Motion Dismissal Az Form 5000

Description

How to fill out Arizona Motion For Dismissal?

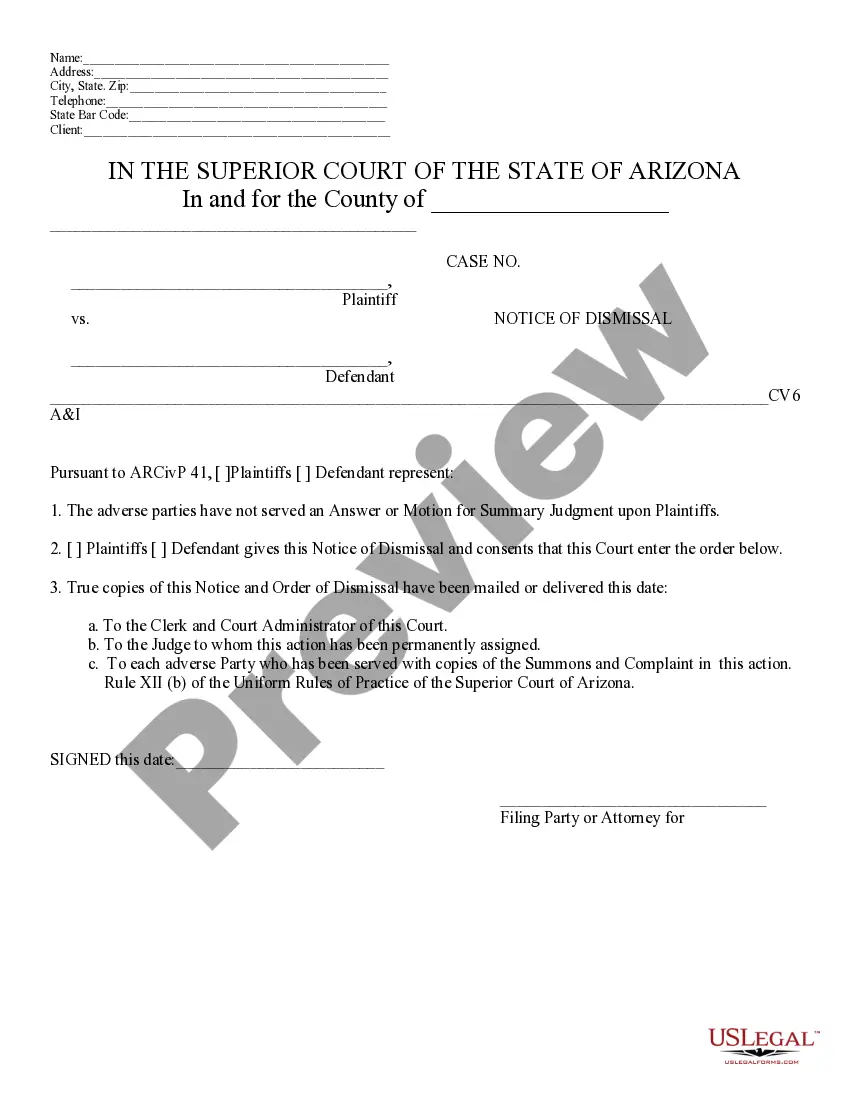

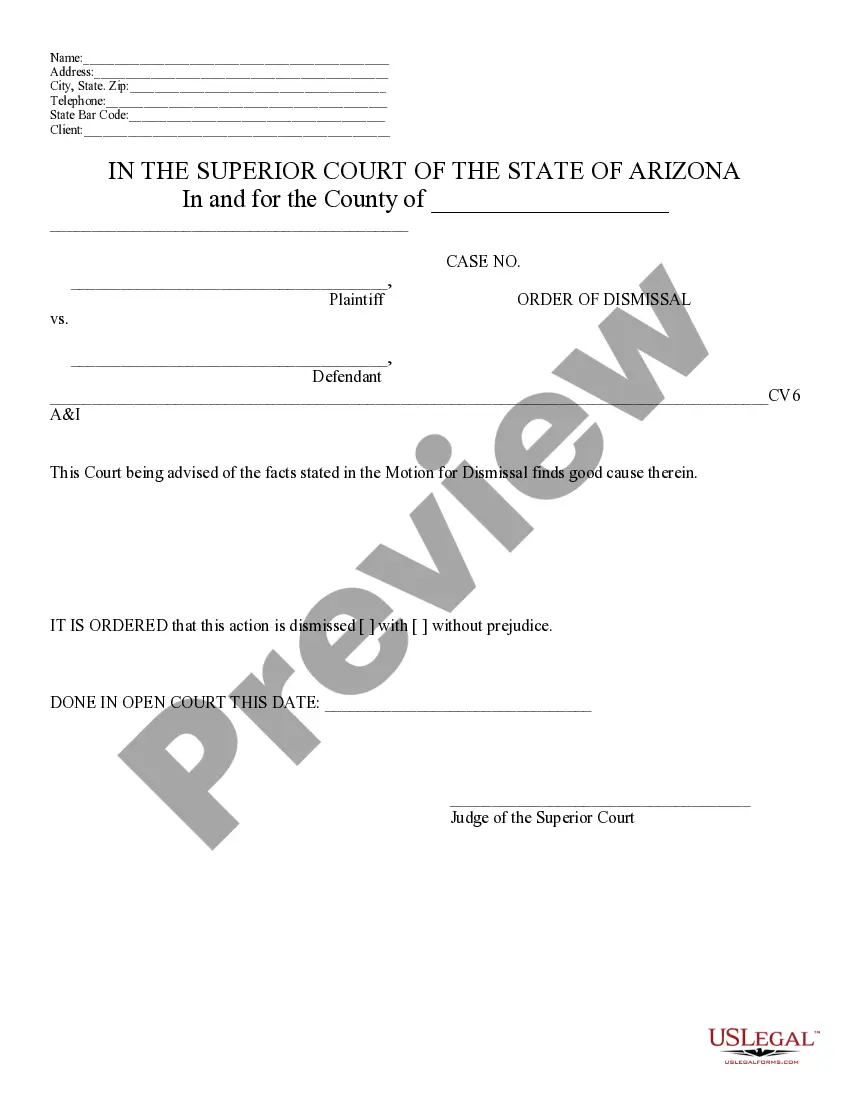

Obtaining legal document samples that comply with federal and regional regulations is essential, and the internet offers many options to pick from. But what’s the point in wasting time looking for the correctly drafted Motion Dismissal Az Form 5000 sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any professional and life scenario. They are simple to browse with all files grouped by state and purpose of use. Our specialists stay up with legislative changes, so you can always be confident your form is up to date and compliant when acquiring a Motion Dismissal Az Form 5000 from our website.

Obtaining a Motion Dismissal Az Form 5000 is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Take a look at the template using the Preview feature or through the text description to ensure it meets your requirements.

- Look for a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and select a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Motion Dismissal Az Form 5000 and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

The exemption application process for individuals and organizations is described in A.R.S. 42-11152 . In almost every case, the taxpayer must file an application with the county assessor, which provides the information required by the assessor to make an exemption determination.

The Arizona transaction privilege tax exemption for manufacturing extends to manufacturing machinery and equipment used directly in processing, fabrication, job printing, refining, metal working, mining, electrical power transmitting, oil and gas extraction, and research and development [ Ariz. Rev. Stat.

Arizona Form 5000 is used to claim Arizona TPT (sales tax) exemptions from a vendor. The Certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the University in these cases, or for the vendor to refund the sales tax already billed to the University.

In Arizona, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Some examples of exceptions to the sales tax are certain types of groceries, some medical devices, certain prescription medications, and any machinery and chemicals which are used in research and development.

Arizona Forms 5000 are used to claim Arizona TPT (sales tax) exemptions from vendors. Arizona Forms 5000A are used to claim Arizona TPT (sales tax) exemptions from vendors when making purchases for resale where tax will be collected on the retail sale to the end user.