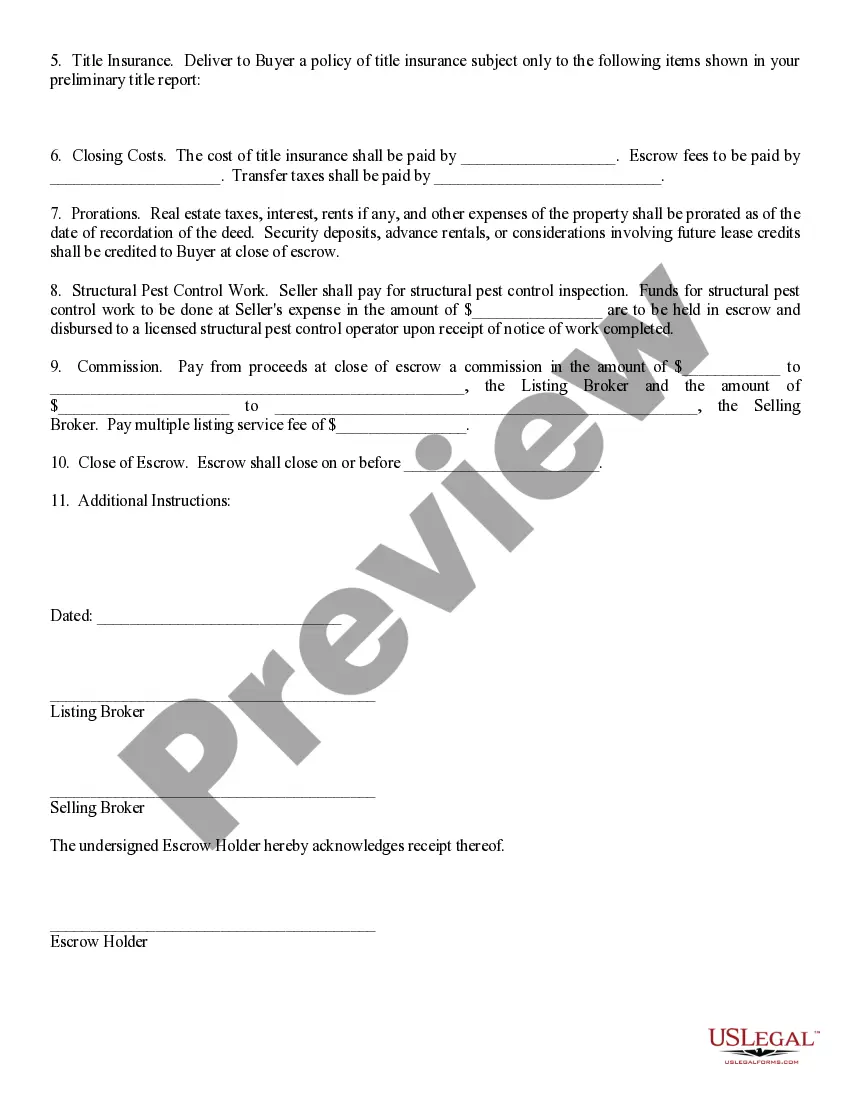

Escrow Instructions - Short Form: This document is a list of intructions when dealing with the escrow account, attached to the buying/selling of property. This form outlines the duties to be performed by the Buyer, Seller and Escrow Agent in conjunction with the buying and selling of the land or home. It is available for download in both Word and Rich Text formats.

Escrow Instructions With Example

Description

How to fill out Arizona Escrow Instructions In Short Form?

- Visit the US Legal Forms website and log in to your account. Ensure your subscription is active; if it isn’t, renew it based on your chosen plan.

- Browse the form templates; utilize the Preview mode to confirm that you’ve selected the correct escrow instructions that align with your jurisdiction's requirements.

- If you don't find the right document, utilize the Search function at the top of the page to locate a more suitable template.

- Once you identify the appropriate form, click on the Buy Now button, select your preferred subscription plan, and create an account to access the forms.

- Complete your purchase using a credit card or PayPal, ensuring your transaction is processed smoothly.

- After the payment is confirmed, download the template directly to your device and find it later in the My Forms section of your account.

In conclusion, US Legal Forms equips users with a wide range of legal documents, ensuring they can quickly execute necessary paperwork with confidence. By following these steps, you can access comprehensive escrow instructions tailored to your specific needs.

Don't hesitate to explore the vast library, and get started today!

Form popularity

FAQ

Escrow typically includes the funds, the agreement details, and relevant documents. These components come together to create a secure environment for completing a transaction. When utilizing escrow instructions with example, you will understand how each of these elements plays a crucial role in the protection of both the buyer and seller. Essentially, escrow provides clarity and legitimacy throughout the process.

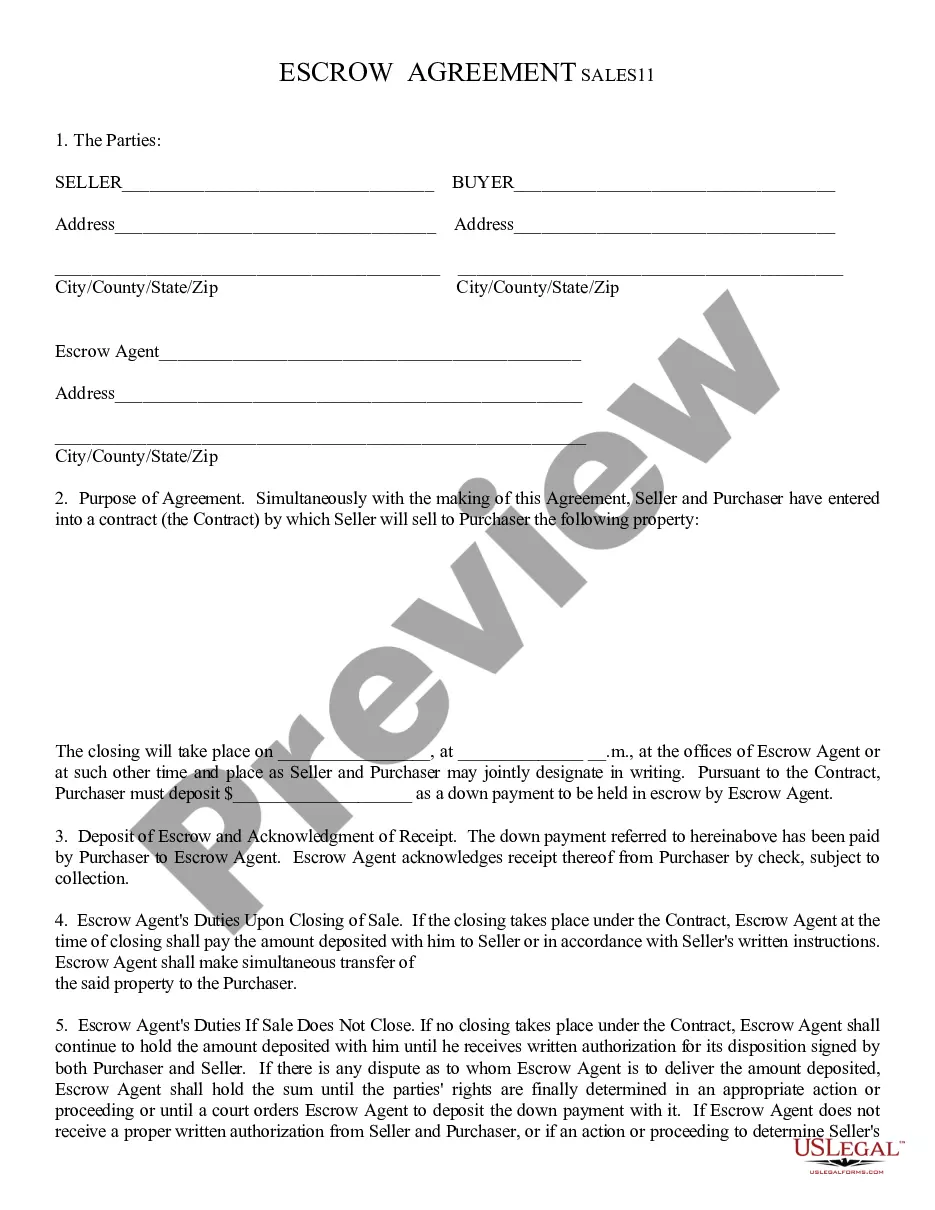

An escrow transaction is a financial arrangement where a third party holds funds or assets until the terms of an agreement are met. This process ensures that both the buyer and seller conduct their part of the deal safely. With our escrow instructions with example, you’ll see how this system protects everyone involved in a transaction. By using escrow, you reduce the risk of fraud and enhance trust between parties.

Escrow instructions are typically prepared by the escrow agent following discussions between the buyer and seller. The agent gathers the necessary information from both parties to create a comprehensive set of instructions that reflect their agreement. This professional assistance ensures accuracy and clarity, minimizing potential issues later on. USLegalForms offers resources that can help users prepare these instructions effectively.

Escrow is a financial arrangement where a third party holds and regulates payment of the funds required for two parties involved in a given transaction. The third party releases the funds only when certain conditions are met, ensuring fairness and security for everyone involved. A straightforward example of escrow instructions can illustrate this process clearly. Using resources like USLegalForms can help you understand and implement escrow correctly.

Commonly used instructions for escrow include terms that specify how funds will be distributed, timelines for payments, and conditions for releasing the funds. These instructions ensure that all parties know when specific actions will take place, leading to a more organized transaction. An effective set of escrow instructions with example scenarios can be found on platforms like USLegalForms, which assists in outlining these aspects.

Generally, either the buyer or seller can request changes to the escrow instructions, but this requires mutual consent. Both parties need to agree on any amendments, and then they should re-sign the updated instructions for them to be valid. This collaborative approach helps to maintain trust and clarity between the involved parties. Platforms like USLegalForms can provide guidance on modifying these important documents.

The parties involved in the transaction, namely the buyer and seller, are the ones who sign the escrow instructions. Their signatures validate the agreement and signify that they understand and agree with the terms outlined. Only authorized signatories can execute these instructions, which reinforces their adherence to the conditions laid out. Accessing templates from USLegalForms can simplify the signing process.

Escrow instructions are generally given by the parties involved in a transaction, primarily the buyer and seller. They collaborate to draft these instructions, which outline how the funds will be handled. This mutual agreement ensures clarity and protects everyone's interests throughout the process. Platforms like USLegalForms provide tools to assist in creating these instructions efficiently.

Typically, the escrow agent or a neutral third party provides the escrow instructions. This agent acts on behalf of all parties to ensure that funds are managed correctly. They take input from both the buyer and seller to create comprehensive instructions that reflect the agreement made by both parties. Utilizing professional escrow services can streamline this process, as seen in offerings from USLegalForms.

Escrow instructions are detailed guidelines that dictate how escrow funds should be handled and disbursed during a real estate transaction. These instructions ensure that all parties involved understand their responsibilities, which helps to prevent misunderstandings or disputes. Essentially, they act as a roadmap for the transaction, detailing what is required for the funds to be released, thus ensuring a smoother process. You can find escrow instructions with example templates on platforms like USLegalForms.