3949 A Form For Child Support

Description

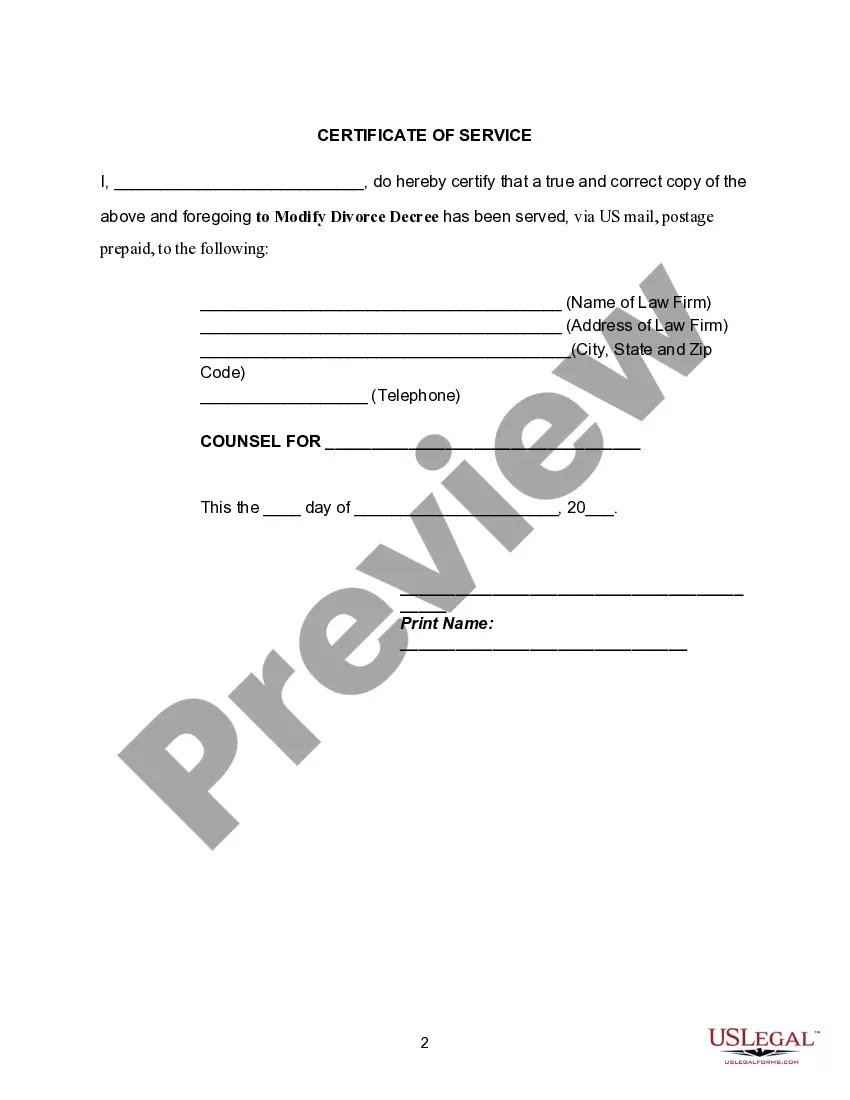

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

Legal papers managing may be mind-boggling, even for knowledgeable experts. When you are searching for a 3949 A Form For Child Support and don’t get the time to devote searching for the appropriate and updated version, the operations may be stressful. A robust online form library could be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you may have, from individual to enterprise papers, in one place.

- Utilize advanced tools to complete and control your 3949 A Form For Child Support

- Gain access to a resource base of articles, tutorials and handbooks and materials connected to your situation and requirements

Help save time and effort searching for the papers you need, and utilize US Legal Forms’ advanced search and Preview feature to get 3949 A Form For Child Support and acquire it. If you have a subscription, log in in your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to see the papers you previously saved as well as to control your folders as you can see fit.

Should it be the first time with US Legal Forms, register an account and acquire unrestricted access to all advantages of the platform. Listed below are the steps to consider after getting the form you want:

- Validate it is the proper form by previewing it and reading its information.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now when you are ready.

- Select a subscription plan.

- Pick the formatting you want, and Download, complete, sign, print and send your document.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and reliability. Change your day-to-day document management into a easy and user-friendly process right now.

Form popularity

FAQ

You can submit Form 3949-A online or by mail. We don't take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report. You won't receive a status or progress update due to tax return confidentiality under IRC 6103.

There are circumstances where filing a Form 3949-a might be appropriate. But it is the nuclear option for most divorce cases and child support disputes. It's a weapon of last resort, which is often more effective as a deterrent than it is once you launch.

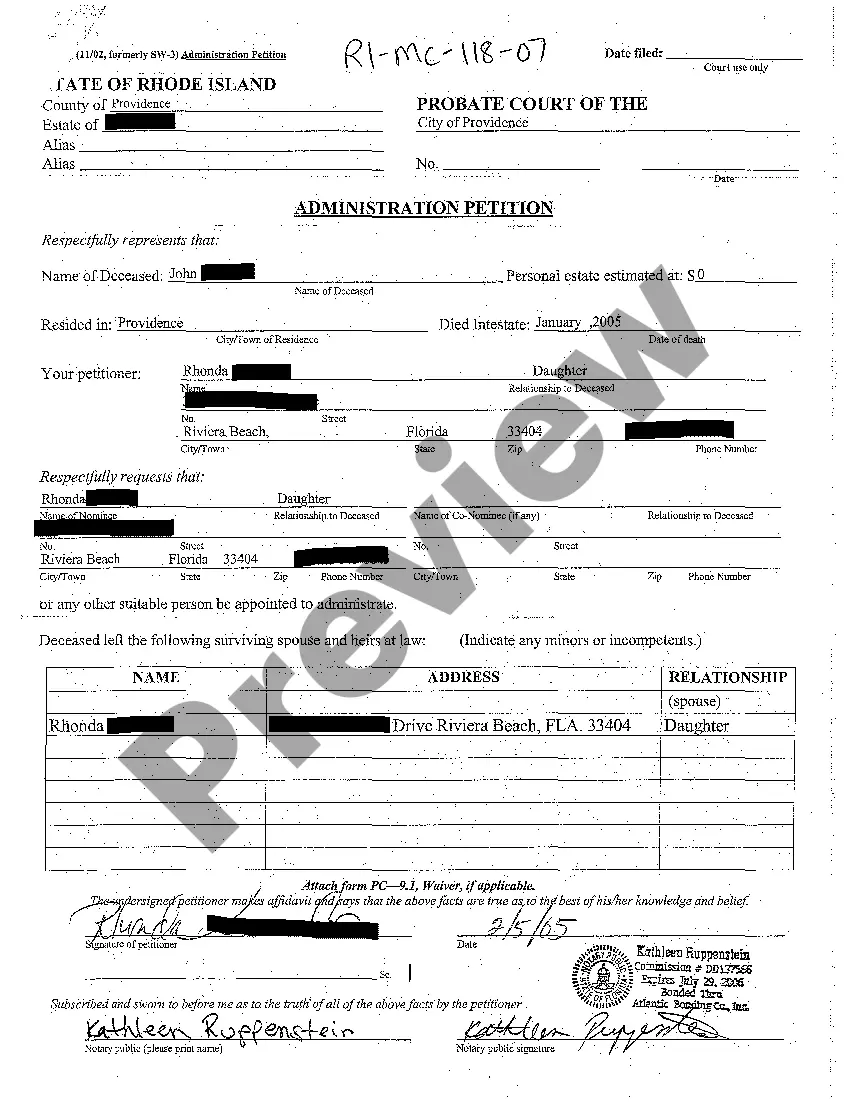

Use Form D-3949A to report alleged tax law violations. Complete if you are reporting an individual. Include their name, street address, city, state, ZIP Code, Social Security Number or Taxpayer Identification Number, date of birth, occupation, marital status, name of spouse (if married), and email address.

Form 3949-A is used to file when one person suspects another person of committing a tax fraud. The form includes some basic details about the persons who are reported. Once the form is filed, IRS contact the person filing the form for more information.

Form 3949-A is used to file when one person suspects another person of committing a tax fraud. The form includes some basic details about the persons who are reported. Once the form is filed, IRS contact the person filing the form for more information.