Person Representative Arizona With Us

Description

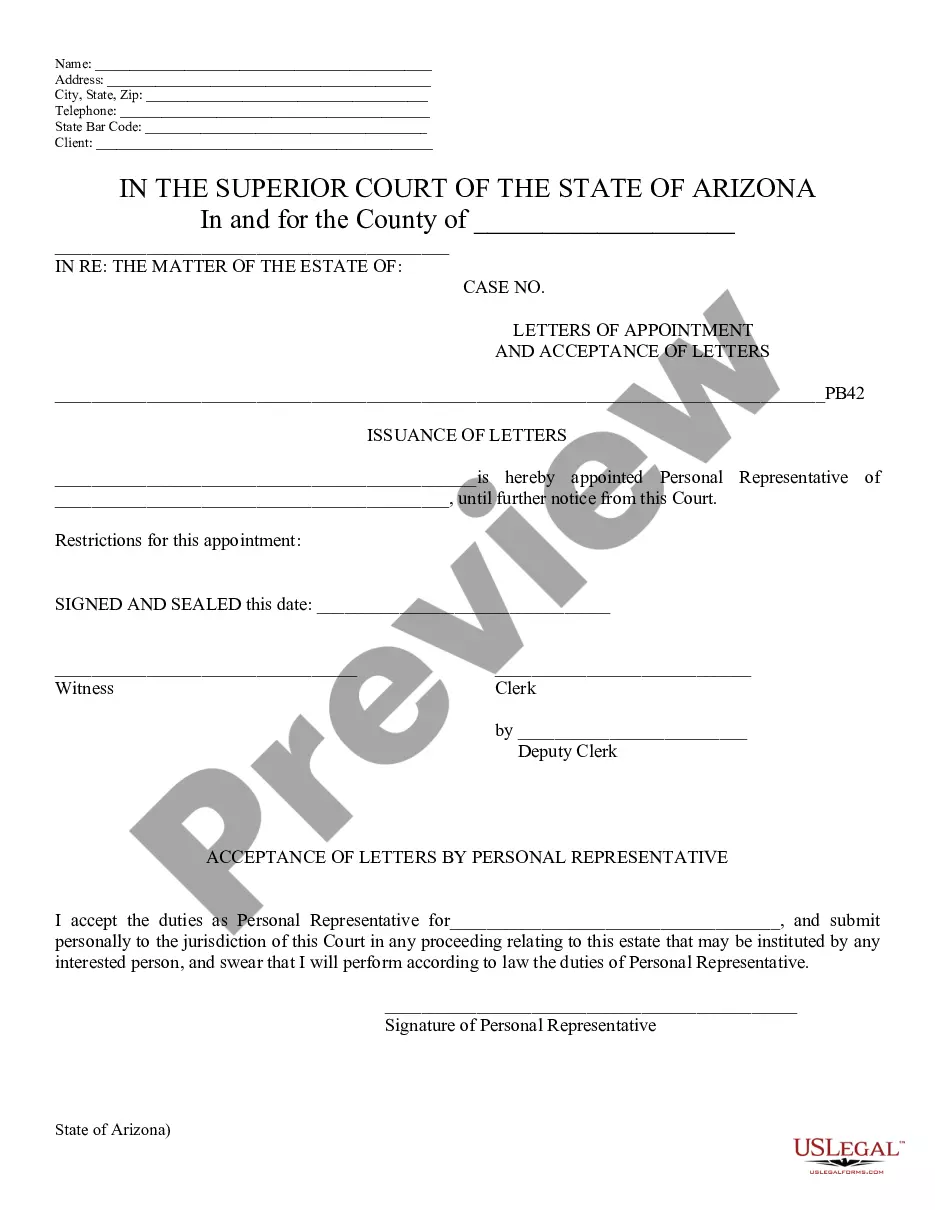

How to fill out Arizona Letters Of Administration And Acceptance By Personal Representative?

- Visit the US Legal Forms website and log into your account if you have previously subscribed. If your subscription has expired, you may need to renew it.

- Browse the form descriptions and use the Preview mode to verify that you have selected the appropriate document for your requirements and jurisdiction.

- If the form is not suitable, utilize the Search tab to find an alternative template that fits your needs better.

- Select the 'Buy Now' button for your chosen document. Choose a subscription plan that best suits your needs and create an account if you are a new user.

- Complete your purchase by entering your payment details, either through credit card or PayPal, to access the form.

- Immediately download the form to your device, and you can always access it later through the 'My Forms' section of your profile.

By following these straightforward steps, you can ensure that you have the necessary legal documents at your fingertips, allowing you to carry out your duties effectively.

Start your legal journey today with US Legal Forms – access over 85,000 forms and experience seamless document management!

Form popularity

FAQ

In Arizona, any competent adult can serve as a personal representative of an estate, provided they are not disqualified by the court. This includes individuals nominated in a will or those who may be interested in the estate. Understanding eligibility is key, and our resources can assist you in ensuring that the right person is appointed as personal representative in Arizona.

If a person dies without a will in Arizona, their power of attorney ceases to exist at death. In such cases, the court appoints a personal representative to manage the estate. If you find yourself in this situation, our platform can guide you through the appointment process and help ensure that the deceased person's affairs are handled properly.

The terms 'executor' and 'personal representative' often get used interchangeably, but there are subtle differences. An executor is specifically designated in a will to manage the estate after the person's death. A personal representative is a broader term that applies to anyone appointed by the court to administer the estate, whether by will or intestacy. Understanding these distinctions can help when navigating Arizona's probate laws with us.

To become a personal representative for a deceased person in Arizona, you must file a Petition for Appointment with the probate court. Along with this petition, you will need to submit necessary documents, including the deceased person's will and an official death certificate. If you are nominated in the will, the process may be more straightforward. Engaging with us makes the entire process of becoming a personal representative easier and less stressful.

In Arizona, a non-US citizen can be a personal representative, provided they have the legal capacity to manage an estate. However, there may be additional requirements or considerations to keep in mind. It is advisable to consult with a legal expert who understands the intricacies of estate law. By working with us, you can navigate these complexities associated with appointing a personal representative in Arizona.

Yes, a personal representative can also be a beneficiary in Florida. While this is allowed, it is crucial to manage potential conflicts of interest that could arise. If you're dealing with this issue, consider exploring tools and resources offered by uslegalforms to simplify your process and ensure compliance with state laws.

A personal representative has a legal obligation to act in the best interests of the beneficiaries while managing the estate. This includes providing timely information about the estate's status and ensuring that assets are distributed according to the will. Should you or someone you know face challenges in this area, incorporating resources from uslegalforms will facilitate clearer guidance.

Yes, a personal representative can also be a beneficiary of the estate they manage. This dual role can sometimes create complications, particularly concerning impartiality in fulfilling duties. If this situation arises, utilizing uslegalforms can help you clarify your obligations and streamline the process.

A personal representative, often called an executor, is responsible for managing the estate according to the will. In contrast, a beneficiary is someone who receives assets from the estate. Understanding these roles can help you navigate your responsibilities and rights. For any questions on this matter, remember that uslegalforms can assist you effectively.

In Arizona, if the estate's total value is less than $75,000, it generally does not require probate. This threshold includes all assets owned individually, excluding certain accounts and property types. If you find yourself struggling with this threshold, uslegalforms provides resources to help clarify your obligations and streamline the probate process.