Arizona Personal Representative Withdrawal

Description

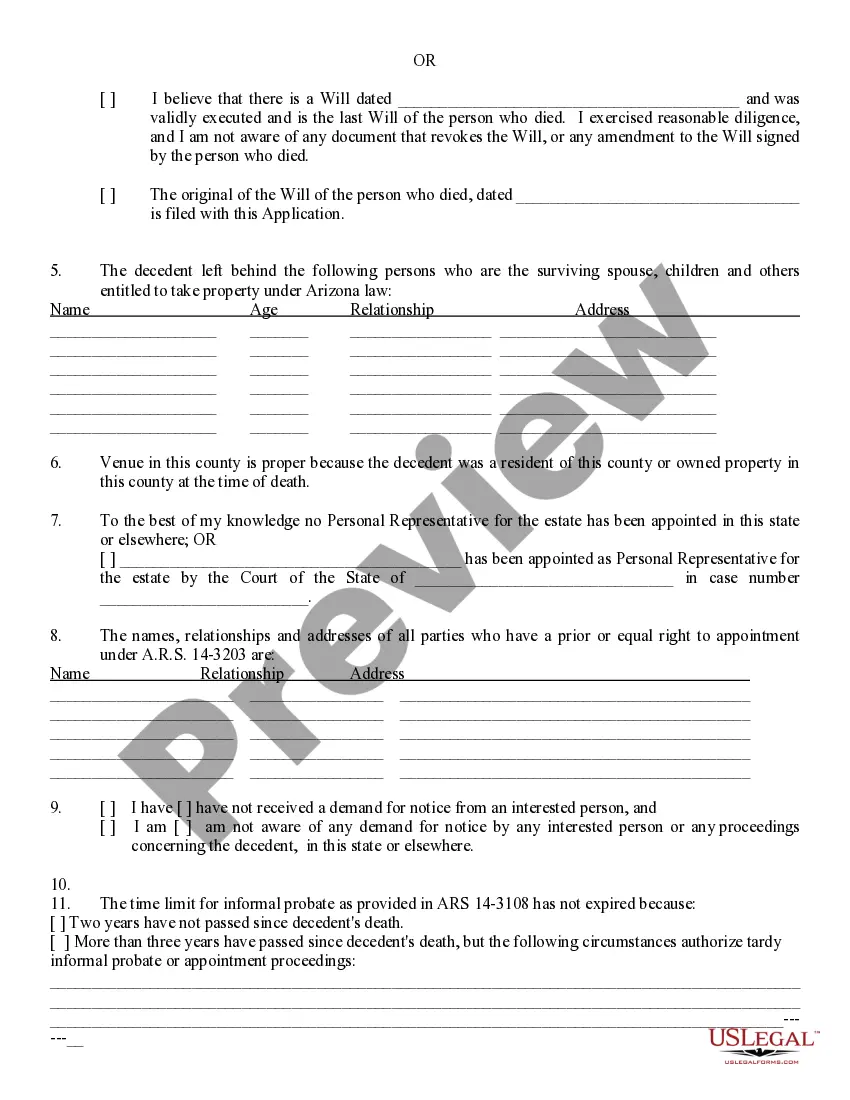

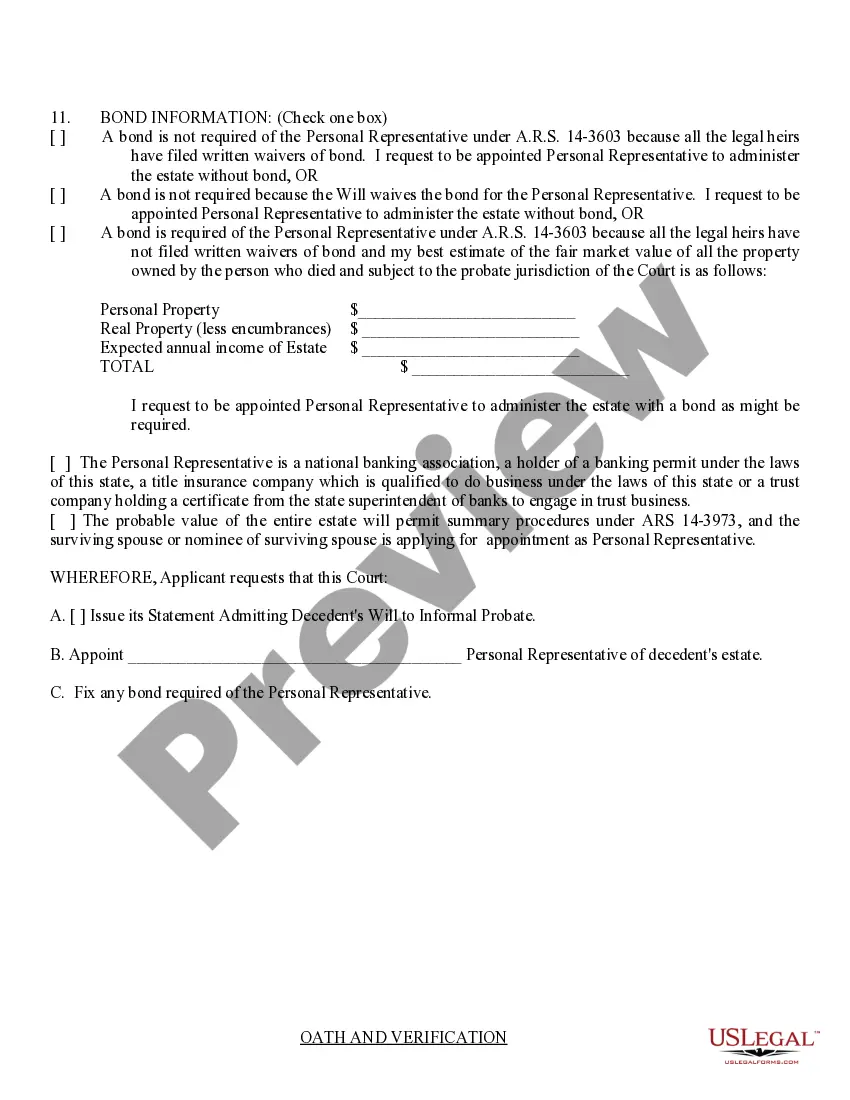

How to fill out Arizona Application For Informal Probate Of A Will And Appointment Of Personal Representative?

Handling legal documents and operations can be a time-consuming addition to your entire day. Arizona Personal Representative Withdrawal and forms like it often require you to search for them and understand how to complete them properly. Therefore, regardless if you are taking care of financial, legal, or individual matters, having a comprehensive and practical online catalogue of forms when you need it will significantly help.

US Legal Forms is the top online platform of legal templates, offering more than 85,000 state-specific forms and a variety of resources to assist you complete your documents quickly. Explore the catalogue of pertinent papers available to you with just a single click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Protect your papers management operations by using a high quality service that lets you put together any form in minutes without having extra or hidden cost. Just log in to the account, locate Arizona Personal Representative Withdrawal and download it right away within the My Forms tab. You may also gain access to formerly downloaded forms.

Is it your first time making use of US Legal Forms? Register and set up up a free account in a few minutes and you will gain access to the form catalogue and Arizona Personal Representative Withdrawal. Then, stick to the steps below to complete your form:

- Make sure you have found the proper form by using the Review option and looking at the form information.

- Pick Buy Now once ready, and select the subscription plan that is right for you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise assisting users manage their legal documents. Get the form you want today and improve any operation without having to break a sweat.

Form popularity

FAQ

A person interested in the estate may petition for removal of a personal representative for cause at any time. On filing of the petition, the court shall fix a time and place for a hearing. Notice shall be given by the petitioner to the personal representative, and to other persons as the court may order.

As long as there aren't any contests to the will or objections to the executor's actions, the executor will be allowed to settle the estate at the conclusion of the four-month waiting period. That means an executor who is on top of their responsibilities could theoretically wrap up probate in as little as four months.

If a beneficiary requests access to financial institution statements and the executor refuses to provide them, the beneficiary can take legal action. They can follow the court for an order compelling the executor to reveal the requested information.

Once a potential creditor has been notified of the death, the creditor has 120 days to present a bill to the estate for payment. Some creditors will file a creditor's claim directly with the court; others will simply send you the bill.

The Executor can show beneficiaries an informal accounting if they ask for it. However, the Executor does not have to show a formal accounting if the beneficiaries do not agree. An executor must file a formal accounting with the court if the beneficiaries are unsatisfied.