Motion To Dismiss With Prejudice Meaning

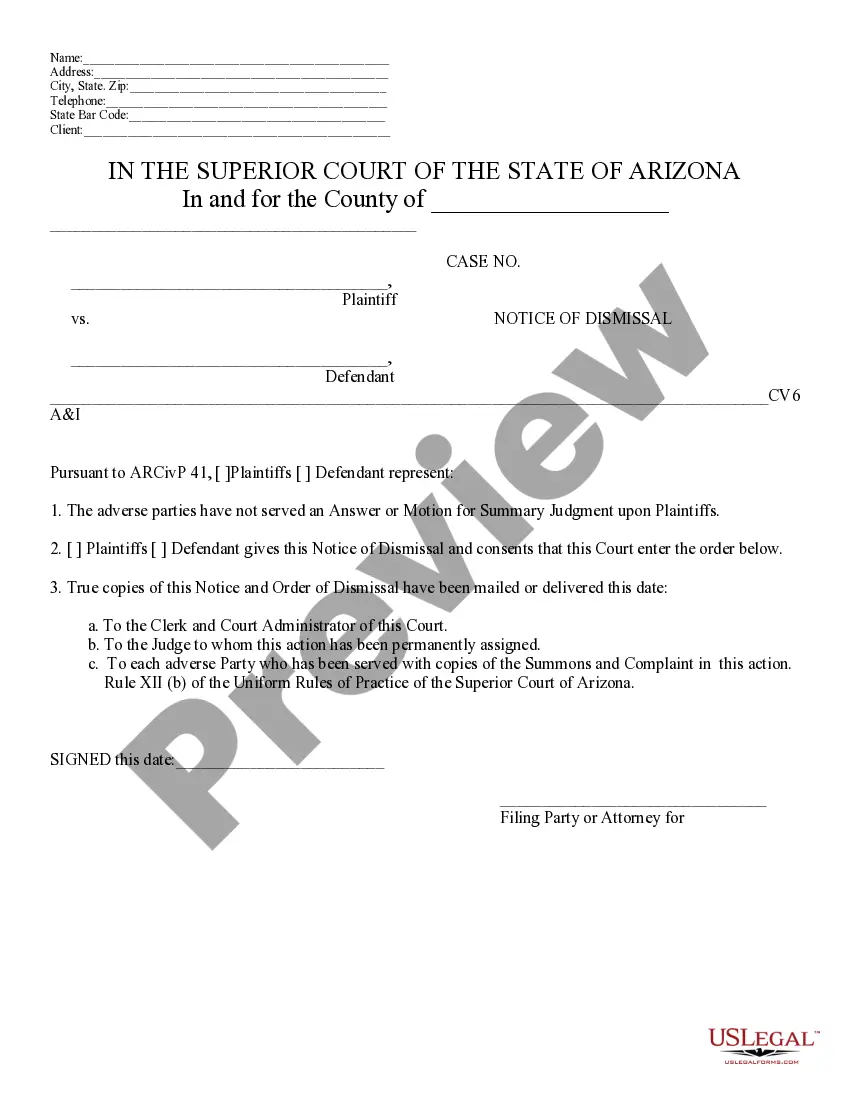

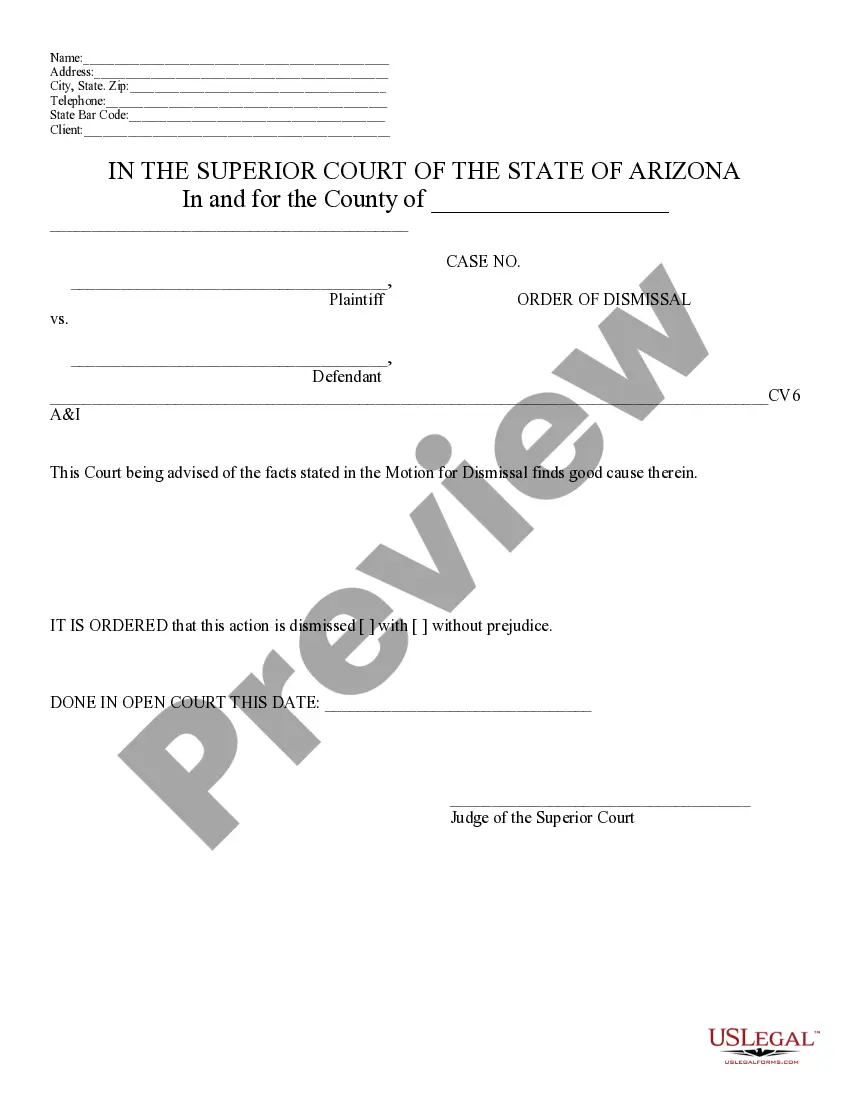

Description

How to fill out Arizona Motion For Dismissal?

Identifying a reliable source to acquire the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Securing the appropriate legal documents requires accuracy and meticulousness, which clarifies why it is essential to obtain samples of Motion To Dismiss With Prejudice Meaning exclusively from trustworthy providers, such as US Legal Forms. An unsuitable template will squander your time and delay your current situation. With US Legal Forms, you have minimal cause for concern. You can access and review all pertinent information regarding the document’s applicability and relevance to your situation as well as within your state or locality.

Eliminate the stress associated with your legal paperwork. Explore the comprehensive US Legal Forms collection where you can find legal templates, verify their relevance to your situation, and download them immediately.

- Use the catalog navigation or search feature to locate your sample.

- Examine the form’s description to determine if it aligns with the demands of your state and locality.

- Check the form preview, if available, to confirm that the form is indeed the one you need.

- Return to the search to locate the correct template if the Motion To Dismiss With Prejudice Meaning does not meet your requirements.

- If you are confident in the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that aligns with your needs.

- Proceed to sign up to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Motion To Dismiss With Prejudice Meaning.

- Once you have the form on your device, you can edit it with the editor or print it and fill it out by hand.

Form popularity

FAQ

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 ? S Corporation Election. ... Form 1120S ? S Corporation Tax Return. ... Schedule B ? Other Return Information. ... Schedule K ? Summary of Shareholder Information. ... Schedule K-1 ? Individual Shareholder Information.

Step 1: Name Your Mississippi LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Mississippi LLC Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Mississippi S Corp Tax Designation.

You can file the document online or by mail. The Articles of Incorporation cost $50 to file ($54 including the card processing fee). Once filed with the state, this document formally creates your Mississippi corporation.

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 ? S Corporation Election. ... Form 1120S ? S Corporation Tax Return. ... Schedule B ? Other Return Information. ... Schedule K ? Summary of Shareholder Information. ... Schedule K-1 ? Individual Shareholder Information.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

Step 1: Name Your Mississippi LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Mississippi LLC Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Mississippi S Corp Tax Designation.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.