Trust Transfer Deed With Power Of Attorney

Description

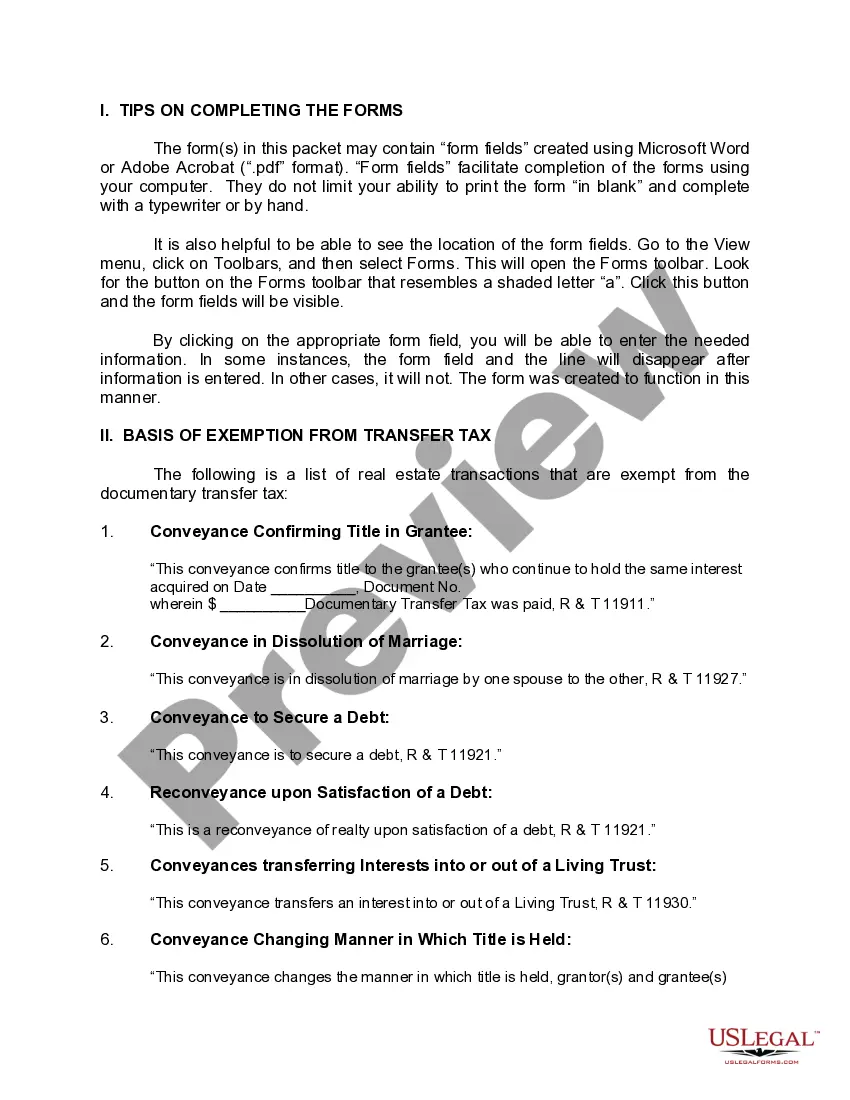

How to fill out California Grant Deed From Individual To Trust?

It’s clear that you cannot become a legal specialist in a day, nor can you quickly understand how to effortlessly create a Trust Transfer Deed With Power Of Attorney without having the necessary expertise.

Crafting legal documentation is a lengthy endeavor requiring specific training and abilities. Therefore, why not entrust the drafting of the Trust Transfer Deed With Power Of Attorney to seasoned professionals.

With US Legal Forms, known for one of the largest legal document repositories, you can locate anything from court forms to templates for internal corporate correspondence.

You can access your forms again from the My documents section at any time. If you’re a current customer, you can merely Log In, and find and download the template from the same section.

Regardless of the objective of your documents—whether they relate to finances and law, or personal matters—our platform has you covered. Explore US Legal Forms today!

- Identify the document you require by employing the search function at the upper part of the webpage.

- Review it (if this feature is available) and examine the accompanying description to confirm if the Trust Transfer Deed With Power Of Attorney is what you're looking for.

- Restart your search if you need a different form.

- Establish a complimentary account and choose a subscription plan to acquire the template.

- Click Buy now. After finalizing the transaction, you can retrieve the Trust Transfer Deed With Power Of Attorney, fill it out, print it, and deliver or mail it to the appropriate parties or organizations.

Form popularity

FAQ

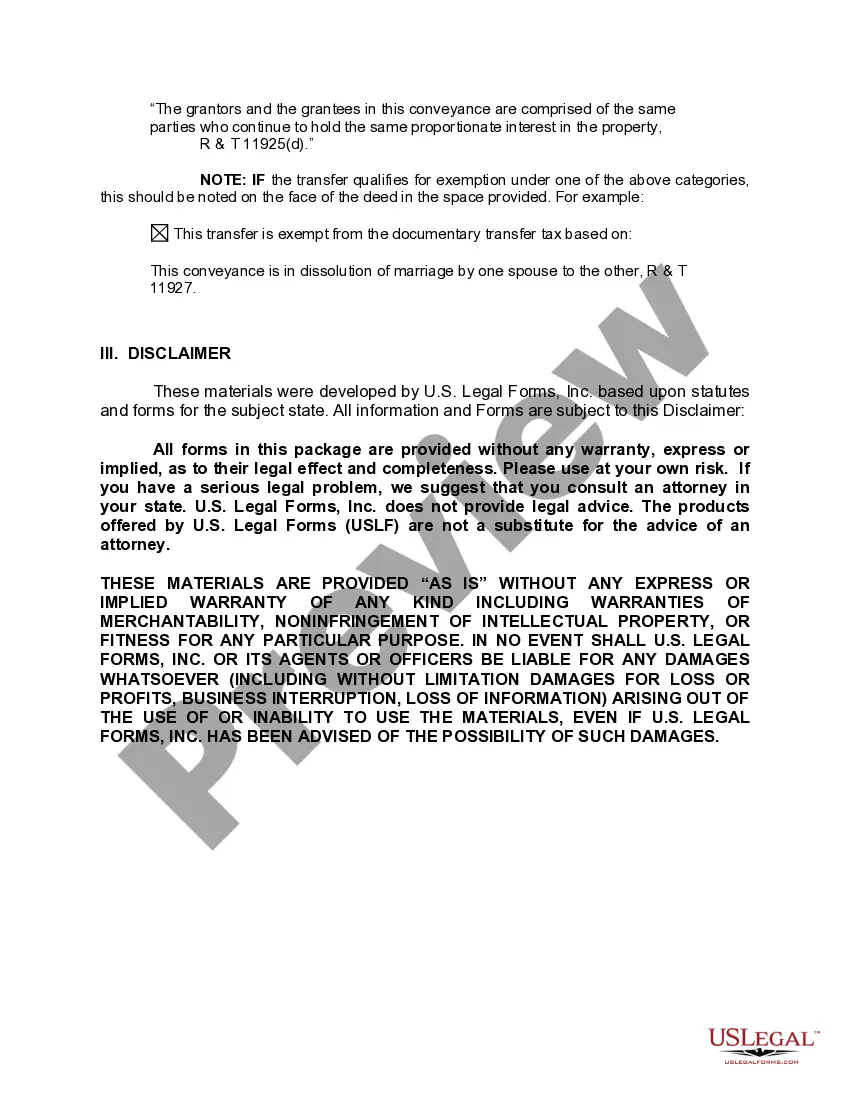

The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees. Additional pages or non-conforming documents will accrue an additional filing fee.

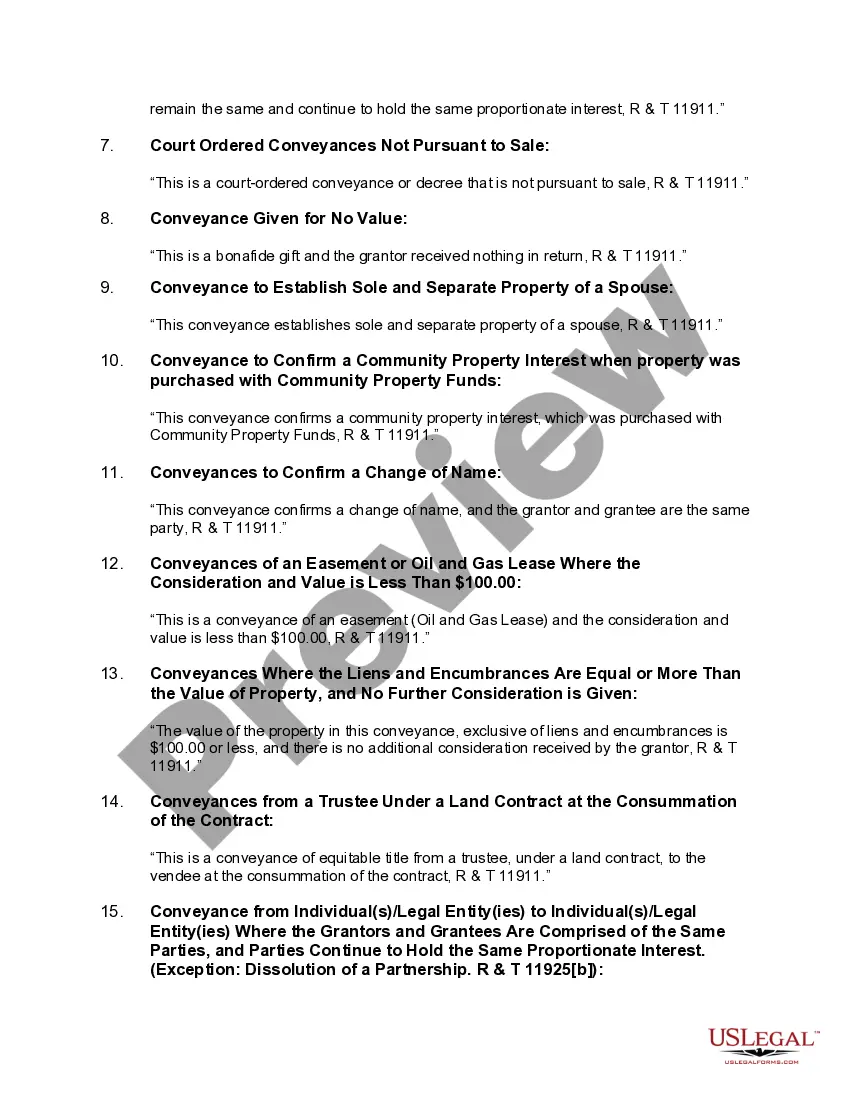

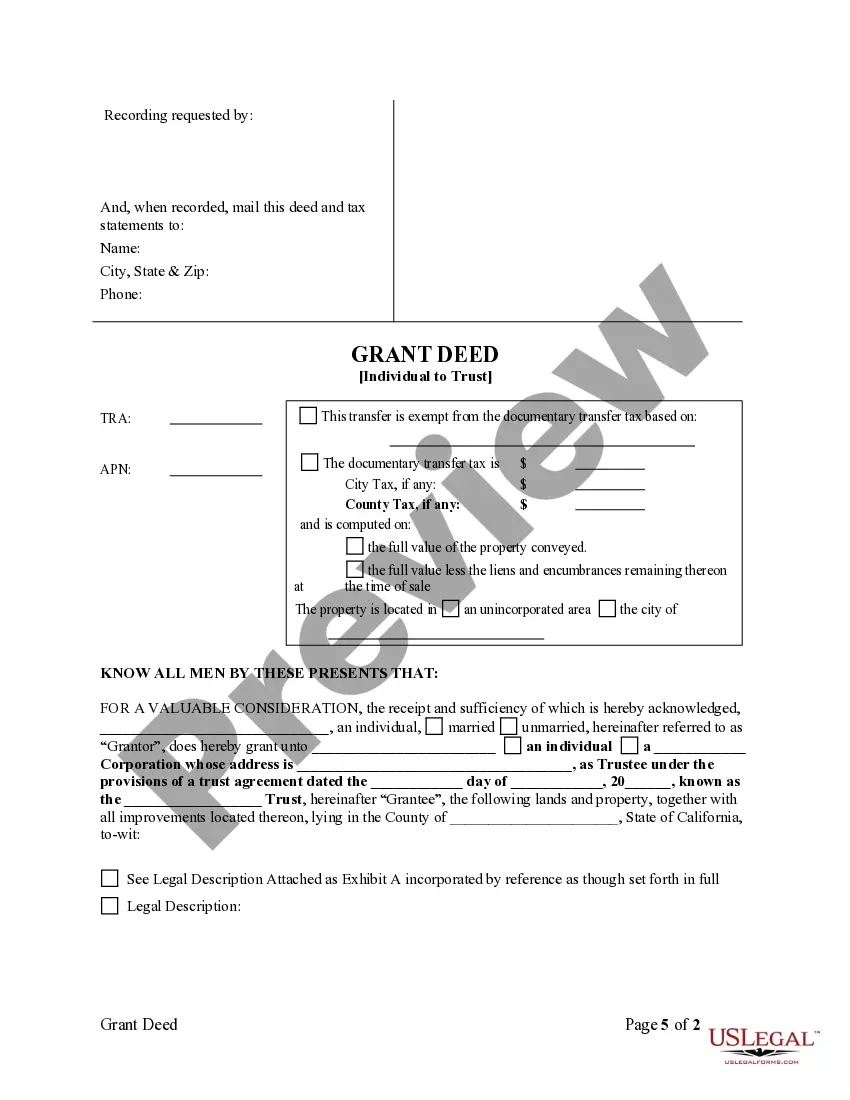

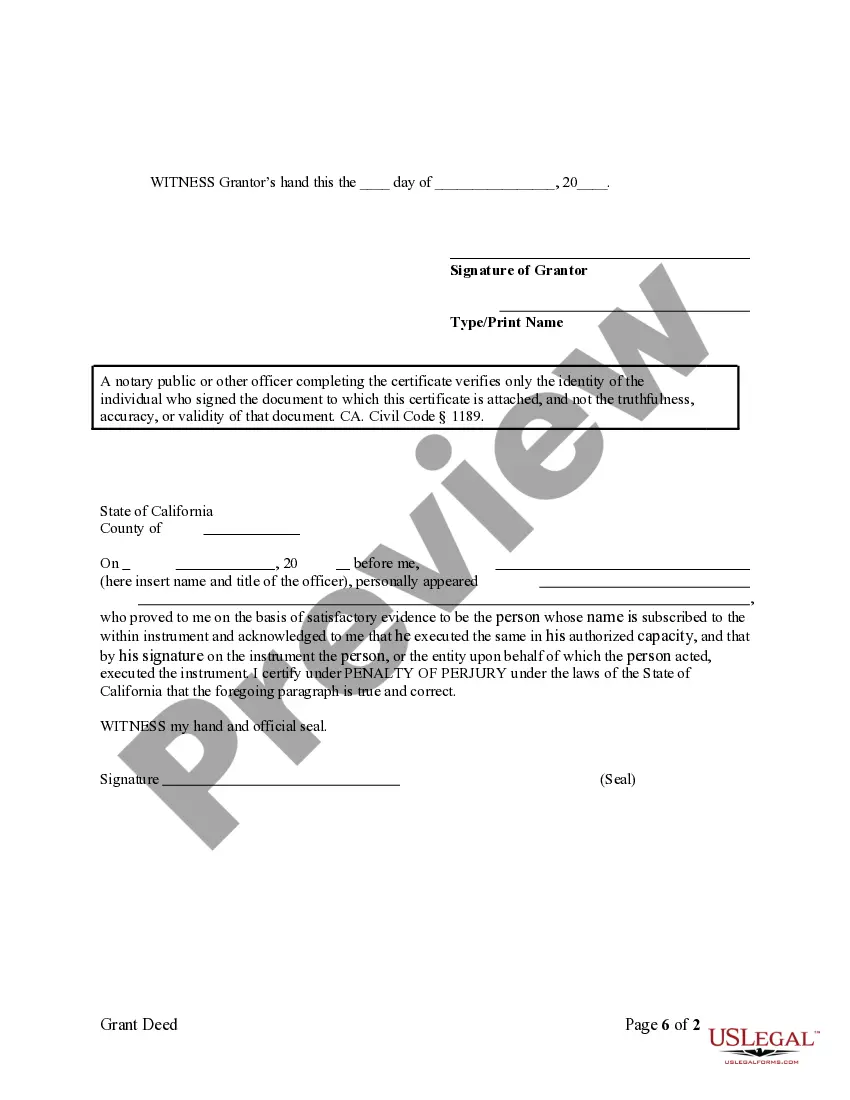

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Yes, for recorded land an original power of attorney which is properly notarized may be recorded. For Registered Land, in a addition to the original power of attorney an affidavit accepting the power of attorney must be filed.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

If the power of attorney is durable and might be used to handle real estate transactions, it should also be recorded with the circuit court in the county where the property is located.