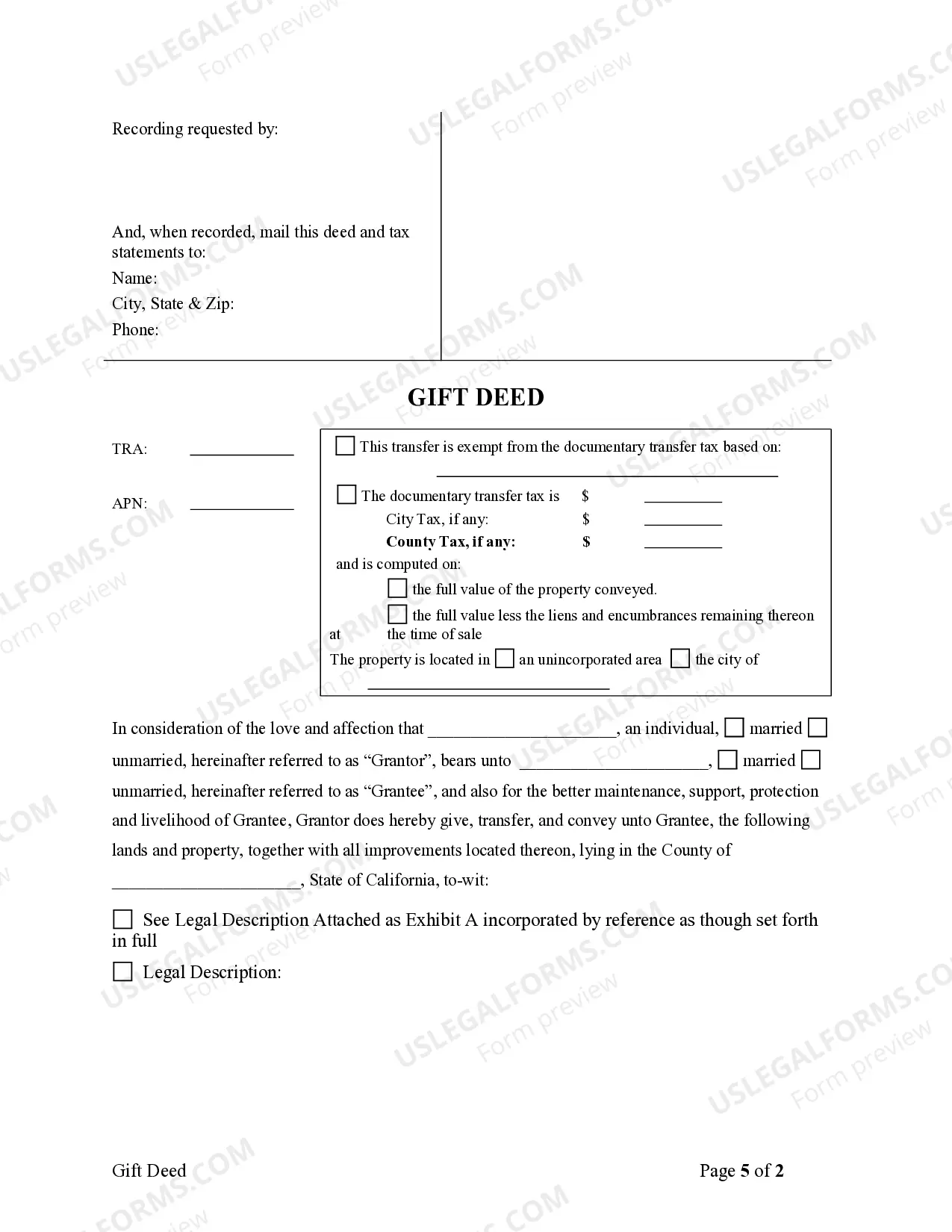

California Gift Deed Without Possession

Description

How to fill out California Gift Deed For Individual To Individual?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations at some point in their life. Completing legal papers demands careful attention, beginning from picking the proper form template. For instance, if you pick a wrong version of the California Gift Deed Without Possession, it will be rejected once you submit it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you need to get a California Gift Deed Without Possession template, stick to these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s information to make sure it fits your case, state, and region.

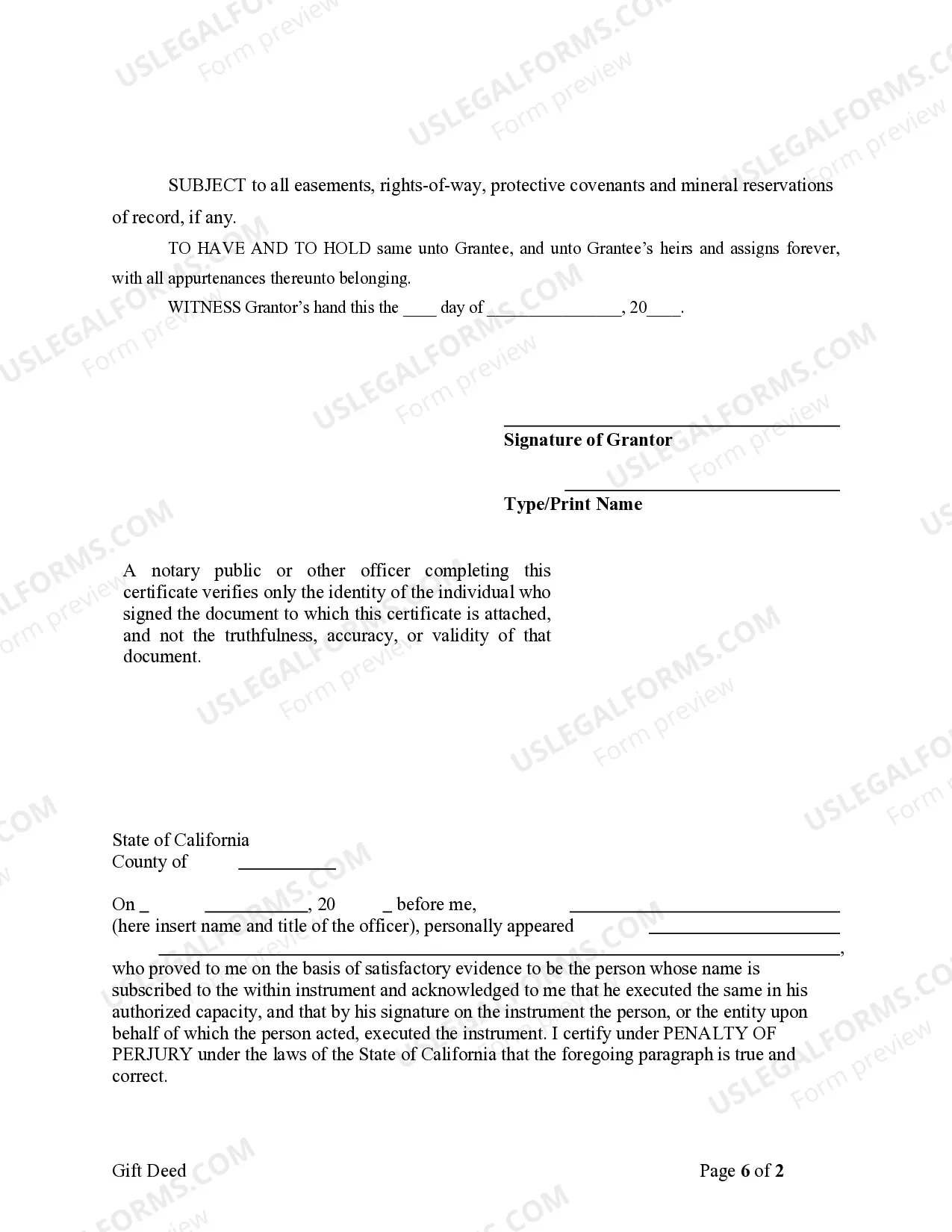

- Click on the form’s preview to see it.

- If it is the incorrect form, return to the search function to locate the California Gift Deed Without Possession sample you require.

- Get the file if it meets your needs.

- If you already have a US Legal Forms profile, click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Finish the profile registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Choose the file format you want and download the California Gift Deed Without Possession.

- After it is downloaded, you can fill out the form by using editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time searching for the appropriate sample across the internet. Utilize the library’s easy navigation to get the right template for any occasion.

Form popularity

FAQ

Both types of gifts share three elements which must be met in order for the gift to be legally effective: donative intent (the intention of the donor to give the gift to the donee), the delivery of the gift to the donee, and the acceptance of the gift.

Whereas, acceptance of gift by the donee is one of very important element of a valid gift. Therefore when gift is made in favour of minor or insane person the acceptance of gift needs to be made by the guardian. In case if a guardian is making gift then the delivery of possession is not required.

Under Section 122 of the Act, delivery of possession is not necessary for acceptance of the gift. Since the gift is defined under Section 122 of the Ac... custom, a gift could be made but to make it valid, it was necessary that the possession of the property should be delivered to the donee.

If the gift deed was not performed and registered in ance with legal requirements, it is invalid, and the Gift deed can be challenged in Court. The gift deed can be challenged in court if either party to the gift was incompetent to contract; the gift is void.

Unregistered gift deed of immovable property is invalid and doesn't results in transfer of ownership of the immovable property but unregistered gift deed, if any, made for movable property will not be invalid just on the ground of it's not being registered.