California Tod Deed Form 2022

Description

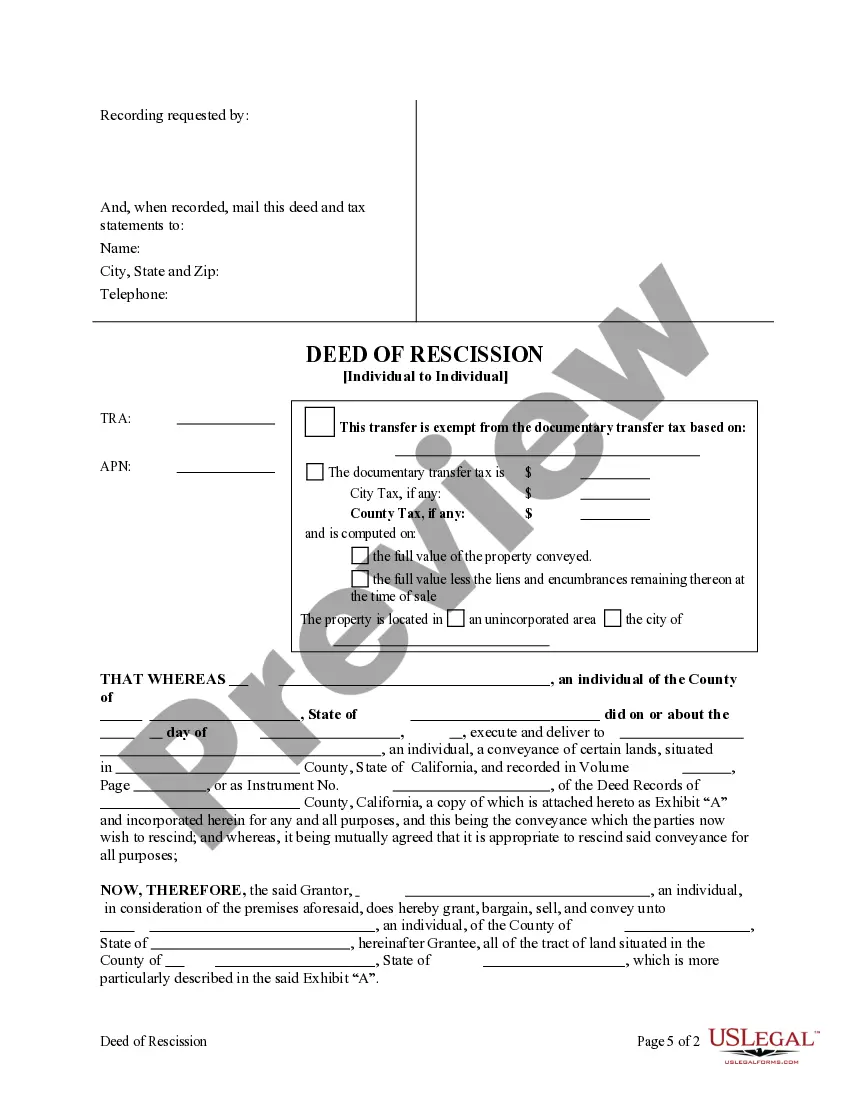

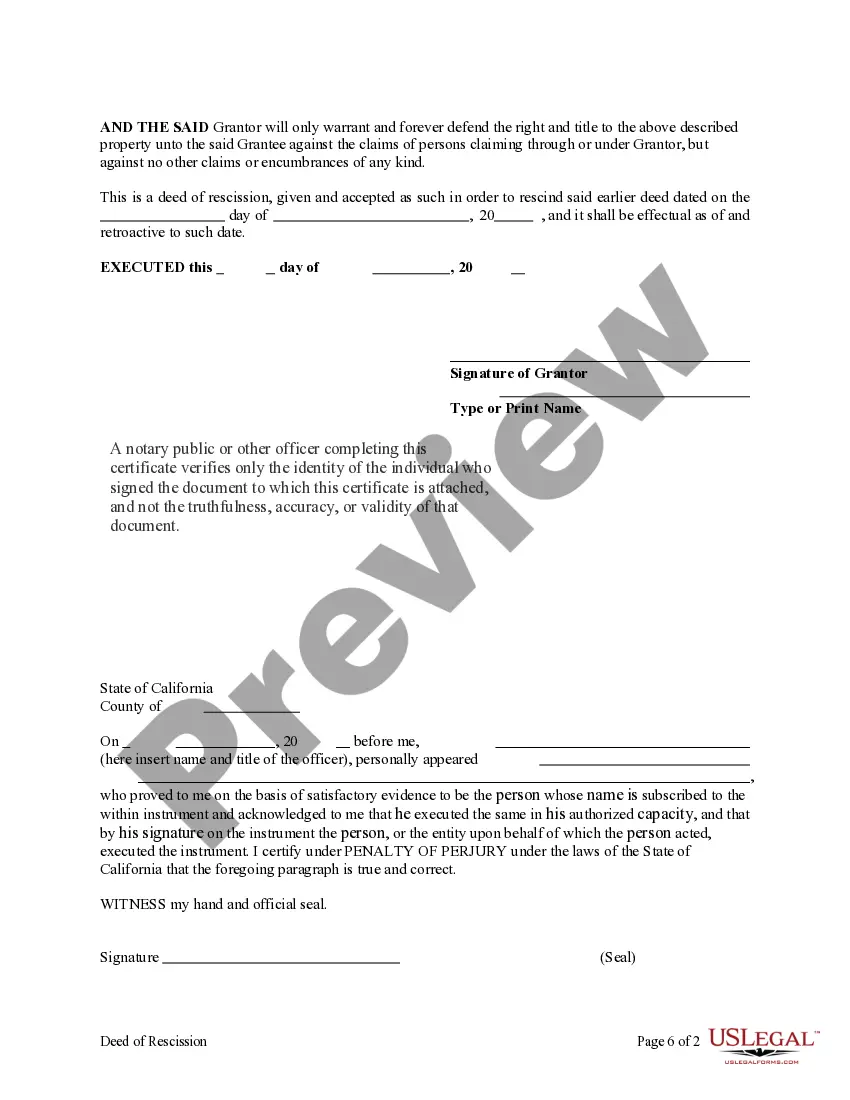

How to fill out California Deed Of Rescission - Individual To Individual?

Whether for corporate purposes or for individual matters, everyone encounters legal issues at some juncture in their lives.

Completing legal paperwork requires meticulous attention, beginning with choosing the suitable form example.

With a comprehensive US Legal Forms catalog available, you won't need to waste time searching for the correct example across the internet. Utilize the library’s straightforward navigation to find the appropriate form for any situation.

- Obtain the form you need using the search bar or catalog navigation.

- Examine the form's description to ensure it aligns with your situation, state, and locality.

- Select the form's preview to review it.

- If it is the incorrect document, return to the search feature to locate the California Tod Deed Form 2022 example you seek.

- Acquire the template if it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can get the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the California Tod Deed Form 2022.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

5% of the lesser of the sale price or fair market value of the agricultural asset, up to a maximum of $32,000; or. 10% of the gross rental income of the first, second, and third year of the rental agreement, up to a maximum of $7,000 per year.

Farm numbers and land in farms unchanged in Pennsylvania in farms, at 7.30 million acres, was unchanged from 2020. The average farm size for 2021 is 139 acres, unchanged from the previous year.

Act 319 - Pennsylvania Farmland and Forest Land Assessment Act (Clean and Green) is a state law passed in 1974, and amended in 1998 by Act 156 that allows land parcels which are 10 acres or more in size and which are devoted to agricultural and forest land use, to be assessed at value for that use rather than Fair ...

Ing to the USDA , small family farms average 231 acres; large family farms average 1,421 acres and the very large farm average acreage is 2,086.

The average farm size for 2021 is 445 acres, up from 444 acres the previous year. Agricultural research and data collection are still mostly based on acres.

In order to qualify, the farmland must yield a yearly gross income of at least $2,000.00. If it does, then it is considered to be real estate devoted to the business of agriculture.

A property must be ten acres in size, and in Agricultural Use, Agricultural Reserve, or Forest Reserve. Agricultural Use applications may be less than 10 acres in size if the property is capable of generating at least $2,000 annually in farm income.

Clean and Green is a state law that allows qualifying agricultural and forestland to be assessed for its use rather than fair market value. Properties valued ing to their use will most often receive a lower tax assessment value and lower property taxes than a tax assessment based on fair market value.