Trustee In Sale Of House

Description

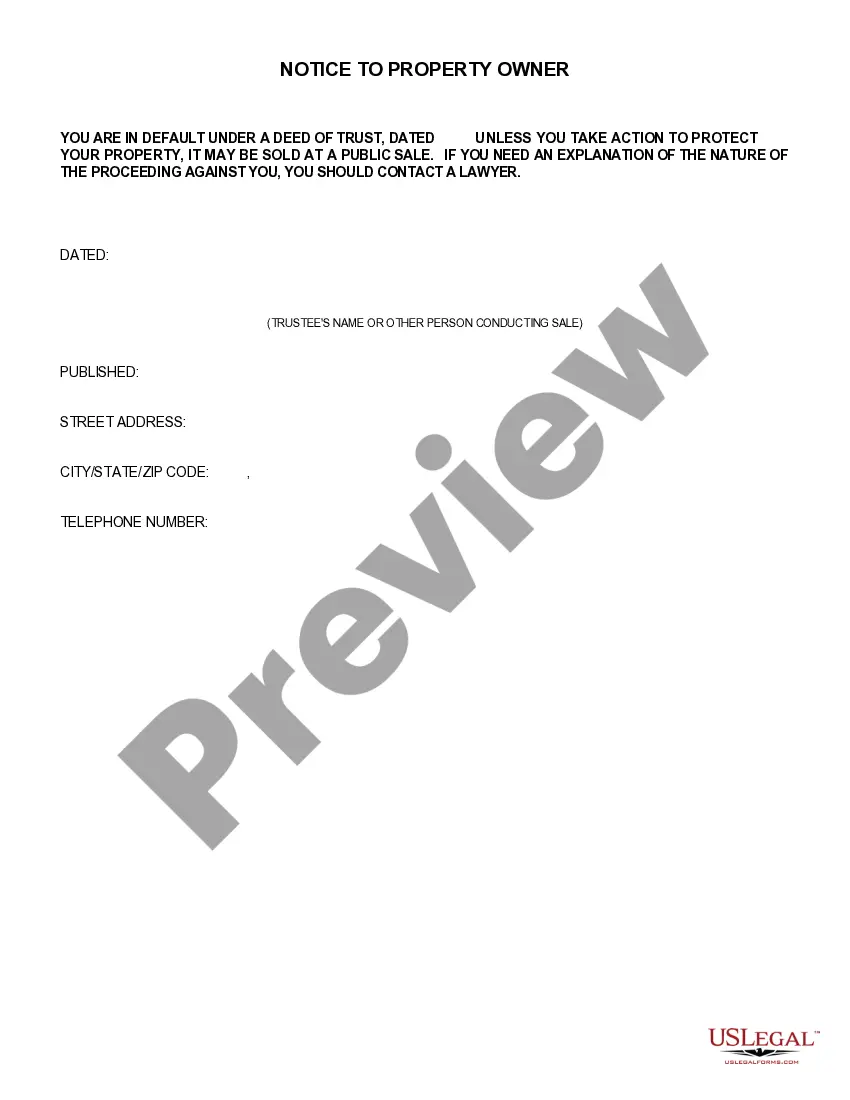

How to fill out California Notice Of Trustee's Sale?

The Trustee In Sale Of House displayed on this page is a versatile official template created by experienced attorneys in accordance with federal and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with more than 85,000 validated, state-specific documents for any business and personal circumstances. It is the quickest, easiest, and most dependable method to acquire the paperwork you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you desire for your Trustee In Sale Of House (PDF, Word, RTF) and store the sample on your device. Complete and sign the paperwork. Print the template to fill it out manually. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a legally binding electronic signature.

- Search for the document you require and evaluate it.

- Examine the example you sought and preview it or assess the form description to confirm it meets your requirements. If it doesn’t, use the search function to find the correct one. Click Buy Now when you have located the template you need.

- Register and Log Into your account.

- Choose the pricing plan that fits you best and set up an account. Utilize PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

Generally, a trustee in sale of house can sell property without obtaining approval from all beneficiaries. However, they must act in the best interest of all parties and adhere to the trust's terms. It's wise for trustees to communicate with beneficiaries about the sale details. Transparency can minimize disputes and foster trust.

Reporting the sale of property held in a trust requires proper documentation and compliance with tax regulations. You should file the necessary forms with the IRS to report any capital gains or losses resulting from the sale. Additionally, consult with a tax advisor or attorney experienced in trusts to ensure you're meeting all legal requirements. Utilizing tools from US Legal Forms can simplify this process and provide the resources you need for accurate reporting.

The letter of intent should contain termination provisions so that the parties will know when their respective obligations under the letter of intent will expire. Some provisions such as the confidentiality provision, will survive the expiration of the letter of intent and continue to bind the parties.

In a business-to-business transaction, a letter of intent normally contains a provision stating that the letter is non-binding. Even if such language is not included, it is possible a court would rule that the letter is only an expression of intent.

A letter of intent is generally not binding since it's basically a description of the deal process. It is, in effect, an agreement to agree. Thus, either party can cancel the letter at any time.

It is important to remember that a letter of intent is not legally binding, but it can serve as evidence of the parties' intentions in case of any disputes. Therefore, it is important to ensure that the letter is clear, concise, and accurately reflects the intentions of both parties.

Typically, a buyer would state its Letter of Intent is open for acceptance for 72 to 96 hours, or in some cases a one-to-two weeks.

Not all letters of intent have legal effect, so the parties may not be contractually bound by their terms. The courts have distinguished between letters of intent that create rights and liabilities and those that do not. Some letters of intent are just ?expressions of hope?, which are not binding.

Much like a cover letter, a letter of intent is a general overview of your industry-specific skills, experience and the reasons you're interested in working for a specific employer. This type of letter, also known as an intent letter or letter of interest, focuses on the company more than your skills.

A letter of intent is a document outlining the intentions of two or more parties to do business together; it is often non-binding unless the language in the document specifies that the companies are legally bound to the terms.