Enhanced Bird Form For Sale

Description

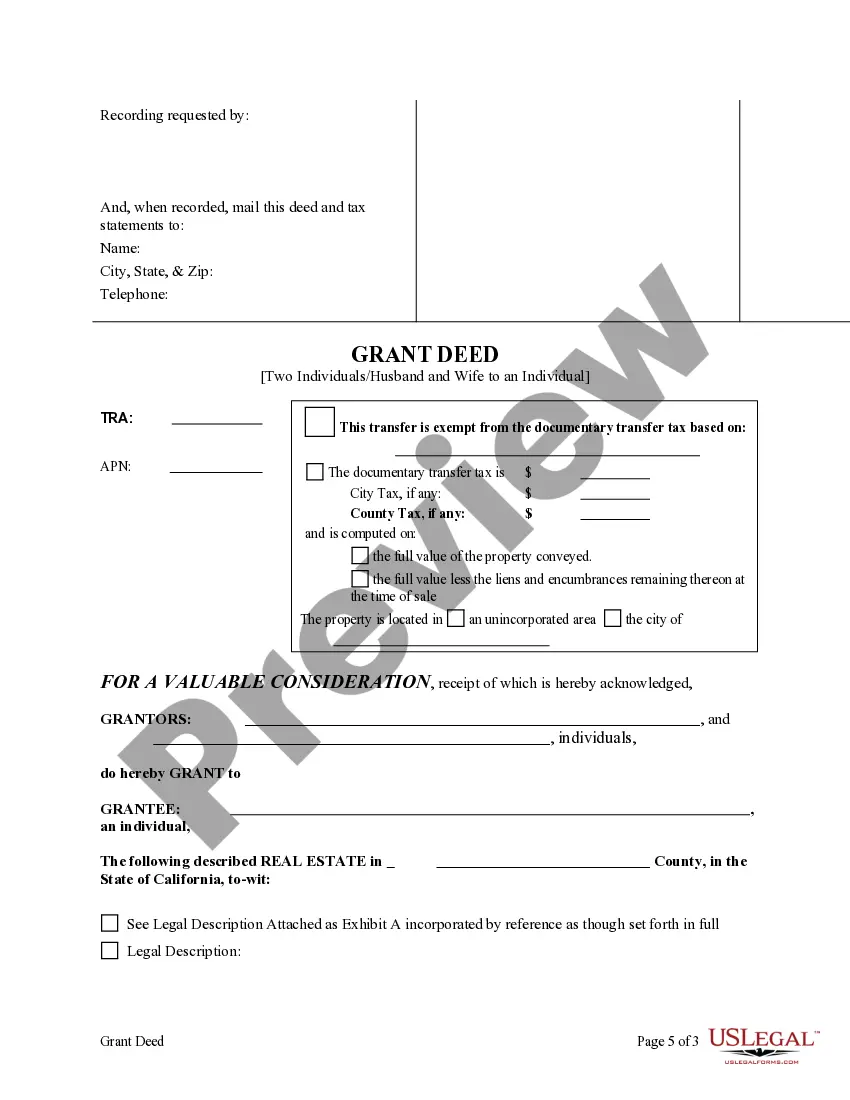

How to fill out California Enhanced Life Estate Or Lady Bird Grant Deed From Two Individuals, Or Husband And Wife, To An Individual?

- Log in to your US Legal Forms account by clicking the Login link. Ensure your subscription is active; if it's expired, renew it based on your payment plan.

- Browse through the form library and enter the preview mode to review descriptions. Double-check that the form meets your needs and complies with local jurisdiction requirements.

- If necessary, use the search feature to find an alternate template. Confirm it fits your criteria before proceeding.

- Click 'Buy Now' and select your preferred subscription plan to gain access to the extensive library.

- Complete the payment process by entering your credit card details or using your PayPal account. Once payment is confirmed, you can purchase the document.

- Download the form directly to your device. You can access it anytime from the My Forms section of your profile.

With US Legal Forms, you benefit from a user-friendly system that empowers you to execute documents promptly.

Start exploring our extensive legal form library today and ensure your documents are compliant and expertly crafted!

Form popularity

FAQ

In most cases, a lady bird deed takes precedence over a will when it comes to the property covered by the deed. This means that if you have designated a beneficiary in your lady bird deed, that successor automatically receives the property upon your passing, bypassing the probate process. Understanding how these legal instruments interact can clarify your estate planning, and the enhanced bird form for sale can facilitate a smoother transition.

A lady bird deed can provide some protections against Medicaid claims, but it is not foolproof. Generally, if you own the property during your lifetime, it is subject to Medicaid recovery rules. However, transferring ownership via a lady bird deed can potentially prevent the property from being counted as an asset after your death. For more information, consider the enhanced bird form for sale to ensure you make informed decisions.

Filing a lady bird deed in Florida involves a few straightforward steps. First, you must prepare the deed with the necessary information, including property details and the names of beneficiaries. Next, you'll need to sign the deed in the presence of a notary public and record it in the county clerk's office. Utilizing the enhanced bird form for sale can streamline this process and ensure accuracy.

While a lady bird deed offers various advantages, it also has some drawbacks. One potential issue is that it may not protect the property from creditors if the original owner has outstanding debts. Additionally, if not properly executed, the deed might lead to disputes among heirs. Assessing these negatives can provide clarity, and the enhanced bird form for sale can simplify the process.

A lady bird deed can help minimize capital gains tax liabilities. By transferring property upon death through this deed, you may benefit from a step-up in basis for tax purposes. This step-up can potentially reduce the capital gains tax when the property is eventually sold. Hence, understanding the complexities can make a significant difference, and exploring the enhanced bird form for sale may be worthwhile.

An enhanced life estate deed is often referred to as a ladybird deed, but there are nuances. Both allow the grantor to retain control during their lifetime and automatically transfer the property upon death. However, the ladybird deed allows the grantor to sell or mortgage the property without needing consent from the beneficiaries. This flexibility is one of the significant benefits of using the enhanced bird form for sale.

Whether a trust is better than a ladybird deed depends on your financial goals and circumstances. Trusts can offer more comprehensive estate planning benefits and can be tailored to fit your family's needs. In contrast, a ladybird deed provides simplicity and ease of transfer, especially for real estate. For those considering an enhanced bird form for sale, evaluating both options with a legal professional is wise.

The downsides of a ladybird deed include potential limitations on the grantor's control over the property. Since the deed names beneficiaries, there is less flexibility in making decisions regarding the property once it has been executed. Additionally, if the grantor needs Medicaid assistance for long-term care, a ladybird deed can complicate eligibility. Review these aspects thoroughly before opting for the enhanced bird form for sale.

While the ladybird deed offers flexibility, it also comes with certain disadvantages. One potential issue is that it may limit the property owner's ability to sell or refinance the property as easily as they could with traditional ownership. Furthermore, if the grantor incurs significant debts, creditors may still be able to make claims against the property. It’s important to evaluate these factors when considering the enhanced bird form for sale.

A ladybird deed does not inherently avoid capital gains tax, but it can help when it comes to inheritance taxes. This type of deed allows the property to pass directly to the beneficiary without the need for probate, making the sale process smoother. When combined with the stepped-up basis rule, properties transferred via a ladybird deed may see a reduced capital gains tax burden. Always check with a tax advisor for your unique situation.