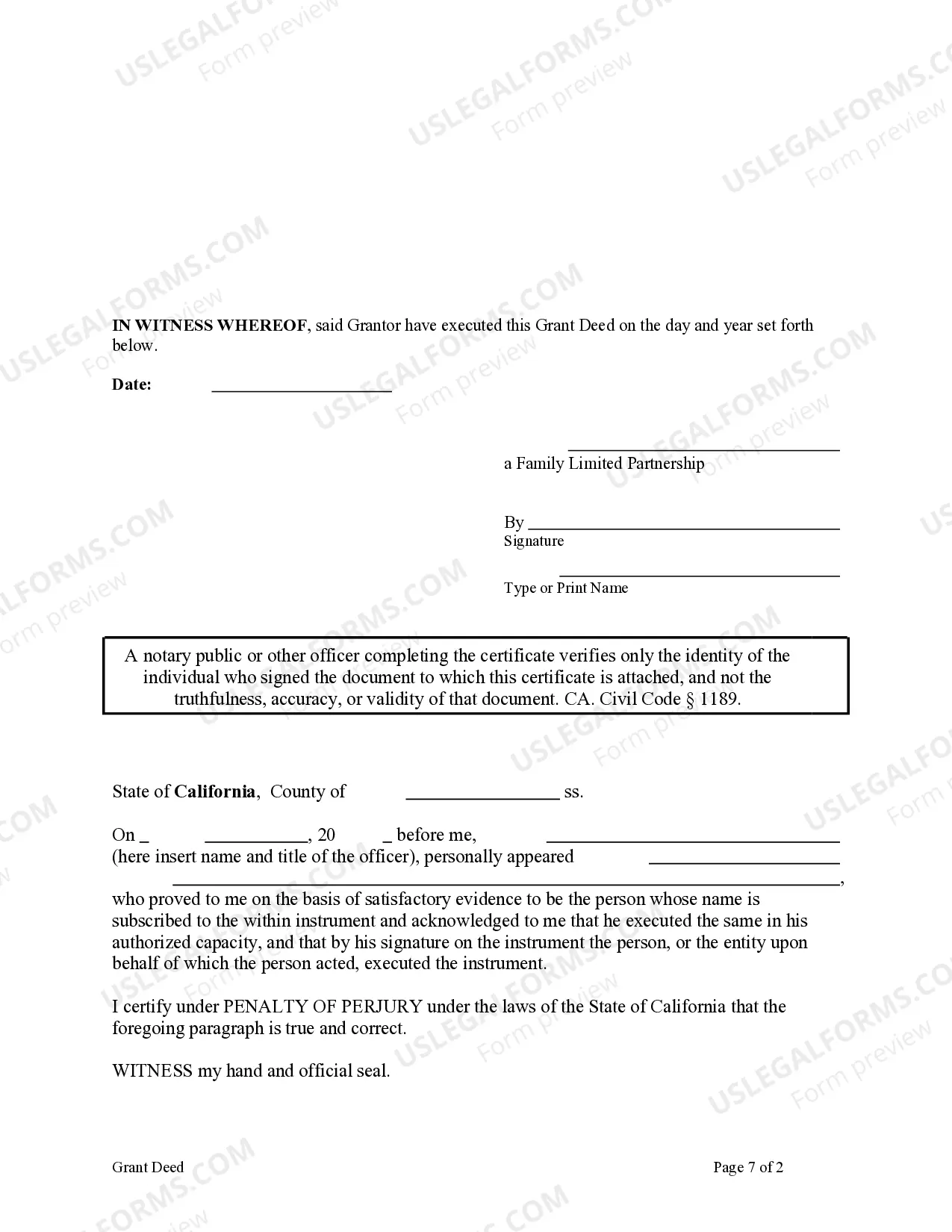

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain situations may require extensive research and considerable financial investment.

If you’re looking for a more simplified and economical method of drafting Deed Partnership To Withholding or any other documents without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal forms encompasses nearly every area of your financial, legal, and personal affairs.

Examine the form preview and descriptions to confirm that you are on the correct document. Ensure the template you select complies with the laws and regulations of your state and county. Choose the most appropriate subscription plan to purchase the Deed Partnership To Withholding. Download the document, then complete, certify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document processing straightforward and efficient!

- With just a few clicks, you can swiftly obtain state- and county-compliant documents meticulously prepared for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can promptly find and acquire the Deed Partnership To Withholding.

- If you’re familiar with our website and have previously set up an account, simply Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and browse the catalog.

- However, before proceeding to download Deed Partnership To Withholding, please consider these suggestions.

Form popularity

FAQ

The withholding rate is California's highest tax rate for each partner's entity type. The current withholding rates are: Noncorporate partners - 12.3 percent. Corporate partners - 8.84 percent.

§1446, Withholding of Tax on Foreign Partners' Share of Effectively Connected Income. Any portion of such income is allocable under section 704 to a foreign partner, such partnership shall pay a withholding tax under this section at such time and in such manner as the Secretary shall by regulations prescribe.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

Form 8805 is similar to Forms W-2 or 1099-MISC. All it requires is information about the partnership and the foreign partner. Then, you'll fill in the amount of tax the partnership withheld from the foreign' partners ECI. Again, review the combined Form 8804 and Form 8805 instructions for more details.

Chapter 3 withholding under sections 1441-1443 generally applies a 30% statutory rate of withholding to payments of FDAP income or gains from U.S. sources but only if they are not effectively connected with a U.S. trade or business made to a payee that is a foreign person.