Arizona Will With Form A-4

Description

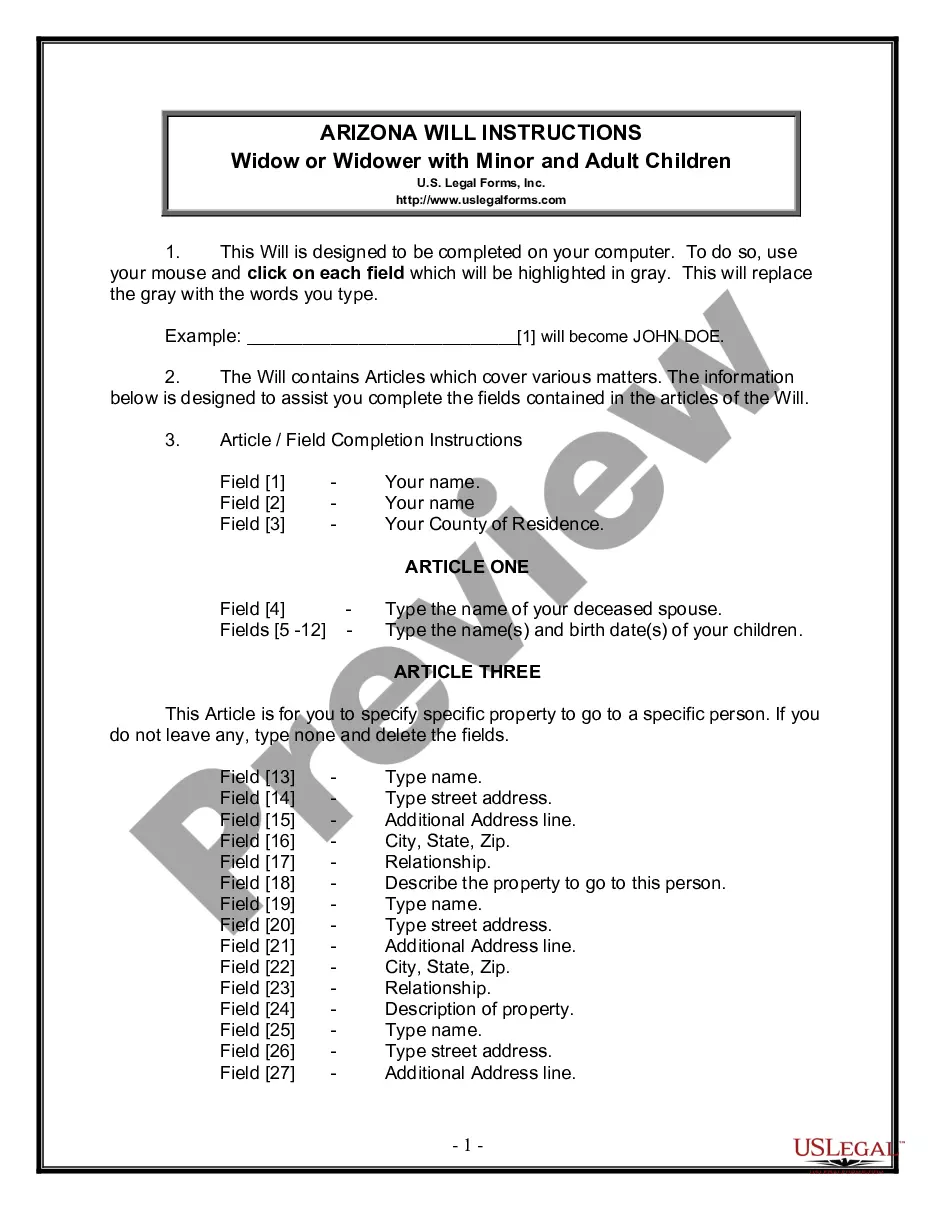

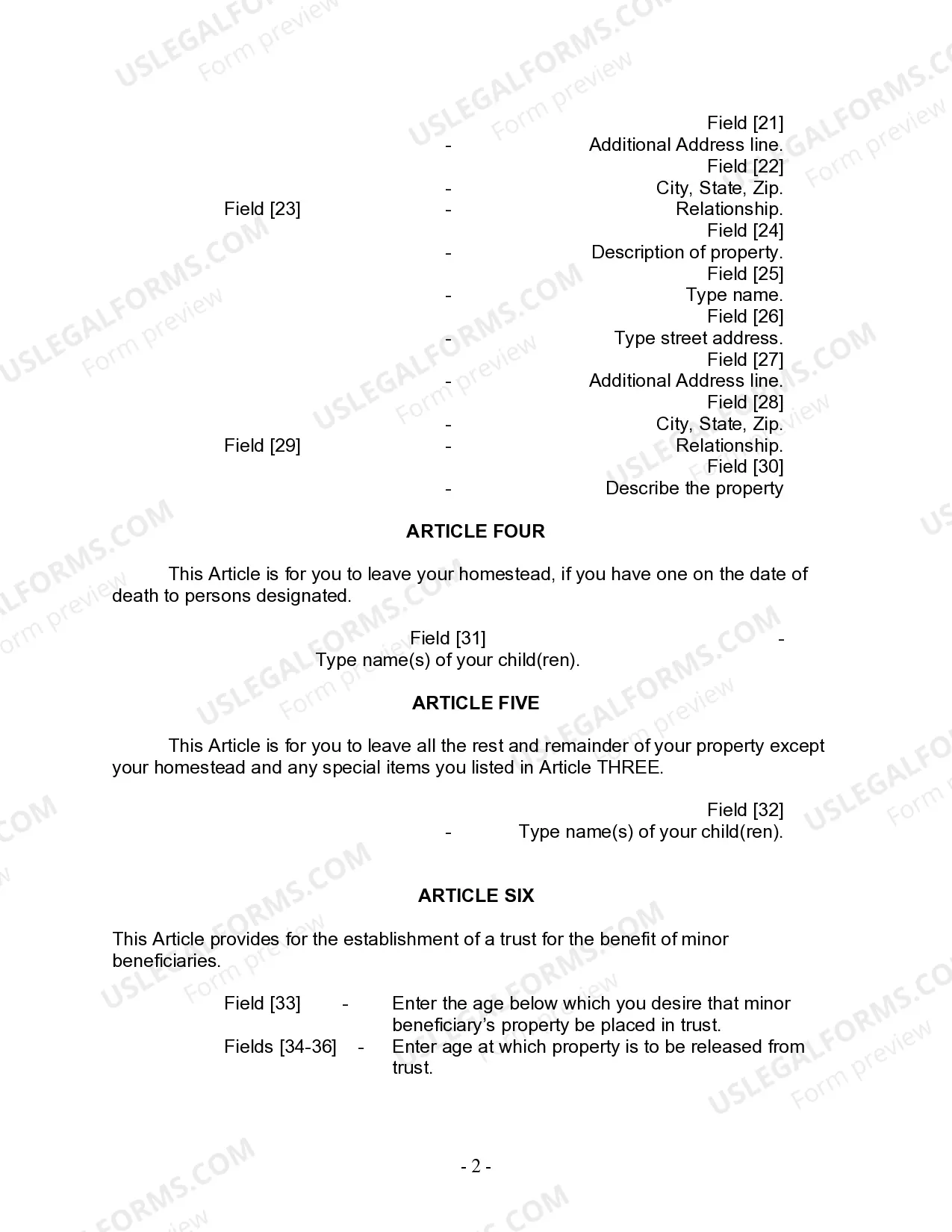

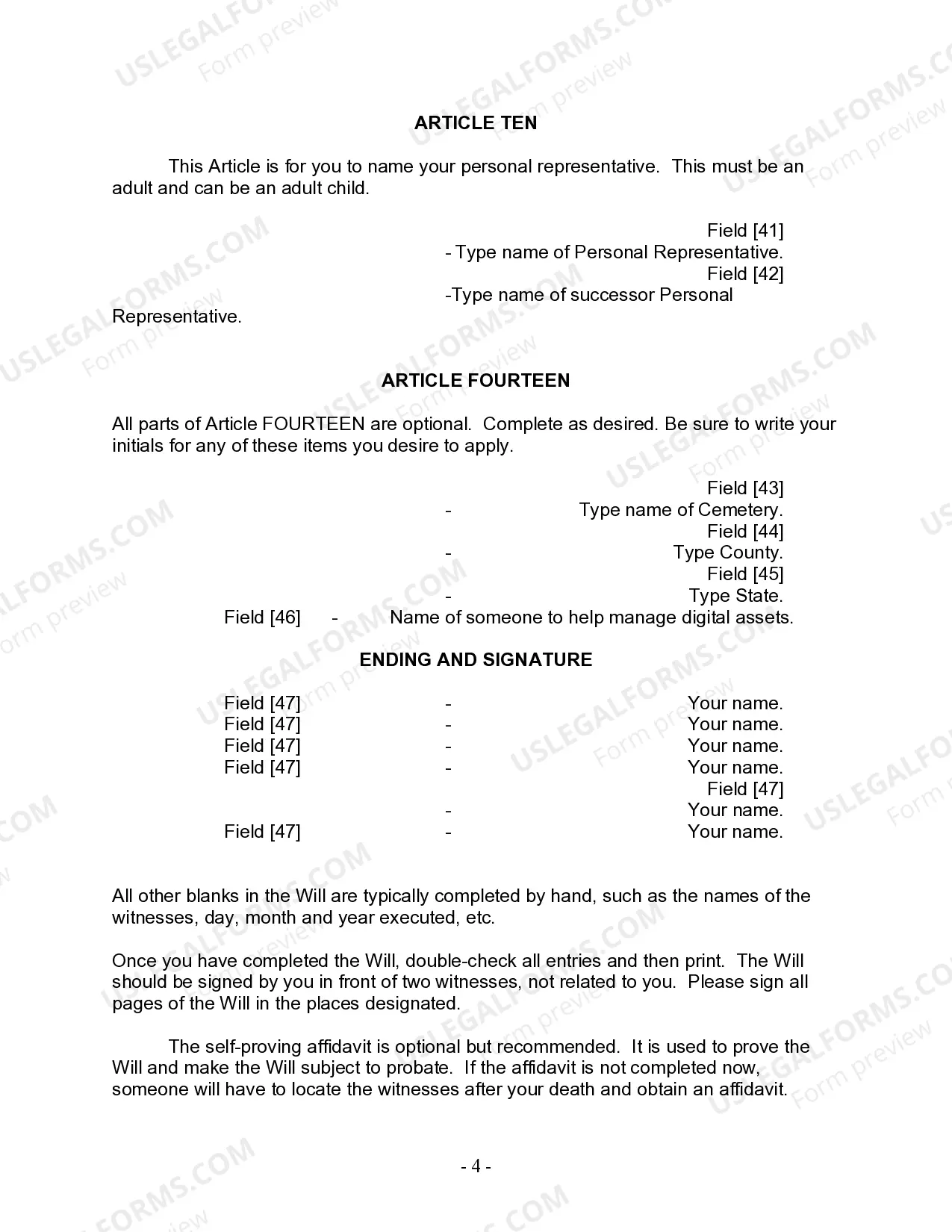

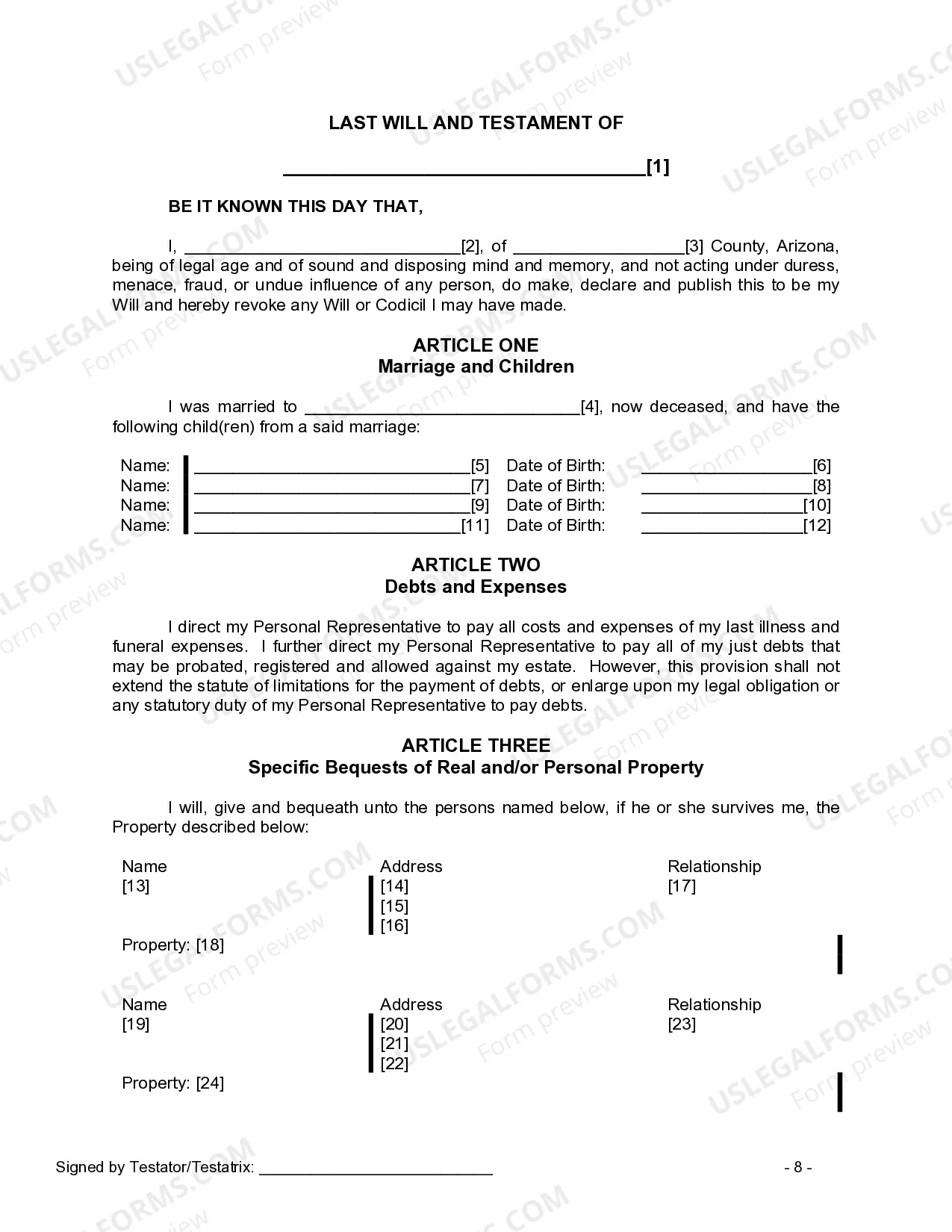

How to fill out Arizona Last Will And Testament For A Widow Or Widower With Adult And Minor Children?

Dealing with legal documentation and processes can be a lengthy addition to your day.

Arizona Will With Form A-4 and similar forms frequently require you to search for them and navigate the way to finalize them correctly.

For that purpose, if you are managing financial, legal, or personal issues, having a comprehensive and accessible online collection of forms at your disposal will greatly aid.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific documents and various tools to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Register and create your account in a few minutes, and you will gain access to the form collection and Arizona Will With Form A-4. Then, follow the steps below to finish your form: Make sure you have located the correct form using the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download then complete, eSign, and print the form. US Legal Forms has twenty-five years of experience assisting users in managing their legal documentation. Find the form you need now and simplify any process effortlessly.

- Examine the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms available anytime for download.

- Safeguard your document management processes by utilizing a top-notch service that allows you to prepare any form in minutes with no additional or concealed fees.

- Simply Log In to your account, find Arizona Will With Form A-4 and obtain it immediately in the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The employee can submit a Form A-4 for a minimum withholding of 0.8% of the amount withheld for state income tax. An employee required to have 0.8% deducted may elect to increase this rate to 1.3%, 1.8%, 2.7%, 3.6%, 4.2%, or 5.1% by submitting a Form A-4. The $15,000 annual wages threshold has been removed.

What if the employee does not update their old Arizona Form A-4? The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

To change the amount of Arizona income tax withheld, an employee must complete Arizona Form A-4 and submit to his or her employer to choose a different withholding percentage option. Employees may request to have an additional amount withheld by their employer.

What if the employee does not update their old Arizona Form A-4? The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

The Arizona Department of Revenue (ADOR) updated the Employee's Arizona Withholding Election form, Form A-4, to reflect Arizona's seven lower individual income tax rates. The new Form A-4 also retained both the zero withholding rate option and line for additional Arizona withholding.