Transfer On Death Deed Form

Description

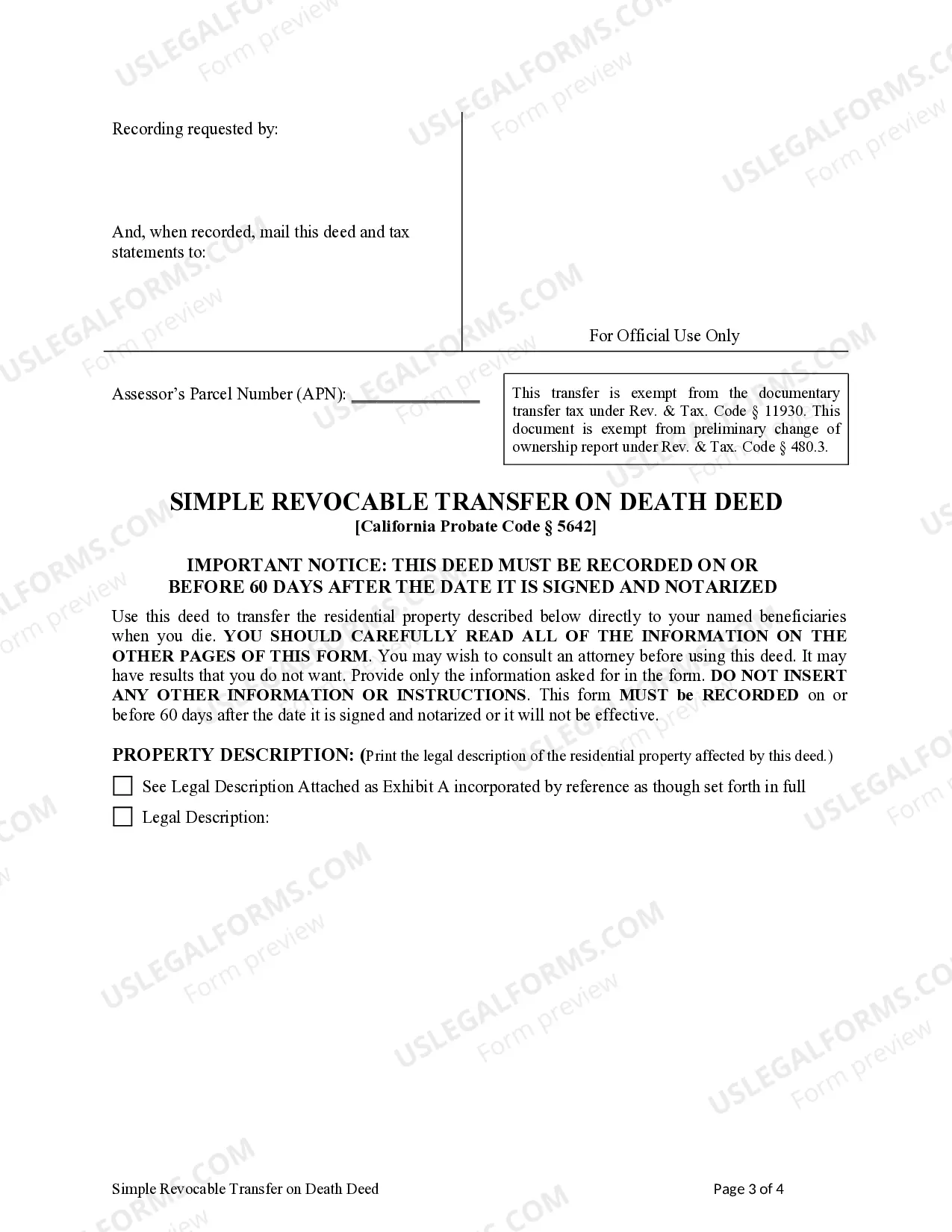

How to fill out California Revocable Transfer On Death Deed - Individual To Individual?

Individuals often link legal documentation with complexity that only an expert can manage.

In a certain sense, this is accurate, as creating a Transfer On Death Deed Form necessitates significant knowledge of the relevant criteria, including state and local laws.

However, with US Legal Forms, everything has become simpler: ready-made legal templates for various life and business scenarios specific to state regulations are assembled in a single online directory and are now accessible to everyone.

All templates in our catalog are reusable: once obtained, they remain saved in your profile. You can access them whenever necessary via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- Examine the page content thoroughly to ensure it fulfills your requirements.

- Review the form description or explore it using the Preview feature.

- Find another sample using the Search field above if the previous one does not suit your needs.

- Click Buy Now when you identify the appropriate Transfer On Death Deed Form.

- Select a subscription plan that aligns with your needs and financial capacity.

- Set up an account or Log In to proceed to the payment section.

- Complete your payment through PayPal or your credit card.

- Choose the file format and click Download.

- Print your document or upload it to an online editor for a quicker fill-out.

Form popularity

FAQ

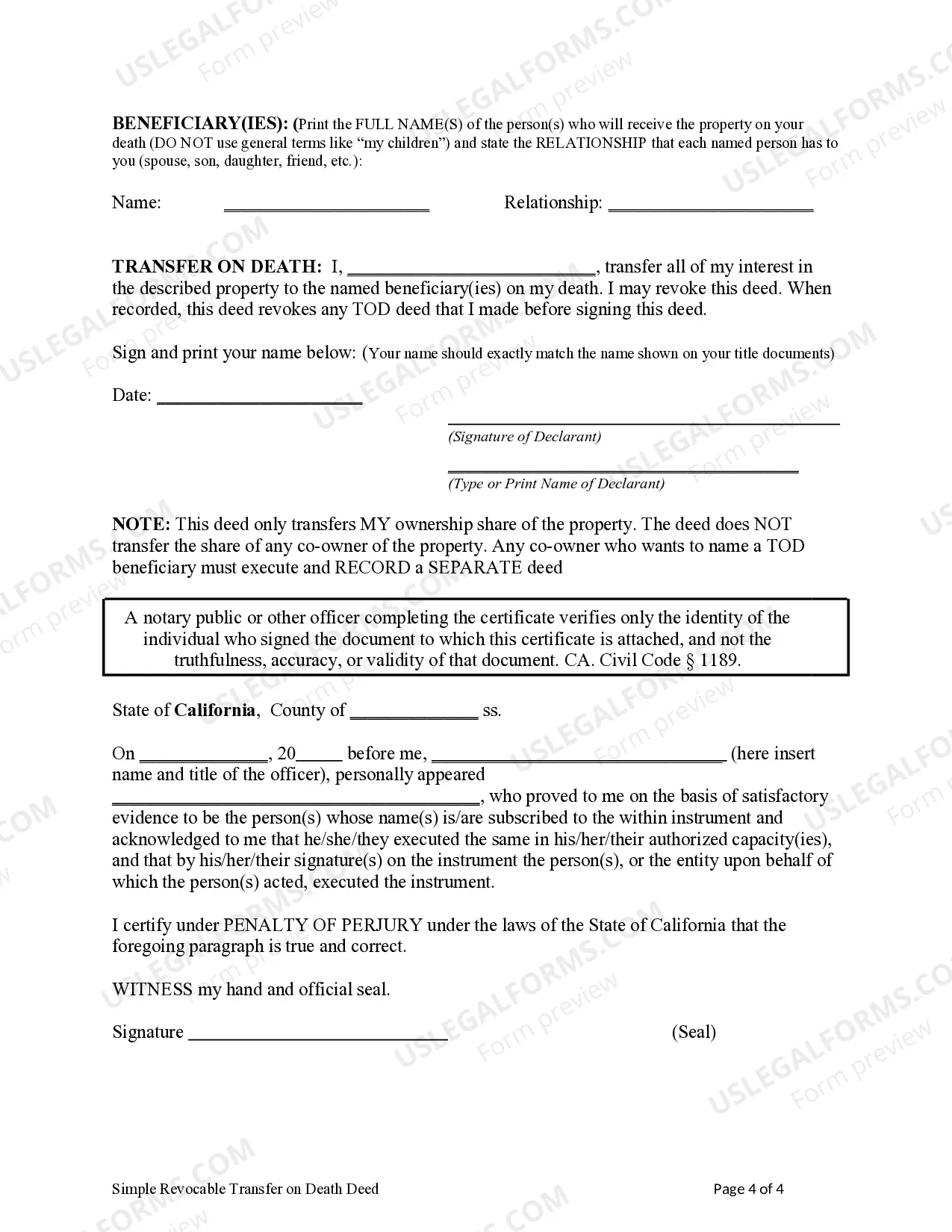

The main advantage of a Transfer on Death deed is its simplicity and efficiency. It allows property owners to designate a beneficiary who will inherit the property upon death, bypassing the probate process. This feature can save significant time and legal expenses, making it an appealing option for estate planning.

In California, transferring property title to a family member after death often requires a Transfer on Death Deed form if one was previously established. If not, you may have to go through probate, which can be time-consuming. Utilizing platforms like uslegalforms can help guide you through the process, ensuring you complete the necessary documentation accurately.

The primary difference between a Transfer on Death deed and beneficiaries lies in their purpose and function. A Transfer on Death deed specifically applies to real estate and automatically transfers property upon the owner's death. On the other hand, beneficiaries can refer to various types of accounts and financial assets, with rights to those assets upon the death of the account holder.

One downside of a Transfer on Death Deed is that it does not provide protection against creditors. If you have outstanding debts, creditors can still make claims against the property before it transfers to your beneficiary. Additionally, if the beneficiary is not responsible or capable of managing the property, it could lead to complications later.

You do not necessarily need a lawyer to transfer a deed in Texas, especially if you use a Transfer on Death Deed form. This form allows you to designate a beneficiary for your property without the need for probate. However, consulting with a lawyer could help ensure that all legal requirements are met and that your intentions are clear.

You do not necessarily need an attorney to complete a transfer on death deed form. Many individuals find that they can navigate the process using the resources available online, including templates and guides. However, if your situation involves complexities, such as multiple beneficiaries or property disputes, consulting an attorney may be beneficial. Ultimately, choosing to work with a legal expert can provide peace of mind and help ensure that all aspects of the transfer are handled correctly.

Yes, the transfer on death designation is available in New York State for real estate. Residents can utilize the transfer on death deed form to specify beneficiaries who will inherit property, avoiding the lengthy probate process. This availability provides an opportunity for efficient estate planning, ensuring that your assets are passed on quickly and according to your wishes. Consider using platforms like US Legal Forms to access the right documentation and guidance.

In New York, the rules for transfer on death (TOD) require that the transfer on death deed form must be signed, notarized, and filed in the county clerk's office where the property is located. This ensures that your intended beneficiaries receive the property upon your passing without going through probate. It's essential to follow the legal protocols carefully to avoid complications later. Using a reliable resource like US Legal Forms can help you navigate these requirements effectively.

In New York, certain assets can bypass probate, which includes jointly owned property, retirement accounts, and assets with designated beneficiaries. Additionally, life insurance policies and transfer on death deed forms facilitate direct transfers to beneficiaries, further simplifying the process. Understanding these exemptions can help streamline estate planning and minimize the hassle for your loved ones. It's wise to consult with a legal professional to ensure your assets are positioned correctly.

The transfer on death law in New York allows property owners to designate a beneficiary to receive their real estate upon their death, avoiding probate. This is achieved using a transfer on death deed form, which must be properly executed and filed. This process simplifies property transfer and ensures that your wishes are honored without the complexities of estate management. It is an effective way to keep your estate planning straightforward.