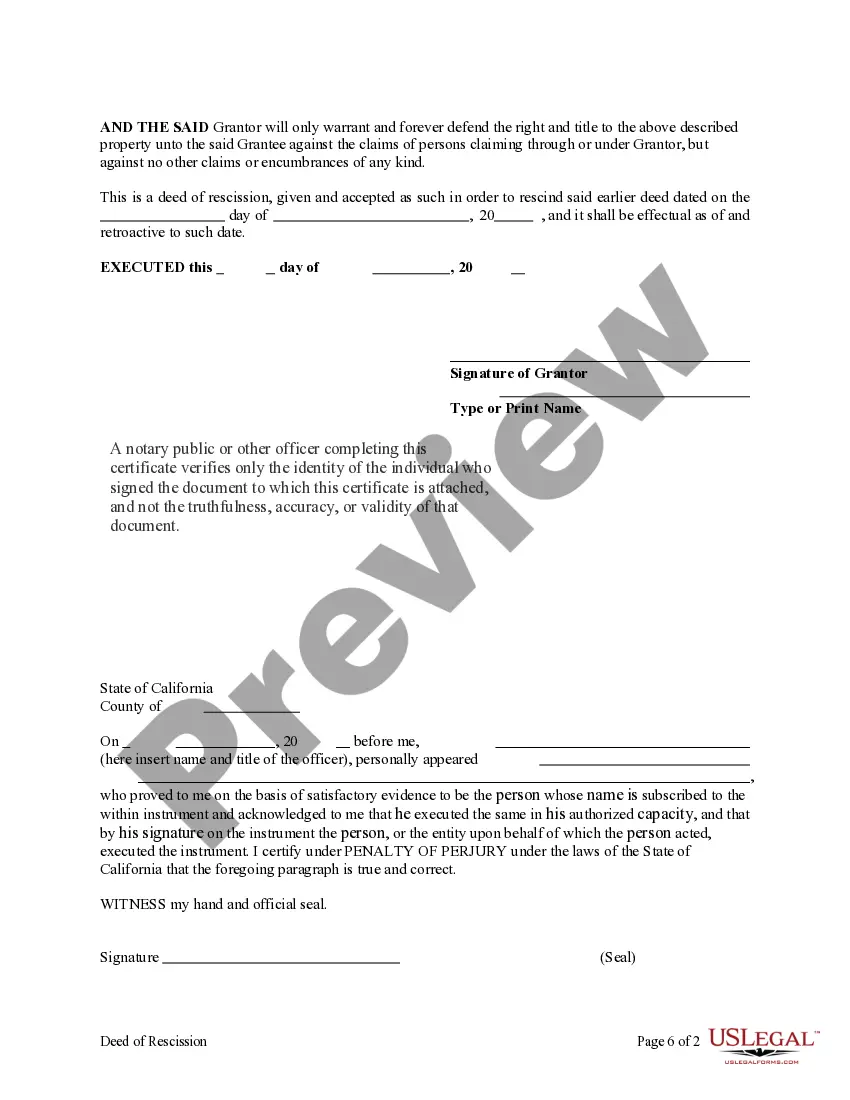

Ca Deed With Vendor

Description

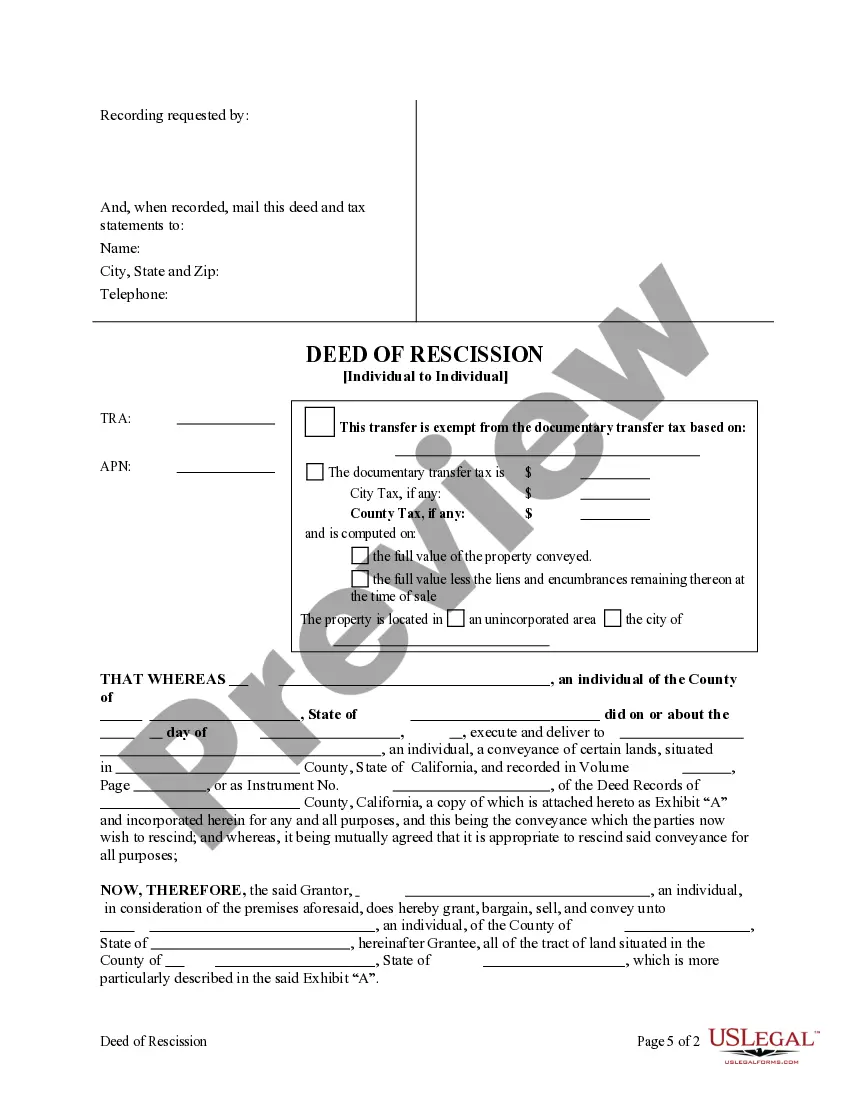

How to fill out California Deed Of Rescission - Individual To Individual?

Creating legal documents from the beginning can at times be overwhelming.

Certain situations may require extensive research and substantial financial investment.

If you’re seeking a simpler and more economical method for preparing Ca Deed With Vendor or any other paperwork without the hassle of unnecessary obstacles, US Legal Forms is readily accessible.

Our online library of more than 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal issues.

Review the form preview and descriptions to confirm that you are selecting the correct document. Ensure that the template you select complies with the laws and regulations of your state and county. Select the appropriate subscription plan to obtain the Ca Deed With Vendor. Download the document, complete it, sign it, and print it. US Legal Forms takes pride in its solid reputation and over 25 years of expertise. Join us today and make form completion a straightforward and efficient process!

- With just a few clicks, you can swiftly access forms specific to your state and county, meticulously crafted by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services through which you can easily locate and download the Ca Deed With Vendor.

- If you’re already familiar with our site and have previously created an account with us, just Log In to your account, choose the template, and download it immediately or re-download it anytime in the My documents section.

- Don’t possess an account? No worries. It's quick to register and explore the catalog.

- However, before directly proceeding to download the Ca Deed With Vendor, adhere to these recommendations.

Form popularity

FAQ

To form a business corporation in Pennsylvania, Articles of Incorporation ? For Profit [DSCB:15-1306/2102/2303/2702/2903/3101/3303/7102], accompanied by a docketing statement [DSCB:15-134A] should be filed with the Bureau of Corporations and Charitable Organizations.

As of 2023, the filing fee is $70. The DOS has a certificate of termination available as a downloadable form. You can file the completed form online through the DOS website. Be aware that your business name will become available for use by others once your LLC is dissolved.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report). However, starting in 2025, the new Annual Report requirement will replace the old Decennial Report.

To make amendments to your limited liability company in Pennsylvania, you must provide the completed Certificate of Amendment-Domestic Limited Liability Company (DSCB: 15-8512/8951) form to the Department of State Corporation Bureau by mail, in person, or online.

Pennsylvania doesn't offer expedited filings for LLCs. It's going to take 5-6 weeks if you file online and up to 8 weeks if you file by mail. Unfortunately, you can't form an LLC any faster in Pennsylvania. Pennsylvania used to have walk-in filings at the Department of State in Harrisburg.

LLC ? An administratively dissolved Pennsylvania LLC cannot reinstate. If you want to do business again, you will have to apply as a new business entity. This costs $125. Corporation ? Pennsylvania imposes a $70 flat Pennsylvania reinstatement fee for administratively dissolved or expired corporations.

You can order a Certified Copy? Online: Go to their website and follow the instructions provided to sign up, search and print a certificate. ... By Mail: Requests by mail will be expedited only if paying the additional fee and requesting expedite service. ... By Fax: ... In Person: ... Order Certified Copy Online.

Corporation ? As for expired and dissolved corporations in Pennsylvania, you may be able to reinstate your company by filing a Statement of Revival-Domestic form with the Corporation Bureau of the Department of State. You will also have to submit a Docketing Statement-Changes form.