Rent To Own Como Funciona

Description

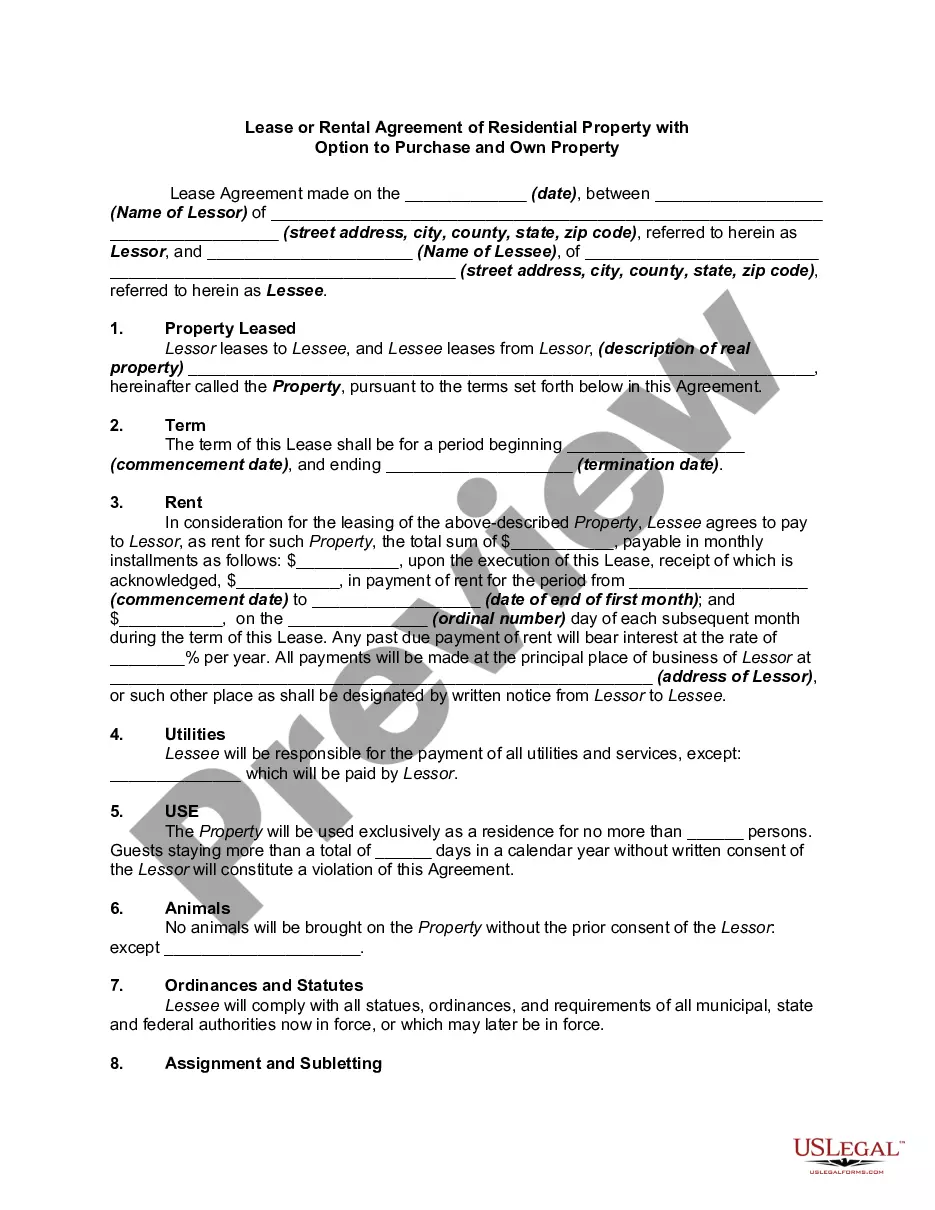

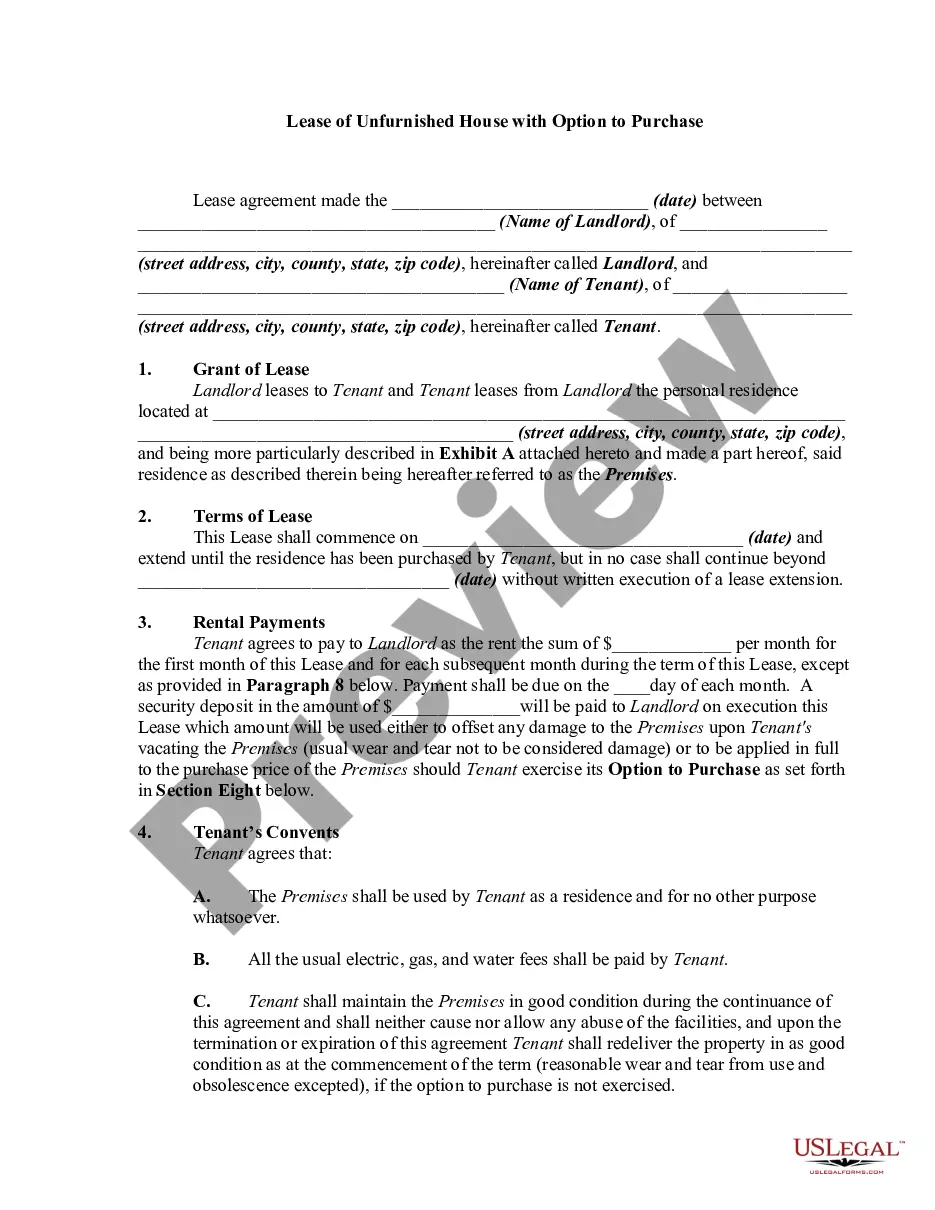

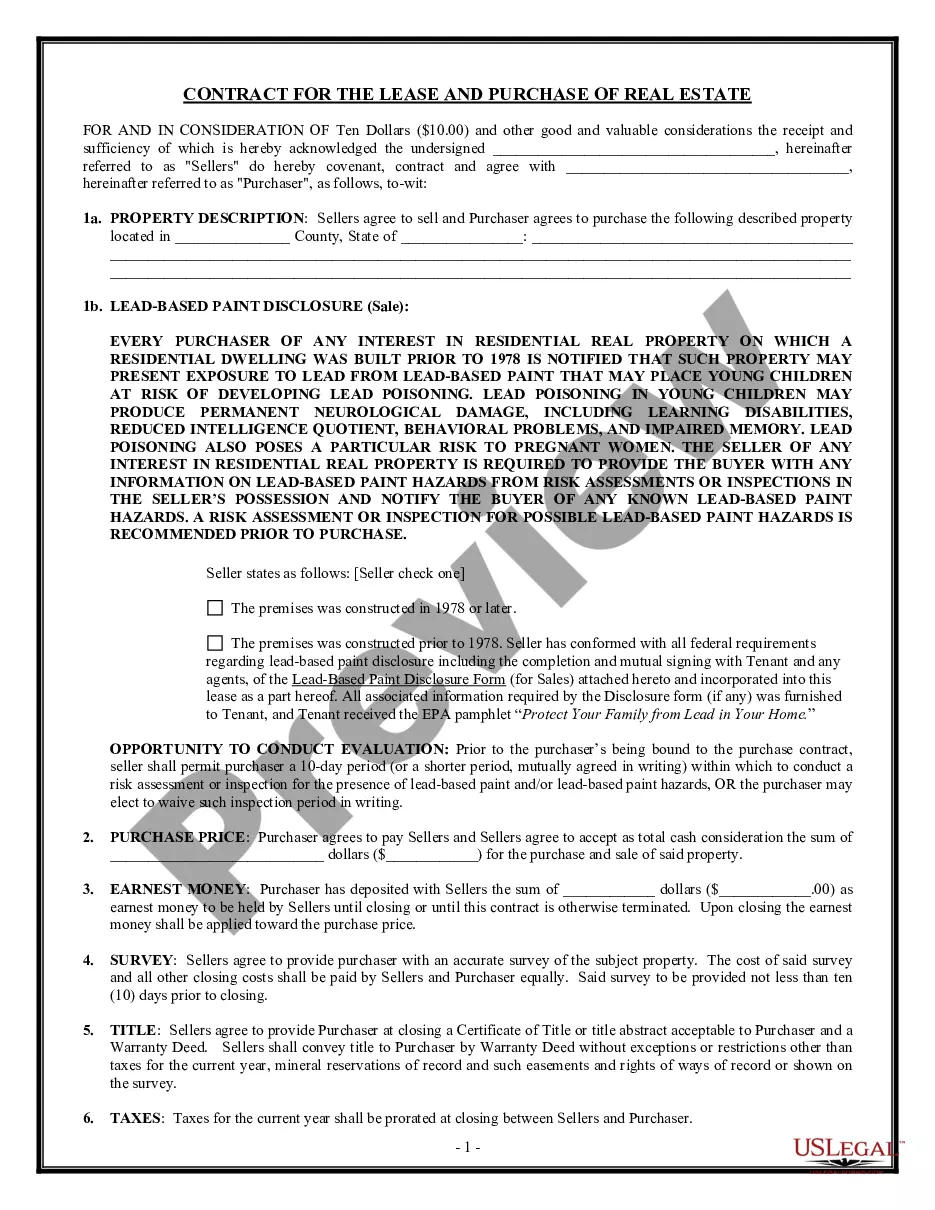

How to fill out Arizona Lease With Option To Purchase - Lease Or Rent To Own?

- If you are a returning user, log in to your account to retrieve the necessary form template. Ensure your subscription is active; if not, renew it as needed.

- For first-time users, start by browsing the form library. Check the Preview mode and description to confirm that you’ve selected a form that aligns with your legal requirements.

- If there are discrepancies with the selected template, utilize the Search feature to find a more suitable document.

- Once you’ve identified the correct form, click on the Buy Now button, then choose your preferred subscription plan and register for an account to access the library.

- Complete your purchase by supplying your credit card information or using your PayPal account.

- Finally, download the form and save it on your device. You can always revisit it through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing a vast library of over 85,000 easy-to-fill legal documents. This ensures that every user can access the necessary templates to fulfill their legal obligations swiftly.

In conclusion, utilizing US Legal Forms not only simplifies the process of obtaining legal documents but also guarantees precision through access to legal experts. Start today to streamline your legal needs!

Form popularity

FAQ

Usually, you cannot write off rent-to-own payments as tax deductions because these payments are not classified as mortgage interest. However, if you handle these payments correctly, there may be certain circumstances where some expenses could qualify for deductions. Consulting a tax professional can clarify how rent to own como funciona in conjunction with your tax obligations. You can also find useful resources on US Legal Forms to navigate this concern.

When considering buying a rental property, a credit score of at least 680 is typically preferable for obtaining favorable terms. Lenders will heavily weigh your credit score alongside other factors, including your income and existing debts. Knowing how rent-to-own como funciona may also help you better prepare for potential ownership. It’s advisable to consult with financial advisors to navigate available options.

Typically, the minimum credit score required to rent a house is around 620, though some landlords may consider scores as low as 580. It is crucial to note that landlords often review the entire financial picture, including income and rental history. Familiarizing yourself with how rent-to-own como funciona can help position your application favorably. Consider tools and services that strengthen your rental application.

To successfully enter a rent-to-own agreement, most landlords prefer tenants with a credit score of at least 580. However, some landlords may accept lower scores depending on personal circumstances and rental history. Understanding how a rent-to-own arrangement works can help you prepare your finances. Explore available resources to enhance your financial standing before initiating the process.

The best way to find rent-to-own homes is by searching online real estate platforms, local classifieds, and neighborhood listings. Network with real estate agents who specialize in rent-to-own agreements. Additionally, communities often have resources or notice boards that list available properties. Tools available through US Legal Forms can also assist in your search.

To start the rent-to-own process, begin by researching properties that offer this option in your target area. Next, reach out to property owners or real estate agents to express your interest. Review the terms of any rent-to-own agreements carefully, as these details are crucial for a successful transaction. Utilizing US Legal Forms can provide clarity as you navigate this journey.

Rent-to-own can be a good idea for potential homeowners who may not currently qualify for a mortgage. This option gives you time to improve your financial situation while living in the home you desire. Ultimately, it depends on your circumstances and willingness to adhere to the terms agreed upon. Exploring options on platforms like US Legal Forms can help clarify benefits.

Yes, rent-to-own can work effectively for many individuals looking to secure a home while improving their credit scores. It allows you to live in the property while gradually working towards ownership. However, it is essential to understand the terms and conditions of your lease agreement to ensure it fits your goals. Consider exploring US Legal Forms for assistance.

To rent-to-own a house, most lenders look for a credit score of at least 620. However, requirements can vary by provider. It's important to check your credit report, as a good score can improve your chances and terms of the agreement. Utilizing platforms like US Legal Forms can help you understand your options better.

In most cases, rent to own como funciona is not cheaper than outright buying a home. While it may seem appealing, the overall financial commitment, including higher rent and possible fees, can add up. Buying outright, when financially feasible, often proves more economical in the long run. Analyze your options carefully and consult a financial advisor if necessary.