Fsh Account

Description

How to fill out Arizona Letters Of Administration And Acceptance By Special Administrator?

- Log in to your Fsh account using your credentials. Ensure that your subscription is active; renew it if necessary according to your payment plan.

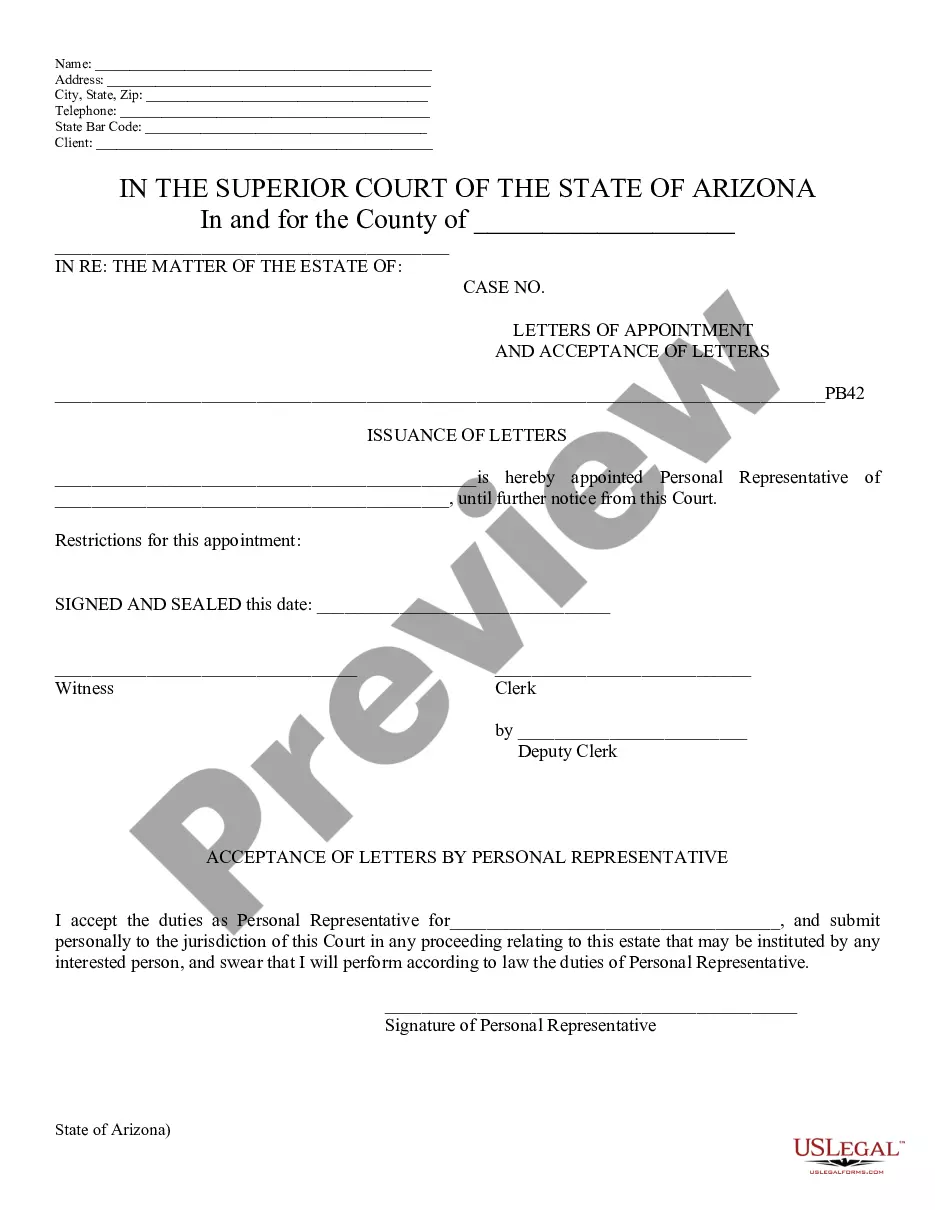

- Preview the available forms and descriptions to identify the correct template based on your needs and local jurisdiction requirements.

- If the desired form isn't suitable, use the Search tab to find another template that fits your requirements.

- Purchase the selected document by clicking on the Buy Now button. Choose the subscription plan that best fits your needs and create an account for access.

- Provide payment details via credit card or PayPal to finalize your purchase.

- Download the completed form template and save it on your device. Access it anytime from the My Forms menu in your profile.

With over 85,000 editable legal forms, US Legal Forms ensures you have the tools needed to execute legal documents accurately. Their robust collection and access to premium experts make it easier than ever to achieve precision in your documents.

Start using your Fsh account with US Legal Forms today and experience seamless access to legal solutions. Get started now!

Form popularity

FAQ

Enrolling in an FSA generally involves a few straightforward steps. Start by reviewing your employer’s benefits package during the open enrollment period. After gathering all necessary information, complete the enrollment forms to set up your FSH account. If you need guidance, US Legal Forms offers valuable tools to help you navigate the enrollment process smoothly.

You cannot set up an FSA completely on your own; this account is usually offered through your employer's benefits plan. However, understanding how to manage your FSH account effectively is crucial for maximizing your tax savings and medical expense reimbursements. If you're unsure, consulting resources from US Legal Forms can guide you through the ins and outs of your employer's FSA options.

To join the FSA, you typically need to take part in your employer’s benefits enrollment period. During this time, you will fill out the necessary forms to establish your FSH account. If you have questions, US Legal Forms can provide resources that clarify the enrollment process and help you understand your options so you can make informed decisions.

Opening an FSA account is usually simple. You will need to check with your employer for the specific process, as it often involves completing enrollment forms during the open enrollment period. Once your application is approved, you will receive details about your FSH account, including how to access it and the eligible expenses you can cover.

Employees generally cannot enroll in an FSA at any time. Typically, you can sign up for a flexible spending account during your company's open enrollment period or if you experience a qualifying life event. If you miss these opportunities, your chance to open an FSH account will have to wait until the next enrollment period. It’s crucial to plan ahead so you can take full advantage of the benefits.

Contributions to an FSA are not subject to federal income tax, Social Security tax, or Medicare tax, making their tax deductibility a bit different. Instead of being tax deductible, these contributions lower your taxable income directly. Therefore, the amount you allocate to your FSH account is beneficial since it decreases your overall tax liability.

If you do not claim your FSA funds, you may lose them at the end of the plan year due to the 'use it or lose it' rule. It is essential to utilize your FSA for eligible expenses, considering that many accounts do not allow for rollover of unused funds. To maximize your FSH account benefits, make sure to keep track of your eligible expenses throughout the year.

Filing for reimbursement from your FSA is quite straightforward. You simply need to submit the required documentation, such as receipts for eligible expenses, through your FSH account's portal or mobile app. Many employers provide guidance on the filing process, so be sure to check those resources for specific instructions governed by your plan.

No, you will not receive a 1099 form for your FSA account. Unlike other types of accounts, FSAs do not report contributions or distributions on a 1099 because the funds are not taxed when contributed or used for qualified expenses. It is always best to keep your own records and receipts to track your FSA spending.

Generally, you will not claim your FSA on your taxes since contributions are made pre-tax. This means you essentially already benefit from tax savings when you contribute to your FSH account. However, it remains crucial to maintain records of your expenses for documentation purposes in case you need to justify your claims later.