California Deed Form For Probate

Description

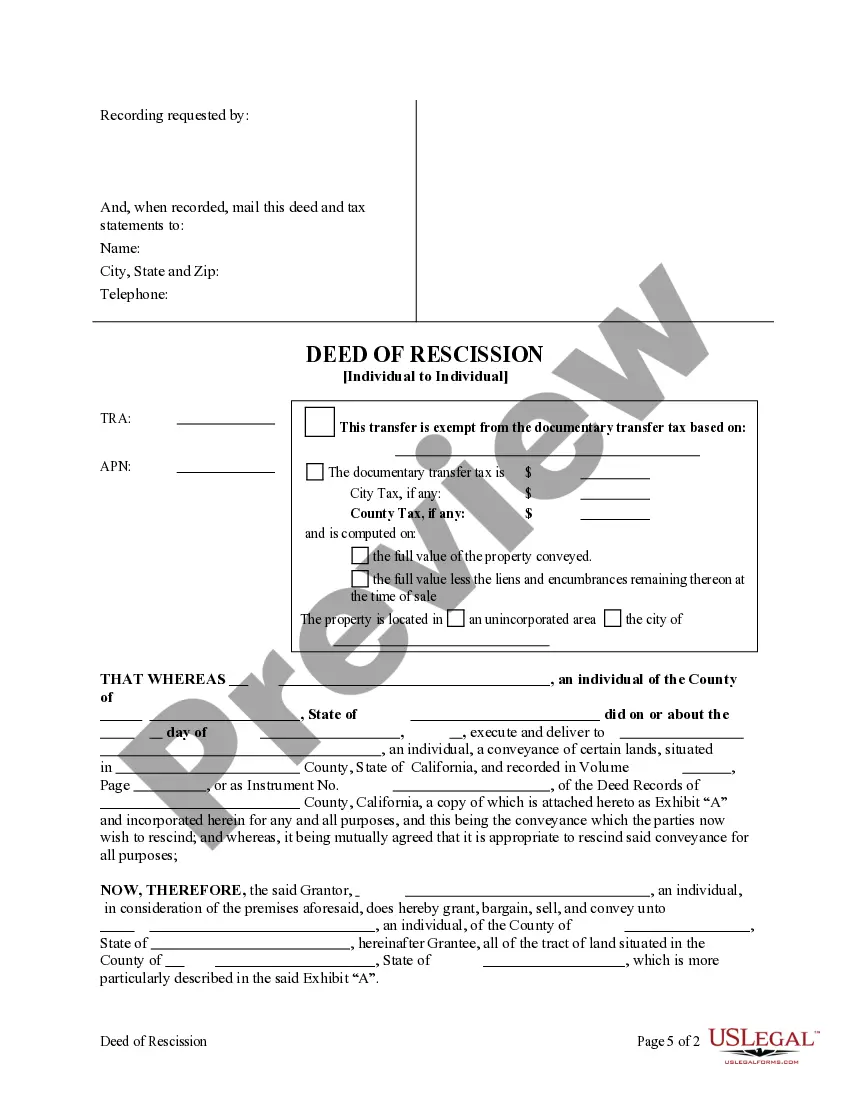

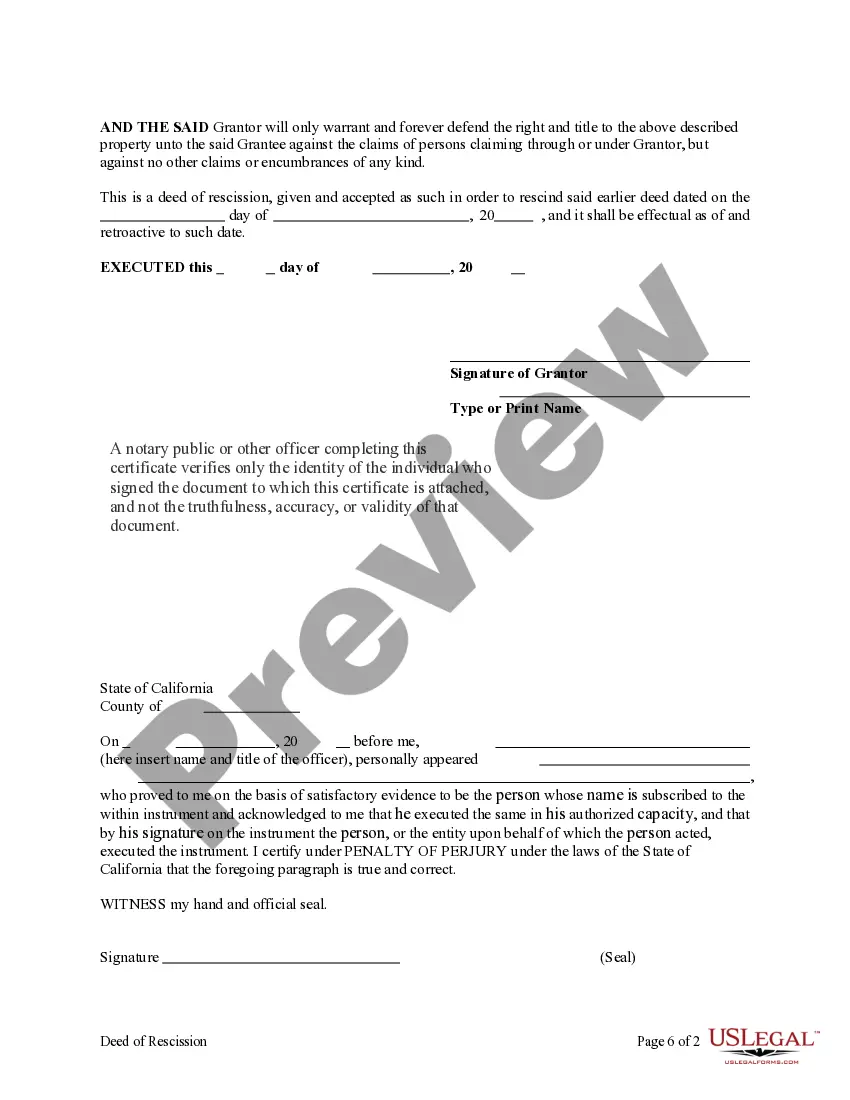

How to fill out California Deed Of Rescission - Individual To Individual?

Whether for business purposes or for personal affairs, everyone has to handle legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, starting with choosing the right form sample. For example, when you select a wrong edition of the California Deed Form For Probate, it will be declined when you send it. It is therefore essential to get a trustworthy source of legal documents like US Legal Forms.

If you need to get a California Deed Form For Probate sample, stick to these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Check out the form’s description to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong form, get back to the search function to locate the California Deed Form For Probate sample you require.

- Download the file when it matches your requirements.

- If you already have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the account registration form.

- Pick your transaction method: use a credit card or PayPal account.

- Choose the document format you want and download the California Deed Form For Probate.

- After it is downloaded, you can fill out the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the appropriate template across the internet. Use the library’s easy navigation to find the correct form for any situation.

Form popularity

FAQ

COMPLETING THE PETITION FOR PROBATE, DE-111 Write your name and address in the top left box. In the box that reads ?Estate of,? write the name of the decedent. Leave the box that reads case number, hearing date, Dept, blank. You will get this information when you file your paperwork with the Probate filing window.

Step 1 Petition for Probate (Form DE-111, Judicial Council), and all attachments, Original Will (if there is one) Notice of Petition to Administer Estate (Form DE-121, Judicial Council) Duties and Liabilities of Personal Representative (Form DE-147, Judicial Council) Order for Probate (Form DE-140, Judicial Council)

To get title to the property after your death, the beneficiary must: Record a certified copy of the death certificate in the county clerk's office. File a Change in Ownership statement. Your beneficiary can obtain this form from the county assessor in the county where the real estate is located.

2. You Can Avoid Probate With A Small Estate Affidavit Cars, boats, or mobile homes. Real property outside of California. Property held in trust, including a revocable living trust. Real or personal property that the person who died owned jointly with someone else (such as joint tenancy)

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500. It typically occurs when the deceased person died without a will, but it can occur even if the deceased person did have a will if they owned real property that is subject to probate.