Limited Liability Form With The Division Of Corporations

Description

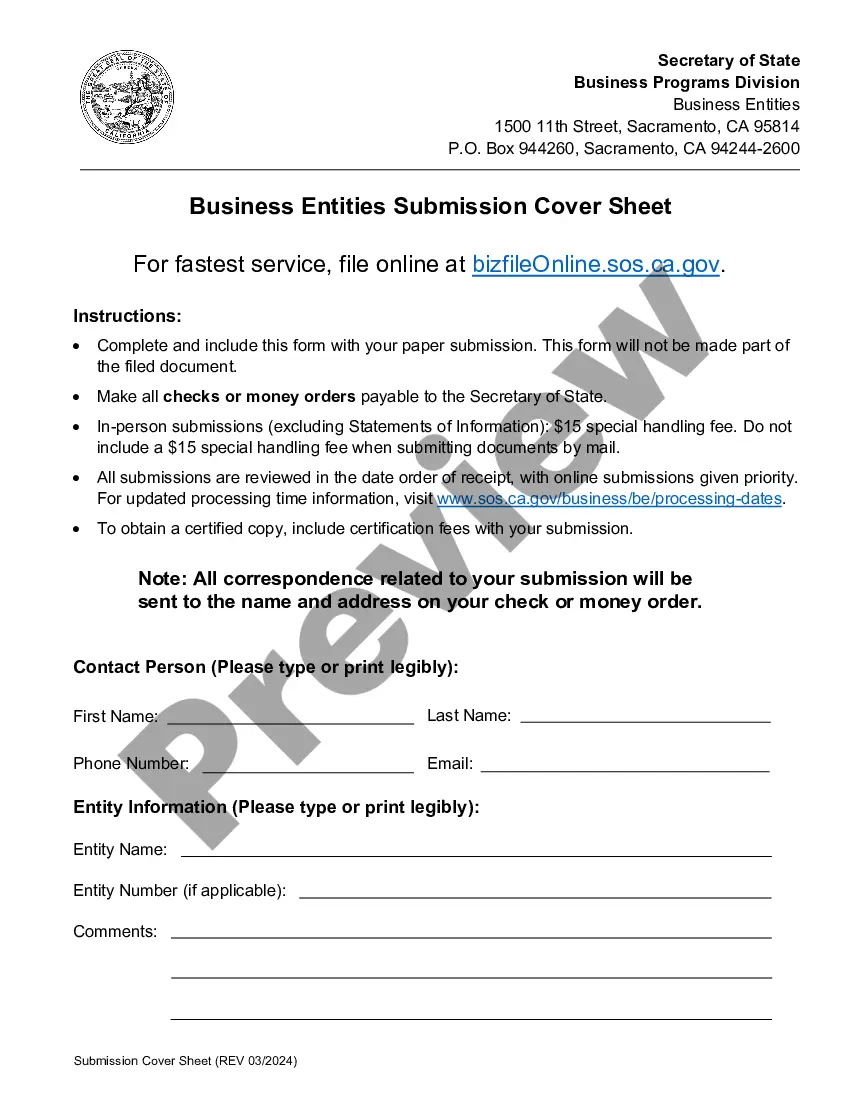

How to fill out California Limited Liability Company LLC Formation Package?

Getting a go-to place to access the most current and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal files demands accuracy and attention to detail, which is why it is vital to take samples of Limited Liability Form With The Division Of Corporations only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Take the following steps to finish your Limited Liability Form With The Division Of Corporations:

- Make use of the library navigation or search field to find your template.

- View the form’s description to check if it fits the requirements of your state and area.

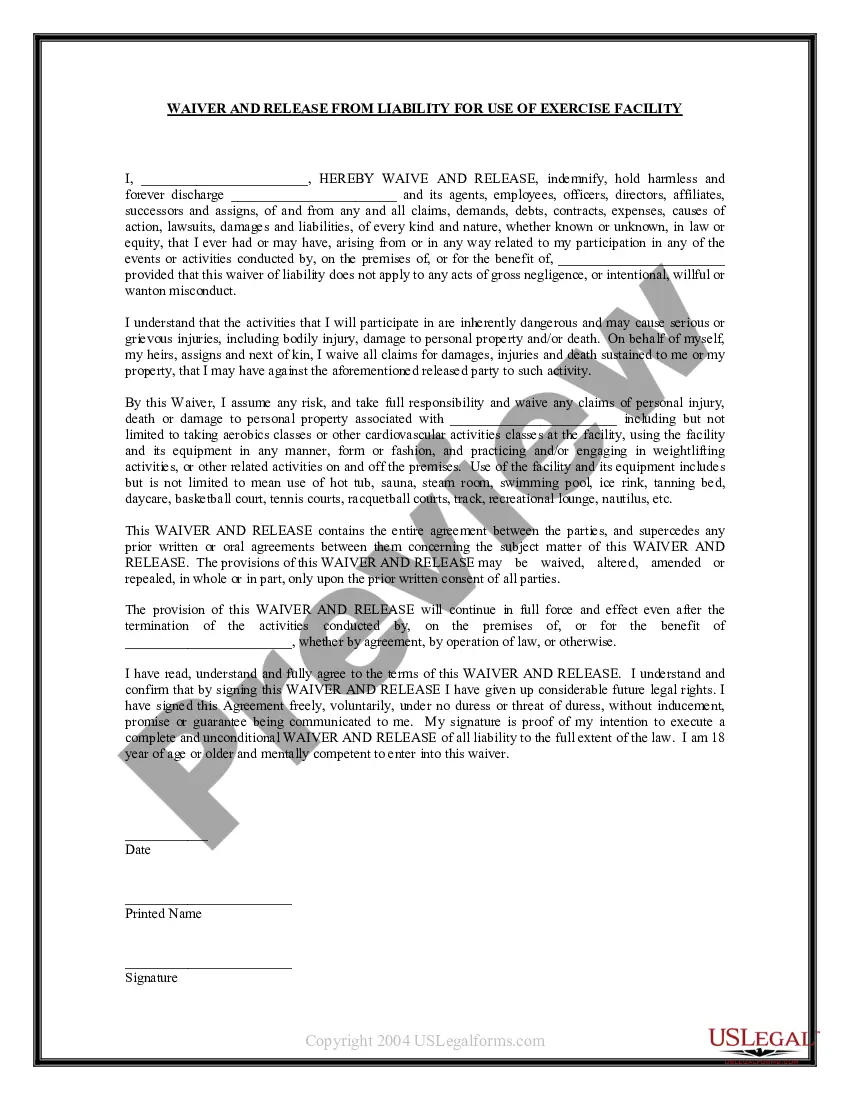

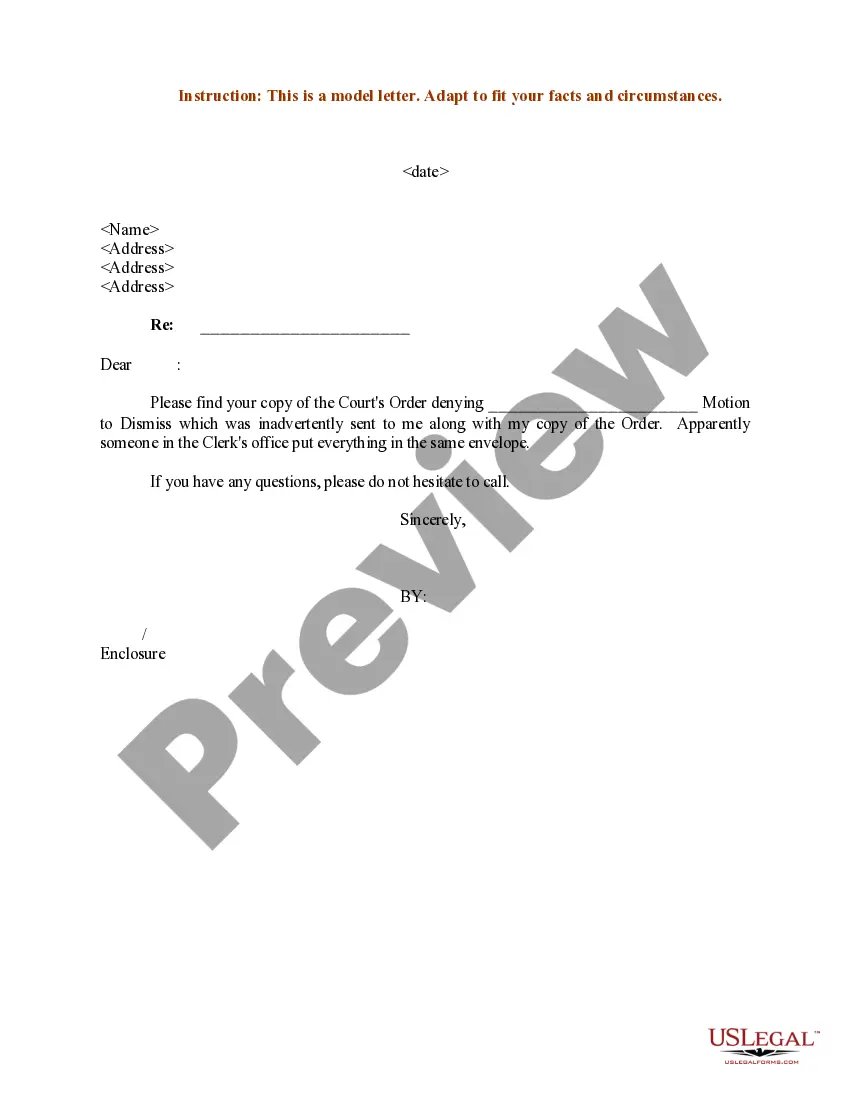

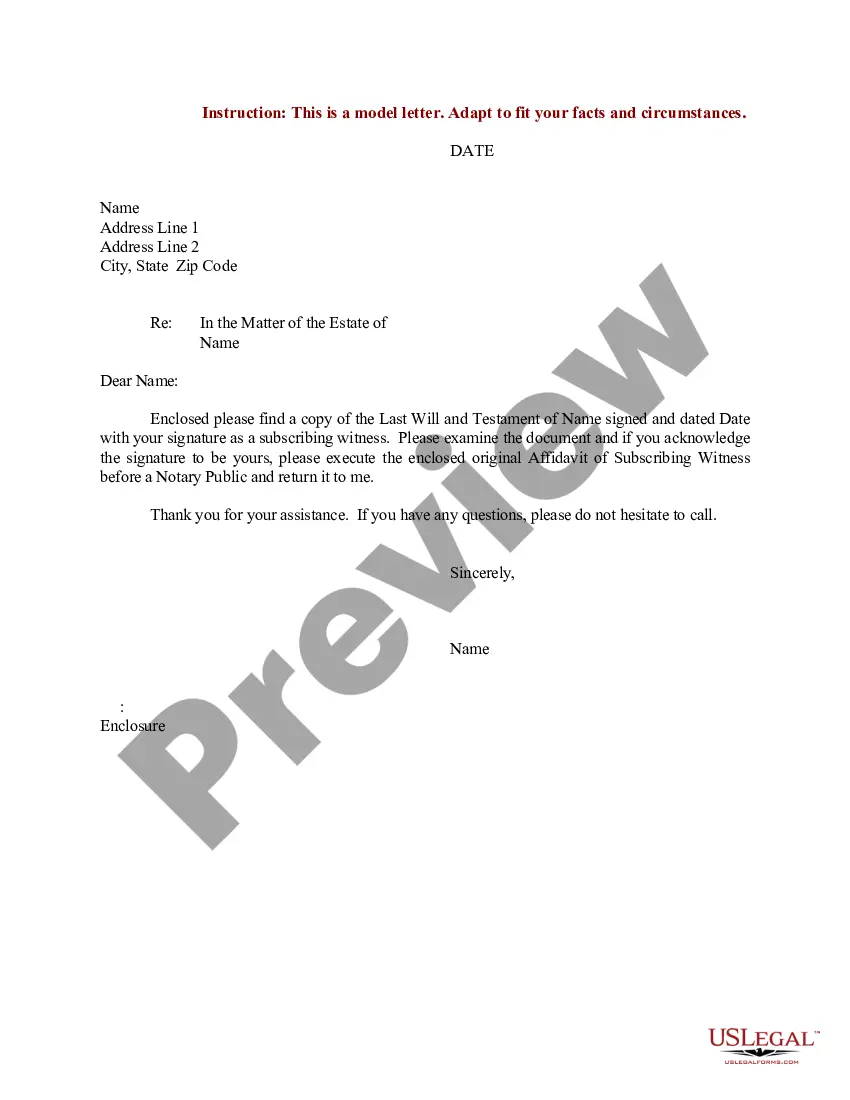

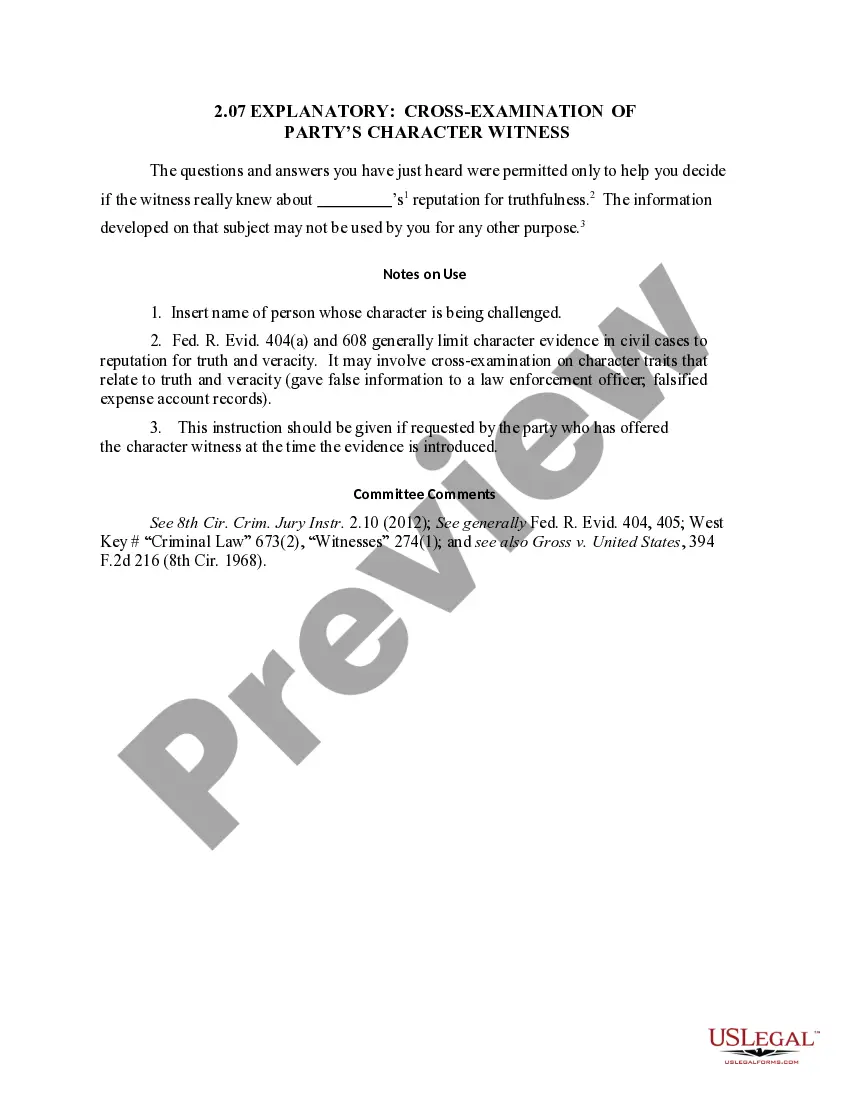

- View the form preview, if there is one, to ensure the template is the one you are looking for.

- Get back to the search and locate the proper template if the Limited Liability Form With The Division Of Corporations does not fit your needs.

- When you are positive about the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by picking a transaction method (bank card or PayPal).

- Choose the document format for downloading Limited Liability Form With The Division Of Corporations.

- When you have the form on your device, you can change it using the editor or print it and finish it manually.

Get rid of the inconvenience that accompanies your legal documentation. Check out the extensive US Legal Forms library where you can find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

An LLC's simple and adaptable business structure is perfect for many small businesses. While both corporations and LLCs offer their owners limited personal liability, owners of an LLC can also take advantage of LLC tax benefits, management flexibility, and minimal recordkeeping and reporting requirements.

Hear this out loud PauseAn LLC is not a type of corporation. In fact, an LLC is a unique hybrid entity that combines the simplicity of a sole proprietorship with the liability protections offered by starting a corporation.

Hear this out loud PauseBoth corporations and LLCs are limited liability entities. This means the owners aren't personally liable for business debts or lawsuits against the business.

Hear this out loud PauseBecause an LLC is a separate entity, the owners of the company have limited liability. This is one of the most important benefits to operating as a limited liability company. Limited liability means that the individual assets of LLC members cannot be used to satisfy the LLC's debts and obligations.

Hear this out loud PauseThere is no documentation required to form an LLC in Delaware. The only information required, whether you are a United States citizen or not, is: Name of the company (check a company name for free) Communications Contact (must be an individual)