Child Support Modification Arizona Withholding Limits

Description

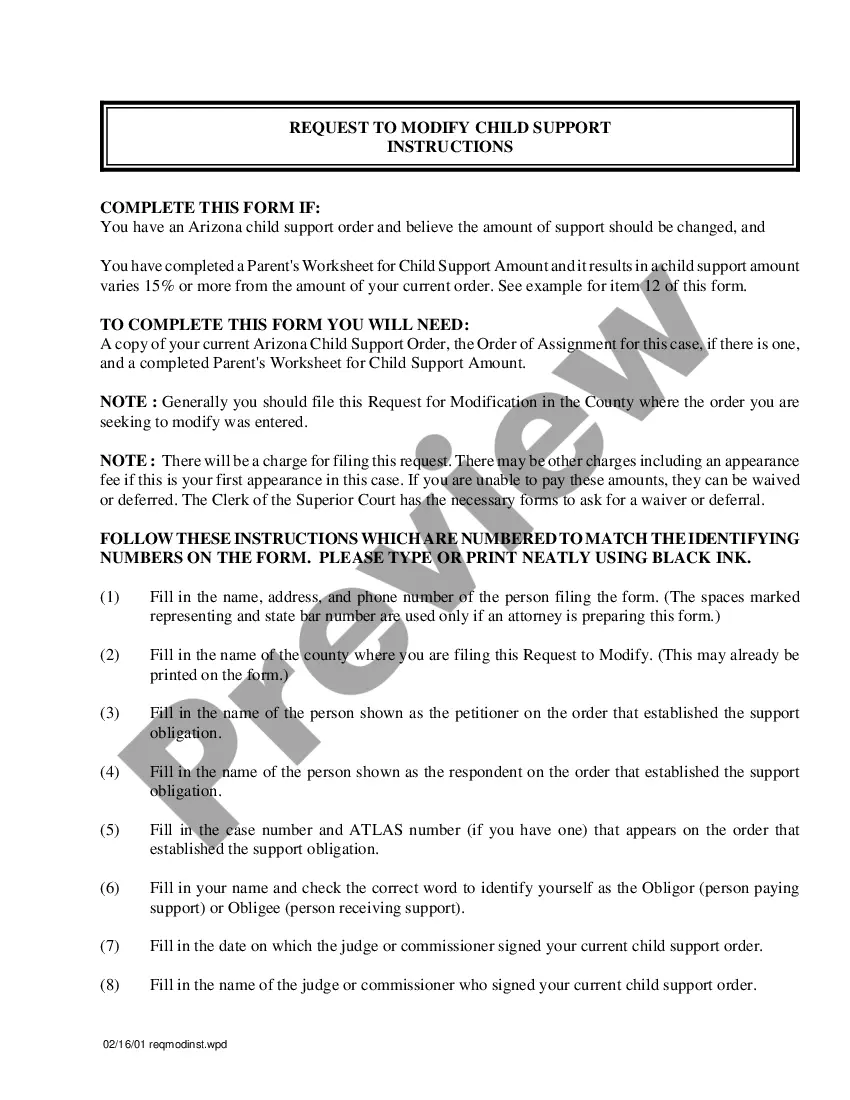

How to fill out Arizona Child Support Modification?

Managing legal documents can be daunting, even for the most experienced professionals.

When seeking a Child Support Modification Arizona Withholding Limits and lacking the time to dedicate to finding the correct and current version, the process can be stressful.

US Legal Forms accommodates all your needs, from personal to business documents, all in one location.

Utilize innovative tools to complete and manage your Child Support Modification Arizona Withholding Limits.

Here are the steps to follow after obtaining the form you need: Validate that it is the correct form by previewing and reading its description. Ensure that the sample is acceptable in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose your desired format, and Download, fill out, eSign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of experience and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- Access a repository of articles, guides, and resources related to your situation and requirements.

- Save time and effort searching for the documents you need by using US Legal Forms’ advanced search and Preview feature to locate and download the Child Support Modification Arizona Withholding Limits.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to view the documents you have previously saved and to manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account for unlimited access to all platform features.

- A comprehensive online form library could transform the way individuals address these matters efficiently.

- US Legal Forms stands as a leader in online legal documentation, offering over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

In Arizona, the maximum amount that can be withheld from your paycheck for child support is typically 50% of your disposable income, depending on your circumstances. This limit ensures that you can still meet your basic living expenses. Familiarizing yourself with child support modification Arizona withholding limits can help you manage your finances better. US Legal Forms offers guidance and forms to help you understand and modify your child support obligations.

In Arizona, you can request a child support modification every three years, or sooner if there is a significant change in circumstances. This could include changes in income, employment status, or the needs of the child. To navigate this process smoothly, consider using US Legal Forms, which provides resources and templates for filing modifications effectively. Understanding child support modification Arizona withholding limits can help you plan your financial responsibilities.

The maximum amount that can be withheld for child support varies by state, but in Arizona, it typically does not exceed 50% of your disposable income. This limit is important for parents undergoing financial changes and seeking modifications. Being informed about the child support modification Arizona withholding limits helps you manage your finances effectively while ensuring your child's needs are met. For clarity and assistance, you can utilize resources like USLegalForms.

Mississippi law requires both parents to contribute to the financial support of their children. The state uses guidelines to calculate the amount based on each parent's income and the needs of the child. While this law does not directly relate to Arizona, understanding child support laws can help you navigate modifications. For Arizona-specific information, focus on the child support modification Arizona withholding limits to ensure accurate adjustments.

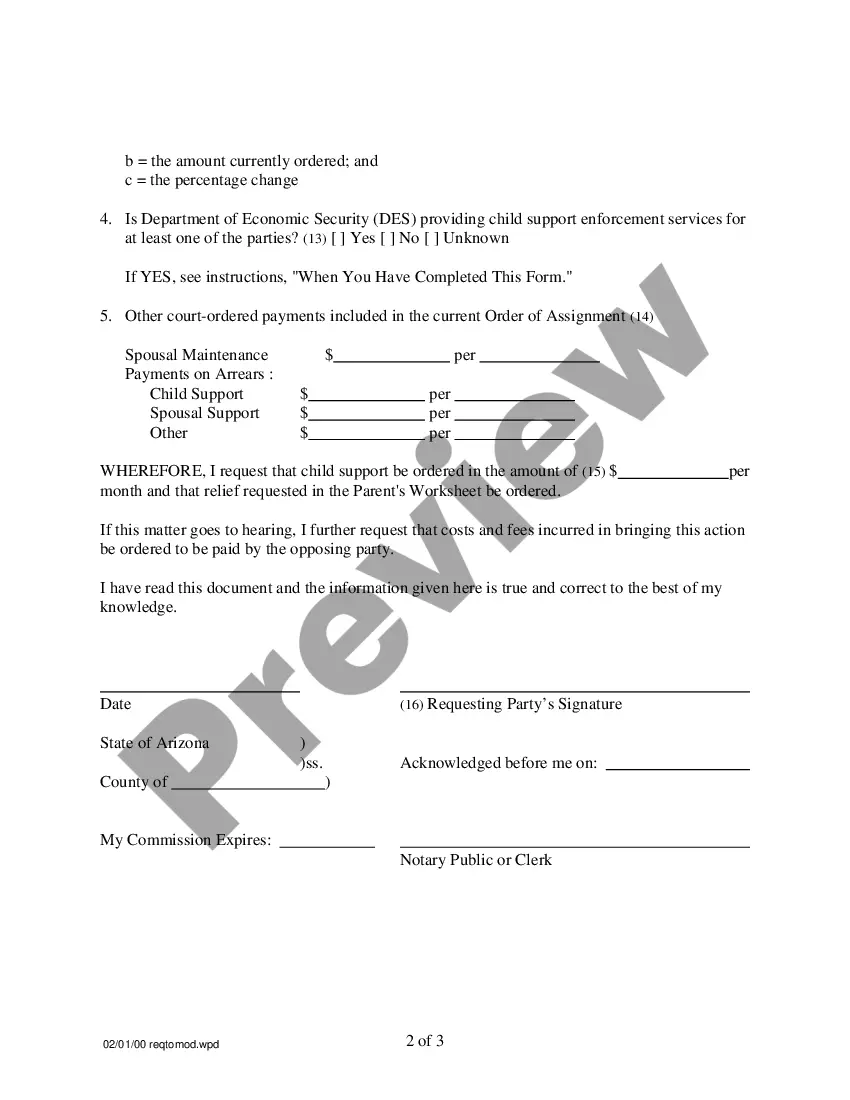

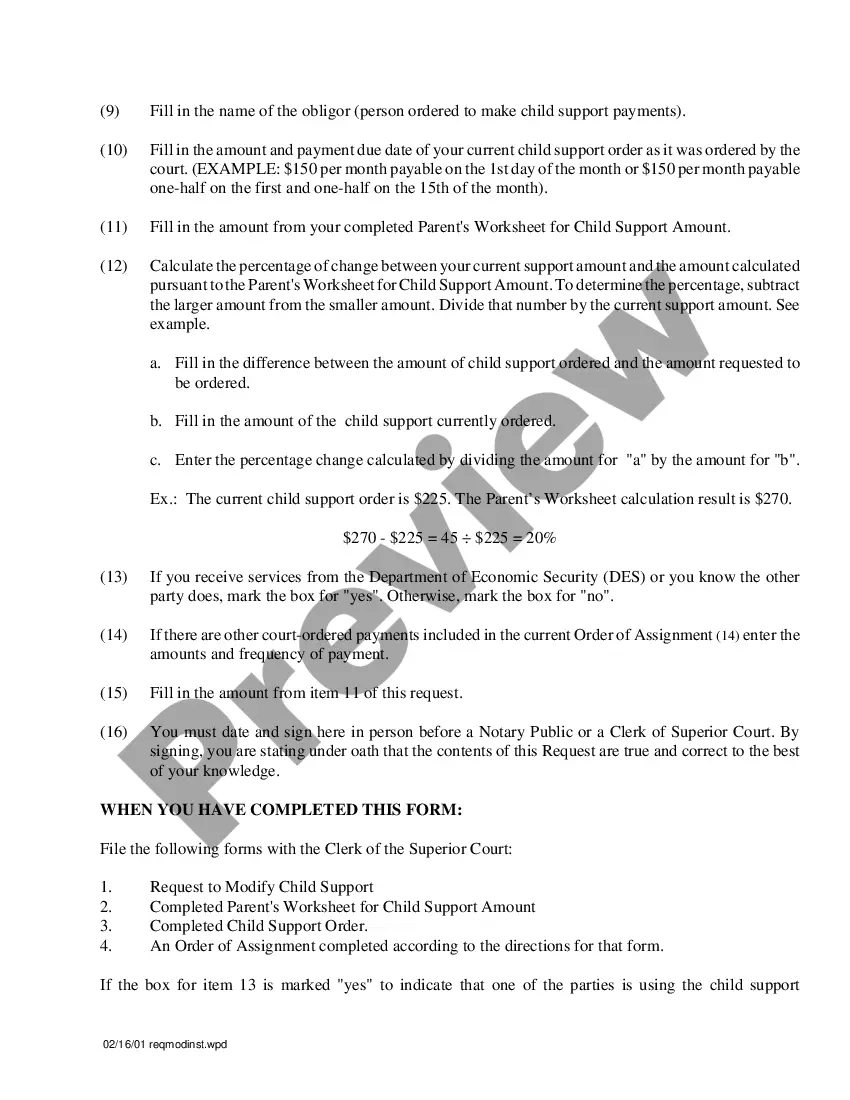

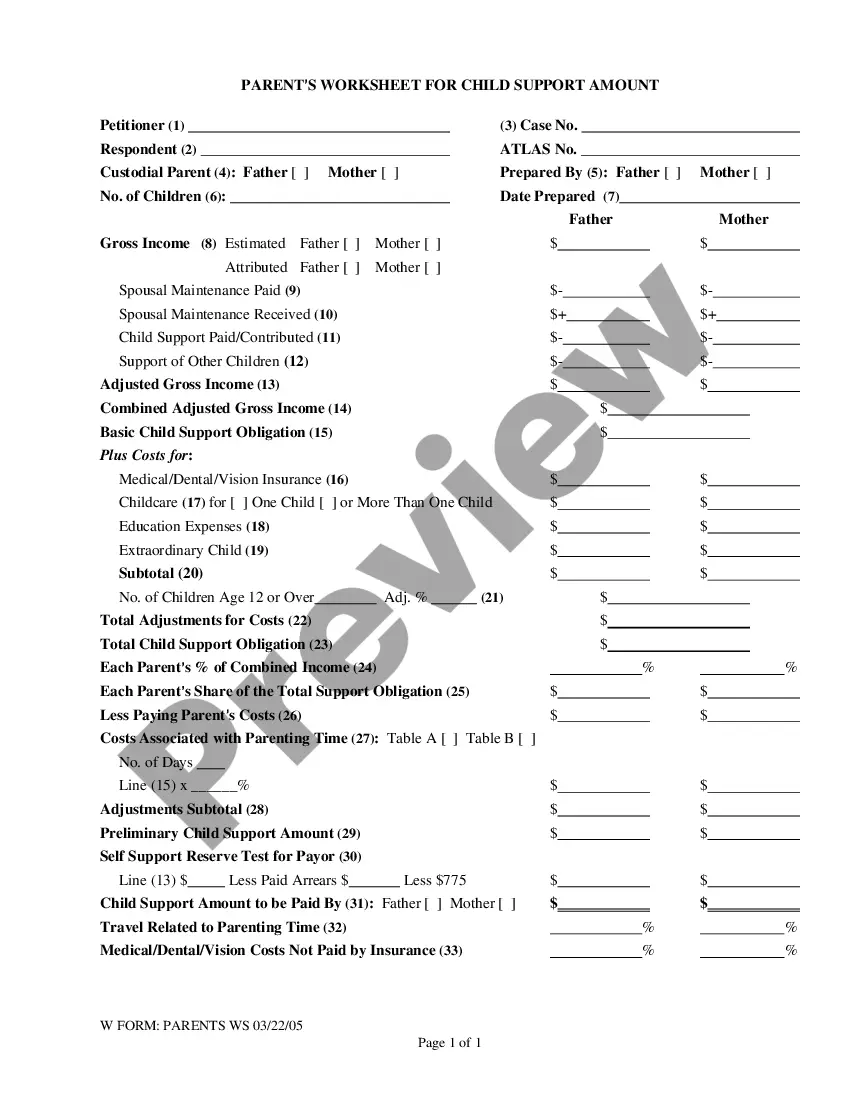

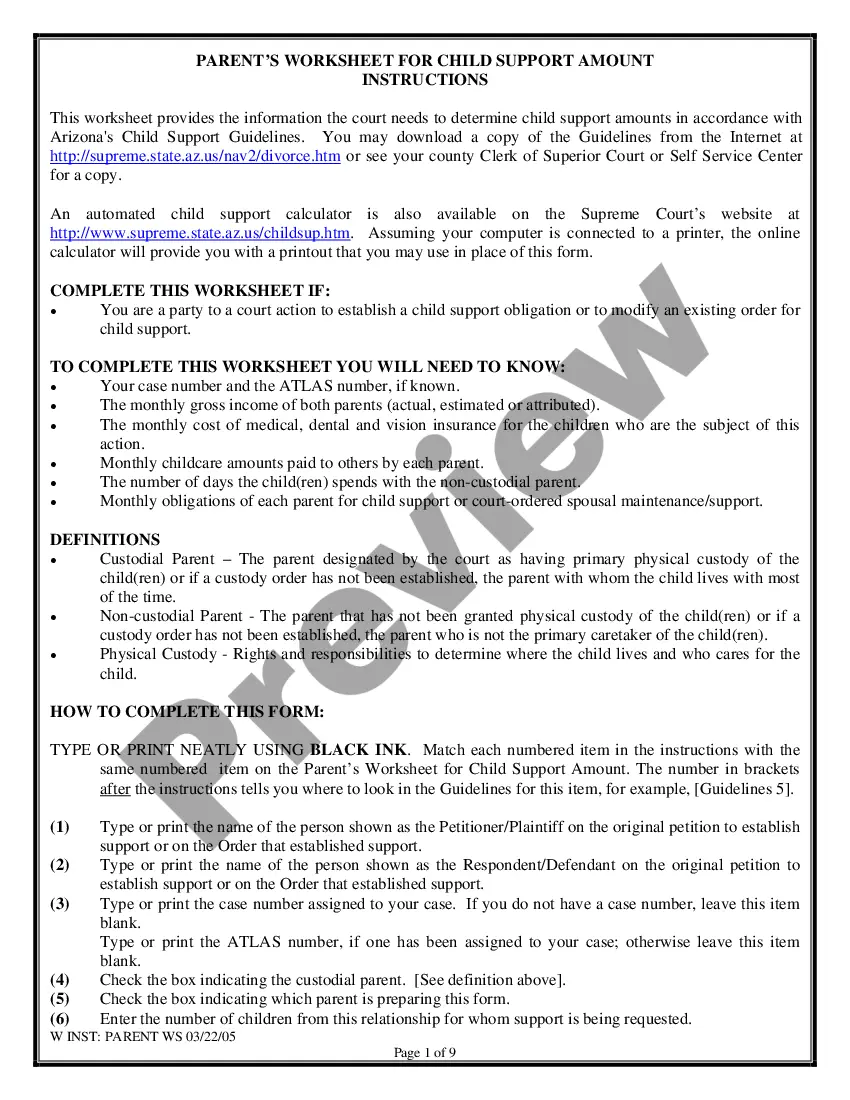

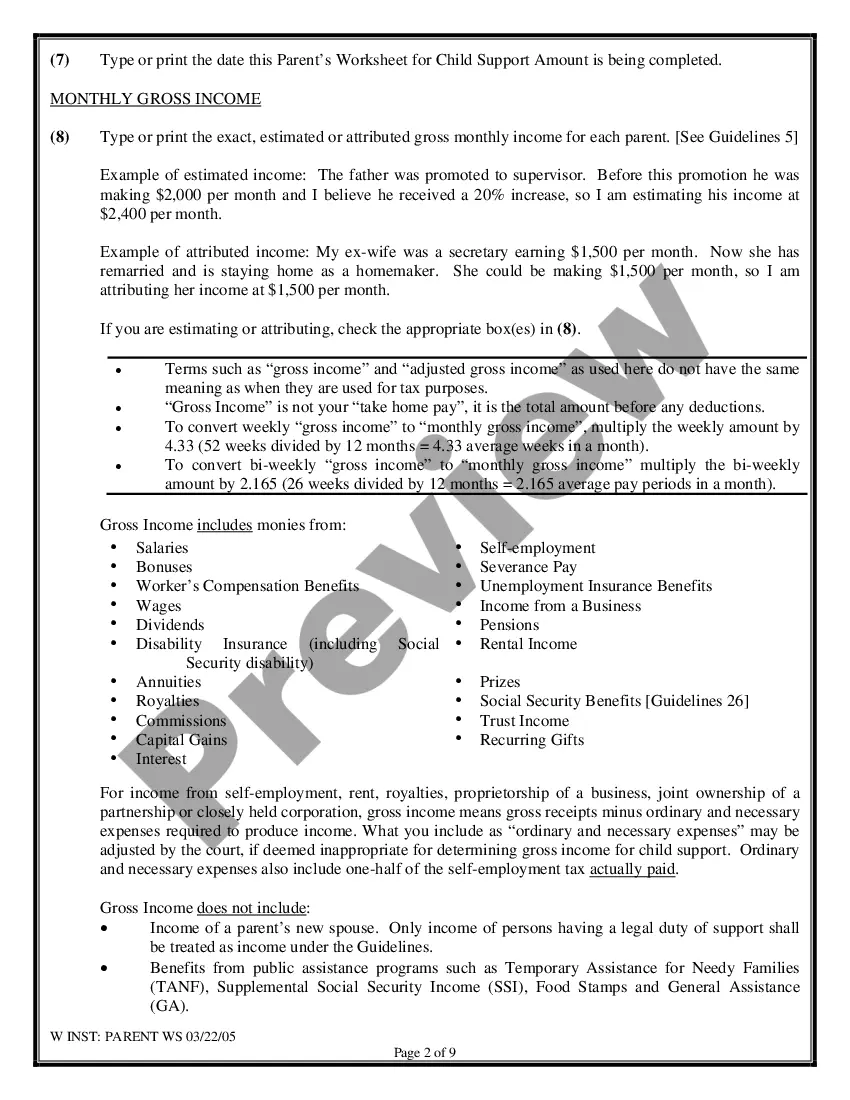

Filling out a child support worksheet in Arizona requires specific financial information from both parents. Start by gathering your income details, including salary, bonuses, and any other sources. Then, input your expenses related to the child, such as healthcare and childcare costs. If you need assistance, consider using USLegalForms to access the necessary templates and guidance on the child support modification Arizona withholding limits.

In Arizona, the maximum withholding for child support is determined by state guidelines. Generally, up to 50% of your disposable earnings can be withheld for child support modification. However, if you are supporting another family, this amount may be reduced. It is essential to understand the child support modification Arizona withholding limits to ensure compliance and avoid penalties.

Child support must be withheld, up to 50% of the employee's disposable earnings, before deductions for other withholding orders are taken.

Three Years: A child support modification can be requested once every three years regardless of the above circumstances. If you have your child support agreement put into place less than three years ago then you are going to need to qualify for a modification along one of the paths listed above.

How long does the modification process take? DCSS should complete the review and modification within six (6) months, however, this may vary ing to the court schedule.

The withholding limits set by the federal CCPA are: 50 percent - Supports a second family with no arrearage or less than 12 weeks in arrears. 55 percent - Supports a second family and more than 12 weeks in arrears. 60 percent - Single with no arrearage or less than 12 weeks in arrears.