Arizona Personal Representative Without Bond

Description

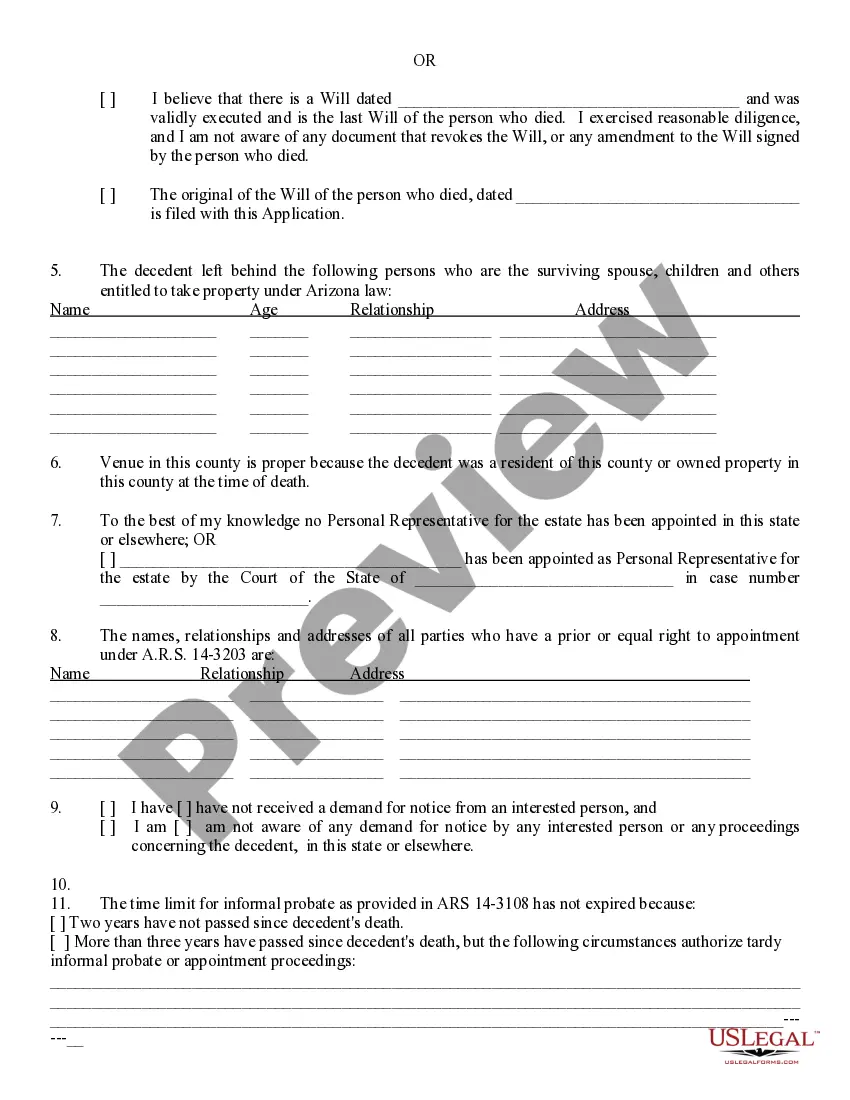

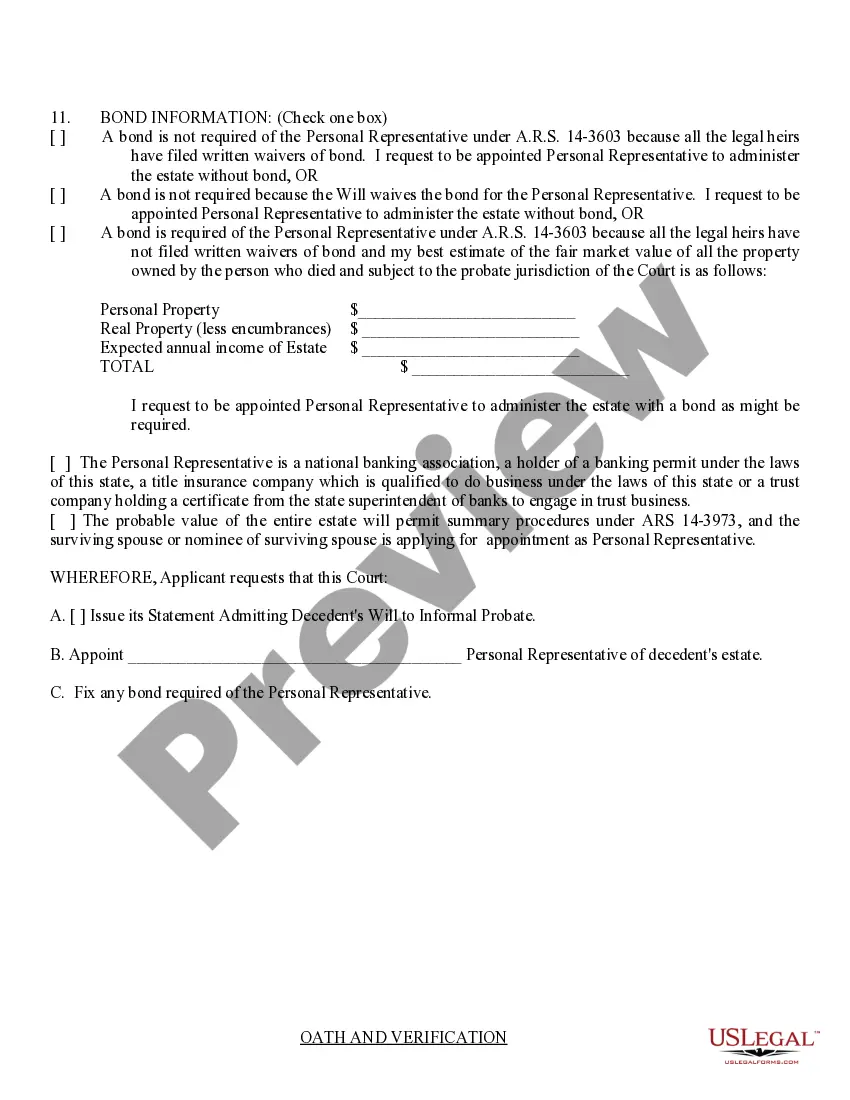

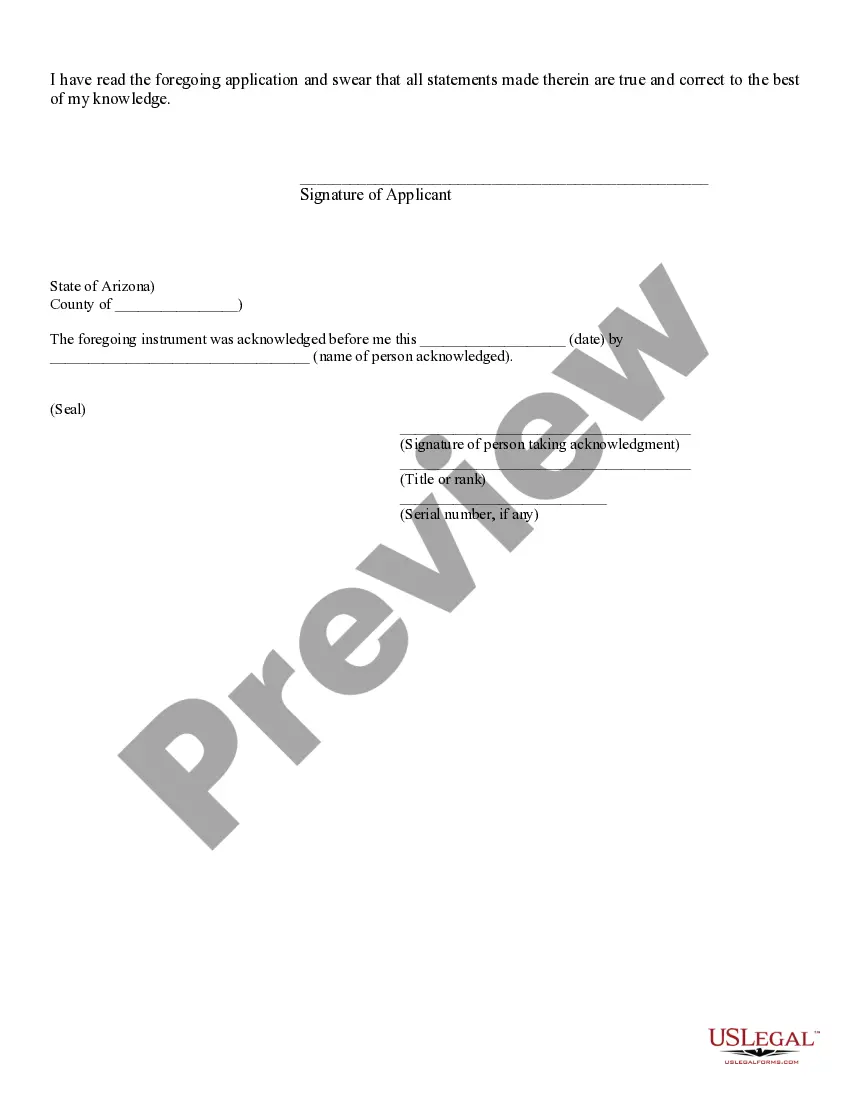

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with choosing the proper form sample. For example, if you choose a wrong version of a Arizona Personal Representative Without Bond, it will be rejected when you submit it. It is therefore important to have a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Arizona Personal Representative Without Bond sample, follow these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, get back to the search function to find the Arizona Personal Representative Without Bond sample you require.

- Get the template when it matches your requirements.

- If you have a US Legal Forms account, click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Pick your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Arizona Personal Representative Without Bond.

- When it is downloaded, you are able to fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time seeking for the appropriate template across the internet. Use the library’s simple navigation to find the correct template for any situation.

Form popularity

FAQ

If a spouse or children survive the person who died, generally speaking, these assets would go to the spouse and children. If neither exist, a close relative would inherit the assets. If the state is unable to identify any relatives, the property then goes to the state.

If someone dies without a will, their estate assets will pass by intestate succession. Intestate succession means that any part of the estate not covered by the decedent's will goes to the decedent's spouse and/or other heirs under Arizona law. (The decedent is the person who died.)

Informal probate is the process of submitting the paperwork to the probate court registrar who may appoint the personal representative and admit a will to probate or that the person died intestate (without a will). All without a court hearing before a judge.

As long as there aren't any contests to the will or objections to the executor's actions, the executor will be allowed to settle the estate at the conclusion of the four-month waiting period. That means an executor who is on top of their responsibilities could theoretically wrap up probate in as little as four months.

Petition for Appointment: File a Petition for Appointment of Personal Representative with the probate court. This petition includes information about yourself, the deceased person, and the estate. You will also need to provide information about any beneficiaries and heirs.