Power Of Attorney Blank Form Durable

Description

How to fill out Arizona Durable Power Of Attorney?

It’s clear that you cannot transform into a legal authority instantly, nor can you understand how to swiftly prepare a Power Of Attorney Blank Form Durable without possessing a specialized skill set.

Drafting legal documents is a lengthy procedure that demands specific education and expertise. Therefore, why not entrust the drafting of the Power Of Attorney Blank Form Durable to the professionals.

With US Legal Forms, which boasts one of the most comprehensive legal template collections, you can find everything from court documents to templates for internal communication.

If you need another form, you can start your search again.

Create a complimentary account and choose a subscription plan to obtain the template. Click Buy now. Once the transaction is complete, you can download the Power Of Attorney Blank Form Durable, fill it out, print it, and deliver or mail it to the specified individuals or organizations.

- We understand how vital compliance and adherence to federal and state regulations are.

- That’s why, on our platform, all templates are tailored to specific locations and are current.

- Here’s how you can initiate the process on our site and acquire the document you need in just a few minutes.

- Locate the form you are searching for using the search bar situated at the top of the webpage.

- Preview it (if this feature is available) and examine the accompanying description to ascertain if Power Of Attorney Blank Form Durable is what you seek.

Form popularity

FAQ

Ends with Your Death ? In the event of your death, a durable power of attorney will no longer be valid. This document is not a replacement for the last will and testament or trust. It Can be Revoked or Not Honored at Any Time ? Due to the lack of court oversight, not everyone honors a durable power of attorney.

Any adult may create a power of attorney in Texas. The document must include one of the following statements: "This power of attorney is not affected by subsequent disability or incapacity of the principal." This makes it a durable power of attorney and gives the agent immediate authority.

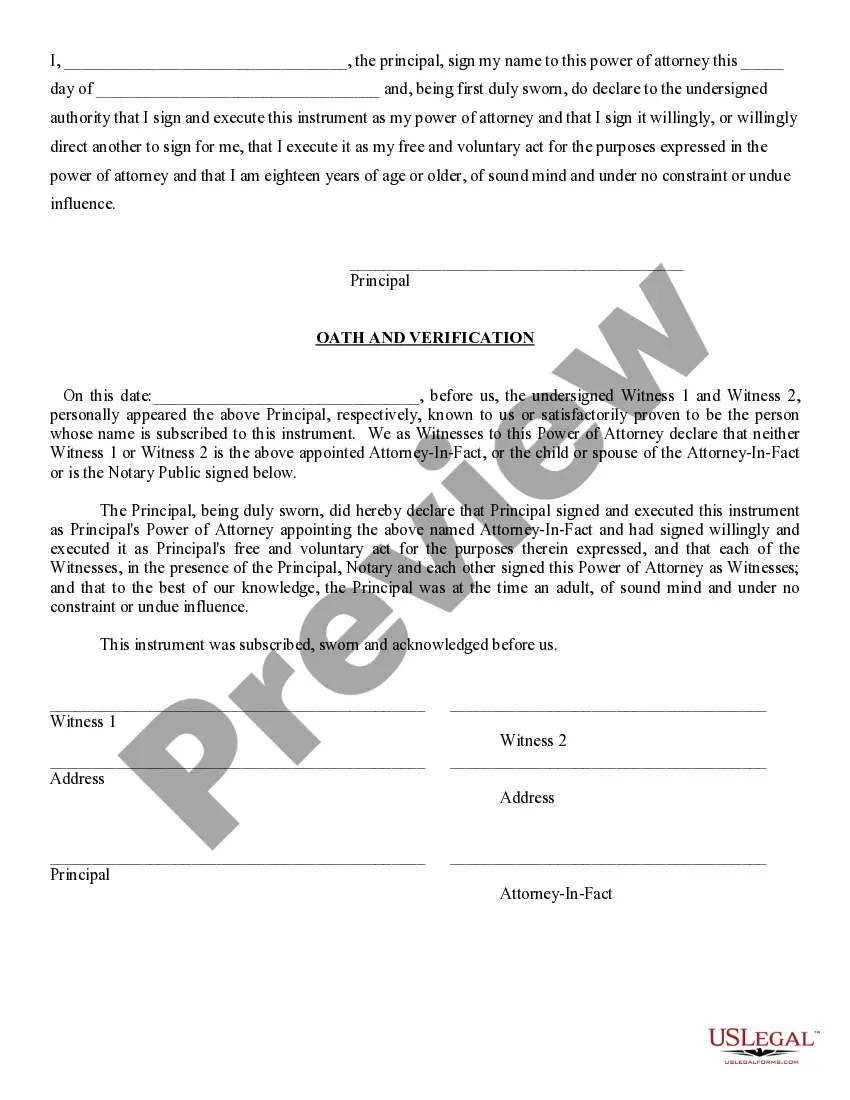

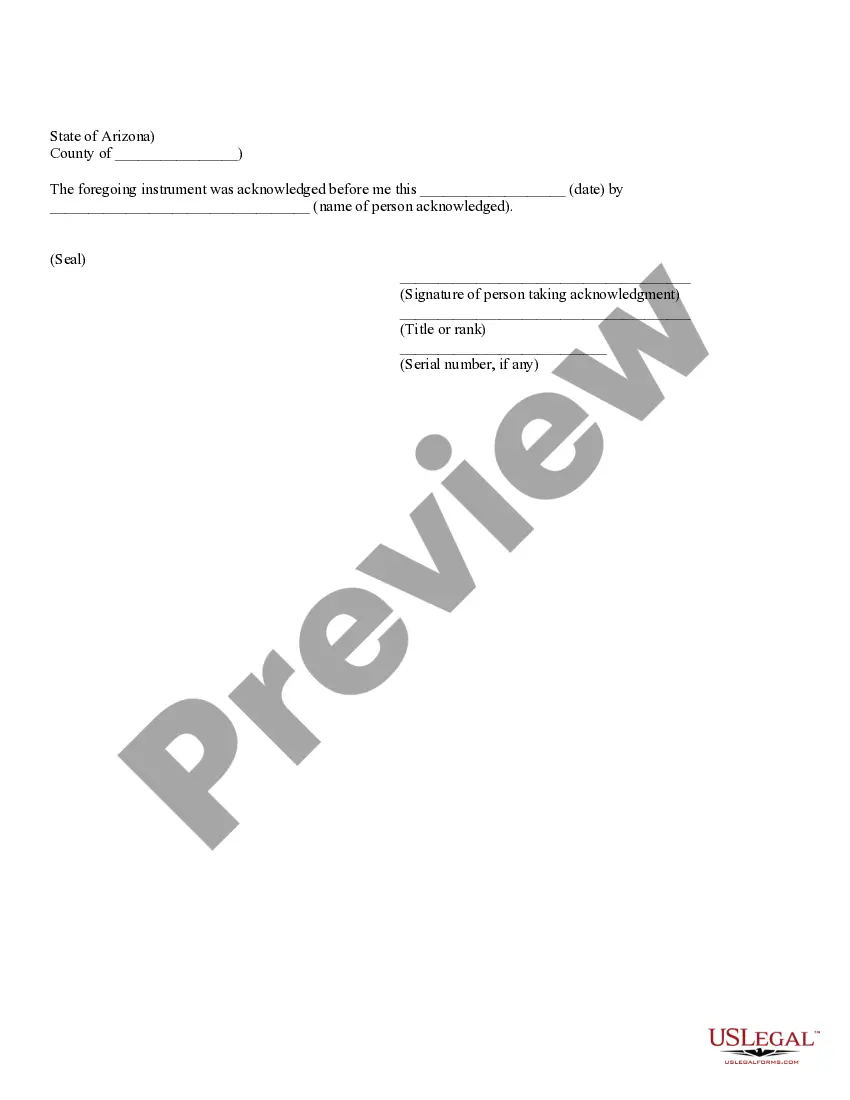

The designee shall sign the principal's name to the power of attorney in the presence of a notary public, following which the document shall be acknowledged in the manner prescribed by K.S.A. 53-501 et seq., and amendments thereto, to the same extent and effect as if physically signed by the principal.

For most people, the best option is to have a general durable power of attorney because it gives your agent broad powers that will remain in effect if you lose the ability to handle your own finances. An attorney can customize a general POA to limit powers even more?or add powers, Berkley says.

Sign the POA in the Presence of a Notary Public As mentioned above, you can't simply sign the document and call it a day. In Kansas, you must also have your POA notarized or witnessed (preferably notarized).