Plumbing Maintenance Contracts For Tender

Description

How to fill out California Plumbing Contract For Contractor?

Regardless of whether for commercial aims or personal matters, everyone must confront legal scenarios at certain points in their lives. Completing legal documents demands meticulous care, starting with selecting the correct form example.

For instance, if you select an incorrect version of the Plumbing Maintenance Contracts For Tender, it will be denied once you submit it. Thus, it is essential to have a reliable source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you no longer need to waste time searching for the right template across the web. Make use of the library’s easy navigation to find the appropriate template for any occasion.

- Obtain the template you require by utilizing the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search feature to find the Plumbing Maintenance Contracts For Tender sample you need.

- Download the file if it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- Should you not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Plumbing Maintenance Contracts For Tender.

- Once saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

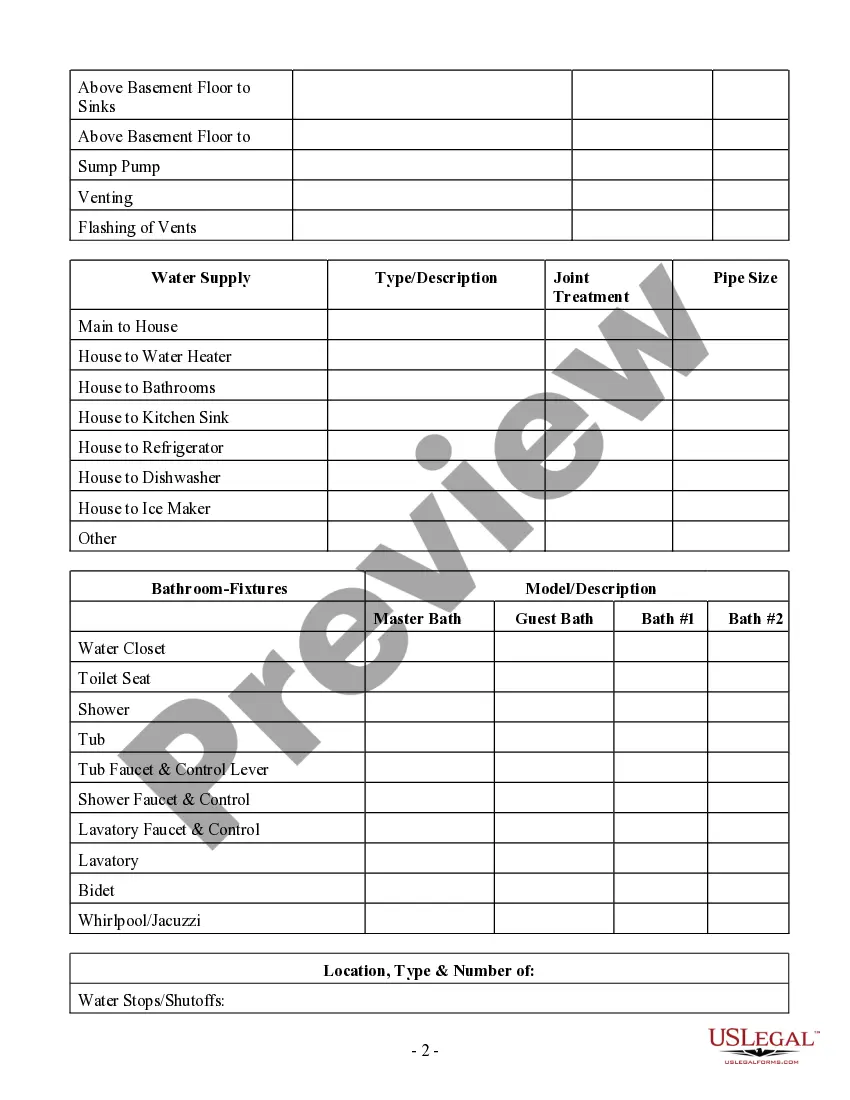

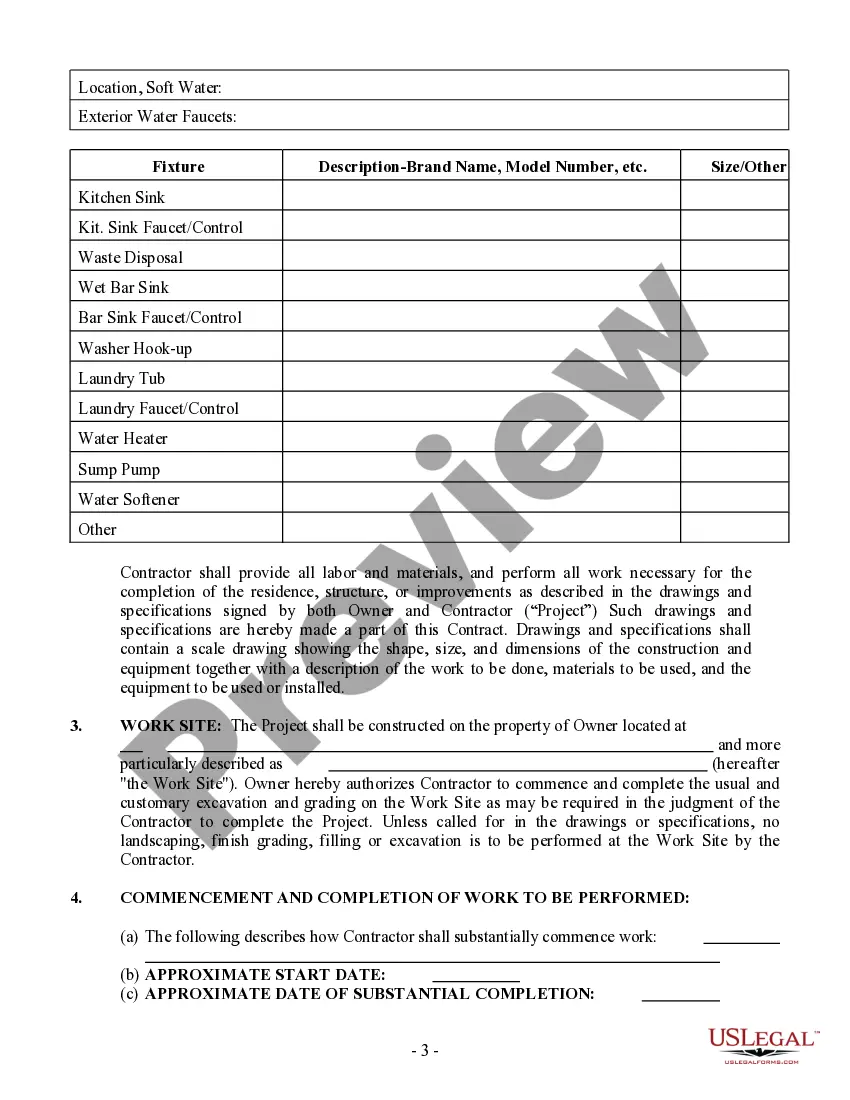

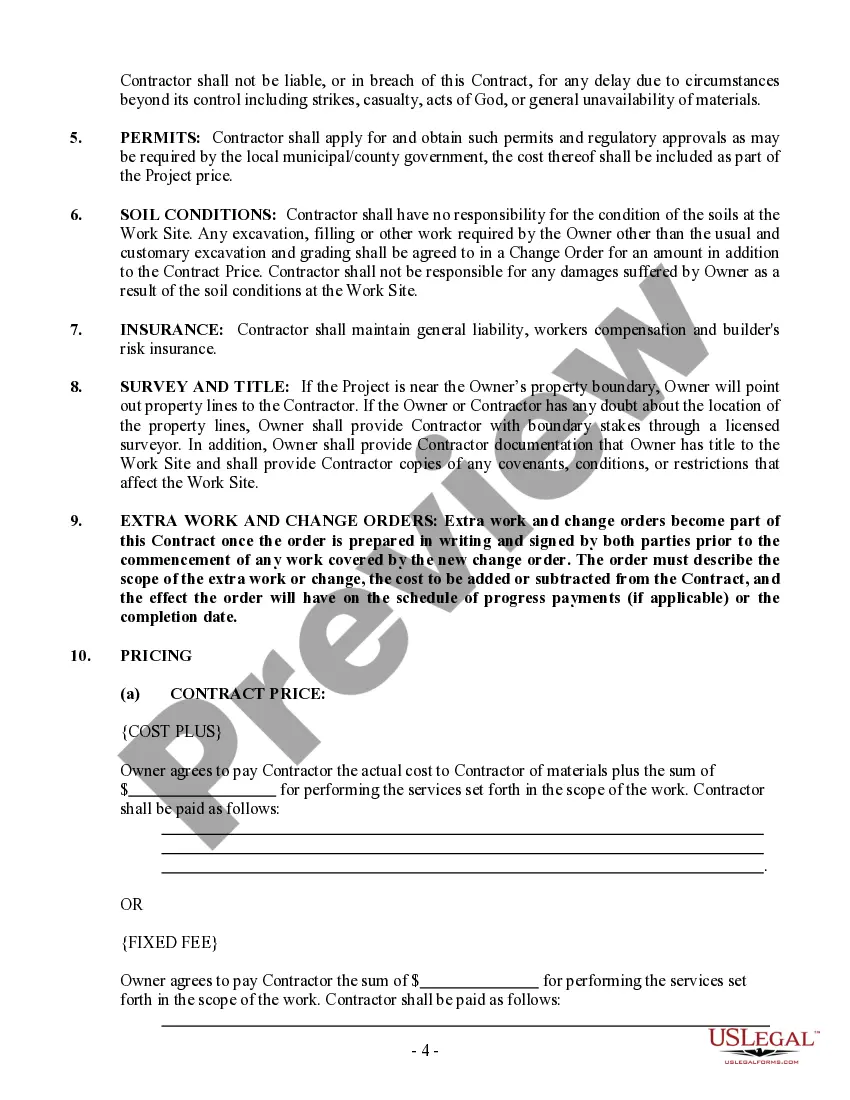

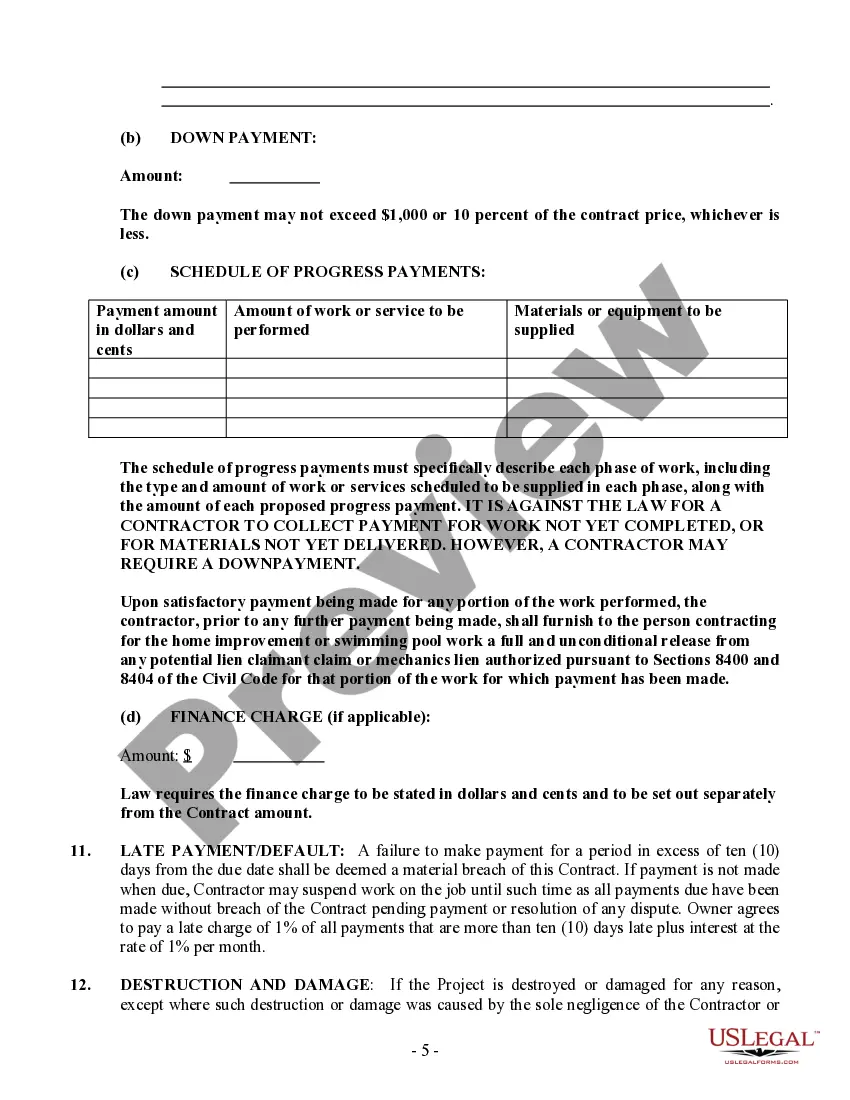

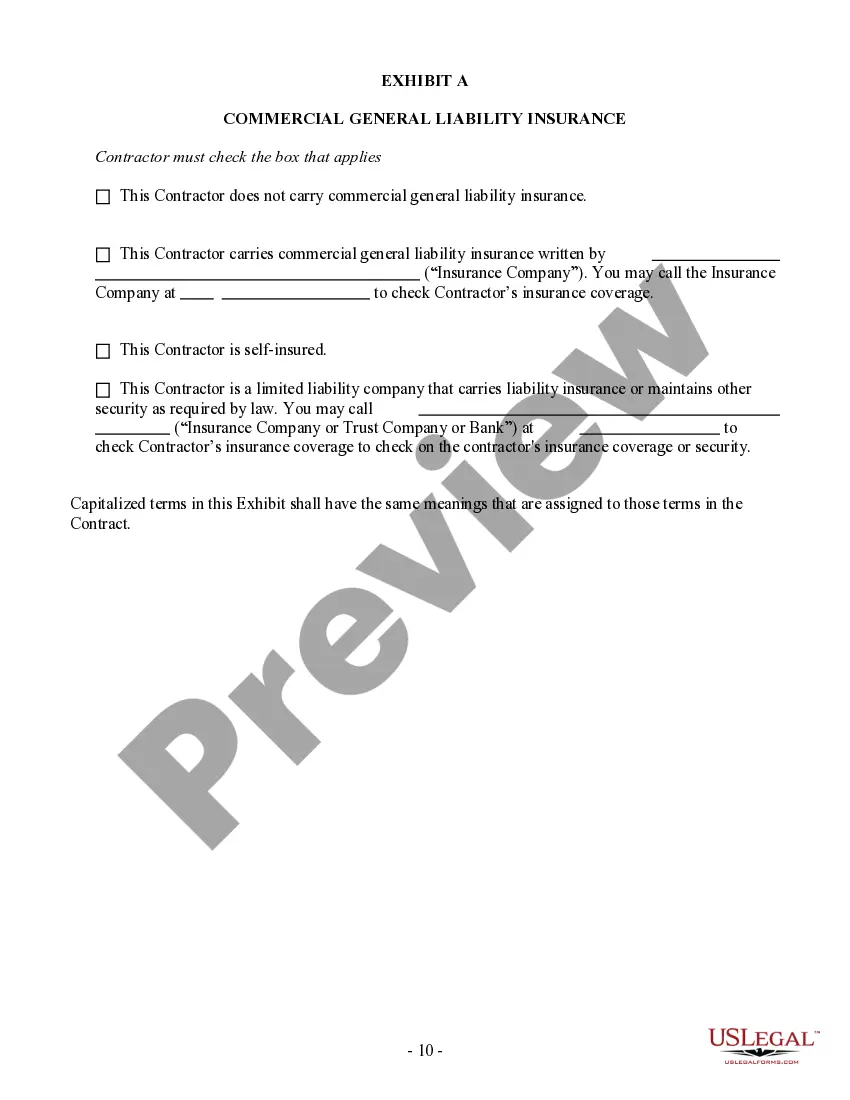

A plumbing maintenance contract for tender is a legal agreement detailing the services and responsibilities related to plumbing upkeep. Major elements typically include service descriptions, payment terms, duration of the contract, and conditions for termination. These components work together to maintain clarity and trust between both parties.

Kentucky Sales and Use Tax License If your business activities are subject to sales and use tax, your LLC must register with the Department of Revenue. Note: This requirement will apply whether you sell products online or in a physical location in Kentucky.

The KY-725 can be extended and e-filed independently of the other Kentucky main forms. The extension is generated from the STEX screen. Amending can be done independent of the KY main form and is done from the 725 screen (note that the amended 725 cannot be e-filed).

Kentucky doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

Ing to KRS 141.010(25), ?doing business? in Kentucky includes but is not limited to: Being organized under the laws of Kentucky. Having a commercial domicile in Kentucky. Owning or leasing property in Kentucky. Having one or more individuals performing services in Kentucky.

A Kentucky registered agent is a resident or corporation that maintains a registered office address in Kentucky and is willing to accept service of process and official mail on behalf of a business. All businesses registered in the state of Kentucky are required to have a registered agent.

Kentucky LLC Cost. To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

Who needs to register their business? In most cases, all businesses in Kentucky are required by law to register with the Office of the Secretary of the State, the Department of Revenue, the Office of Employment Training, the Internal Revenue Service and with local municipalities to obtain business licenses and permits.

How to Form a Kentucky LLC in 2023 (Step-by-Step Guide) #1: Name Your Kentucky LLC. #2: Find a Kentucky Registered Agent. #3: File Articles of Organization. #4: Create an Operating Agreement. #5: Register With the Necessary Tax Authorities. #6:Fulfill Your Ongoing Obligations.