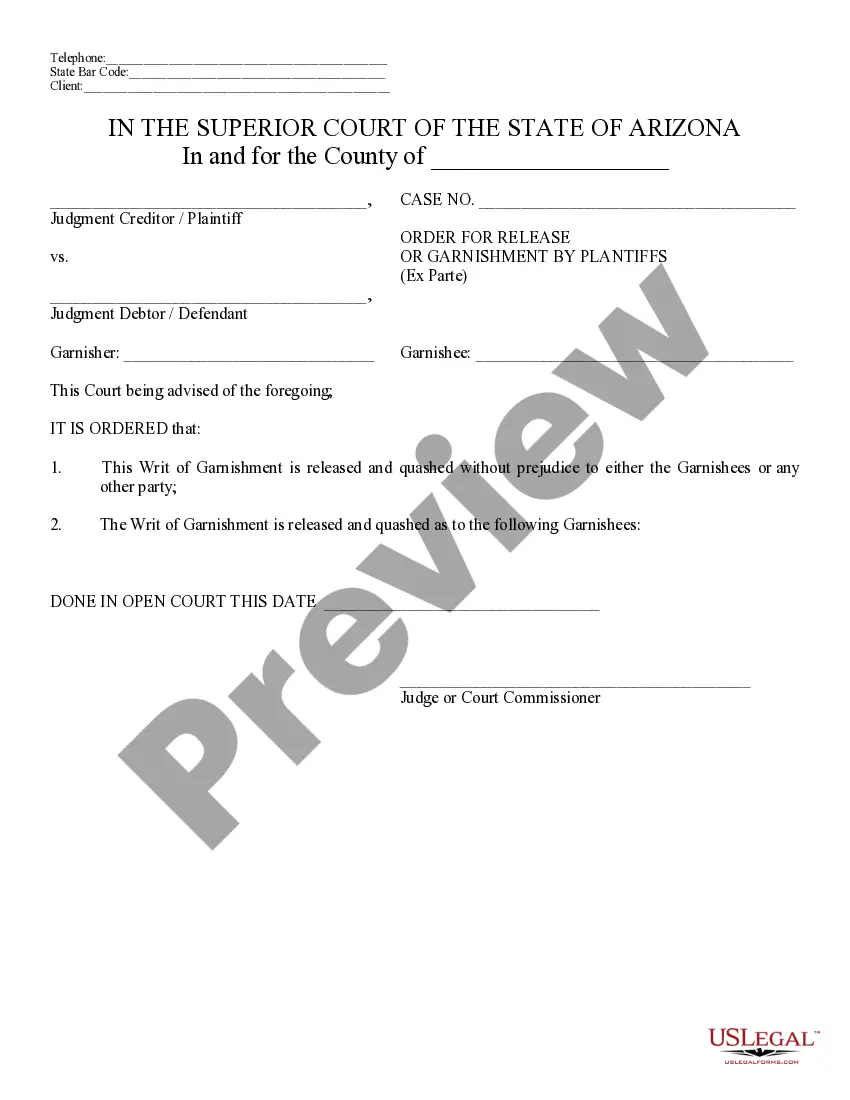

Az Garnishment Withdrawal

Description

How to fill out Arizona Notice Of Release Of Garnishment And Order?

Whether for business purposes or for individual matters, everybody has to handle legal situations at some point in their life. Completing legal paperwork demands careful attention, starting with choosing the right form template. For instance, if you pick a wrong edition of a Az Garnishment Withdrawal, it will be turned down once you submit it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you have to get a Az Garnishment Withdrawal template, follow these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Look through the form’s information to make sure it matches your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Az Garnishment Withdrawal sample you need.

- Get the template if it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Az Garnishment Withdrawal.

- After it is downloaded, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time searching for the right template across the web. Utilize the library’s easy navigation to find the appropriate template for any situation.

Form popularity

FAQ

File a motion to set aside judgment: Challenging the judgment is a valid way to stop the garnishment if you did not know there was a judgment against you. You normally require an attorney to navigate the technical parts for you.

You may object to the garnishment or file a claim of exemption by requesting a hearing with this court, if you believe any of the following is true: 1. The judgment creditor does not have a valid provisional remedy order or support order or judgment against you or that the debt or judgment has been paid in full. 2.

Hear this out loud PauseUp to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in ance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25%* of your non-exempt disposable earnings to be paid to a single judgment creditor.

You must file a Garnishee's Answer with the Court Clerk within 10 business days after you receive the Writ of Garnishment and Summons. Within 10 business days after you receive the paperwork listed above, fill out a Garnishee's Answer (Earnings)(FORM 6) and file it with the Court Clerk.

Release of Garnishment forms are most commonly used to stop the garnishment because the amount owed is paid in full however, they can also be used if the person being garnished has switched employment. If an amount is still outstanding the garnishment can be reinstated.