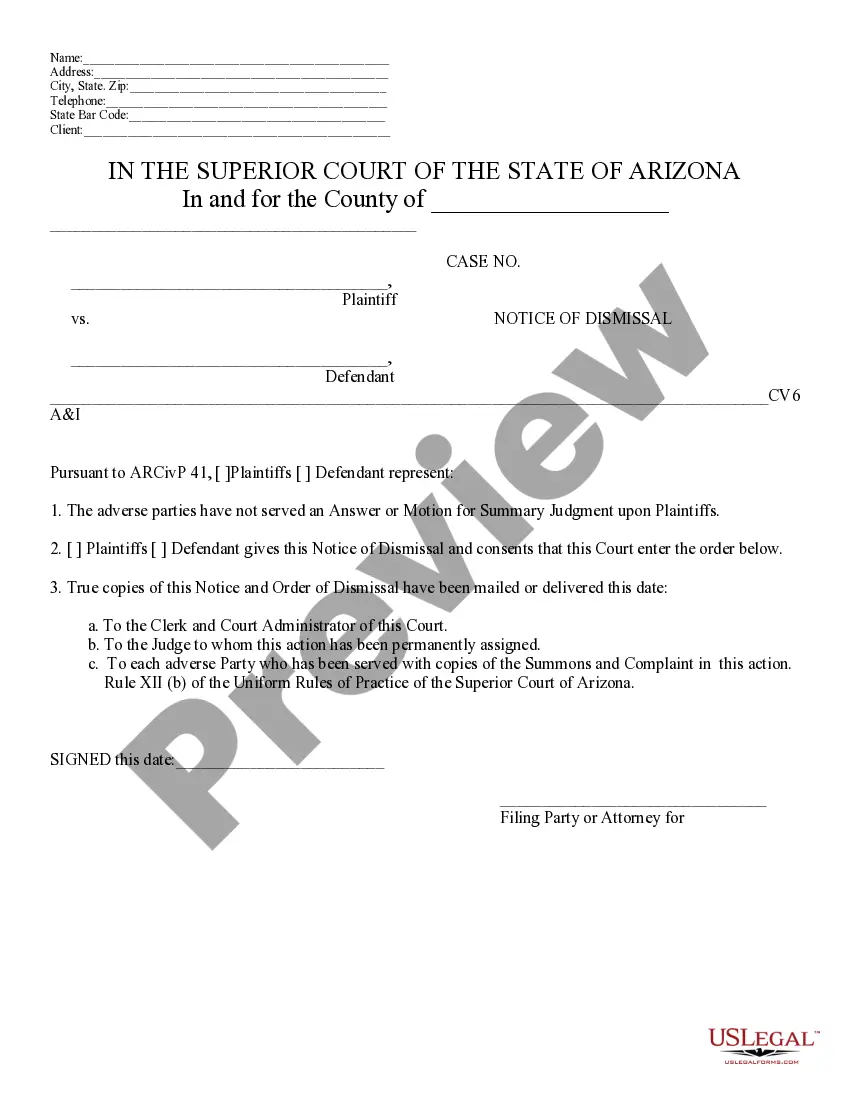

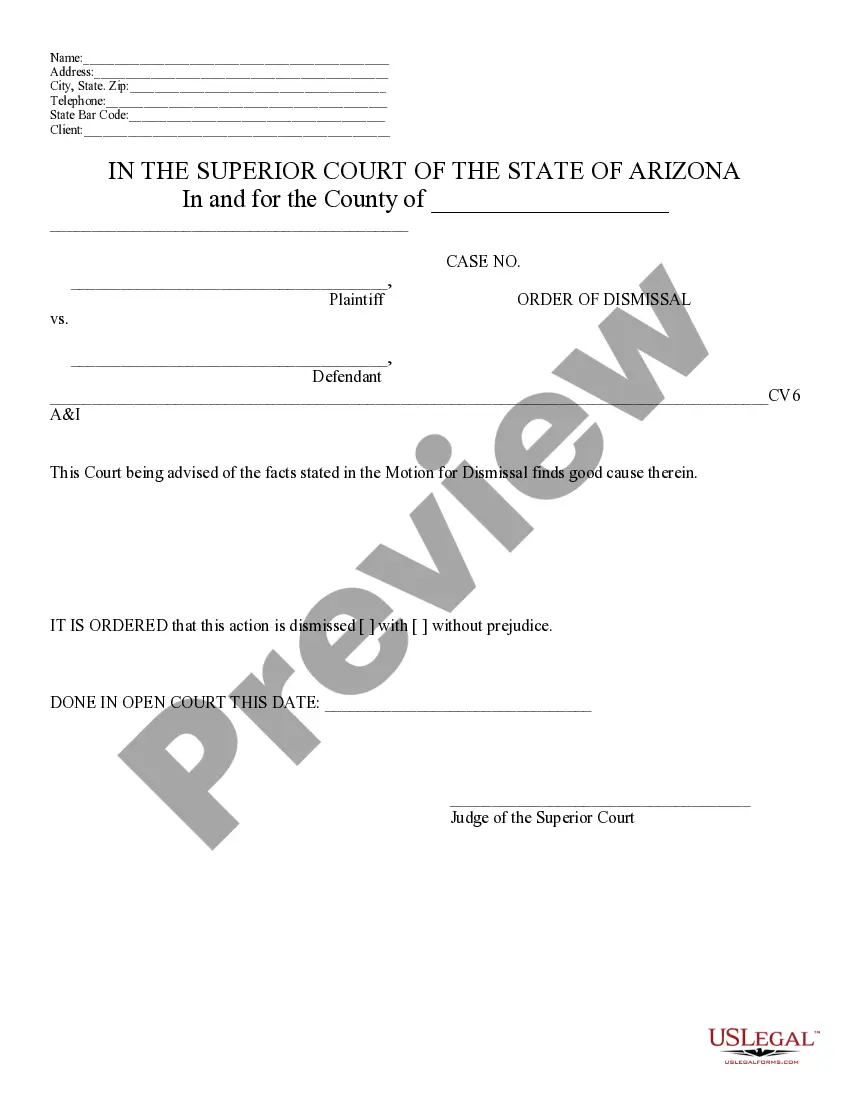

Motion for Dismissal: This is a motion which asks the court to dismiss a particular cause of action. The document must include the reasoning behind wanting the dismissal, as well be signed in front of a Notary Public. Also included, is a sample Order Granting Dismissal. This would be signed by the Judge and filed with the clerk's office. This form is available in both Word and Rich Text formats.

Arizona Motion Az Withholding

Description

How to fill out Arizona Motion For Dismissal?

It’s no secret that you can’t become a law professional immediately, nor can you figure out how to quickly prepare Arizona Motion Az Withholding without the need of a specialized set of skills. Creating legal documents is a time-consuming venture requiring a certain education and skills. So why not leave the preparation of the Arizona Motion Az Withholding to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Arizona Motion Az Withholding is what you’re searching for.

- Start your search over if you need a different form.

- Register for a free account and choose a subscription option to purchase the form.

- Choose Buy now. Once the transaction is through, you can get the Arizona Motion Az Withholding, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Employers should withhold half (7.65%) of the 15.3% owed in FICA (Social Security and Medicare) taxes from an employee's gross pay. FICA taxes come in addition to regular federal income taxes, which change depending on your income level. There are seven tax brackets in 2022 and 2023: 12%. 22%, 24%, 32%, 35%, and 37%.

As of January 1, 2023, the new default withholding rate for the Arizona flat income tax is 2.0%. If employees don't submit an updated Form A-4, employers may withhold a baseline of 2.0% starting in 2023.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

How withholding is determined Filing status: Either the single rate or the lower married rate. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can request an additional amount to be withheld from each paycheck.