Business Incorporate With The Us

Description

How to fill out California Business Incorporation Package To Incorporate Corporation?

- If you are a returning user, log into your account and download the necessary form by clicking the Download button. Ensure your subscription is active. If it’s expired, renew according to your payment plan.

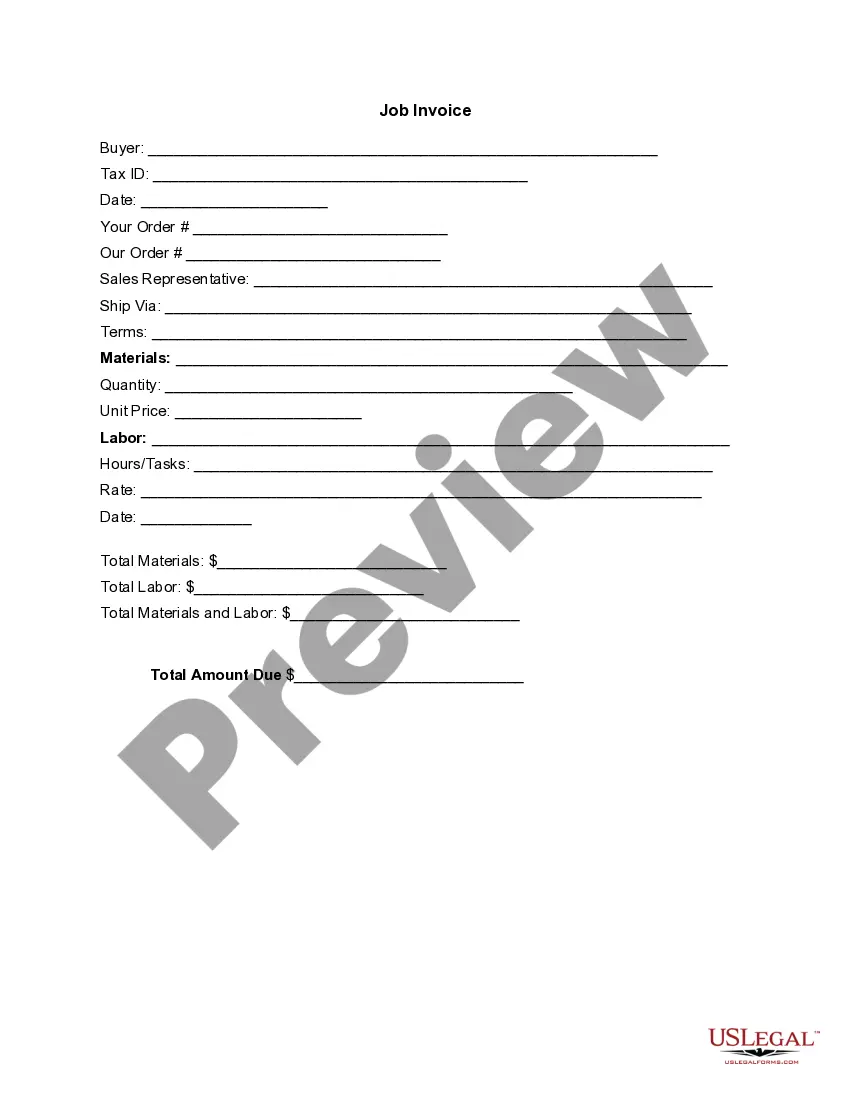

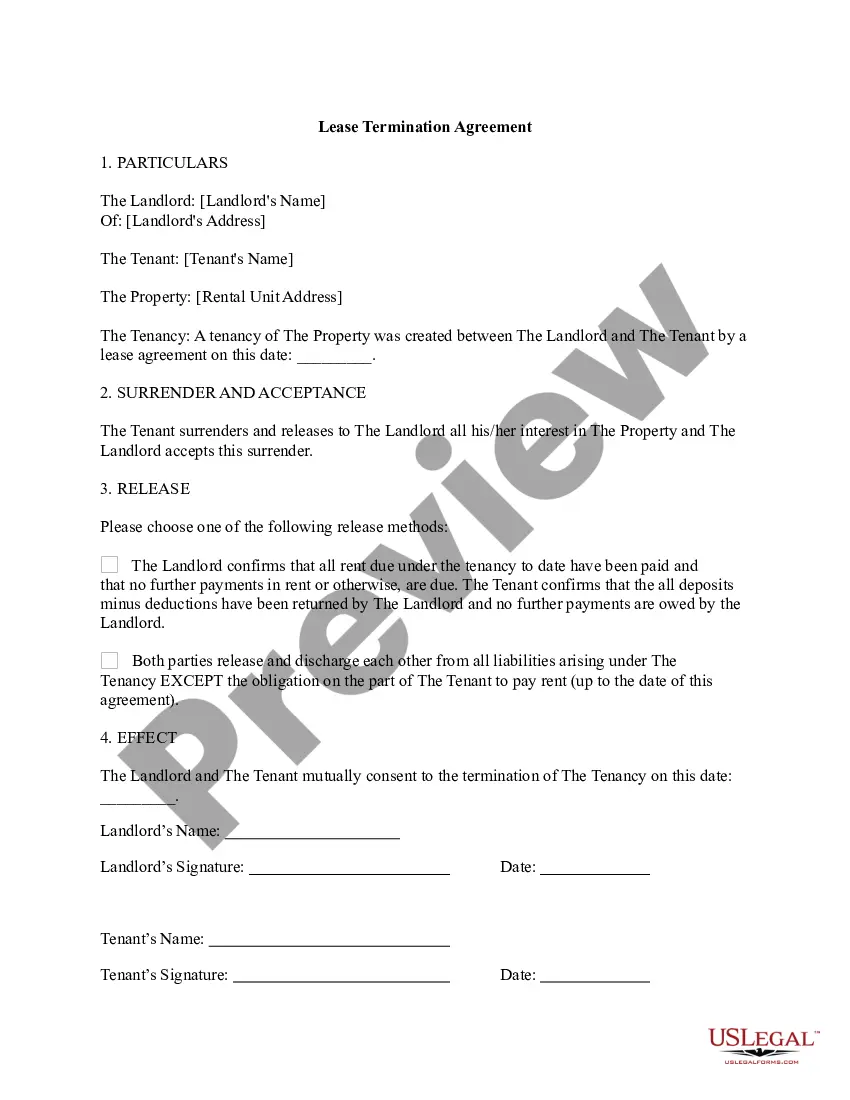

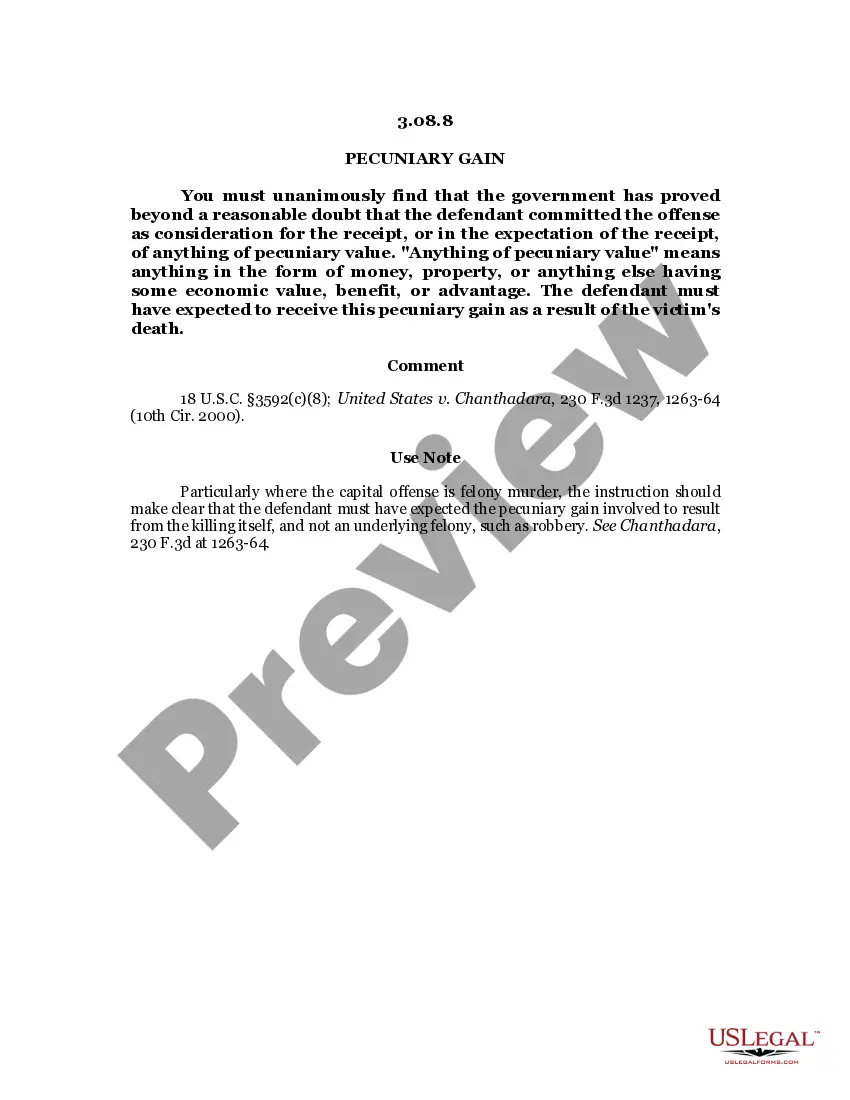

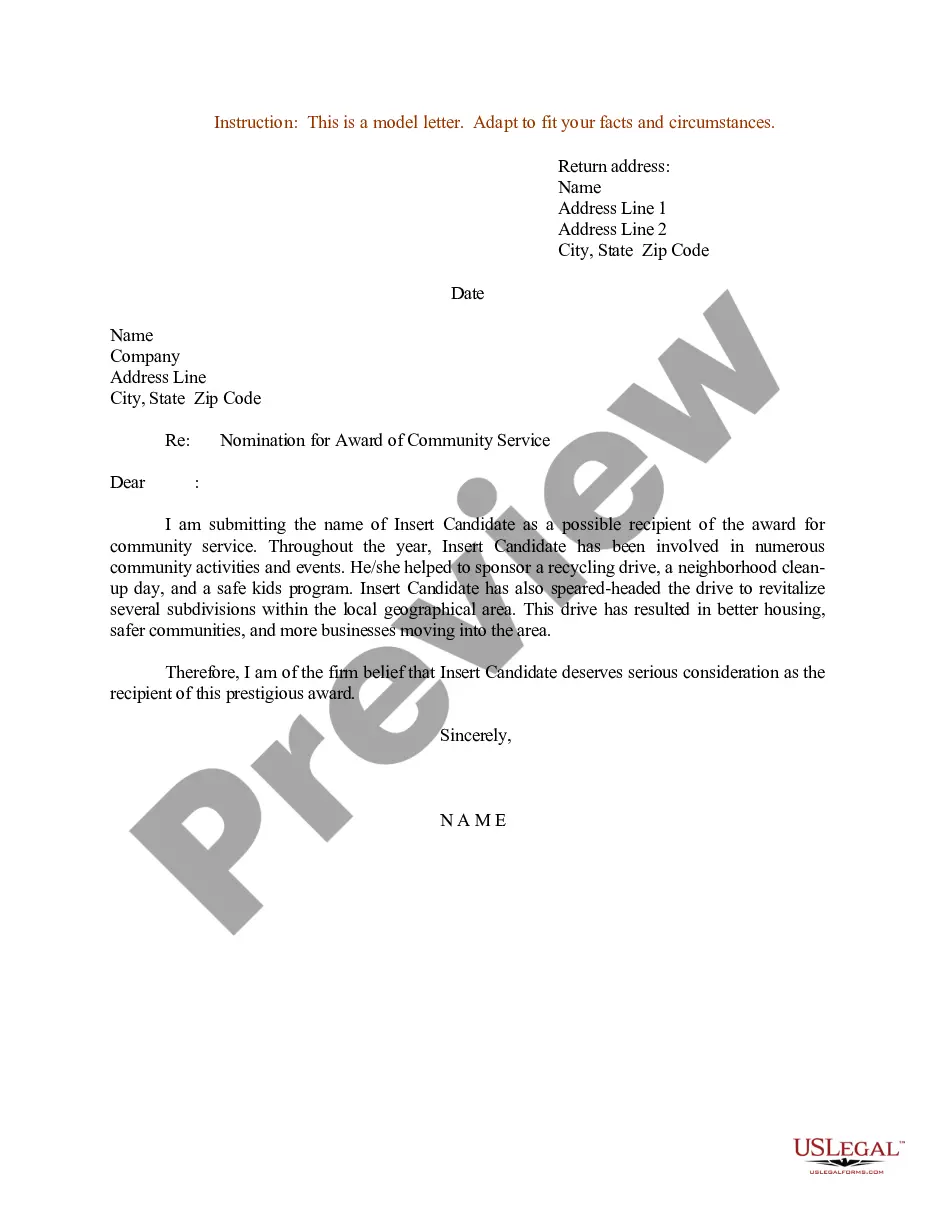

- For first-time users, start by reviewing the Preview mode and form descriptions to choose the right document that fits your local jurisdiction requirements.

- If the form is not suitable, utilize the Search tab to find an alternative template that meets your needs.

- Purchase the required document by clicking the Buy Now button and selecting your preferred subscription plan. Registering an account will grant you access to the library.

- Complete the purchase by entering your payment details through credit card or PayPal options.

- Finally, download your form and save it on your device for easy access. You can always find it later in the My Forms section of your profile.

Utilizing US Legal Forms empowers users and legal professionals alike to effectively manage legal documentations, ensuring they are both comprehensive and compliant with the law.

Start your incorporation journey today with US Legal Forms, and make the legal process as simple as possible!

Form popularity

FAQ

Being incorporated in the US means that your business is legally recognized as a separate entity. This status provides personal liability protection, allowing the company to enter contracts and own assets independently of its owners. When you business incorporate with the US, you also gain credibility with customers, suppliers, and investors. Additionally, it opens up various funding opportunities that are typically unavailable to unincorporated businesses.

Choosing between an LLC and a corporation depends on your business goals. When you decide to business incorporate with the US, an LLC offers flexibility, simpler tax structures, and less administrative paperwork. On the other hand, a corporation provides the ability to raise funds through stock sales and forms a stronger legal separation from personal assets. It's essential to weigh these factors to determine which option best aligns with your business strategy.

Yes, a foreigner can register a company in the US without being a resident or citizen. Many foreign entrepreneurs choose to incorporate with the US due to the robust business infrastructure and numerous opportunities available. You will need to supply proper documentation and may benefit from using organizations like USLegalForms to navigate the specific requirements your chosen state may have. This opens doors for you to successfully manage a business from wherever you are located.

Choosing an LLC over a corporation can offer unique advantages for many business owners. LLCs provide liability protection while allowing more flexible management and fewer formalities compared to corporations. This relaxed structure often accommodates small business owners better, particularly those focused on fewer regulations. Therefore, if you want to easily business incorporate with the US, consider the benefits of forming an LLC.

Determining whether an LLC or INC is better for your business involves assessing your specific needs. An LLC is typically more suitable for small businesses with straightforward financial structures, while an INC may offer advantages for larger companies looking for investment opportunities. Both options come with distinct legal and tax implications. Thus, carefully evaluating your circumstances will help you decide how to business incorporate with the US.

A company may decide to transition from an LLC to an INC for several reasons. This move often aims to attract investors or access public funding, as corporations tend to have more extensive growth avenues. Additionally, an INC can enhance a company's credibility and provide a clearer structure for future expansion. If you are considering how to business incorporate with the US, weighing such options is crucial for your company's success.

When you choose to start a business, understanding the difference between an LLC and an INC is essential. An LLC, or Limited Liability Company, offers flexibility in management and protects personal assets from business debts. An INC, short for Corporation, is a more structured option that provides additional financing opportunities but comes with stricter regulations. Ultimately, your decision to effectively business incorporate with the US will depend on your business goals and structure preferences.

A US citizen can own a foreign corporation without any issues. This ownership can provide opportunities for diversification and international engagement. However, it's important to be aware of taxes and compliance requirements that come with such ownership. If you are considering ways to business incorporate with the US and expand overseas, USLegalForms can provide the necessary resources to help you understand the implications.

Yes, foreign companies can operate in the US, but they must adhere to specific state and federal regulations. This typically involves registration as a foreign entity in the state where they intend to do business. Properly navigating these regulations can open doors to lucrative opportunities. If your goal is to business incorporate with the US and gain access to the market, consider utilizing services like USLegalForms to ensure compliance.

An offshore company can indeed own a US LLC. This situation is common and provides various benefits, such as limited liability and tax advantages. When setting this up, ensure you follow all necessary state and federal guidelines. If you wish to business incorporate with the US and explore LLC ownership, leveraging platforms like USLegalForms can simplify this process.