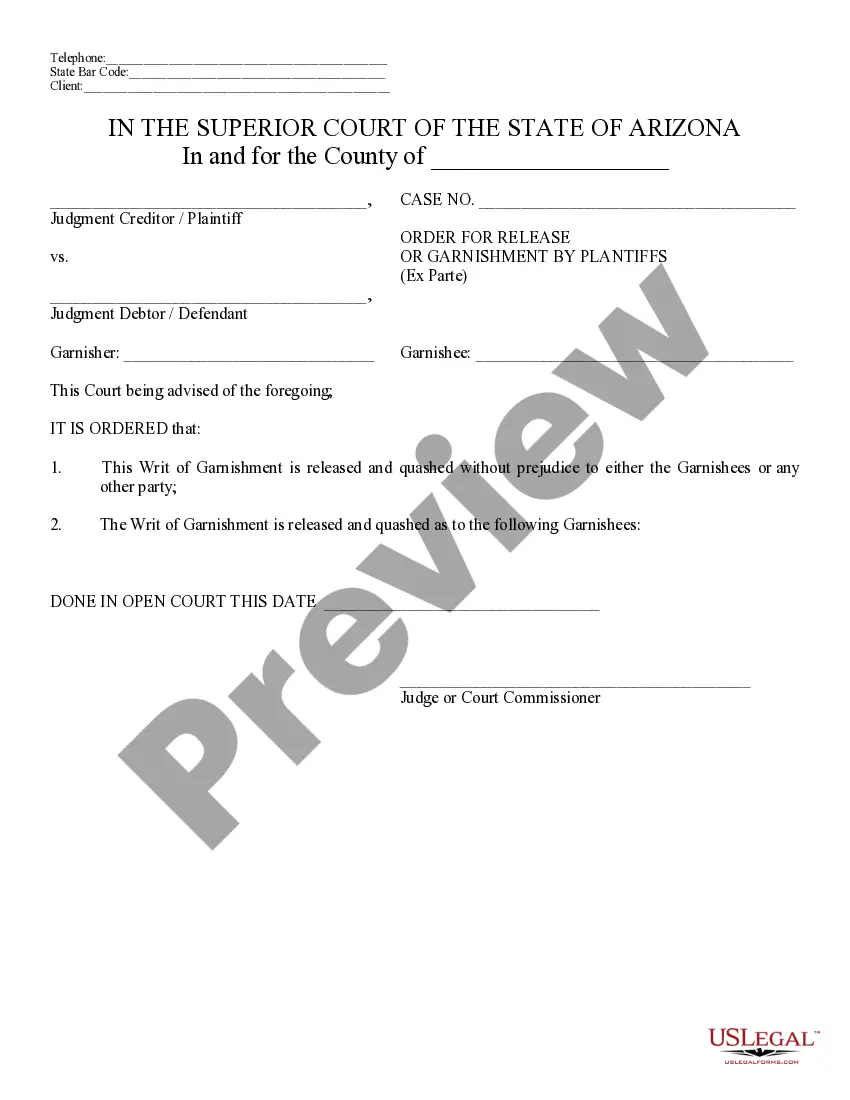

Az Garnishment Withholding

Description

How to fill out Arizona Notice Of Release Of Garnishment And Order?

It’s obvious that you can’t become a legal expert overnight, nor can you learn how to quickly prepare Az Garnishment Withholding without having a specialized background. Putting together legal documents is a long venture requiring a particular training and skills. So why not leave the preparation of the Az Garnishment Withholding to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Az Garnishment Withholding is what you’re searching for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription plan to purchase the template.

- Pick Buy now. Once the transaction is complete, you can download the Az Garnishment Withholding, fill it out, print it, and send or send it by post to the necessary individuals or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25%* of your non-exempt disposable earnings to be paid to a single judgment creditor.

You may object to the garnishment or file a claim of exemption by requesting a hearing with this court, if you believe any of the following is true: 1. The judgment creditor does not have a valid provisional remedy order or support order or judgment against you or that the debt or judgment has been paid in full. 2.

Impact on Wage Garnishments ? Medical Debt Before Proposition 209, creditors could garnish up to 25% of a debtor's non-exempt disposable earnings. Now, the law has reduced this maximum limit to 10% of an individual's disposable income or 60 times the highest applicable minimum wage (whichever is less).

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.