Letter For Domiciliary Account

Description

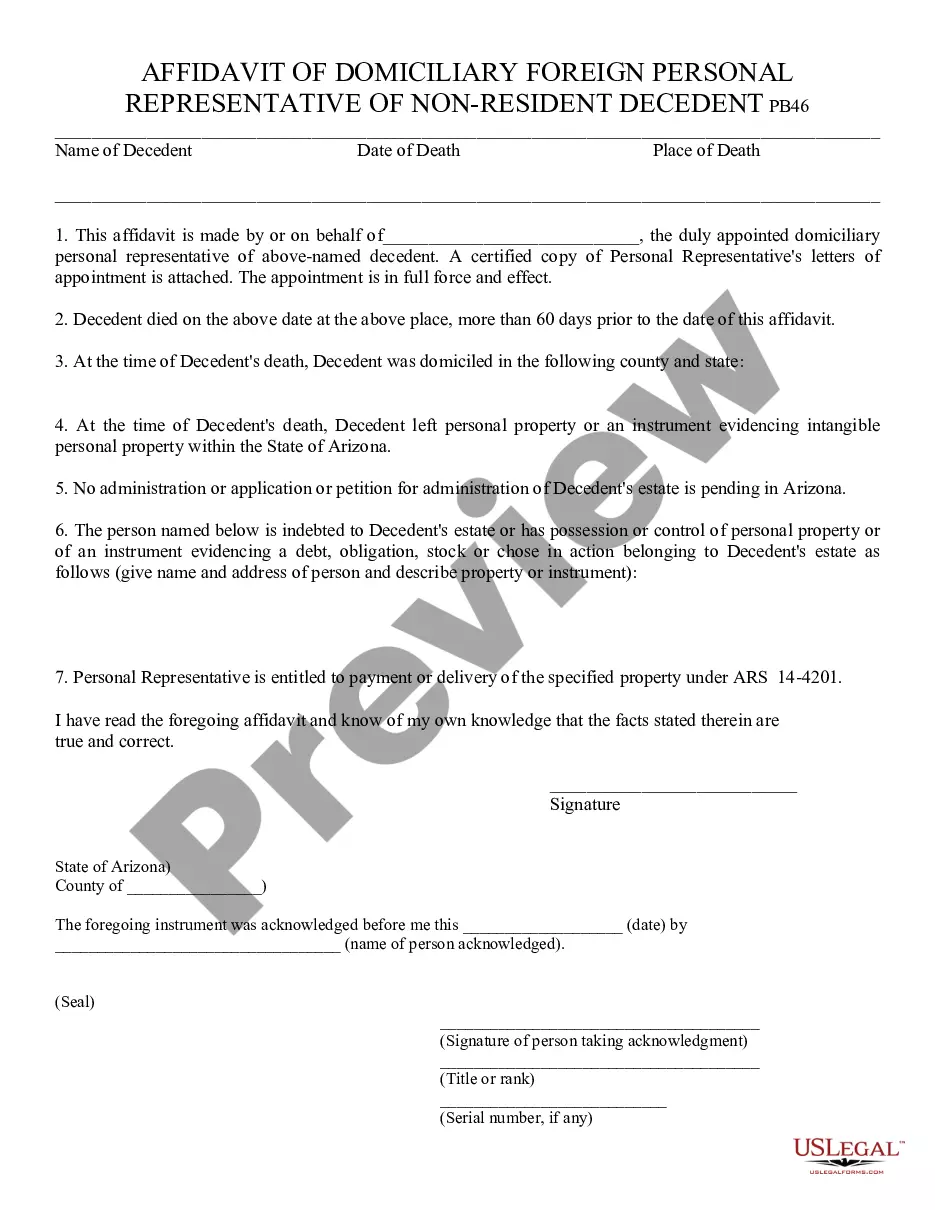

How to fill out Arizona Affidavit Of Domiciliary Foreign Personal Representative Of Nonresident Decedent?

There's no longer a reason to squander hours searching for legal documents to comply with your local state stipulations.

US Legal Forms has compiled all of them in a single location and made them more accessible.

Our platform offers over 85k templates for any business and personal legal situations gathered by state and area of application.

Use the search field above to find another sample if the current one does not meet your needs. Click Buy Now next to the template name when you identify the suitable one. Choose the most fitting pricing plan and create an account or Log In. Pay for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Letter For Domiciliary Account and download it to your device. Print your form to fill it out manually or upload the sample if you wish to do so in an online editor. Organizing formal documentation under federal and state regulations is quick and simple with our library. Experience US Legal Forms today to maintain your documentation orderly!

- All forms are skillfully drafted and verified for accuracy, assuring you receive a current Letter For Domiciliary Account.

- If you are familiar with our service and already have an account, make sure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all obtained paperwork anytime by visiting the My documents tab in your profile.

- If you have not used our service before, the process will require a few additional steps to complete.

- Here’s how new users can find the Letter For Domiciliary Account in our library.

- Read the page content attentively to ensure it includes the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

To transfer naira to a domiciliary account, you typically need to initiate a wire transfer through your local bank. This process usually involves converting your naira into the currency of your domiciliary account before completing the transaction. It's essential to check the exchange rates and any applicable fees during this transfer. For a seamless experience, you might consider using our resources, including a Letter for domiciliary account, which can guide you through necessary steps.

The two types of joint domiciliary accounts are joint tenancy accounts and tenancy in common accounts. In a joint tenancy account, both account holders have equal rights to the funds, while in a tenancy in common account, each holder can own different shares of the account. Choosing the right type depends on your relationship with the other account holder and how you plan to manage the funds. To assist with this decision, you may want to use our Letter for domiciliary account for clarity.

The two most common types of domiciliary accounts are the US dollar account and the euro account. These accounts are popular choices for individuals who frequently engage in international trade or receive payments in foreign currencies. They simplify currency exchange and can protect your funds from currency fluctuations. You can find guidance on opening these accounts, along with a Letter for domiciliary account, here at US Legal Forms.

There are generally three types of domiciliary accounts: the US dollar account, the euro account, and the British pound account. Each account allows you to hold funds in a specific foreign currency, making it easier for you to manage your international transactions. Understanding these types can help you choose the one that best meets your needs. If you're considering opening a domiciliary account, our platform offers comprehensive resources, including a Letter for domiciliary account to facilitate the process.

To obtain an account verification letter, you should reach out to your financial institution, either in person or online. Mention that you need a letter for domiciliary account verification, and provide necessary identification and account information. This will help your bank process your request promptly.

Requesting bank account verification typically involves reaching out to your bank's support team or visiting a branch. Clearly indicate that you need a letter for domiciliary account verification along with any pertinent details, such as your account number. They will guide you through the necessary steps.

To get a bank account verification document, start by contacting your bank directly. Ask them for a letter for domiciliary account verification, and provide any necessary information they require. Depending on your bank, you might be able to request this document electronically or in person.

You can request a verification letter by contacting your bank’s customer service or visiting a local branch. Be specific about your need for a letter for domiciliary account verification, and supply any required information, such as account number and personal identification. This will help expedite your request.

To obtain a standard bank account confirmation letter, you should visit your bank's local branch or access their online portal. Request the letter specifically stating you need a letter for domiciliary account verification. Provide necessary identification documents and account details to ensure a smooth process.

Filing a probate claim in Wisconsin requires you to prepare and submit the appropriate claim form to the probate court. You must include any supporting documents, including evidence of your claim. If you need to access funds related to a letter for domiciliary account, this claim can help you secure what is owed to you. Platforms like US Legal Forms can provide templates and guidance for this process.