Arizona Power Of Attorney Form 285 Instructions

Description

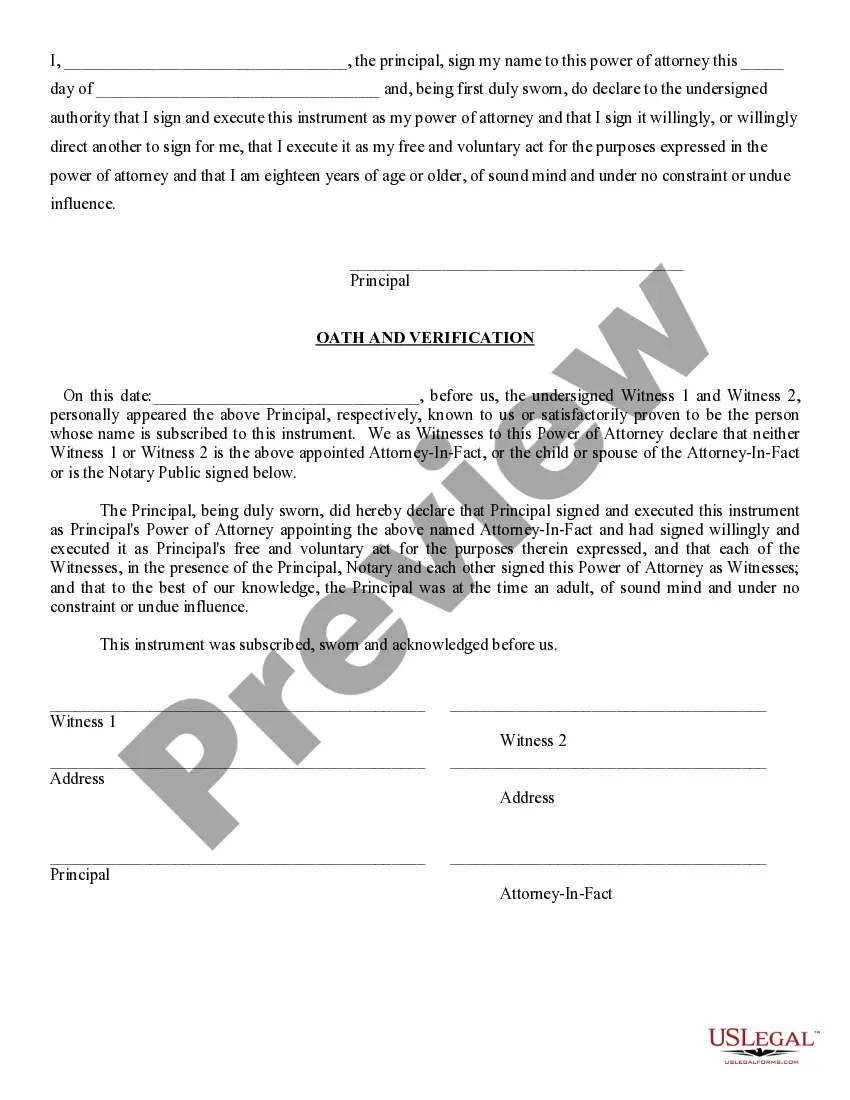

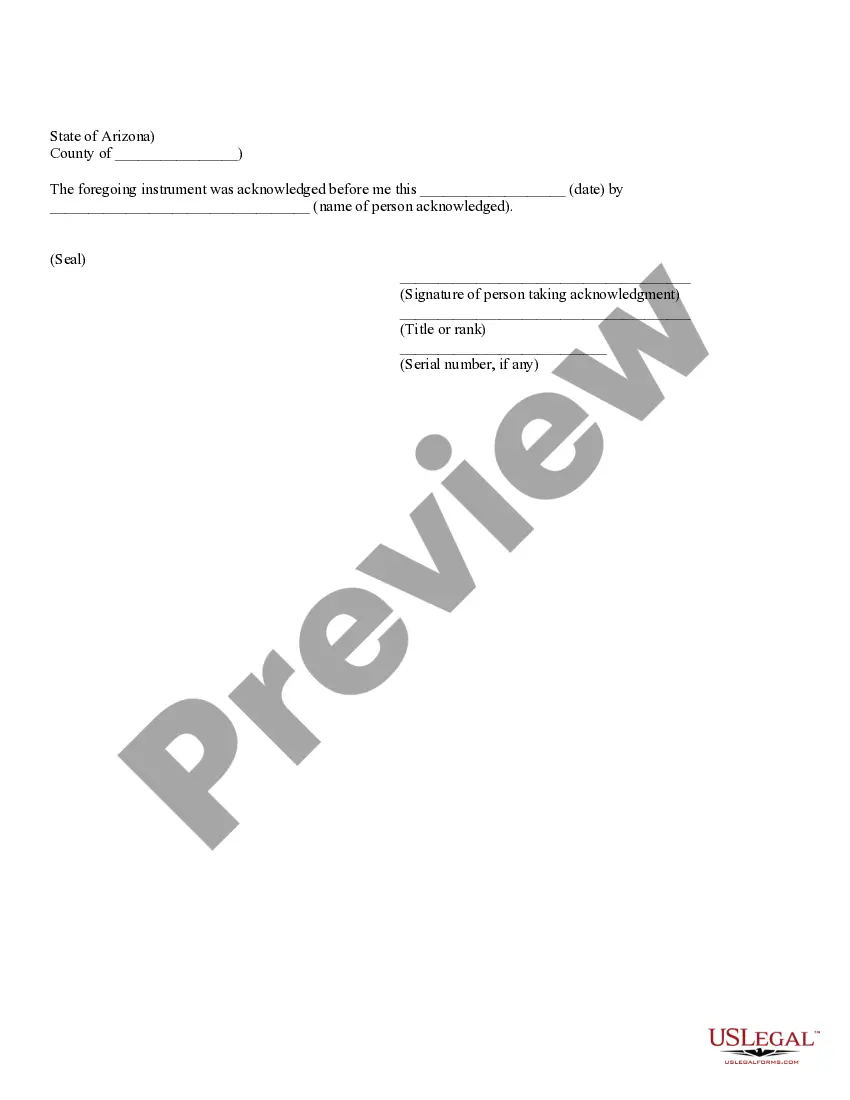

How to fill out Arizona Durable Power Of Attorney?

The Arizona Power Of Attorney Template 285 Instructions displayed on this page is a reusable official document crafted by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and lawyers with over 85,000 validated, state-specific documents for various business and personal needs. It’s the quickest, most straightforward and most dependable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware security.

Join US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Browse the sample you looked for and preview it or review the form description to confirm it meets your needs. If it doesn't, utilize the search bar to find the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card to complete a quick payment. If you already possess an account, Log In and check your subscription to continue.

- Acquire the editable template.

- Choose the format you desire for your Arizona Power Of Attorney Template 285 Instructions (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Redownload your documents once more.

- Utilize the same document again whenever necessary. Access the My documents section in your profile to redownload any previously purchased forms.

Form popularity

FAQ

An Arizona tax power of attorney (Form 285-I) allows a principal to give agent-specific tax-related power of attorney in the event they find themselves unable to work directly with the state Department of Finance.

The document must be sent via one of the following methods: By email: By Mail: Arizona Department of Revenue. ATTN: Power of Attorney. PO Box 29086. Phoenix, AZ 85038-9086. By Fax: (602) 716-6008. Disclosure Authorization (Form 285B) Durable (Financial) Power of Attorney.

For individuals needing to authorize the Department to release confidential information to the taxpayer's Appointee or file a power of attorney on behalf of another taxpayer, Arizona will accept the Federal Power of Attorney (POA) Form 2848 provided certain changes are made.

A taxpayer may use Arizona Form 285 to authorize the department to release confidential information to the taxpayer's Appointee.

Learn How to Complete the Arizona Form 285, General Disclosure ... YouTube Start of suggested clip End of suggested clip Available in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for theMoreAvailable in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for the taxpayer. Information. There is space to enter the taxpayers. Name address and a time telephone.