Who Applies For Probate

Description

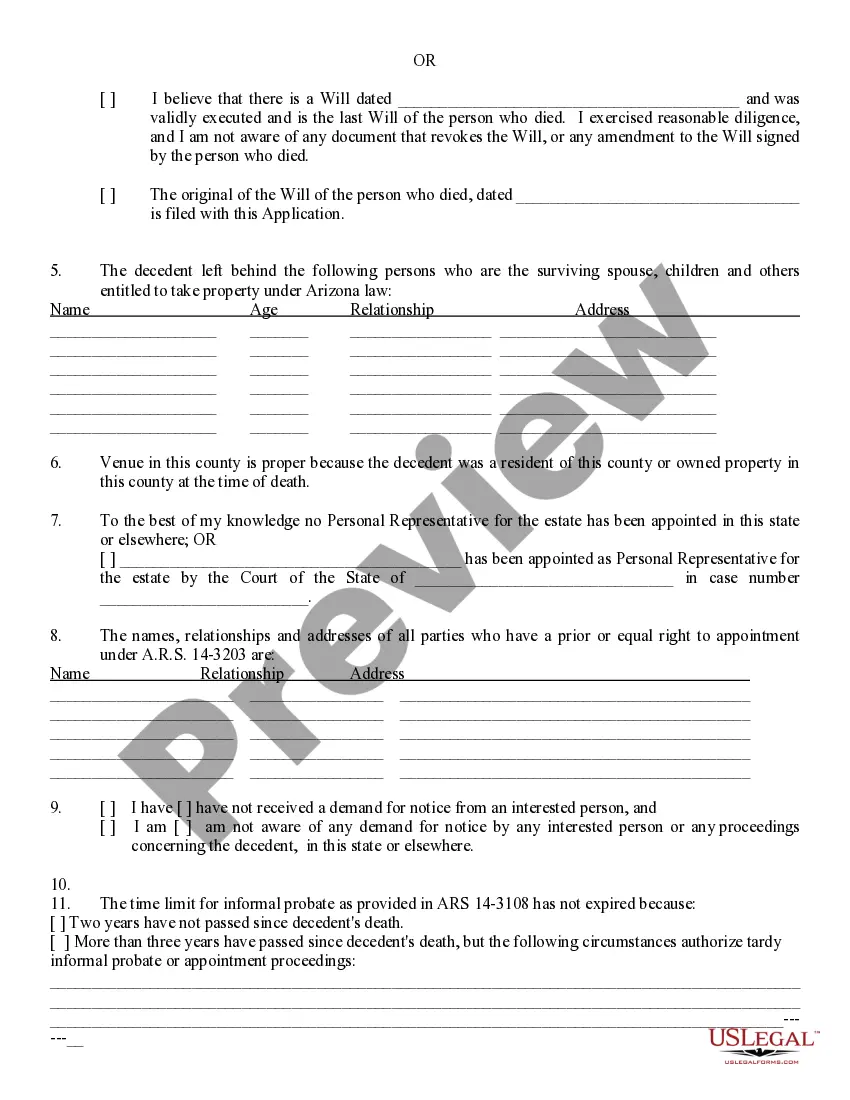

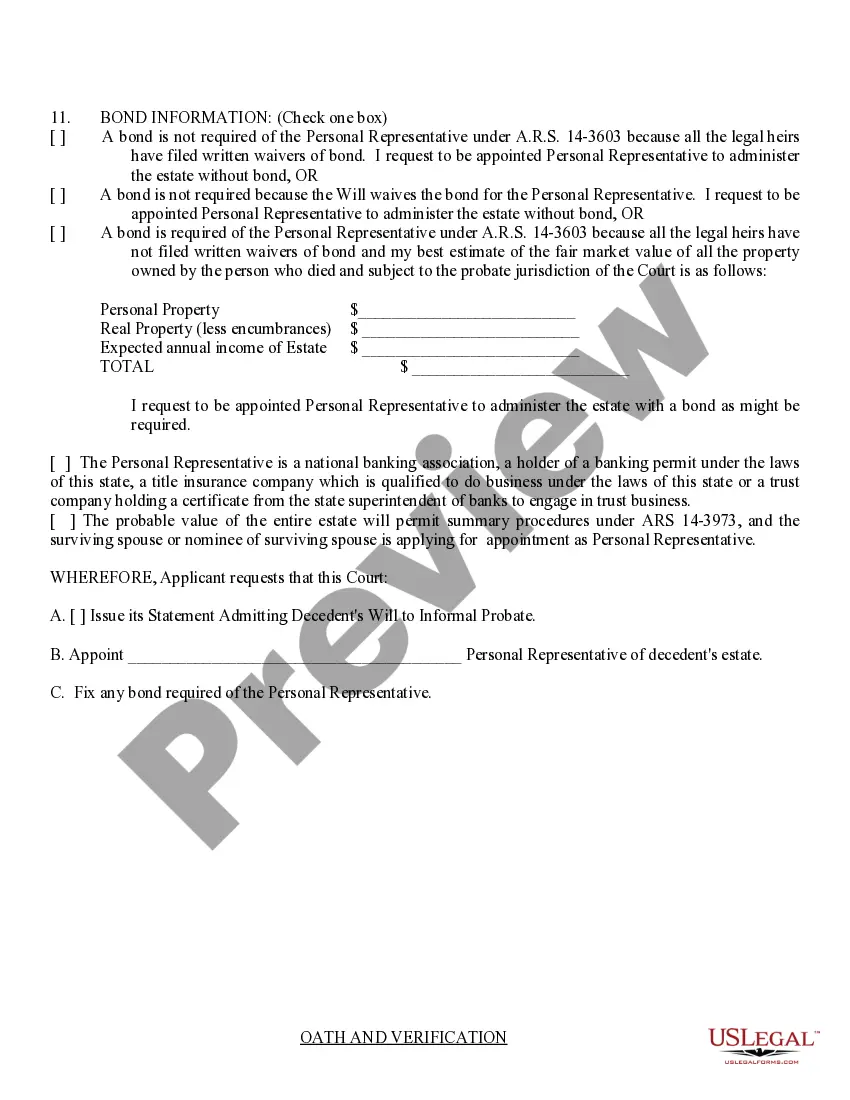

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

- If you’re already a US Legal Forms user, log in to your account. Ensure your subscription is active, and then download the required form template.

- For new users, start by checking the Preview mode and descriptions of form templates. This ensures you select the appropriate document that aligns with your jurisdiction.

- If you don’t find the correct form, utilize the Search tab to locate the right template for your needs.

- Once you identify the right document, click on the Buy Now button. Select your preferred subscription plan and create an account to gain resource access.

- Complete your purchase by entering your credit card information or using your PayPal account, then finalize your subscription.

- After purchase, download the form directly to your device. You'll also find it anytime in the My Forms section of your profile.

With US Legal Forms, you gain access to an extensive library of over 85,000 legal forms and packages, far surpassing competitors. This means you can find precisely what you need more efficiently.

Empower yourself with the right documents and expert assistance. Start your probate process today with US Legal Forms – your reliable partner in legal documentation.

Form popularity

FAQ

Yes, an estate can be settled without probate in Pennsylvania if it is structured properly, such as through a living trust or joint ownership of assets. These setups allow for direct transfer to beneficiaries without the probate process. Those considering this option should consult resources like UsLegalForms to understand how to structure their estate plan and determine who applies for probate in such cases.

You do not need a lawyer to become an executor of an estate; however, having legal support can make your responsibilities easier. Executors must manage a range of tasks, including settling debts and distributing assets. If you're unclear about your role, understanding who applies for probate will provide clarity on your legal obligations.

In Pennsylvania, there is no minimum estate value for probate. Whether the estate is large or small, any assets must be properly managed and distributed according to state law. Therefore, those who apply for probate should be prepared to follow the legal processes regardless of the estate’s total value.

Probate in Pennsylvania must be initiated within three months after the individual's death to avoid any complications. Timely filing ensures that the estate is managed correctly and that beneficiaries receive their due shares. Those who apply for probate within this time frame can prevent potential disputes and delays.

While hiring a lawyer to probate a will in Pennsylvania is not a legal requirement, it can be beneficial for many. Legal experts can guide you through complex issues like debt settlements and tax considerations. However, if you're comfortable handling the paperwork and processes, you can certainly navigate probate independently. Remember, understanding who applies for probate can simplify your path.

In Pennsylvania, you must file for probate within three months after the date of death. Delaying this process can lead to complications, including additional fees or penalties. Therefore, it's advisable to act promptly and keep in mind that those who apply for probate should also notify heirs and beneficiaries during this time.

Probating a will in Pennsylvania without a lawyer is possible, but it requires you to understand certain procedures. First, you will need to gather the necessary documents, including the original will and a death certificate. Then, file the will with the local Register of Wills. Make sure you also comply with any required notices to beneficiaries, as this process plays a role in determining who applies for probate.

Individuals may choose not to probate a will for various reasons, such as the estate having little to no assets or debts. In cases where a trust is in place, probate may be unnecessary as the assets have already been placed outside of the estate. Additionally, family agreements or disputes may lead some to skip the probate process entirely. Knowing who applies for probate can help you assess whether it's the right route for you.

In Tennessee, the probate process begins with filing the will with the local court along with a petition for probate. The court will review the will to determine its validity and then appoint a personal representative to oversee the estate. This representative is responsible for managing debts, taxes, and distributing assets according to the will. Understanding who applies for probate in Tennessee can simplify this process for you.

Typically, an estate should go into probate within a few weeks to a few months after the person's death. The exact time frame can vary depending on state laws and the complexity of the estate. It's essential to act promptly, especially if there are debts or taxes to settle. Knowing who applies for probate can expedite the process and ensure compliance with state requirements.